![]()

Original article: Web3 Profile

1. Could you please introduce yourself first?

Hello everyone, I am Daxiao, the founder of the 6551 community, responsible for the community's alpha team and tool team. Our community is a platform that combines alpha investment research and tool development. The alpha team will track market hotspots, and the tool team will develop corresponding products based on these hotspots for community members to use. The products we are currently incubating include Solana and ETH's DEX functions and automated cashing systems.

2. Can you tell us about your past experiences?

Before entering the cryptocurrency world, I worked as a developer in a Web2 company. I started my internship in 2017, when the Internet was at its peak. I was in charge of the company's advertising business. Customer traffic mainly came from JD.com's 618, Taobao's Double 11 and Double 12. We mainly did big data analysis and monitored the exposure and click-through rate of advertisements. At that time, I personally felt the formation of the Internet bubble, because we knew that the traffic obtained by many advertisers was fake.

Since 2019, the Internet has clearly gone downhill. Then came the failure of Alipay's IPO and the collapse of the bubble. I turned to the field of infrastructure, responsible for hybrid cloud to reduce costs and increase efficiency. The main task was to expand the machine load to the public cloud KVM&K8S when the traffic peaked, and return to the self-built computer room when the traffic dropped. This is essentially a product of the late Internet era, a strategy to reduce costs and increase efficiency. For me, it can be regarded as a complete cycle of the Internet.

In addition to writing code and making products at work, I mainly spend the rest of my time speculating in A-shares, because the liquidity of A-shares is very poor, and the trading strategies are basically based on speculation. At the end of 2021, a developer friend who speculates in A-shares came to talk to me about NFT. I found this very interesting and joined the circle. I opened a studio to make white orders. Because I found that it is very similar to the new issuance of A-shares, but it is less risky than the new issuance, because if the secondary issuance breaks, it can be minted, and the loss cost is only the labor cost.

I first came into contact with LuMao at the Web3 gathering in Dali, where the APT developer community left a deep impression on me. I used the new user coupon of Google Cloud Server to run the node, and each node was given 300 tokens. At that time, I felt the critical hit brought by LuMao, so I entered the LuMao circle. At that time, NFT was actually at the end of its stage, and I learned LuMao knowledge from them in the robot community. There were many big guys who helped me a lot, and the studio was transformed into a LuMao studio, and it has been doing it until now, and DaMao has also received a few.

Next came the Inscription period. I was biased against its value at first, so I missed Ordi and missed the first wave. In the second wave, I found that it was not a technical narrative in essence, but a kind of anti-centralized emotional release. Before the second wave of Inscription was launched, there were some signs on the chain, such as LOVE 0 and FERC. At that time, I began to slowly understand the subsequent gameplay on the chain. Basically, when a project came out, we immediately wrote tools to batch it. For example, we played thousands of ETHS and Facet, and of course we sold a lot of them. Later, there were SOLS, ATOM, and NAT, and they all took a lot of early chips.

The idea of building a community was actually born when we were in the early days of Inscription. At that time, it was just a small group doing research together. At that time, the capacity of the chain was not high. Although everyone was making money, their enthusiasm was declining in the long run. However, we could use "community" as a medium to bind everyone together more deeply. Later, with friendtech, we found a matrix solution at the first time, and developed a fully automated matrix tool to help some studios in the community earn considerable income.

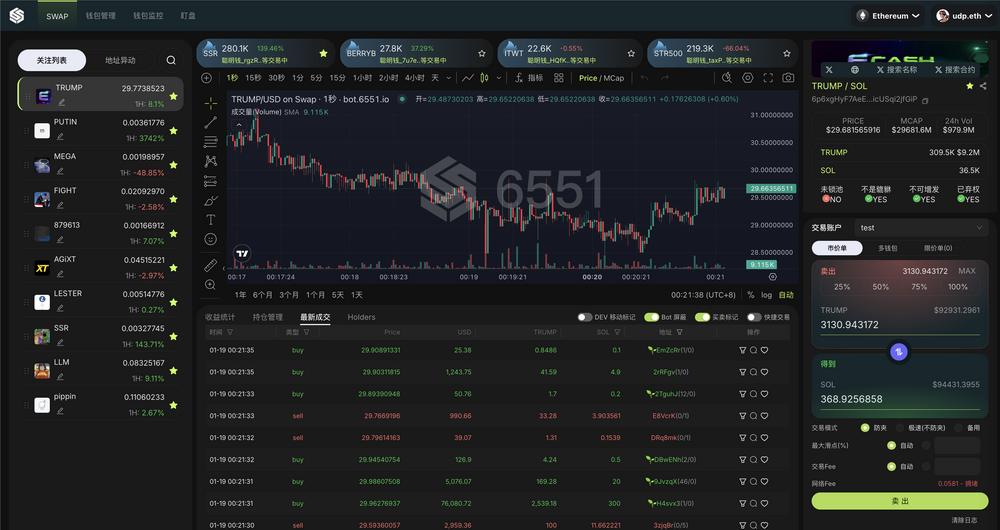

What comes next is actually the meme market. The meme+bull market is actually the final form of fair launch. It is no longer a semi-finished market of order book inscriptions that compromises for liquidity in the bear market. In April 24, pump began to be popular. We saw its potential and developed the first SWAP tool in the market that supports pump internal disk, and cooperated with the external disk tool. So far, our community 6551 has covered many aspects. We have our own alpha team, swapbot, contract monitoring, related news and exchange monitoring. We follow the principle of "where to make money, go there" and provide useful tools to community members. We have actually experienced many attempts and failures, especially in the field of automated hair pulling. At that time, we took too many detours because of browser automation. But these are more tools. We have established a stable development team and will continue to build an integrated product in 2025. You can wait and see.

Core content: I came into contact with NFT at the end of 2021 and opened the Lubaidan studio, and entered the "Lumao" circle through Web3 gatherings. At present, the 6551 community I built covers tools such as the alpha team and swapbot, and is always at the forefront of the market. In the future, we will launch integrated products to continue to promote community growth.

3. What are you currently working on?

Our current main focus is AI+DEX products. We will build a professional integrated product that meets the current DEX capacity from the perspectives of novices and professional traders.

4.What are your most memorable experiences in web3?

I experienced a return to zero in May 2023, when I was all in Blur's airdrop and bid heavily on many projects. Blur was ranked fourth on the list at the time, and then many projects were banned and backstabbed by Tieshun Centralization at the end of the day, and the points were cleared retroactively, causing the funds to turn into small pictures and the points to return to zero.

Core content: In May 2023, I went all in on the Blur airdrop and ranked fourth on the Blur list, but near the end of the project, my points were cleared by centralized operations, causing my funds and points to return to zero.

5. Can you share with us the skills or areas that you think you are good at?

What I am personally good at may be the execution of hot spots. No more nonsense, just do it.

Make more friends with positive people, hang out with more newcomers, always focus on your own business, and work hard once you’ve found the right track.

Making money is to make your life better. Making money is not life. Don’t waste time on yourself during your low points.

We are all about to enter the most prosperous, balanced, and successful period of our lives. We are naturally prone to good fortune and have not only wealth but also a lot of wealth. We all have the ability to create the life we want.

Core content: I am good at taking quick actions, focusing on hot spots, and growing with positive people. We are all heading towards a richer and more successful future, with good luck and wealth, and can create the life we want.

6. Do you have any favorite track or token? Can you share the reasons why you are optimistic?

The track I am currently optimistic about is the DEX track. $Trump has already proved that there are 40B on the chain, and people who originally played altcoins have turned to the chain. The capacity on the chain is increasing significantly, but the construction of good products and infrastructure on the chain is still in its infancy. So I think there is a lot of room for development in this field, and a product with product strength and willingness to innovate can get a lot of dividends on this track.

Core content: I am currently optimistic about the DEX track. The on-chain capacity is increasing significantly, but high-quality products and infrastructure are still in their infancy. $Trump has proven the potential of the chain, and I believe that a project with innovation and product strength can reap huge dividends in this field.

7. How do you view investment or are there any investment methods you can share?

In my opinion, investment methods are essentially a form of arbitrage . Whether it is buying stocks, buying new stocks, buying local stocks, or buying narrative stocks, they are essentially an arbitrage of emotions and market liquidity. You need to increase the odds in this limited space and do things with more certainty. Choose the current direction of the market and stick to it.

You must stick to your own investment methodology. If you choose to make a small investment for a big return, you should choose a good project. If you think the project is good, you can continue to go long and hold more chips, breaking your profit and loss at some point.

Core content: In my opinion, investment is essentially an arbitrage, which is to improve the odds within a limited space, do more certain things, and always stick to the direction of the market.

【Web3 Profile】Web3's first personal interview platform, deeply explores the stories behind 100 KOLs, fund founders, entrepreneurs, and builders in the industry, focusing on their experience in the cryptocurrency circle and their growth experience, and focusing on exploring their personal experience. It is committed to making the personal experience of the interviewees shine and showing the most authentic growth stories of the people.

Disclaimer: [Web3 Profile] disseminates content with a neutral attitude. This article does not constitute any investment advice and is for reference only.