In April 2024, a CryptoPunk NFT numbered 3100 was bought by a user for $16 million (4,500 ETH), ranking third in the highest price of a single NFT. On April 10, 2025, the CryptoPunk was sold for $6 million (4,000 ETH), a loss of $10 million compared to the purchase price a year ago.

The losses were partly due to the drop in Ethereum prices caused by the volatile macroeconomic environment caused by the US "reciprocal tariff" policy, and partly due to the bleak NFT market.

It's not just CryptoPunks. The trading volume of popular and high-profile NFT IP series such as Bored Ape Yacht Club, Azuki and Pudgy Penguins has been steadily declining since 2022, and the market performance has been particularly bleak in recent weeks.

Compared to the highlights of the past two years, NFTs are now slowly fading from view. But NFTs are a relatively new development. The first NFT was born about ten years ago, and it was not until the end of November 2017, when Ethereum launched the ERC-721 standard, that this technology began to gain public attention.

NFT is by no means limited to being a carrier of digital artwork to reflect value. It can represent almost anything unique or unique: identity (such as digital identity identification DID), virtual image, personal profile picture (PFP), personal data records, virtual real estate, artwork, assets in games or virtual worlds, music, domain names, etc.

The core of NFT is digital property rights: as long as you own an NFT, you truly own the content specified in the NFT smart contract, whether it is an image, a game item, the commercial use rights of an asset, or anything else. This "true ownership" represents an important paradigm shift in the Internet world, as people used to use goods and services through authorization rather than directly owning them.

In other words, it has only been about seven years since we truly entered the "era of digital ownership of virtual items."

Currently, we usually regard NFT as a separate area of Web3, alongside the metaverse, cryptocurrency, RWA, and DePIN. This view has both reasonable and unreasonable parts.

The reasonable part is that as for NFT itself, it can constitute a prosperous NFT field alone. Various virtual items are cast into NFTs through smart contracts, or physical objects are mapped into assets through chain, forming NFT trading markets such as OpenSea and Blur platforms.

The unreasonable part is that NFT is a tool that is integrated into various fields. NFT can be used as assets such as games, real estate, props, etc. in the metaverse, as on-chain circulating assets of RWA, as circulating assets of the DePIN project ecology, and as a unique carrier of identity, avatar, music, video, domain name, and data.

For example, in the decentralized cloud computing power in the DePIN field (PowerVerse is a decentralized cloud computing power project, that is, NFT is used as a carrier of computing power resources for trading and circulation), computing power resources can be traded and circulated on the platform in the form of NFT.

Industry insiders once regarded NFT as an innovative invention as important as BTC. This recognition shows that NFT may play an increasingly important role in the future metaverse and AI era. The market and users need a unique, freely circulated, traceable and secure asset carrier.

Compared with traditional centralized projects in the history of science and technology, the innovative applications of NFT show its subsequent potential.

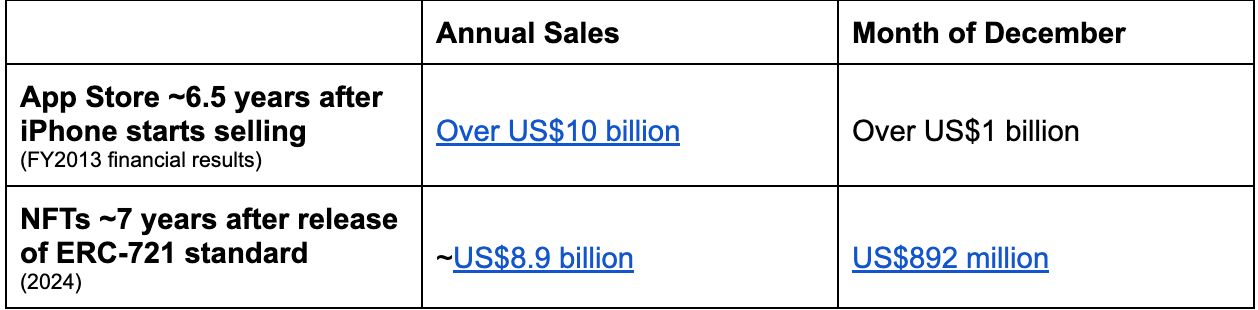

Apple distributes software and content for iOS devices in its closed App Store ecosystem. According to financial reports, in 2013, about six and a half years after the iPhone was first released, Apple's App Store annual sales reached approximately $10 billion, with December alone contributing more than $1 billion.

Also, seven years after NFT technology entered the market, the annual NFT transaction volume in 2024 was approximately US$8.9 billion, and the monthly transaction volume in December was approximately US$892 million.

Under the condition that the time difference is not much, the transaction volume of NFT and Apple is gradually approaching.

It is also interesting that when the iPhone was first launched on the market, it impressed people with its high cost and high performance. The same is true for NFTs. IPs such as "Bored Ape" and CryptoPunk are all calculated in tens of millions of dollars.

As the market develops, most NFTs are not expensive and are used for various purposes. They are either combined with brands as a tool for brand cohesion, or used by traditional project parties for brand marketing, or used for value-added products such as tickets and IP peripherals. Following the nature of NFT, we can keep an eye on its subsequent development.