1. Attention Value-Market Key Points

1. Market conditions

(1) Macro environment:

l U.S. December CPI data released: Slowing inflation triggers market optimism

Data released by the U.S. Bureau of Labor Statistics on January 15 showed that the Consumer Price Index (CPI) in December 2024 rose 2.9% year-on-year, and the core CPI (excluding food and energy costs) rose 3.2% year-on-year. Although the core CPI only increased by 0.2% month-on-month, the overall CPI rose by 0.4% month-on-month, the largest increase since March last year. The data reflects factors such as falling hotel accommodation prices, slowing growth in health care services and moderate rent increases, which effectively curbed inflationary pressures. This situation eased the sell-off in the bond market and revived market expectations for the Federal Reserve to cut interest rates, although investors generally believe that rate cuts may not be realized until after June. The U.S. stock and bond markets rebounded accordingly, with the S&P 500 index rising nearly 2% and the Dow Jones Industrial Average soaring more than 700 points. At the same time, the cryptocurrency market also performed strongly, with Bitcoin returning to the $100,000 mark, showing its sensitivity to macroeconomic trends.

(2) Web3 field:

U.S. crypto exchanges will implement third-party reporting requirements starting in 2025, with tax information submitted directly to the IRS

Starting in 2025, crypto trading in the United States will face third-party reporting requirements for the first time, and all trading information conducted on centralized trading platforms such as Coinbase and Gemini will be submitted directly to the Internal Revenue Service (IRS). According to the new regulations, institutions such as custodial trading platforms, digital asset wallet providers, cryptocurrency ATM operators and digital asset payment processors are required to track users' buying and selling transactions throughout the year and submit relevant reports to users and the IRS in early 2026. The specific implementation schedule shows that the reporting of crypto asset cost benchmark information will begin in 2026, while peer-to-peer trading reports on decentralized platforms such as Uniswap and Sushiswap will be postponed until 2027, and only the total transaction amount will be reported. In addition, transactions of newly listed Bitcoin spot ETFs will also be reported through 1099-B or 1099-DA forms, including share transactions and taxable events generated within the fund.

2. Hot events

(1) Macro environment:

Global pension funds begin to allocate Bitcoin and focus on emerging asset classes

According to the Financial Times, multiple pension funds are trying to buy Bitcoin. Pension funds in Wisconsin and Michigan have become one of the major holders of US stock market funds focused on cryptocurrencies. As of the end of September, the Wisconsin Investment Committee became the 12th largest shareholder of BlackRock's Bitcoin ETF, with a holding value of approximately $155 million, while Michigan was the sixth largest shareholder of the Grayscale Ethereum ETF, with a holding value of $12.9 million. At the same time, some pension fund managers in the UK and Australia have also made small allocations to Bitcoin through funds or derivatives. Cartwright, a British pension advisory firm, has facilitated the first Bitcoin transaction, with a small pension plan investing approximately £1.5 million directly in Bitcoin. In addition, more than 50 individual savers want to transfer their pensions in full to cryptocurrencies. Although cryptocurrency investments are still a minority in the pension industry and most advisors are cautious about clients getting involved in this field, more and more pension funds are beginning to pay attention to this emerging asset class.

(2) Web3 field:

l The Financial Services Commission of South Korea reports for the first time a case of unfair trading under the Virtual Asset User Protection Act

South Korea's Financial Services Commission (FSC) announced the first unfair trading case under the Virtual Asset User Protection Act on January 16. The act, which takes effect in July 2024, requires local virtual asset service providers (VASPs) to report abnormal transactions and investigate unfair trading patterns. According to the FSC, the suspect manipulated the market using a "pump and dump" technique, initiating multiple buy orders to raise the price of a certain cryptocurrency, and then quickly selling a large amount of pre-purchased assets. The entire manipulation process was usually completed within 10 minutes, causing the price of the underlying asset to fluctuate violently and illegally making hundreds of millions of won in profits within a month. This case marks an important step forward in South Korea's fight against misconduct in the cryptocurrency market.

3. Hot topic narrative

l XRP market value reaches $ 170 billion, surpassing asset management giant BlackRock

In the past 24 hours, the price of XRP broke through $3 for the first time, reaching its highest point since 2018, with a 15-day increase of 40%. Currently, XRP is only 17% away from its all-time high of $3.84, and its market value has exceeded $170 billion, surpassing asset management giant BlackRock. The rise was mainly driven by expectations of cryptocurrency-friendly policies and US digital asset regulatory reforms, especially the long-standing legal battle between Ripple and the US Securities and Exchange Commission. Diego Cardenas, a trader at digital asset platform Abra, pointed out that XRP's surge was due to new partnerships, the launch of Ripple's stablecoin RLUSD, and speculation about a potential spot XRP ETF. Ripple President Monica Long said she expects spot ETFs to be approved soon, and Ripple's leadership's engagement with the incoming US government may promote a regulatory environment that is favorable to digital assets. In addition, the continued accumulation of "whales" holding 1 million to 10 million tokens has provided support for the rebound. Analysis firm Santiment reported that these addresses have accumulated 1.4 billion XRP since November, worth about $3.8 billion. In addition, Google Trends data also shows that XRP searches have surpassed Bitcoin.

2. Attention Value-Hot Projects

1. Project Introduction

l $sora | AI | @labs_sora

- Sora Labs is an artificial intelligence organization focused on the Solana ecosystem.

- Mainly developing the following projects: Zen, an open source AI dialogue framework built in Go, designed to simplify and flexibly develop agent chat systems, with features such as mix-and-match, adaptability to multiple AI models, personalized chat and memory functions; Hana, a Twitter AI agent based on the Zen framework, demonstrating Zen's capabilities; Toolkit, developed in Go and Rust, to help manage tools that work seamlessly with AI models; Solana Toolkit, an extended toolkit that provides specific functionality for Solana. All projects have been open sourced.

- Token Economics: DEV purchased 100 million tokens, of which 99.2 million have been locked until March 12, and 24.75 million tokens will be unlocked linearly every two weeks, with the next unlocking time being January 29. In addition, 829.6K tokens have been transferred to the streamflow contract but have not yet been locked.

- The top 100 holdings account for 61.95%, of which the largest holder accounts for 9.92% of the locked positions. The average purchase price of the top 100 has doubled.

3. Attention Value-Sector Rotation

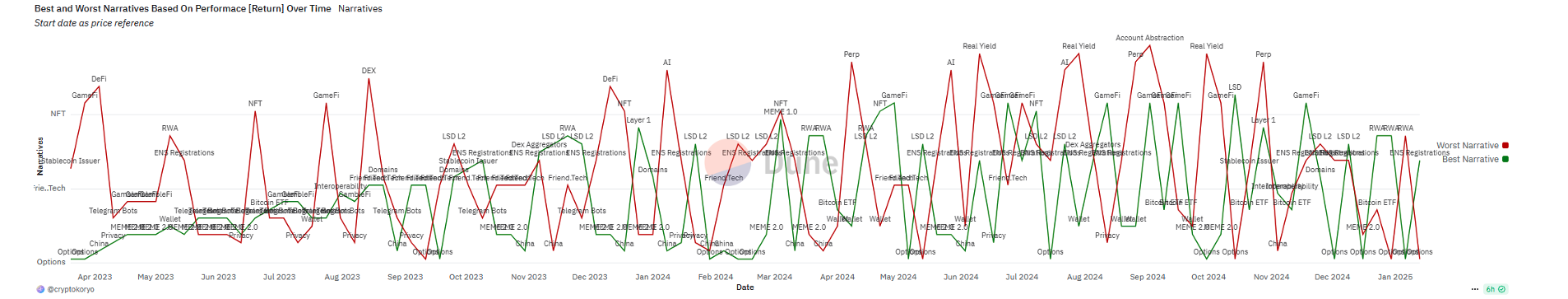

1. Hot topics

Source: Dune, Dot Labs

Source: Dune, Dot Labs

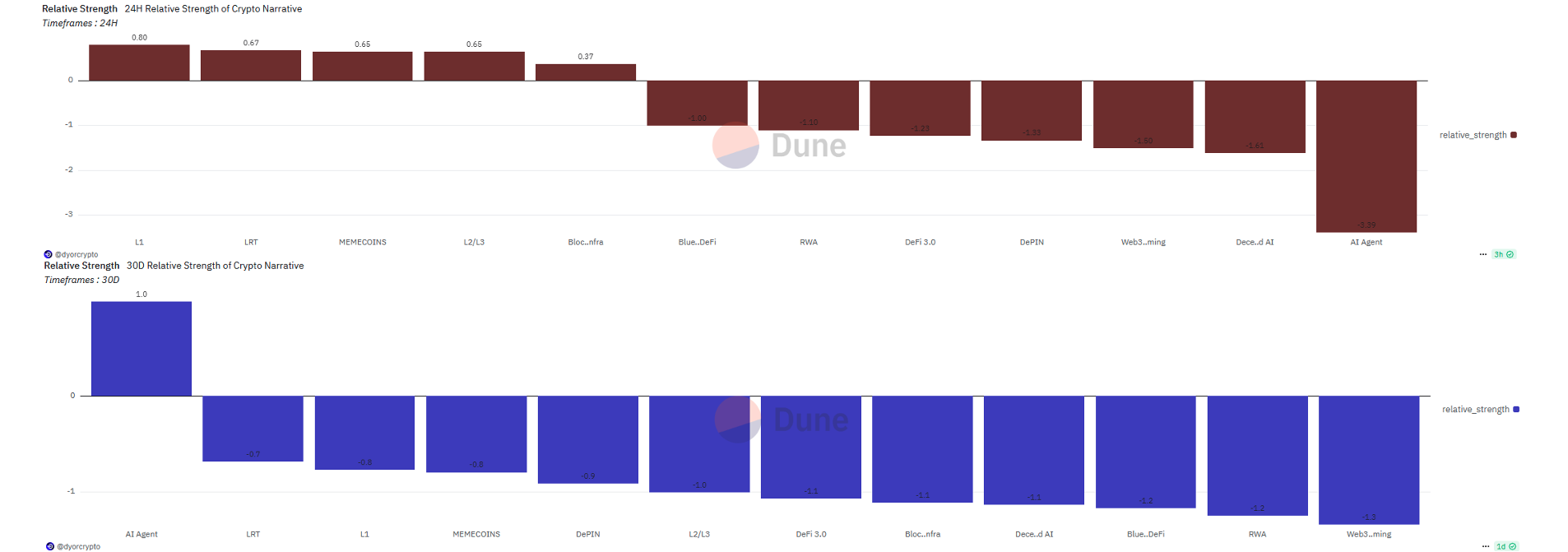

2. Inside the plate

Source: Dune, Dot Labs