The outstanding technical features of the Polkadot ecosystem have made it the focus of the Web3 industry. DOT, as its core token, is not only the key to governance, but also an important part of obtaining benefits. Therefore, every user who actively participates in the Polkadot ecosystem will be concerned about one question: "How to maximize DOT benefits?"

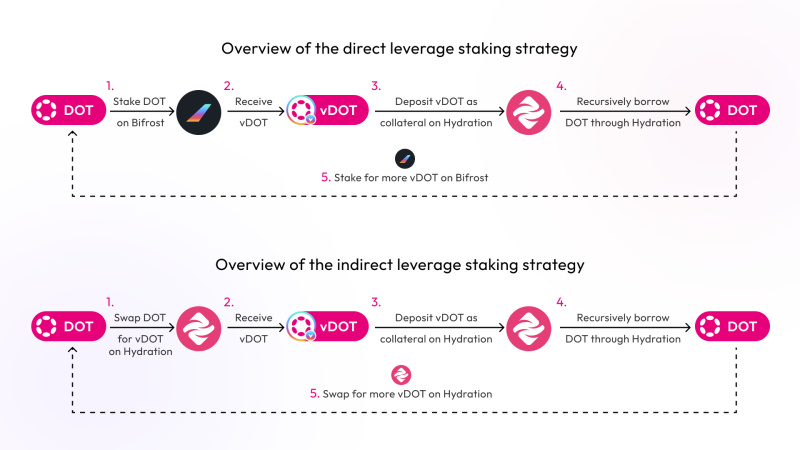

Among them, native staking and liquidity staking have become the main forms of DOT management and staking practices. In addition to the management method represented by native staking, the recent development and tracking of the Hydration staking platform has become an important goal for those following the Polkadot ecosystem.

Second to none: Hydration builds an integrated DeFi platform

Hydration is (formerly HydraDX) the leading DEX parachain in the Polkadot ecosystem, providing liquidity incentives through the platform

, providing users with DOT single-currency liquidity management services. Users can choose to use DOT as a single asset to provide liquidity, participate in Farming and obtain relevant benefits. Ben, head of the Hydration ecosystem, said in a recent media interview, "Hydration is an integrated DeFi platform built on Polkadot, and will soon fully present the three pillars - flash exchange, lending and stablecoins. The first two are now online, and the stablecoin function will be launched soon."

Rapid growth: Hydration receives large financial support from the Treasury

It is worth mentioning that the report "Polkadot 2024 Treasury Report: Where did the $133 million go?" summarized at the end of last year shows that in the "Polkadot Treasury Assets Distributed by Chain", parachains have become an important part of the treasury economy, with 19% of treasury assets distributed to different DeFi chains, and the Hydration chain alone has reached $34.7 million, accounting for 16.5% , which shows the proportion of assets held. It was also in June last year that Hydration received 2 million DOT funds from the Polkadot Treasury for liquidity support plans and user incentives; in July, Hydration's total locked value (TVL) exceeded $46 million, becoming the parachain with the highest TVL in the Polkadot ecosystem , and truly becoming the center of liquidity in the Polkadot ecosystem. Let us get closer to Hydration, feel the rapid growth trend supported by its advanced technological superiority, and explore the innovative opportunities that users and developers can grasp from it.

Exploring the significance and role of Hydration in the Polkadot ecosystem

Since Hydration was renamed from HydraDX, it has brought new meaning to the development of the Polkadot ecosystem with liquidity management and incentive plans. Overall, Hydration provides corresponding technical support for DeFi ecosystem liquidity and multi-chain asset interoperability . Specifically:

Unleashing Polkadot’s Staking Asset Liquidity

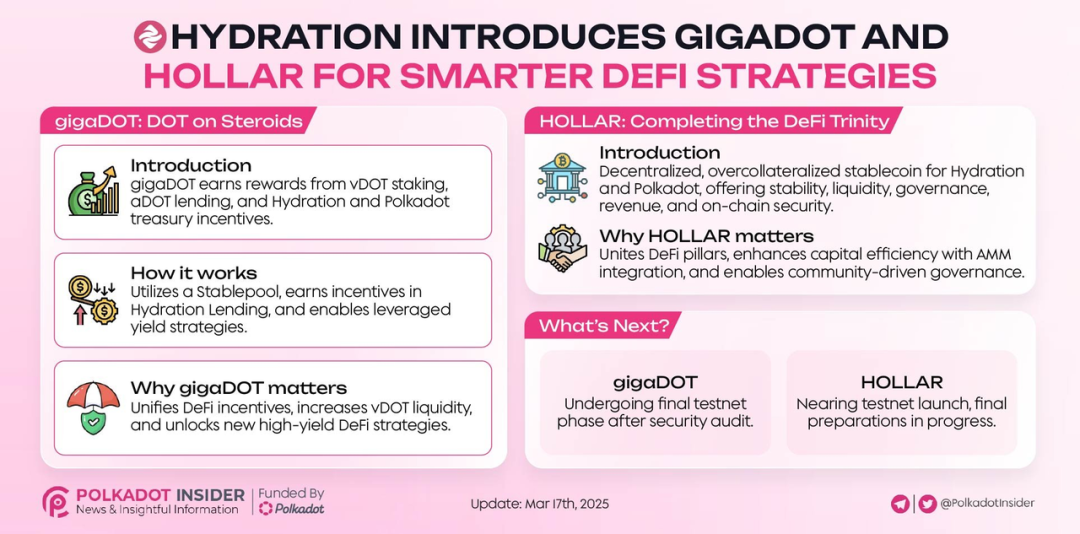

As a core DeFi project in the Polkadot ecosystem, Hydration has effectively released the liquidity of Polkadot's staked assets by providing decentralized liquidity solutions . Its HOLLAR stablecoin solves the exchange rate fluctuation problem of traditional stablecoins through an innovative liquidation and liquidity framework, further optimizing the capital efficiency within the ecosystem; in addition, Hydration has achieved seamless integration of asset lending and liquidity pools by integrating the forked AAVE v3 lending platform , providing Polkadot users with diversified financial services and improved financial transaction experience functional support, promoting the transition of DeFi from a single transaction to a comprehensive financial ecosystem.

Support multi-chain asset interoperability design

Currently, the overall operation of Hydration also relies on Polkadot's cross-chain communication protocol (XCM). Hydration can interoperate with other parachain assets and promote cross-chain liquidity aggregation. This interoperability not only enhances the overall synergy of the Polkadot ecosystem, but also provides users with a wider range of asset choices. Further, Hydration achieves efficient use of XCM in the following directions:

- Cross-chain asset transfer: Users can directly transfer assets (such as DOT, GLMR, etc.) from the Polkadot parachain to the Hydration chain through the cross-chain communication protocol (XCM) without relying on third-party bridging, with low fees and fast speed. For example, users can complete the asset transfer by selecting the cross-chain path of "Polkadot → Hydration" through the Polkadot wallet.

- Messaging and smart contract interaction: The cross-chain communication protocol (XCM) allows Hydration to communicate directly with other parallel chains (such as Moonbeam) smart contracts. For example, Moonbeam and Hydration can achieve free flow of GLMR and HDX through a two-way HRMP channel, support remote EVM calls, and enhance the seamless experience of cross-chain financial services.

Speaking of this, we cannot leave out Hydration’s core technical design and highlights in its support for cross-chain asset flows.

Hydration core technology advantages and features

The biggest technical highlight of Hydration is the innovative Omnipool mechanism, which allows the use of a single currency to add liquidity and has better depth, effectively promoting the improvement and growth of liquidity in the Polkadot ecosystem and providing a new direction for DOT management exploration.

Omnipool (universal pool) aggregation effect

Traditional DEX usually adopts the "XYK model" (having multiple liquidity pools) to provide liquidity to each pool, which requires adding pairs of two assets. HydraDX adopts the Omnipool (all-asset liquidity pool) design, which can provide liquidity by adding a single currency. LRNA serves as the hub currency for Omnipool exchange, and the relative value of different currencies is determined by the relative pricing of each currency and LRNA.

Specifically, through the cross-chain communication protocol (XCM), Hydration can aggregate assets from inside and outside the Polkadot ecosystem (DOT, USDT, ETH, etc.) and inject them into Omnipool to form a single liquidity pool, further simplifying the operational process for users to add liquidity. By combining the Agile Coretime mechanism, it can also dynamically adjust the cross-chain liquidity incentive method , and attract users to provide cross-chain assets through dual rewards of vDOT (liquidity staking token) and HDX.

Stable economic model and diversified applications

In addition to the Omnipool core technology design, Hydration is developed based on the Substrate technology framework , inheriting the high modularity and scalability of Hydration, and can quickly iterate product functions (stablecoin HOLLAR and lending platform) , dynamically allocate core resources in market-oriented resource allocation, and optimize transaction processing efficiency and costs. Just as the Polkadot Treasury injected $12 million in liquidity funds into Hydration in 2024 , it significantly increased users' enthusiasm and confidence in participating in staking and liquidity provision, and invisibly enhanced users' trust in Hydration. At the same time, the HOLLAR stablecoin is not only used in the transaction process, but also integrated into actual scenarios such as lending and derivatives, forming a diversified and multi-functional portfolio of financial instruments.

Hydration is a future-oriented financial solution that is on the way to long-term success

With a core technology drive and rapid development plan. At the beginning of 2025, HOLLAR completed the mainnet deployment and enhanced stability through a multi-collateral mechanism (including DOT and cross-chain assets), with a daily trading volume exceeding US$5 million ; Polkadot DAO also added US$8 million to the Hydration liquidity pool in the first quarter of 2025, pushing its TVL to exceed US$200 million, becoming the top three DeFi protocols in the ecosystem... A large amount of funds and resources have been tilted to support Hydration, giving it new impetus for continued exploration, and also making us believe that its pace of technological upgrading and product iteration will continue to move forward, and ultimately reach a new vision of highly expanded and sustainable prosperity of the financial ecosystem.

As the core pillar of Polkadot DeFi, Hydration's future development will also closely revolve around cross-chain interoperability, AI + Web3 integrated applications and enterprise-level technical solutions . With the upgrade and evolution of Polkadot 2.0 technology, the iteration of XCM V5 version, and the development of AI intelligent risk management tools, it is believed that Hydration will continue to improve the efficiency of asset information transmission, explore the application of off-chain computing and privacy protection technology , cover more real-world economic scenarios such as supply chain finance and cross-border payments, and achieve more breakthrough progress in the development of low-latency transactions and complex financial derivatives. Let us wait and see!