As market sentiment polarizes, the crypto market is undergoing a hidden but decisive reshaping.

Some people shouted "the bull market is back", some people warned "the crash has just begun", and the smart money has quietly completed the final reshuffle.

We have just passed through the "last bear trap".

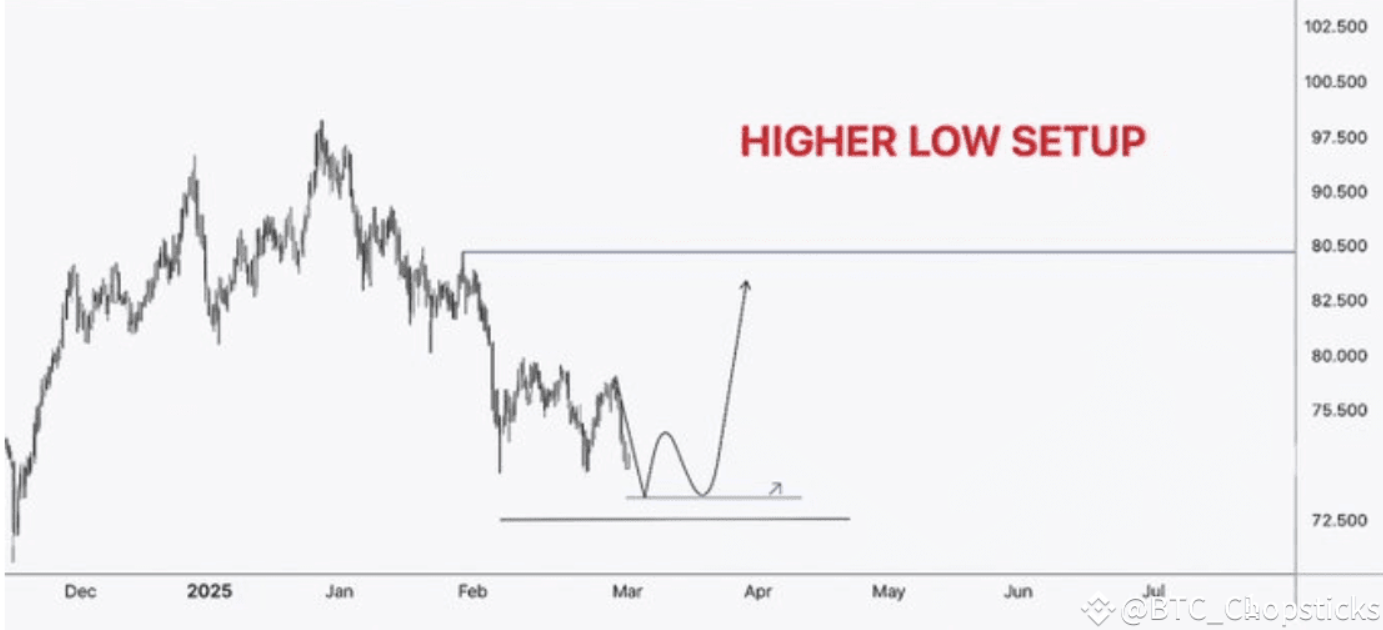

I had previously accurately predicted that Bitcoin would top out at $106,000 and then pull back to $74,000. Now, everything points to one conclusion:

Bitcoin is heading for new highs in June.

🧭 The current situation is the "reaccumulation zone", not the "top zone"

Structurally, BTC is in a classic re-accumulation phase:

→ Range oscillation → False breakthrough scares away retail investors → Major funds quietly build positions.

The current $73,600 area forms an institutional defense line (I call it the "Blackstone Line"), which is a key position for big funds to defend and buy low.

As long as it breaks through $95,000, Bitcoin will officially leave the range and enter a new round of "price exploration" stage.

🔥 Above is the area of concentrated short position liquidation——huge upward elasticity

A large number of short order liquidation points have accumulated above the current price. If a short-term squeeze is initiated, funds will be forced to cover, further pushing BTC upward.

At the same time, risk aversion has led to a large amount of funds entering stablecoins and fiat currency safe-haven positions, which in turn provides ample "rebound fuel".

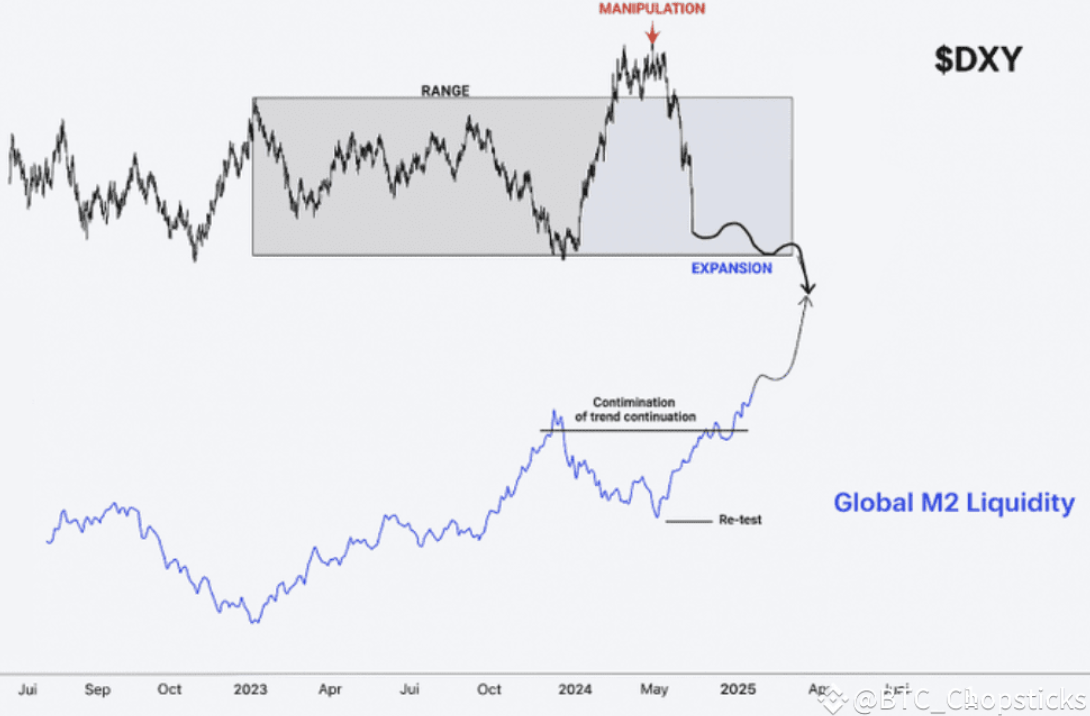

🧮 Macroeconomic coordination: US Treasury yields fall, global liquidity rebounds

The US dollar index (DXY) is weakening, target area: below 90

Global M2 liquidity has resumed expansion

The 2-year and 10-year U.S. Treasury yields have fallen below key support levels, signaling strong expectations of a policy shift.

The market is betting on a quick rate cut, and the U.S. Treasury itself urgently needs lower interest rates to ease refinancing pressure in Q3.

🧊 Inflation is receding, opening up space for the Fed to "pivot"

Truflation data has been below 2% for several weeks in a row (leading CPI by about 4–6 weeks)

April CPI and PCE will be released soon, which may officially confirm that inflation is below target

Coupled with the recent decline in crude oil prices and the upcoming rebound in ISM economic confidence, all macro signals are creating legitimacy for loose policies.

🧠 Political strategy and timeline also fit perfectly

The Trump team hopes to "refinance" US debt without triggering inflation.

The new round of tariffs has created short-term panic - just the right amount to depress inflation expectations and pave the way for interest rate cuts.

The market structure has been quietly completed:

April-June: Policy shift confirmed → Market rebound ignited

July-September: Peak or interest rate hike pause signal → Beware of the peak

Q4: Market high risk period → Adjustment or consolidation

Mid-2026: Mid-term elections may usher in a second bull market

🪙 BTC leads the market and develops an independent trend

At present, the S &P500 has not stabilized, but BTC has quietly bottomed out, repeating the script of Q4 2023.

That time, the Blackstone ETF was the fuse; this time, the global macro has gathered all the fuel.

Even without new positive news, BTC will take the lead in launching the next round of rise.

💡 The last piece of the puzzle: the golden rotation is about to be completed

The price of gold has already risen in advance and is currently consolidating; and BTC is replicating this rhythm.

When funds flow from the "defensive asset" gold to the "offensive asset" BTC, the market tends to start violently and continue rapidly. We are approaching the switching point.

✅ Conclusion:

The underlying logic of the current market is clearly visible:

✅ The re-accumulation pattern has been completed

✅ Global liquidity recovers

✅ The US dollar and bond yields fell

✅ Falling inflation paves the way for interest rate cuts

✅ A huge rebound momentum is brewing amid extreme panic

✅ Gold → Bitcoin asset rotation is about to be triggered

BTC is not waiting for the bull market, it is quietly leading the next bull market. In June, Bitcoin hit a record high, which is no longer a dream, but a continuation of reality.