Hash (SHA1):

806d5f7fb94ffcc548b8b0fc51fcab378a63f2c23070d0207ab169f51a07ab8b

No.: PandaLY Hotspot Insights Broadcast No.010

Bitcoin is the world's most valuable digital asset and has become the cornerstone of decentralized finance (DeFi). However, Bitcoin's native infrastructure was not originally built to support the fast and flexible transactions required by DeFi. Bitcoin accounts for more than 50% of the entire cryptocurrency market and is worth approximately $2 trillion. With more than $1 trillion worth of BTC sitting idle, Solv Protocol aims to unlock the full potential of this $1 trillion worth of Bitcoin assets through a liquid consensus infrastructure. By addressing the fragmentation of Bitcoin assets, providing yield opportunities, and introducing compliant custody solutions, Solv Protocol aims to create a comprehensive gateway to BTCFi.

1. What is Solv Prototal

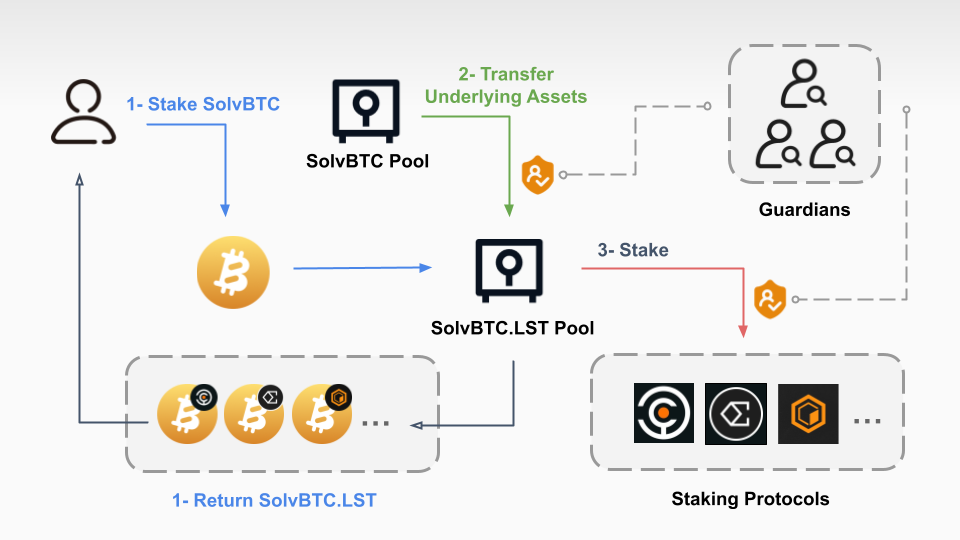

Solv Protocol is an on-chain Bitcoin reserve that brings together Bitcoin holders from different blockchains into a shared system, which allows Bitcoin holders to stake their assets to participate in high-yield decentralized finance (DeFi) activities. Through Solv's staking abstraction layer, SolvBTC and SolvBTC.LST (liquid staking tokens), retail and institutional investors can gain diversified income opportunities without sacrificing liquidity by seamlessly integrating Bitcoin into the DeFi ecosystem.

[What is Solv Token; SolvBTC; solvBTC.LST? ]

SolvBTC: Solv Protocol’s native Bitcoin token, backed by BTC 1:1, represents actual Bitcoin assets stored in decentralized Bitcoin reserves. SolvBTC is primarily used for trading, lending, and other activities in decentralized finance (DeFi).

SOLV Token: is the governance and utility token of Solv Protocol, giving holders governance rights over the protocol and the ability to participate in staking. In addition, users holding SOLV tokens can also receive rewards through staking and enjoy discounts on transaction fees.

SolvBTC.LST (Liquid Staking Token): SolvBTC.LST sets the standard for Liquid Staking Tokens (LST) in the SolvBTC ecosystem. These tokens enable Bitcoin holders to stake their assets and maintain liquidity, earning yield without locking up their Bitcoin. Through SolvBTC, users can access cross-chain yield opportunities and enhance Bitcoin's application capabilities in decentralized finance (DeFi).

SolvBTC.LST includes two types:

Linked to LST, pegged to Bitcoin 1:1, providing stability and liquidity;

The profitable LST accumulates rewards through staking, increasing long-term profit potential while maintaining market activity.

2. Solv Technical Highlights and Analysis

1) Staking Abstraction Layer (SAL)

The Staking Abstraction Layer is a core component of the Solv Protocol, designed to simplify the user's staking experience while maximizing Bitcoin's liquidity and yield. This layer allows users to convert Bitcoin (BTC) into yield-generating tokens (SolvBTC). When users stake BTC, they immediately receive SolvBTC tokens. These tokens can be traded on the market or used in other DeFi applications, allowing users' assets to always remain liquid and participate in the DeFi ecosystem without losing liquidity.

The pledge abstraction layer is managed by smart contracts to ensure that the user's Bitcoin pledge is safe and reliable during use. This layer defines the logic and rules of various operations such as pledge, minting and redemption for users to ensure that all operations are under the supervision of the contract.

Solv Protocol has also established a dedicated liquidity pool to manage the liquidity of pledged assets and SolvBTC. Users' pledged Bitcoin will be deposited in this pool to ensure the stable operation of the entire ecosystem.

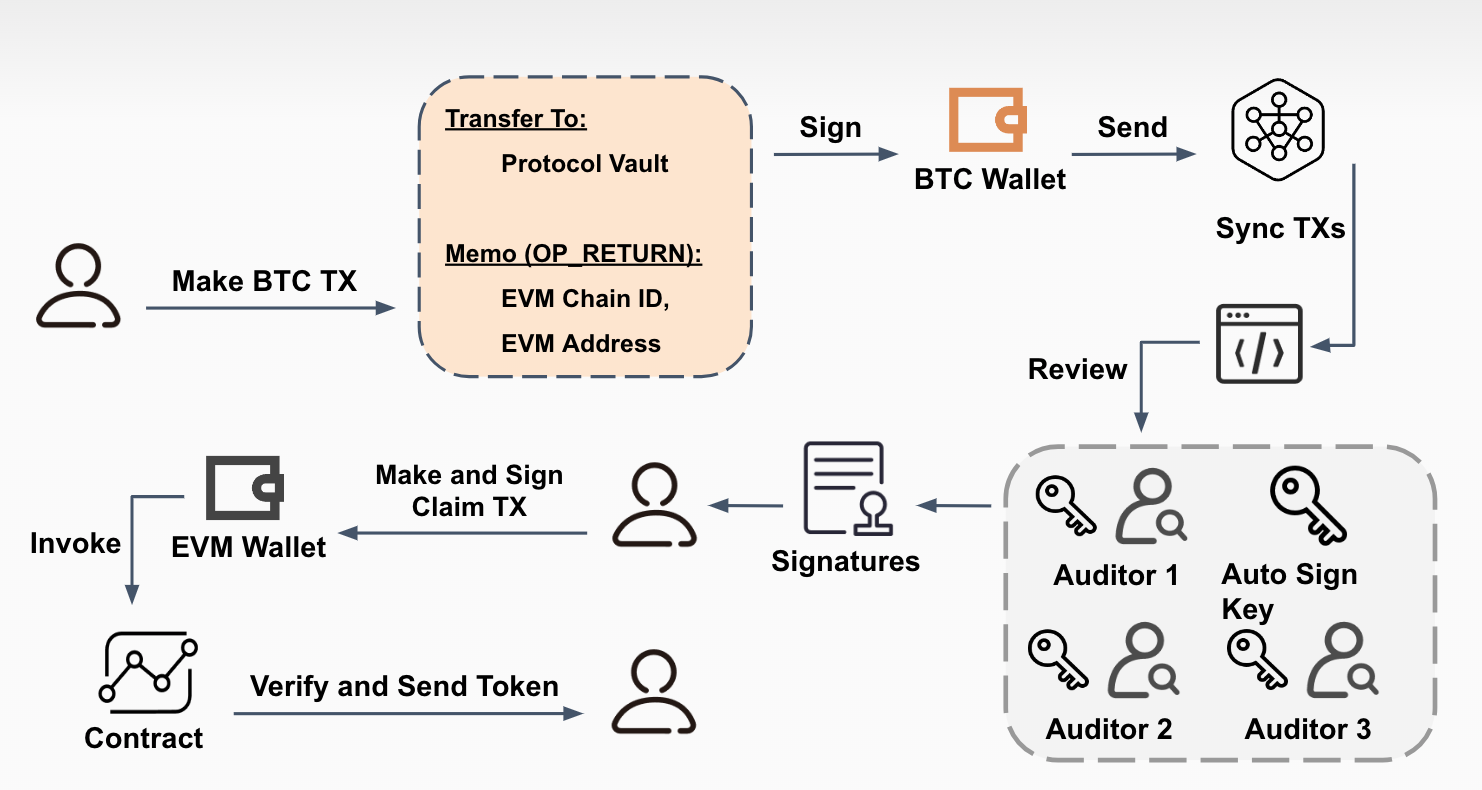

2) Proof of Reserve (PoR)

Proof of Reserve (PoR) is a transparency and security mechanism that ensures that each SolvBTC token is 1:1 backed by the corresponding Bitcoin or trusted wrapped Bitcoin. This mechanism is designed to enhance users' trust in the platform, allowing them to verify their holdings in real time.

The reserve proof system enables users to check at any time whether their SolvBTC is backed by the corresponding Bitcoin assets. This transparency reduces users’ security concerns caused by information asymmetry and enhances the credibility of the system.

Through the PoR system, users can effectively ensure that there will be no loss of assets due to improper manipulation or undisclosed operations. All SolvBTC are backed by real Bitcoin or trusted alternative assets (such as Wrapped Bitcoin), and the entire process remains transparent.

3) Multi-role permission management

In Solv Protocol, multi-role permission management is a crucial security design that ensures that different operations are performed by different roles, thereby reducing the risk of a single role abusing power, and aims to ensure the transparency, security and efficiency of protocol operations. By assigning functions within the system to different roles, the protocol can effectively supervise and control various operations and prevent potential malicious behavior.

Several key roles are defined in Solv Protocol, each with specific permissions and responsibilities. The setting of these roles allows for more fine-grained management, ensuring the security and flexibility of the system. The main roles include:

Administrator role: responsible for managing the permission allocation of other roles.

Minter role: has the authority to create new tokens and adjust the total supply.

Pool Burner Role: Focus on managing token destruction of the liquidity pool and ensuring the validity of circulating tokens.

4) Oracle and cross-chain technology

Solv Protocol integrates Chainlink and Redstone oracles to ensure that its token prices are accurate and updated in real time, which is essential for the transaction and value assessment of any asset. In addition, the cross-chain mechanism allows assets to flow on multiple chains.

Cross-chain interoperability: Using Chainlink’s Cross-Chain Interoperability Protocol (CCIP) and Free.tech, users are able to seamlessly transfer SolvBTC from one chain to another, increasing the platform’s flexibility and user experience.

Reliable access to price data: The oracle network ensures that users can obtain the latest market trends through real-time data updates, thereby making more informed trading decisions.

3. Solv Protocol from a Security Perspective

➡️Technical complexity: Solv Protocol involves complex smart contracts and financial instruments, which makes it possible for code vulnerabilities or design flaws to lead to serious security incidents. In-depth code audits and continuous security monitoring must be conducted to reduce such risks.

➡️Security risks: Despite the adoption of multiple security measures, technical flaws in smart contracts may still exist. Continuous monitoring and updating of security protocols is essential to prevent possible vulnerabilities from being maliciously exploited.

➡️Liquidity risk: Although Solv's BTC holdings have exceeded those of multiple BTC trust funds, Bitcoin liquidity is still scattered across multiple platforms. This decentralization may affect the concentration and effective use of Solv in the DeFi ecosystem.

➡️Market volatility and policy risks: Bitcoin price fluctuations and changes in global regulatory policies pose potential challenges to the project. In this rapidly changing and uncertain environment, it is crucial to maintain a sound market strategy and ensure user benefits.

➡️Competitive pressure: Solv Protocol faces a lot of competitive pressure from similar protocols. Other projects may pose challenges in terms of technological innovation, user experience, and capital acquisition. Solv needs to continue to innovate to maintain its market position.

Conclusion

In the current rapidly changing environment of the crypto market, Solv Protocol provides an innovative solution for unleashing the potential of Bitcoin assets. However, while promoting the development of decentralized finance (DeFi), the project also faces multiple risks and challenges. Factors such as technical complexity, liquidity risk, market volatility and competitive pressure may affect its long-term success. Therefore, it is key to ensure the continued growth of Solv Protocol for the project to fully prepare for these risks.

Solv Protocol is synonymous with both opportunities and challenges. The future crypto market will seek a balance between technological innovation and risk management. As the application of Bitcoin in the DeFi ecosystem continues to deepen, the success of the project will depend on its ability to cope with risks and seize opportunities. In this wave of digital assets, project owners and investors should work together to push the crypto market towards a new era of greater transparency, security and efficiency.

Thank you for your reading. We will continue to focus on and share blockchain security content.