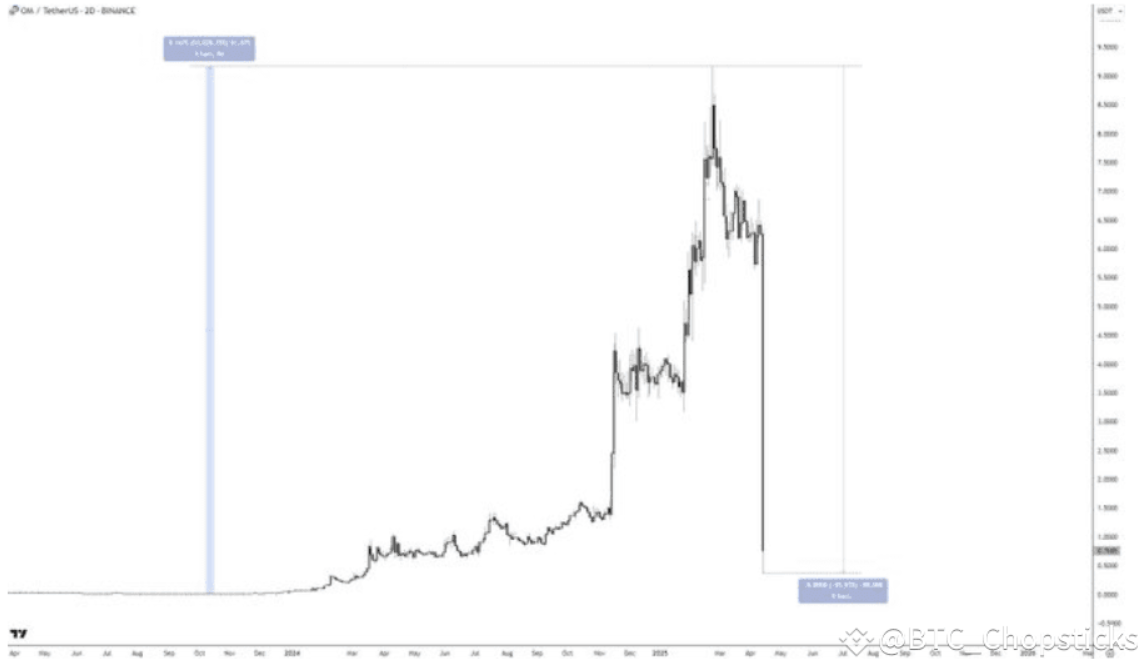

Many people thought that this round of black swan events ended with OM , but in fact it was far more than that.

📉 Recently, $ IP plummeted by 25% without warning, catching the community off guard. However, this kind of plunge is not an "accident", and there are already signs on the chain.

🔍 Review of OM’s financial crisis: It’s not groundless

Although the Mantra team insisted that “there was no sell-off”, on-chain data showed:

More than $227 million of OM flowed into CEX before the crash

Most of the transfer addresses are directed to investors/market makers

Transactions are centralized and synchronized, with “quasi-internal transaction” features

OM essential question:

Lack of a complete ecosystem, popularity outweighs value

Highly controlled + extremely low on-chain liquidity

OTC funds bought at low prices, and panicked after breaking through the market bottom line

⚠️ Is $ IP next?

Currently, the market is concerned about $IP, but there has been no concentrated shipment of OM on the chain.

However, potential risks still exist:

Valuations are inflated, and market value is out of touch with fundamentals

VC OM crashed, reduce $IP position in advance

The community is very enthusiastic, but the on-chain liquidity support is insufficient

📉 A 25% drop may just be the beginning, so we need to remain vigilant.

🧠 The next batch of "black swan candidates"? —— MOVE & LAYER

The following phenomena deserve special attention:

Large amounts of funds from private wallets are transferred to CEX

Lack of real buying after rapid pull

Community popularity soars, but on-chain liquidity cannot keep up

This is a typical sign before a chain "explosion".

🛡️ How should investors prevent it?

We have not yet entered the stage where “all projects are going to fail”, but the risk of structural failures is rising rapidly.

📌 Self-questioning checklist:

✅ Does the token have sufficient on-chain liquidity?

✅ Is it highly controlled?

✅ Is the community really popular, or is it controlled by KOLs?

✅ Are there any traces of OTC distribution that have not been disclosed?

⛔️ Don’t use “high market value = safety” as a basis for judgment!

🎯 In conclusion, the OM collapse was not an accident, but a systematic release

🔺 $ IP , $MOVE , $LAYER , etc. have on-chain change signals

📉 OTC + market makers + liquidity exhaustion = crash trigger

“The real danger does not come from the event itself, but from our ignoring the truth that has already been written on the chain.”

Now is not the time to panic, but to go back on-chain and look for truly safe investment strategies.