Source: Talking about Li and other things

Although Binance Alpha 2.0 was launched on the 18th of this month, I did not update and experience it immediately because I have no interest in trading MemeCoin recently. However, two days ago (March 24), after I updated the APP, I bought a coin in the Alpha zone for a small amount to experience it. The operation was indeed very smooth, which is equivalent to being able to directly purchase DEX tokens in Binance (CEX).

Maybe it was because the operation was too smooth, the coin I bought lost almost 30% in less than a day, but because it was a small test, I didn’t take this loss seriously. What I want to say here is that from a development perspective, Binance Alpha seems to have completely blurred the boundaries between CEX and DEX, and at the same time, it can allow some on-chain tokens to directly obtain Binance’s liquidity, allowing ordinary users (newbies) to easily obtain some on-chain assets, without having to consider issues such as slippage, GAS, and bridging. This is indeed an improvement.

1. The turning point of the war between CEX and DEX

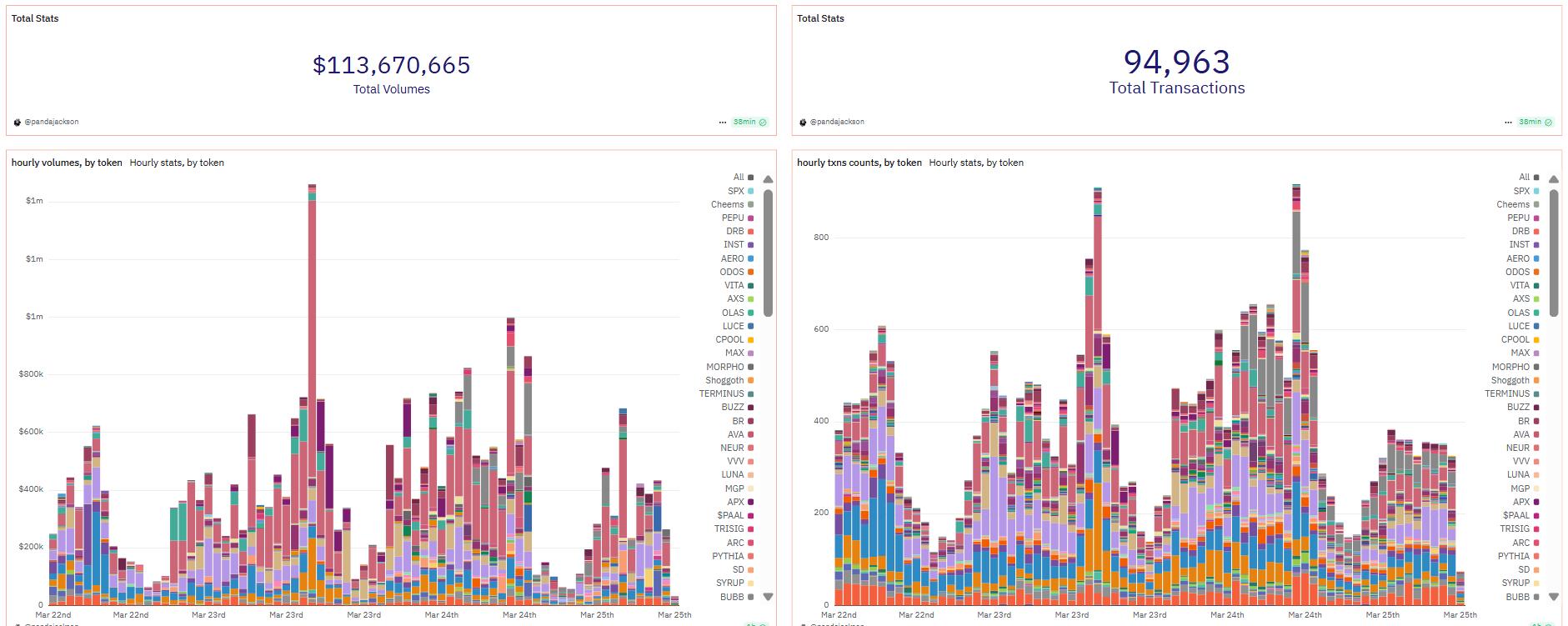

It has only been about a week since Binance Alpha 2.0 was launched, and its transactions have reached nearly 94,900, with a transaction volume of more than 113 million US dollars. In the current market situation with overall low sentiment, it can be said that it is still performing well. As shown in the figure below.

Many people have been discussing the future war between CEX and DEX before, but it is not difficult for us to foresee from here that perhaps in the future, there will no longer be any so-called competition between CEX and DEX in the crypto market, but whoever can seamlessly combine the two will become the final winner.

Of course, we are only looking at the issue from a development perspective. If you only look at it from the perspective of current liquidity, you can also think that Binance is just trying to squeeze the market.

2. Market uncertainty and opportunities

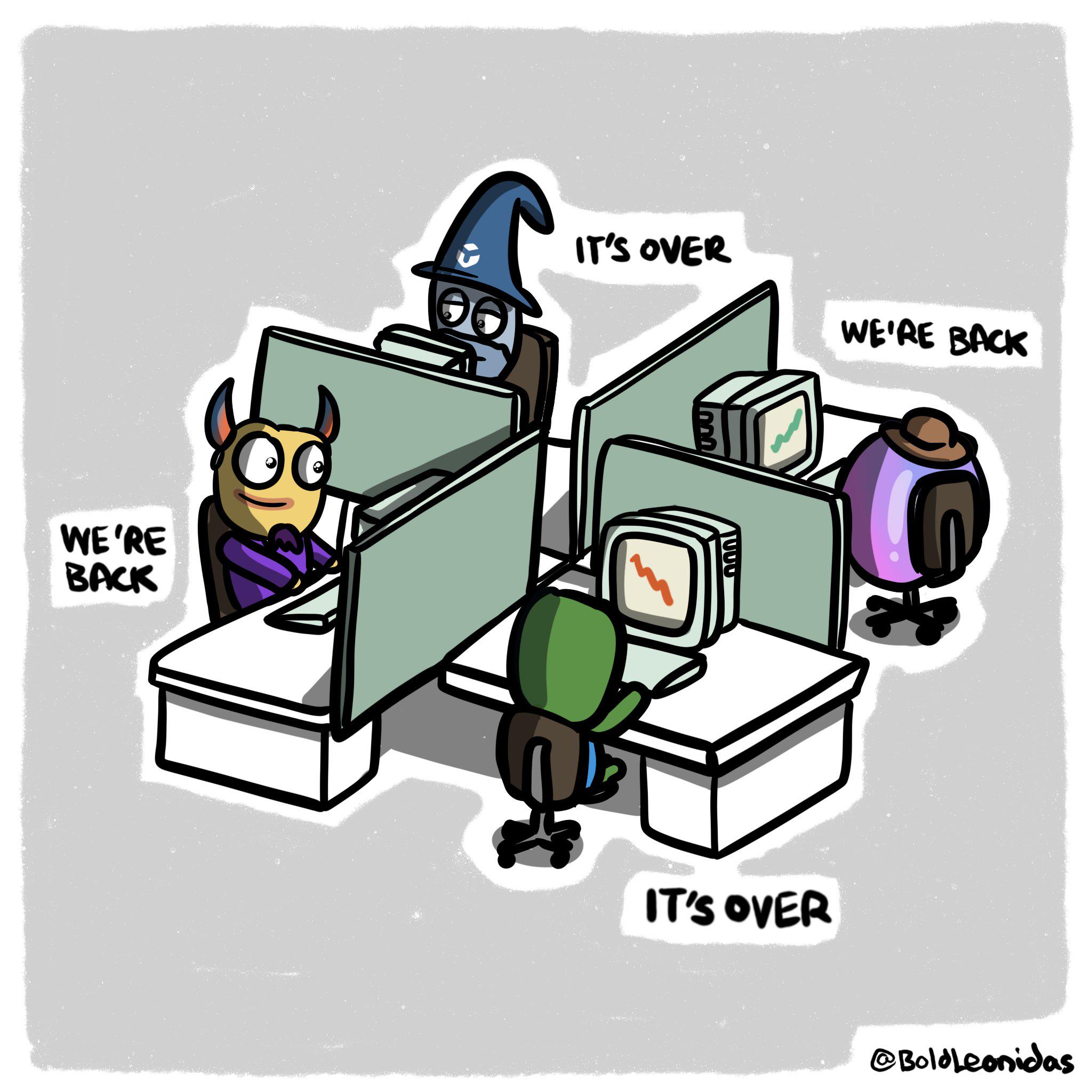

As we mentioned in the previous article (March 24), apart from the hot spots created by the CZ system (MemeCoin, wallet IPO activities) and the active participation of some people, it seems that the market has fallen into a certain continuous silence. Everyone seems to be waiting for a bigger black swan or a bigger positive (such as the Federal Reserve’s interest rate cut, Trump’s tariff policy changes, etc.).

But at the same time, another interesting point is that many projects (token prices) have been slowly rising since around March 15, which we can basically find out by simply looking at the corresponding daily trend. Here is an example, for example, Pendle in my watch list has risen by about 50% in the past two weeks (the price has risen from US$1.9 to US$2.9), but not many people are discussing it.

Of course, what I want to express here is not that the big thing is coming back or the so-called copycat season is coming. Now, talking about the bull market coming back or the copycat season will be criticized, and there is also suspicion of misleading people. What I want to express here is just an idea, that is, if you are still paying attention to this market, then whether it is short-term, medium-term or long-term, you must find some perspectives of your own to conduct necessary in-depth understanding, so that you can have a greater probability of discovering possible potential opportunities ahead of others, and such opportunities often appear when most people are pessimistic or desperate. On the contrary, when most people can see the opportunity, or everyone is striving for such an opportunity, you should consider exiting.

Let me give you another simple example. For example, you can now recall or look at your study notes or trading notes. What were you doing in September last year (2024)? What differences in the market did you pay attention to at that time? What specific operations did you take at that time?

If you can’t remember anything, you might want to review our series of articles from the same period last year and re-read them. You may gain some new insights, as shown in the figure below.

In short, it is still the point of view in our previous article: there will always be various opportunities in this market. We should not worry too much about the so-called bull market or bear market. A bull market does not mean that you can definitely make money, and a bear market does not mean that you can definitely not make money. The market is nothing more than three structures (upward, downward, and sideways). We just need to combine our own risk preferences, grasp the rhythm of different periods and find our own opportunities.

Every investor wants to make money, but if everyone makes money, where does the money come from? To put it bluntly, the reason you can make money in the market is simply because others happen to lose money. If we classify investors (individual investors), they can be roughly divided into the following three categories:

Ordinary investors: Most people will make up for their lack of learning or cognition in the field by making mistakes (such as trading losses, being cheated, etc.).

Blind investors: These people tend to repeat mistakes without thinking, but do not seek to improve, and always place their hopes of making money directly on others.

Smart investors: are able to learn from their own mistakes/experiences, and even the mistakes/experiences of others, in order to continuously optimize and improve their trading strategies.

If we talk further based on the above classification of investors, the main direction of money flow is basically clear, that is, it will flow from blind investors to ordinary investors, and then continue to flow to smart investors.

The reason why many people think that making money in the crypto field is as easy as breathing is because they only see the 0.1% of people who make a lot of money, but these people are difficult to replicate. In fact, trading (investment) is a long-term process. As we mentioned before, we can only adjust our mentality and put down our posture to learn and experience it ourselves. When you continue to gain some new perspectives, many of the original puzzled problems may be solved directly. With this accumulation, when encountering market fluctuations, our brains will have the determination to hold on. This is actually the same as learning basic skills and muscle training in daily boxing. Then, on this basis, we may be able to discover some potential opportunities earlier or more easily than others.

At the same time, it is precisely because of the uncertainty in the market that some new opportunities are created. Everyone knows that the sun will definitely rise from the east tomorrow, so there will be no opportunity to make money (no one will bet on which direction the sun will rise tomorrow). But if I tell you (this is just an example and hypothesis) that there is a 75% probability that Bitcoin will see a price starting with 9 in the next few weeks, and a 25% probability that it will continue to see a price starting with 7, then there will actually be certain opportunities. In the case of such uncertainty, what will you do?

As for what you will do, I don’t know, and of course I can’t provide specific trading guidance. Now there are many big guys who will tell you that Bitcoin will fall below $50,000, and there are also many big guys who will tell you that Bitcoin will rise to more than $200,000... But do these really matter to you? Are you betting on tomorrow or the next ten years when you enter the crypto field?

Never think that you are smarter than the market. No one can know exactly what will happen next. Our reasonable approach should be: stay open to all possible situations, make your own trading plans by assigning different probabilities, and actively pay attention to the triggers that change the corresponding probabilities, and customize plans or programs in advance (at least Plan A + Plan B, how to participate, what to participate, when to participate, when to exit, etc.).

Here, the only advice I can give is still this: you can use a certain percentage of your positions for short-term adventures, such as pursuing some higher-risk altcoin or MemeCoin opportunities, but all your short-term operations, including your large-proportion positions, should ultimately point to a long-term goal, which is to accumulate more Bitcoin (not altcoins).

From a big macro perspective, we are most likely still in a bull market cycle structure.

From the medium-term time frame, Bitcoin seems to be trying to break through the local range formed by the local top (but Bitcoin is still in the downward channel of the medium-term trend. Let's see if it can break through the $92,000 position this week or next week). Some altcoins have also begun to show some signs of recovery (but it may not be a fundamental-driven rebound, but a new wave of liquidation squeezes against shorts may lead to price recovery). Of course, it may also fail to break through, so we need to continue to observe and wait.

Judging from the short-term market sentiment, we are indeed in a "bear market" atmosphere (many altcoins have fallen by more than 70% since the local highs of this cycle).

The strategies adopted should be different from the above different perspectives. For example, I personally look at things from a macro perspective, so I have been hoarding Bitcoin with a large position and keeping it still. At this time, just be patient enough. If you want to take action based on a medium-term framework or short-term emotions, you should always keep your head clear and don't let yourself fall into passivity (for example, you should adopt a strict stop-profit/stop-loss trading plan, carry out necessary hedging strategies, etc.), actively look for what you want to see (rather than what others often recommend to you, or the news that the software actively pushes to you every day), and once you find a possible opportunity (something you think is more likely to happen), then execute it immediately.

In short, trading is not luck, but a kind of discipline and system. Think about what your ultimate goal is, then stick to it, and never risk any trade that exceeds the loss you can afford.