Written by: Web3 farmer Frank

How did you fare in the latest Plume airdrop?

The answer may be mixed. In fact, with the current stock involution, airdrops are no longer an effective means of incentive for open source traffic, but have become a financial game for crypto studios and on-chain whales. With the recent airdrops of new tokens such as PLUME, a question has become increasingly prominent: how can ordinary users participate in the dividends of the emerging ecosystem more fairly and efficiently, rather than just becoming the runner-up of the whales?

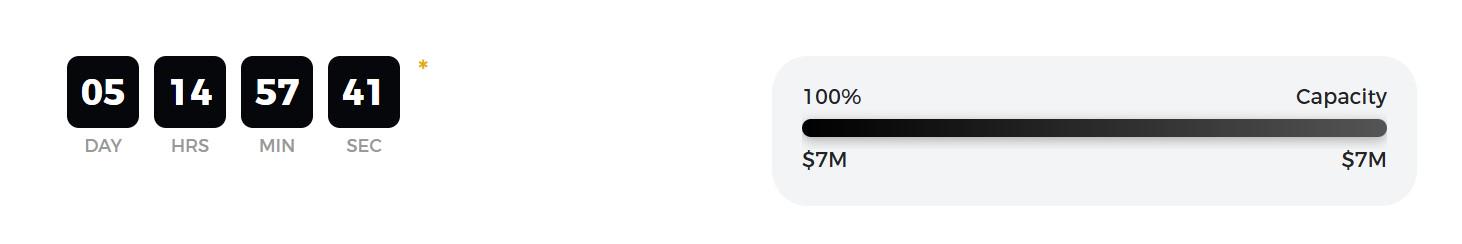

Interestingly, StakeStone, which launched the pre-deposit vault before the Plume airdrop, officially announced that it would upgrade the original StakeStone Vault brand to StakeStone LiquidityPad, and the first launch project Aria reached the purchase limit of 7 million US dollars in 9 minutes.

An interesting analogy is that in today's multi-chain era, each emerging public chain is like a country, with unique characteristic industries, but they are in urgent need of capital and resources to complete industrialization. In this context, just as the VIE legal structure helps companies in developing countries obtain US dollar capital investment, grow and grow, and then bring the results back to the US financial market for trading, StakeStone LiquidityPad is essentially playing a similar role:

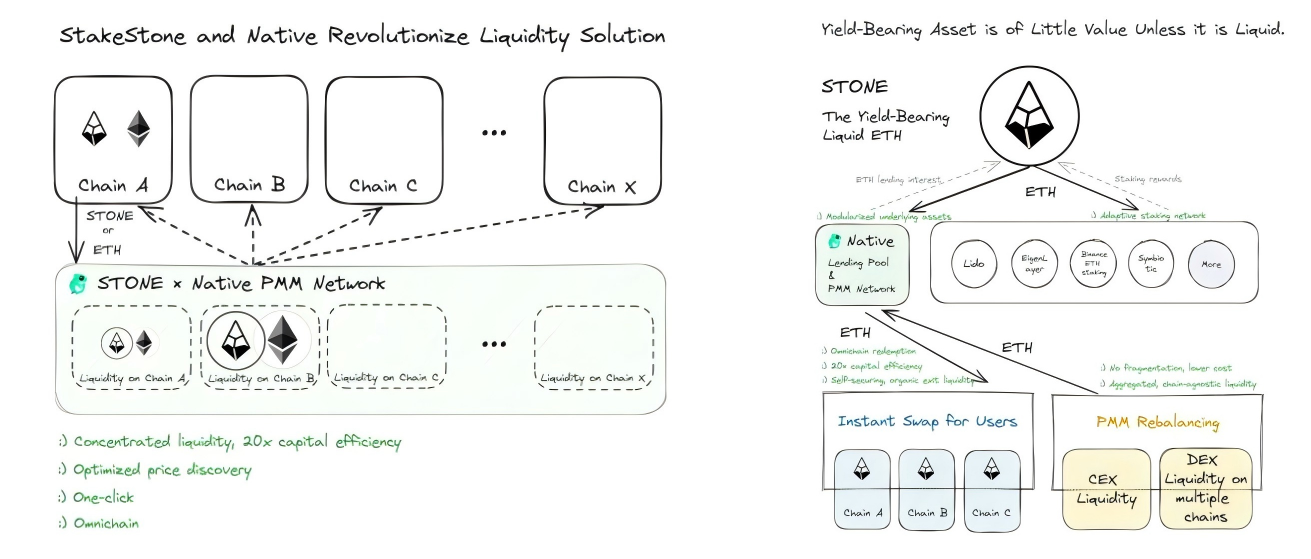

One end is connected to Ethereum's mature on-chain financial ecosystem, and the other end is connected to various emerging public chain ecosystems, helping emerging public chains to raise resources on the Ethereum mainnet, and bring the excess returns (Alpha) generated after the development and growth of these resources back to the Ethereum mainnet with mature financial services for transactions, becoming the largest pipeline infrastructure connecting Ethereum (US dollar capital) and emerging public chains (developing countries).

In the prosperous multi-chain era, the liquidity dilemma of "entropy increase"

Things always develop in the direction of increasing entropy, and Crypto is no exception.

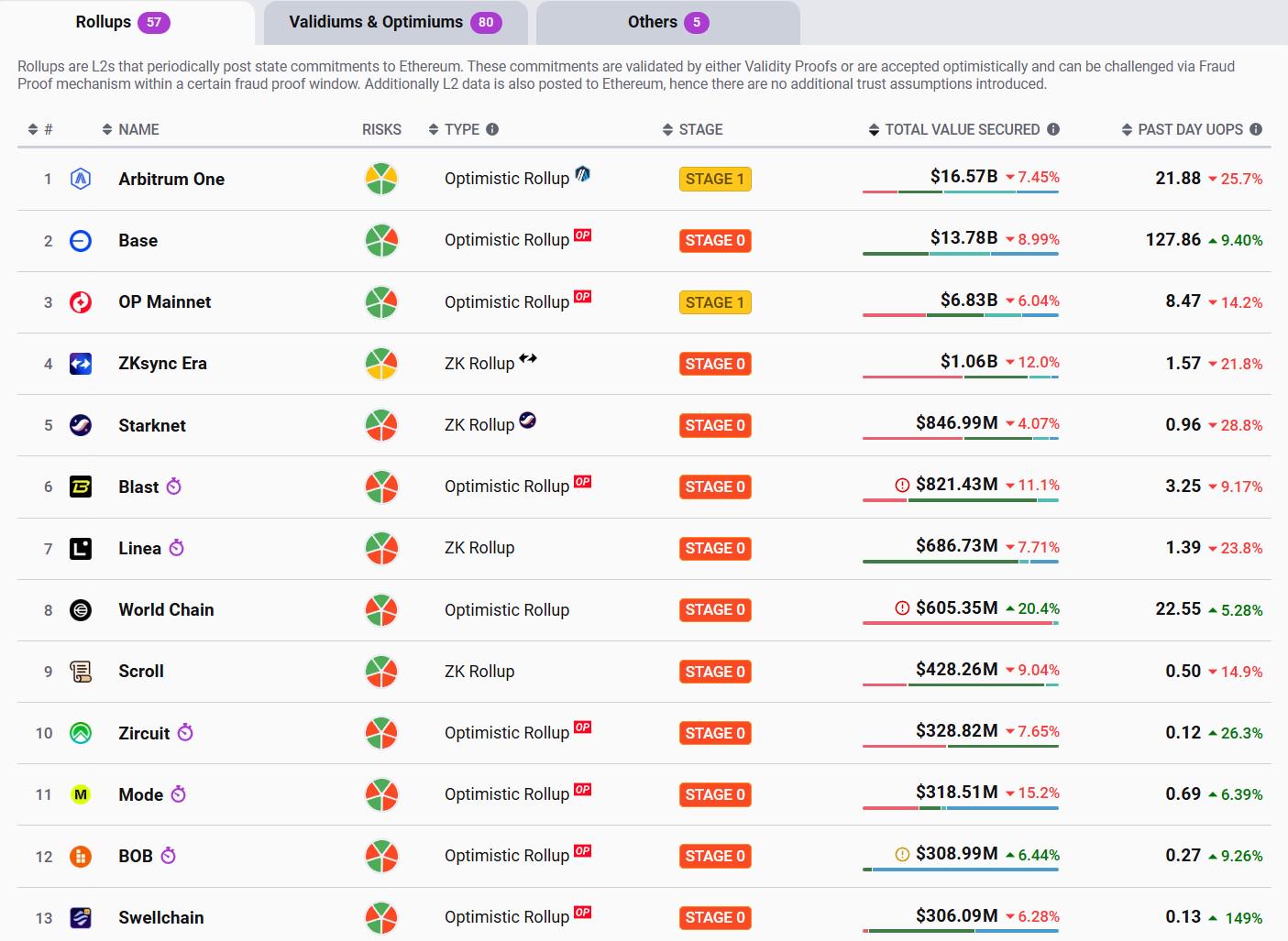

Driven by the wave of modularization, from the initial multi-chain concept of Cosmos and Polkadot, to the prosperity of Rollup in the Ethereum L2 era, to the application chains such as OP Stack, Arbitrum Nova, and Starknet, more and more protocols and applications have begun to build exclusive chains for specific needs, trying to find the best balance between performance, cost and functionality.

According to incomplete statistics from L2BEAT, there are hundreds of Ethereum L2s in a broad sense. Although this diversity has brought more possibilities to the on-chain ecosystem, it has also led to a long-standing problem - the extreme fragmentation of liquidity .

Especially since 2024, liquidity has not only been dispersed on Ethereum and L2, but has also been severely isolated in the exclusive ecosystems of various emerging public chains/application chains. This fragmentation has not only increased the complexity of user operations and experience, but also greatly restricted the further development of DeFi and on-chain applications:

For Ethereum and L2, liquidity cannot flow freely, capital efficiency is reduced, and the potential of on-chain Lego cannot be fully realized; for emerging public chains such as Plume and Berachain, it means that the migration cost and entry threshold are high, the liquidity island effect from 0 to 1 is difficult to break, and the expansion of the ecosystem is hindered.

In a nutshell, the "entropy increase" trend in the multi-chain era has become the biggest curse for prosperity in the multi-chain era.

In the context of accelerated fragmentation of multi-chain asset liquidity, users and developers are eager for funds to flow efficiently in any network's DEX, lending and other on-chain protocols, breaking the fragmented network barriers and user experience, especially in emerging public chain ecosystems such as Plume and Berachain outside the Ethereum ecosystem:

The profit opportunities in these emerging public chain ecosystems are often highly attractive, and users need to be able to easily migrate assets from Ethereum or other chains to these emerging ecosystems to participate in their DeFi protocols, liquidity mining or other profit opportunities.

In fact, for users, liquidity is the key no matter how composable it is. So objectively speaking, if Ethereum and the multi-chain ecosystem want to continue to expand and prosper, it is urgent to efficiently integrate liquidity resources scattered across multiple chains and platforms.

This requires the establishment of a unified technical framework and specifications to combat "entropy increase" and thus bring wider applicability, liquidity, and scalability to the multi-chain ecosystem. This will not only further promote the "unification" process of on-chain liquidity, but also promote the maturity of the multi-chain ecosystem.

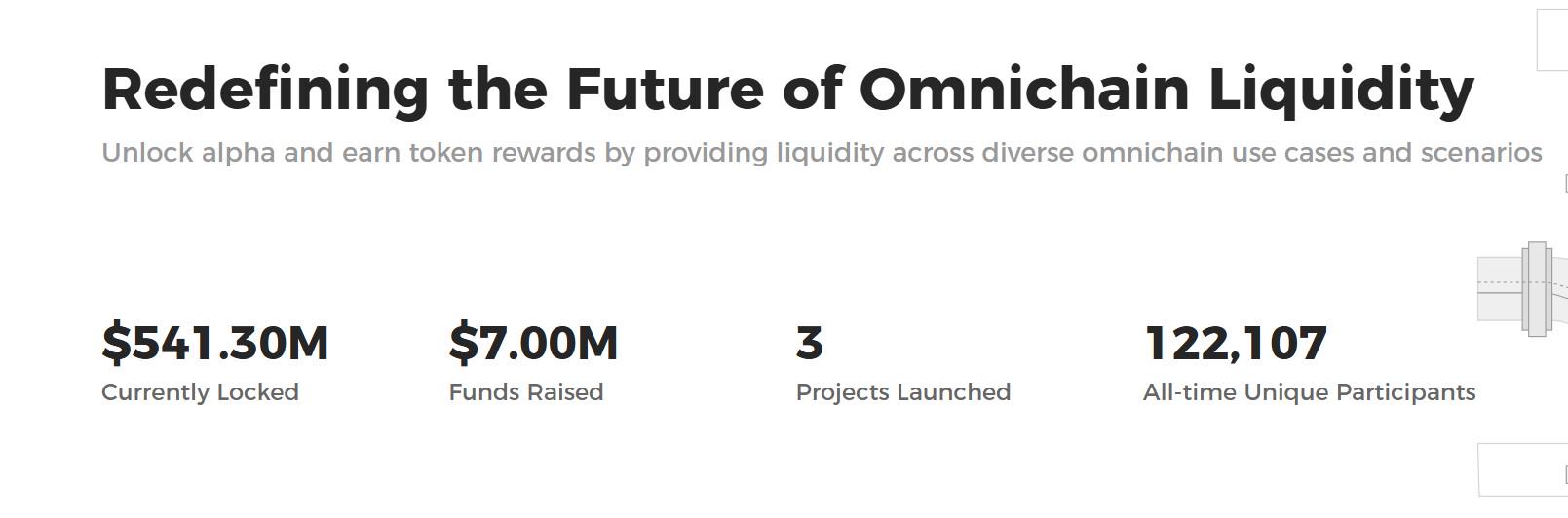

This "unified" demand and vision also provides room for full-chain liquidity infrastructure such as StakeStone LiquidityPad to display its strength. As an innovative full-chain liquidity treasury product issuance platform, StakeStone LiquidityPad aims to help emerging public chains and application chains efficiently integrate cross-chain liquidity resources by providing customized liquidity fundraising solutions, breaking liquidity silos and promoting the efficient circulation of capital.

As of the time of writing, StakeStone LiquidityPad has locked in over US$540 million in funds, with a total of over 120,000 unique on-chain addresses participating. This data not only proves the market's recognition of StakeStone LiquidityPad, but also reflects users' strong demand for full-chain liquidity solutions.

StakeStone LiquidityPad: From Point to Surface, Transition to Liquidity Network

Many users may still think of StakeStone as an income-generating agreement related to Ethereum Staking/Restaking. However, from the very beginning, StakeStone’s product architecture has been aimed at the full-chain liquidity infrastructure. However, in the early stage, it has gradually built the prototype of its liquidity network by targeting the Vault products of the emerging public chain ecosystem:

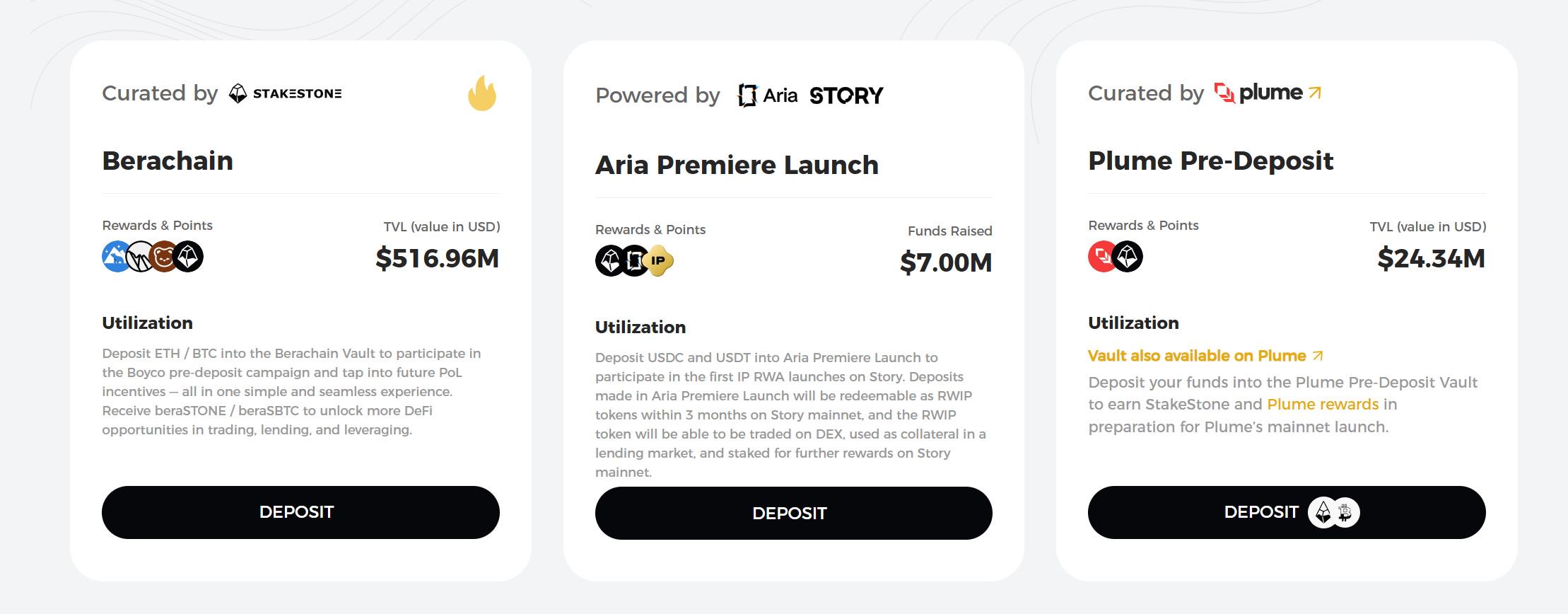

Whether it is the Plume Pre-Deposit Vault launched in cooperation with Plume, or the Berachain StakeStone Vault launched in cooperation with Berachain, they are both StakeStone's pioneering attempts in different ecological scenarios. They not only bring much-needed liquidity support to the emerging public chain ecology, but also set a good example for the construction of StakeStone's incomplete chain liquidity infrastructure.

This also explains why StakeStone decided to further upgrade its product line and rebrand the original Vault into StakeStone LiquidityPad - a more comprehensive, flexible and customized full-chain liquidity fundraising and management platform. It is not only an evolution of the product form, but also a key step for StakeStone to leap from a "point-to-point" liquidity solution to a "point-to-face" liquidity network.

In short, as a full-chain liquidity infrastructure, StakeStone has always been committed to connecting the liquid assets on the Ethereum mainnet with the liquidity needs of emerging public chains and L2 ecosystems.

From this perspective, the rebranded StakeStone LiquidityPad is actually a customized full-chain liquidity solution for diversified needs, covering full life cycle liquidity support from cold start to ecosystem expansion.

1. Projects that have not yet launched the mainnet: Pre-deposit vaults to help cold start

For public chains or protocols that are still in the cold start stage and have not yet launched their mainnet, StakeStone LiquidityPad supports project owners to raise liquidity required for early cold start by issuing a pre-deposit vault on the Ethereum mainnet, and use the funds for the following purposes:

- Liquidity provision for DeFi protocols: such as Berachain Vault, which helps the Berachain ecosystem quickly build core DeFi components;

- Liquidity support for the RWA protocol: such as Plume Vault, which provides resources for the on-chainization of real-world assets (RWA);

- Investment in RWA assets: such as Story Protocol Vault, which supports emerging protocols to introduce on-chain liquidity into real asset scenarios;

2. Projects that have been launched on the mainnet: Specific income scenario vaults accelerate ecological growth

For projects that have already launched the mainnet and entered the mature operation stage, StakeStone LiquidityPad supports customizing vaults for specific liquidity income scenarios to help the project ecosystem achieve rapid growth, such as:

- Liquidity provision for DeFi protocols: such as Solana/SUI Vault, which provides liquidity support for DeFi protocols on these public chains and improves capital efficiency;

- Liquidity provision for special profit scenarios: For example, BNB Chain Vault supports special profit scenarios on BNB Chain, such as liquidity mining, staking rewards, etc., through customized liquidity solutions to meet the high-yield needs of specific ecosystems;

In order to meet the needs of a wider range of application scenarios in the future, StakeStone will also expand support for more mainstream assets in addition to STONE/SBTC/STONEBTC issued by StakeStone, including but not limited to ETH, WETH, WBTC, cbBTC, BTCB, LBTC, FBTC, USDT, USDC, etc.

It can also be seen here that, from point to surface, through the upgrade of StakeStone LiquidityPad, StakeStone not only provides more flexible tools for emerging public chains and L2, but also builds a more efficient full-chain liquidity network - whether it is liquidity support from cold start to mature stage, or resource integration of cross-chain ecology, LiquidityPad aims to become the key link in the on-chain liquidity cycle.

This will not only meet diverse liquidity needs, but also efficiently integrate liquidity resources scattered across multiple chains to form an interconnected liquidity network. Whether it is the cold start needs of emerging public chains or the expansion needs of mature ecosystems, StakeStone LiquidityPad will become their most reliable liquidity partner.

The “Full-chain Liquidity Flywheel” behind StakeStone

Increment is the core primitive of Web3.

For StakeStone LiquidityPad, its core value lies not only in solving the liquidity isolation problem of emerging public chains and application chains, but also in forming a "full-chain liquidity flywheel" that integrates multiple asset returns and liquidity release through its unique mechanism design.

The core of this flywheel effect is the multiple income and liquidity release mechanism centered around LP Token.

First of all, after users deposit assets through StakeStone LiquidityPad, they will obtain LP Tokens (such as beraSTONE). These LP Tokens are not only the user’s equity certificates in the emerging public chain ecosystem, but also the key to unlock multiple benefits.

On the one hand, the assets deposited by users will directly participate in the emerging public chain ecosystem, such as Berachain's liquidity mining rewards and governance token airdrops. At the same time, StakeStone's automated strategies help users efficiently capture these local benefits without having to face complex technical operations and automated strategies within the Vault.

This low-threshold participation method allows more users to easily enter the emerging ecosystem and seize early dividends.

On the other hand, the corresponding LP Token not only represents the rights and interests of users in the emerging public chain ecosystem, but also encapsulates the income of the emerging ecosystem as interest-bearing assets, and connects with more mature main network infrastructure, with a high degree of financial composability - users can seamlessly access DeFi financial facilities on Ethereum through LP Token, further releasing liquidity potential:

- Providing liquidity or trading on DEXs such as Uniswap/Curve: Users can use LP Tokens for liquidity mining or trading to obtain additional benefits;

- Use AAVE/Morpho for collateralized lending: LP Tokens can be used as collateral to participate in the lending market, further improving capital utilization;

- Use Pendle to sell earnings: Users can split or sell the earnings rights of LP Tokens through protocols such as Pendle to realize early cashing of earnings;

This mechanism not only allows users to reuse their assets in multiple ecosystems to maximize profits, but also significantly lowers the participation threshold of emerging ecosystems, allowing more users to efficiently participate in the local revenue capture of emerging public chain ecosystems such as Berachain.

Therefore, with the superposition of multiple benefits, the user's investment return can be maximized, and the acceptance and recognition of the emerging ecosystem can also be quickly opened up, forming a positive flywheel effect: more users participate → more liquidity is injected → the development of the emerging ecosystem is accelerated → the value of the income-encapsulated assets is increased → attracting more users to participate.

What’s more interesting is that with the upgrade of StakeStone LiquidityPad, it also means that it can better and effectively connect emerging ecosystems such as Berachain that are in the cold start stage with mature ecosystems with different revenue scenarios:

- Help emerging public chains raise cold start funds: Through StakeStone LiquidityPad, emerging public chains can raise cold start funds on the Ethereum mainnet and obtain the "from 0 to 1" liquidity support needed for early development;

- Bring excess returns back to mature markets: After growing stronger with the help of resources, the excess returns (Alpha) on the emerging public chain will be brought back to the Ethereum mainnet with mature financial services for trading, thus achieving a complete cycle of the entire resource cycle;

Overall, this dynamic adaptation mechanism improves the compounding ability of asset returns and further enhances the market adaptability and competitiveness of StakeStone LiquidityPad.

Human beings’ demand for new assets is eternal. From this perspective, in the horse racing landscape of the multi-chain era, StakeStone LiquidityPad is very likely to become a key tool for building liquid niche assets and a prosperous on-chain ecosystem by virtue of its positioning as a full-chain liquidity infrastructure:

By introducing a new income structure with full-chain liquidity attributes, it can not only stimulate the dull on-chain ecology, but also design product forms and composable DeFi scenarios with higher capital efficiency and better returns. This not only satisfies users' pursuit of diversified returns, but also provides efficient liquidity solutions for emerging public chains and mature ecosystems.

Conclusion

In the future, with the accelerated expansion of the multi-chain ecosystem, StakeStone LiquidityPad is expected to become a core hub connecting emerging public chains with mature markets, bringing more efficient and fairer liquidity solutions to users and protocol parties.

From the liquidity dilemma of "entropy increase" to the ecological prosperity of "flywheel drive", redefining the liquidity infrastructure of Web3 is not only the inevitable path for StakeStone to further improve the full-chain liquidity issues, but also the optimal solution to promote the maturity of the multi-chain ecology.

As to whether the critical point of transformation can be reached in 2025, it remains to be seen.