Trump wants to build a "Crypto Monopoly"? (Related reading: " Trump, an old fan of Monopoly, enters the blockchain game, making another move in the crypto market ")

Although Trump has disturbed the world since he took office, we have to admit that, personally, Trump is undoubtedly the most money-making president of all time. In addition to his well-known real estate industry, the growth of his media and technology companies, and the shady stock operations that have made the market extremely suspicious, he has also opened up a new channel for profit-making - cryptocurrency, and has made at least $1 billion in profits from it.

To date, Trump's crypto territory has been expanding, from the initial NFT to Defi, from MEME to stablecoins, and finally to mining. A new crypto empire named after Trump seems to be rising. And just recently, according to Fortune, the Trump family is suspected of targeting the blockchain game field again.

Looking back at Trump's crypto journey, we have to start with digital cards. In June 2021, Trump at the time was still advocating the "great dollar theory", denouncing cryptocurrencies as a "scam" that affects the value of the dollar, and also said that cryptocurrencies should be strictly regulated. But in less than a year and a half, Trump has shown his true colors.

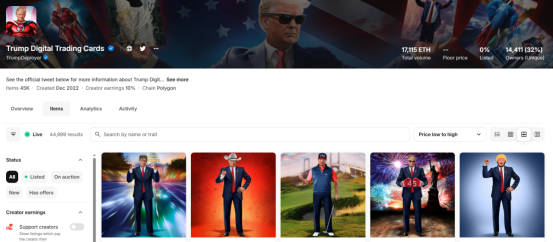

On December 15, 2022, Trump announced the release of Trump digital trading card NFT through TruthSocial, a social media website he founded. The series was minted on the Polygon blockchain, and a total of 45,000 NFTs were initially created, with a starting price of $99 per piece. Buying 45 digital trading cards will get you a ticket to dinner with Trump. This series of NFTs can be purchased with credit cards and WETH, and requires KYC and email. Although it caused ridicule at the time, with the traffic blessing and call of the former president, this series was still sold out in less than a day after its launch. Judging from the trading volume of opensea, the total transaction volume of this series reached 17,115ETH, and there are currently 14,411 holders.

In short, Trump made a huge profit of $4.45 million on his first attempt. After tasting the sweetness, on April 18, 2023, Trump quickly released his second series of NFTs - Trump Digital Trading Cards Series 2. The same marketing method, but the total number of series increased to 47,000, which he said was to express his confidence in serving as the 47th president. The price is still $99. Although it was also sold out within 5 hours of release, it plummeted rapidly on the second day. It can be seen that the market has been tired of the consecutive sales.

But Trump doesn't care about the market, he only cares about the actual benefits. Shortly afterwards, Trump released the third series of MugShot Edition NFTs. This time it was even more outrageous, with a total of 100,000 pieces, with no price increase, and introduced special benefits. For $10,000, you can be invited to the reception, and a unique Ordinal digital trading card limited to 200 pieces will be included. It is precisely because of this series that Trump's subsequent "making NFT hot again" came into being. A simple calculation shows that with just three sets of NFT combinations, the Trump team has attracted $19 million, and according to its financial disclosures, the actual profit of NFTs has reached millions of dollars.

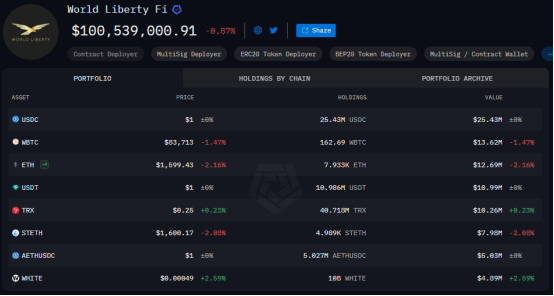

NFT is just the beginning. It is both for earning political donations and for canvassing votes. In September 2024, the Trump family announced the launch of the cryptocurrency project "World Liberty Financial". This company named Defi has not seen much improvement in Defi since its listing. Instead, it has continuously bought coins and built positions, which has attracted attention. The total holdings have reached 1 billion US dollars, with a loss of 0.87%. More directly, the sale of governance tokens. In the context of clarifying that the tokens will not be resold at the secondary level and that there are market interests, in March this year, WLFI still announced the completion of the sale of $550 million WLFI governance tokens, and the currency circle OG Sun Yuchen also contributed $75 million.

The documents show that after deducting operating costs, Trump and his business partners will receive 75% of the project's net income, including the WLFI token sale. Of the funds raised from the WLFI sale, $30 million has been designated to pay company expenses, compensation and obligations. Project documents also show that Trump and his partners in DT Marks DEFI LLC will receive 75% of the remaining amount, or $390 million, as marketing fees for Trump to promote the project "from time to time" and allow the use of his name and image.

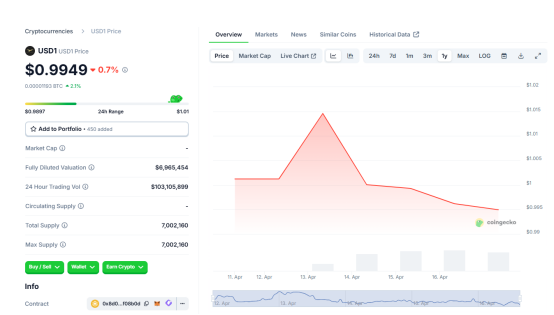

Just as Trump talked about the future of stablecoins at the first White House Crypto Summit, the family business took action. On March 25, WLFI announced the launch of a stablecoin called USD1, which is pegged to the US dollar and 100% backed by US government short-term treasury bonds, US dollar deposits and other cash equivalents. USD1 will be minted on the ETH and BSC blockchains, and plans to expand to other protocols in the future. USD1 reserves will be hosted by BitGo. As of now, according to Coingecko data, USD1 transaction volume has exceeded 44.91 million US dollars.

Next up is mining. The president has made it clear that he wants to ensure that the remaining bitcoins are made in the United States, so the Trump family naturally wants to seize the opportunity. At the end of March, Trump's second son Eric Trump and mining company Hut 8 Mining announced the joint establishment of a new bitcoin mining company, American Bitcoin. Hut 8 injected most of its ASIC mining machines into American Data Centers, which was co-invested by Eric Trump and Donald Trump Jr., and changed its name to American Bitcoin after the transaction was completed. Hut 8 holds 80% of the shares.

If mining and stablecoins seem to have just taken shape and there is no big profit to speak of, the one that shocked the world must be Trump MEME. In January, Trump's personal MEME Trump opened the precedent of the president issuing coins, and successfully made him a lot of money amid the abuse. But from the peak of $70 to the current $7.89, from a 125-fold surge to a 90% drop from the high point, investors are in a state of extremes, and it also laid the root cause of further tightening of liquidity in the subsequent cryptocurrency circle.

Due to the unlocking problem, the actual profit is not as huge as imagined. From the perspective of token distribution, the total supply of TRUMP is 1 billion, but only 200 million will be circulated initially, and the remaining 800 million are expected to be unlocked linearly within 3 years. Two subsidiaries of the Trump Group occupy an absolute share. Trump's companies CIC Digital LLC and Fight Fight Fight LLC will own 80% of the TRUMP tokens, with a lock-up period of 3-12 months and unlocking within the next 24 months. The current book value profit is approximately US$6.344 billion.

Overall, a huge Trump crypto empire is emerging, and its layout is already very extensive. After a small trial of NFT, the mining business is about to take shape, and it also includes profit cash cow stablecoins and Defi, and even MEME provides blood packages. Although it is scattered, the industrial chain has gradually formed, and both infrastructure and applications are involved, and it is expected to continue to expand around "core applications". Bloomberg reported that as of now, the Trump family has attracted more than $1 billion in the crypto field. From the current point of view, the crypto market is not in a boom cycle. After entering the bull market after the foothold, it is obvious that the Trump family will make a lot of money.

Just a few days ago, Fortune reported that Trump's latest crypto project will be a real estate video game. People familiar with the matter said that this game is an adaptation of "MONOPOLY GO!". Players earn in-game cash by moving chess pieces on a digital "Monopoly" board and build buildings in a digital city. It was also revealed that Trump's long-time friend Bill Zanker is the driving force behind the project. However, Zanker spokesman Kevin Mercuri denied this, saying only that Zanker is indeed developing a game, but it is not Monopoly. It can be seen that the Trump family's subsequent crypto tentacles are very likely to extend to the field of blockchain games.

It has been mentioned before that Trump's business philosophy adheres to the principle of traffic monetization. The currency circle, which has always been traffic-oriented, is obviously very consistent with its business characteristics. With the support of its own controllable policies, Trump can continue to raise the currency market by releasing favorable news, and can also directly use his influence to cut into the most profitable and policy-promising fields. This is undoubtedly an alternative political corruption and insider trading. Looking at its layout in the encryption field, it is all before and after the government releases the signal, the family team quickly follows up, and interest groups are also formed. A typical example is that one of the co-founders of WLFI is Zach Witkoff, who is also the son of Steve Witkoff, the Trump administration's special envoy for the Middle East.

Not everyone is happy about this, and high-level doubts from the Democratic Party and nonpartisan parties have never stopped. Elizabeth Warren, a well-known crypto opponent, said that the SEC's abandonment of law enforcement activities is part of Trump's use of the crypto business to get rich, which undoubtedly hinders regulatory legislation. Kedrick Payne, general counsel and senior director of ethics at the nonpartisan Campaign Legal Center, also said that Trump is personally advocating laws to promote the development of the crypto industry.

This is not groundless. After Trump took office, not only did the SEC completely become crypto-friendly, the Department of Justice also promised to reduce crypto lawsuits, and even stopped prosecuting the mixers that were previously deeply involved in anti-money laundering controls, and stakeholders were able to let go. Take Justin Sun as an example. In 2023, he was also sued by the SEC for fraudulent market manipulation and other suspected misconduct, but after investing heavily in WFLI last year, the SEC stopped the lawsuit this year.

It seems that the policies under Trump's control are ironclad, but arbitrary regulation can easily trigger political conflicts, especially in the current complex political situation in the United States, where there is a possibility of regulatory backlash. Investment bank TD Cowen said today that the Trump family's crypto business (including the planned stablecoin) may trigger a backlash and delay the US regulatory process. Although lawmakers are accelerating crypto regulations, political risks are rising.

In fact, conflicts of interest and insider information are not limited to the cryptocurrency circle. After the recent tariff storm swept the global stock market, Trump's close friends have successfully made a fortune. According to congressional disclosure documents, Marjorie Taylor Greene, a Georgia congresswoman who has a close relationship with Trump, successfully made 21 stock purchases the day before and the day Trump suspended tariffs. What's even more ridiculous is that on the same day, Trump's personal account stock holdings soared 22.67%, with a single-day profit of more than $415 million. In addition to this congresswoman, Republican Congressman Rob Bresnahan of Pennsylvania also coincidentally sold shares of American steel producer Steel Dynamics in advance on the day Trump announced the imposition of tariffs on steel and aluminum products. Although the two congressmen later came forward to clarify that the investment was legal and compliant, it still aroused suspicion in the market.

The family makes money in the cryptocurrency circle, and allies profit in the stock market. No matter how it is clarified, Trump's operation is inevitably suspected of conflict of interest. At present, the Democratic Party has jointly sent a letter to the new SEC Chairman Paul Atkins, asking for an investigation into whether Trump has created trading opportunities for allies through policy changes and whether he is suspected of market manipulation. However, considering that the chairman was pushed to the top by Trump, the Democratic Party's impeachment may be difficult to succeed.

It is obvious that the Trump family has not stopped making money. Less than half a year after taking office, the Trump family has already made billions of dollars. After four years in office, how much more money will they make? The evaluation of the Trump family's ability to govern has not yet begun, but the most profitable president in the United States seems to have been born.