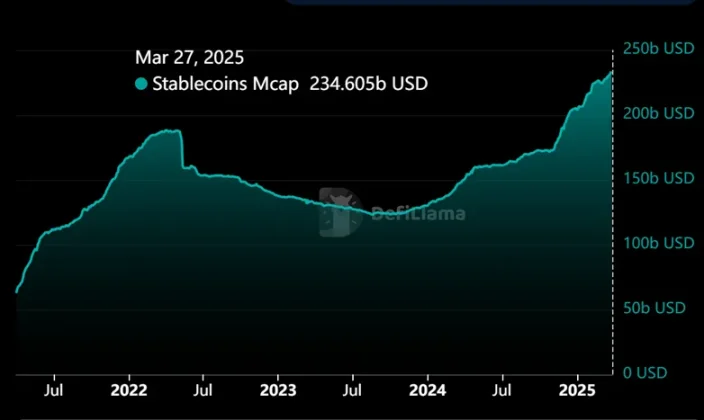

According to DefiLlama data, the market value of stablecoins hit a record high last week, with a total market value of more than US$234.6 billion, almost doubling the low of US$124 billion in August 2023. USDT is still leading the stablecoin market with a market share of more than 62%.

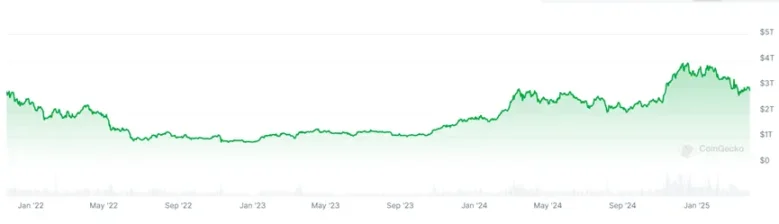

At the same time, the total market value of Crypto has almost shown similar market value changes to stablecoins in the past two years, doubling from about US$2 trillion in mid-2023 to about US$4 trillion. However, the highest point was in December last year, and it has now fallen back to around US$2.8 trillion, a drop of about 30%, which is inconsistent with the growth of the market value of stablecoins.

So an interesting question arises: Why is the market value of stablecoins growing, while the total market value of the Crypto market continues to decline?

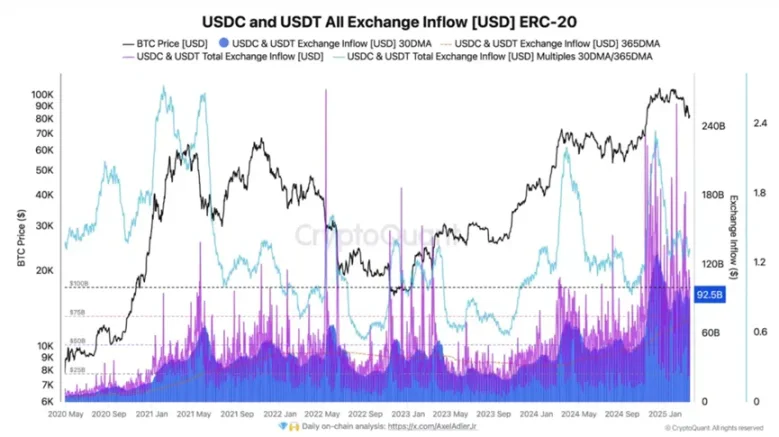

From the changes in the total market value of stablecoins and the market value of BTC in the figure below, we can see that before December last year, the trend changes of the two were almost the same. The rise of BTC was often accompanied by an increase in the market value of stablecoins, and the decline of BTC would also lead to changes in the market value of stablecoins, but the fluctuation range was different.

According to statistics, during the bull market of 2020-2021, the issuance of USDT was strongly positively correlated with the price of BTC, with a correlation coefficient exceeding 0.85, which also confirmed this trend change.

The current trend seems to be consistent with the trend of stablecoins and BTC in early 2022. At that time, there was a period of time when the market value of stablecoins expanded, but BTC retreated. However, I think the changes in stablecoins this time may be different from that time.

First of all, regarding the separation of stablecoins and BTC price changes, the new funds in this cycle did not directly flow into the BTC spot market on a large scale. Data shows that the open interest of derivatives in March 2025 remained at a high level of US$54 billion, while the net inflow of spot stablecoins in exchanges was relatively weak. This means that a large number of stablecoins are used for leveraged transactions (such as futures and perpetual contracts) rather than actual holding needs, and have even become more of a hedging tool.

Secondly, compared to a few years ago when the use of stablecoins was mainly concentrated in the single Crypto market, now stablecoins have gone beyond the Crypto industry itself and begun to move from virtual to real.

According to Visa's survey data, in emerging markets, about 47% of users use stablecoins for US dollar savings, 43% for better currency exchange, and nearly 40% of users use stablecoins for actual payments (commodities, cross-border remittances or salary payments). In countries such as Turkey and Egypt where the inflation rate exceeds 50%, the number of stablecoin holders has increased by 400% year-on-year, becoming the core choice for residents to preserve value.

Electronic payment giants like PayPal have connected their stablecoin PYUSD to over 1 million merchants such as eBay and Shopify, with transaction volume exceeding US$1.2 billion in the first quarter of 2025. According to BlackRock's forecast, the stablecoin market size will reach US$2.8 trillion in 2028, penetrating 5% of global cross-border payments and 15% of the gig economy.

Therefore, the current expansion of the stablecoin market is not only limited to the growth of the market value of the Crypto market, but also lies in the expansion of its application scale itself, so the previous correlation has begun to weaken in terms of numbers. So based on the current market conditions, what data should we pay attention to about stablecoins?

The author believes that we should pay more attention to the changes in the data of stablecoin inflows into large exchanges. Historically, surges in stablecoin inflows coincide with local tops or bottoms, usually heralding increased volatility. The latest surge exceeded $92.5 billion, one of the highest inflow levels ever.

Although the Crypto market has experienced greater volatility, the ups and downs of the market are bringing more changes, which also drive the industry forward, although not 100% consistent with price changes.

As an interesting news report last week, the Financial Times quoted people familiar with the matter as saying that asset management giant Fidelity Investments is pushing forward the issuance of its own stablecoin, which is currently in the late stages of testing. It can be seen that more and more traditional financial giants are joining the stablecoin competition.

We have to admit that stablecoins are currently the largest application of the Crypto market or blockchain, but the value changes and carrying capacity brought about by this underlying application may quietly change something. After all, it is also an expansion of Web3 users, but it has not yet brought about real qualitative changes.

As for whether the Crypto market will eventually benefit from the expansion of the market value of stablecoins, there is an old saying that goes, since you are here, don’t be polite? The wild geese leave their voices behind, and the wind leaves its traces behind. There will always be some feathers plucked.