Original title: Monthly Outlook: How Do You Define a Crypto Bear Market?

Original article by: David Duong, CFA - Global Head of Research

Compiled by: Daisy, ChainCatcher

Summary of key points:

- As of mid-April, the total market value of cryptocurrencies other than Bitcoin has fallen 41% from a high of $1.6 trillion in December 2024 to $950 billion. In addition, venture capital investment has also fallen 50% to 60% from the level in 2021-2022.

- We believe that a conservative risk response strategy should be adopted at this stage. However, we expect that crypto market prices may stabilize in the middle and late second quarter of 2025, laying the foundation for a rebound in the third quarter.

Overview

Multiple factors are combining to foreshadow the arrival of a new round of "crypto winter". As global tariff policies are introduced and may escalate further, market sentiment has deteriorated significantly. As of mid-April, the total market value of cryptocurrencies other than Bitcoin fell to $950 billion, down 41% from the high of $1.6 trillion in December 2024 and down 17% year-on-year. It is worth noting that this level is even lower than the market value performance for almost the entire period from August 2021 to April 2022.

In the first quarter of 2025, venture capital in the crypto industry rebounded from the previous quarter, but it was still 50% to 60% lower than the peak period of 2021-2022. This significantly restricted the entry of new capital into the ecosystem, especially the altcoin sector. The above structural pressures are mainly due to the current macroeconomic uncertainty. Fiscal austerity and tariff policies continue to suppress traditional risk assets, causing investment decisions to stagnate. Although the regulatory environment provides support to a certain extent, the road to recovery in the crypto market is still challenging against the backdrop of overall weak stock markets.

The interweaving of multiple factors has made the digital asset market face a severe cyclical outlook, and caution is still needed in the short term (expected to be in the next 4 to 6 weeks). However, we believe that investors should adopt flexible tactics to deal with market fluctuations. Because once the market sentiment is repaired, the rebound may start quickly. We are still optimistic about the market performance in the second half of 2025.

The division between bull and bear markets

In the stock market, a 20% rise from a recent low or a 20% fall from a high is often used as a rule of thumb to determine a bull or bear market. However, this criterion is inherently subjective and does not apply to the highly volatile crypto market. Crypto assets often experience price fluctuations of more than 20% in a short period of time, but this does not necessarily represent a fundamental change in market trends. Historical data shows that, for example, Bitcoin can fall 20% in a week and still be in a long-term upward trend, and vice versa.

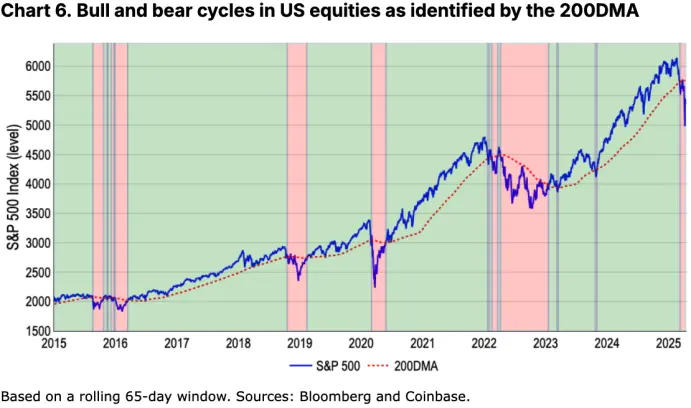

In addition, the crypto market is traded 24/7, which makes it a barometer of global risk sentiment during the periods when traditional financial markets are closed (such as at night or on weekends). Therefore, crypto asset prices tend to react more strongly to global emergencies. For example, from January to November 2022, when the Federal Reserve adopted an aggressive interest rate hike policy, the US stock market (represented by the S&P 500 index) fell by 22% in total; while Bitcoin began to fall earlier in November 2021, with a cumulative decline of 76% in a similar period, about 3.5 times the decline of the US stock market in the same period.

The truth in contradiction

It should be pointed out that the "20% rule" traditionally used to define bull and bear markets is essentially just a rule of thumb, and there is no unified standard to date. As US Supreme Court Justice Potter Stewart said when commenting on "What is obscenity": "I can't define it, but I know it when I see it." Similarly, the identification of market trends often relies more on experience and intuition than on strict calculation models.

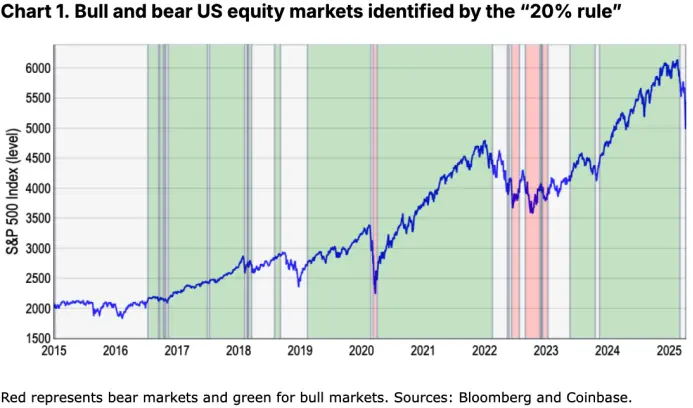

Nevertheless, to make our judgment more systematic, we refer to the closing highs and lows of the S&P 500 index within a rolling one-year window to identify key market reversals. According to this method, the US stock market has roughly experienced four bull markets and two bear markets in the past decade - not including the latest round of declines in late March and early April (our model has begun to send bear market signals). See Figure 1 for details.

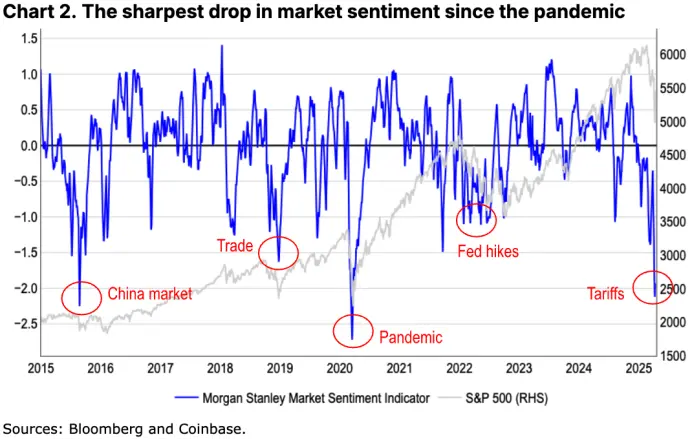

However, this “20% threshold” also ignores at least two pullback events that had a significant impact on market sentiment, but the decline was between 10% and 20%. For example, the increase in volatility caused by the turmoil in the Chinese stock market in late 2015, and the market shock caused by the intensification of global trade frictions in 2018 (the Federal Reserve’s global trade policy uncertainty indicator rose). See Figure 2 for details.

We have seen in the past that sentiment-driven market declines often trigger defensive portfolio adjustments, even though the declines do not reach the artificial 20% threshold. In other words, we believe that bear markets are essentially a reflection of a shift in market structure, characterized by deteriorating fundamentals and shrinking liquidity, rather than simply the magnitude of price declines. Moreover, the "20% rule" risks paralysis because it ignores some early warning signs, such as weakening market depth and defensive sector rotation, which are often the precursors to major down cycles in history.

Alternative indicators

Therefore, we try to find alternative indicators that can more accurately reflect the relationship between price movements and investor psychology, applicable to both stocks and crypto assets. The definition of a bear market is not only about asset returns, but also closely related to market sentiment - the latter often determines whether investors believe that the downward trend will continue and adjust their strategies accordingly. This concept is more complicated because we are not observing simple consecutive rises or falls, but turning points in long-term trends. For example, during the COVID-19 pandemic, the market experienced a rapid and sharp decline and then rebounded quickly. Of course, the short-lived bear market was largely due to the large-scale fiscal and monetary stimulus policies subsequently launched by governments, which prevented investors from falling into a long-term retracement.

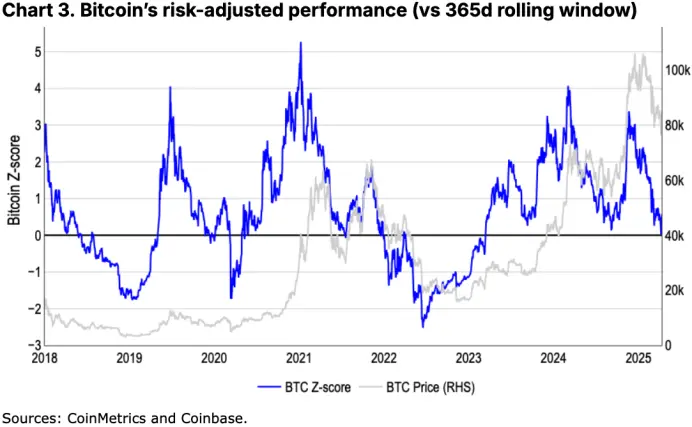

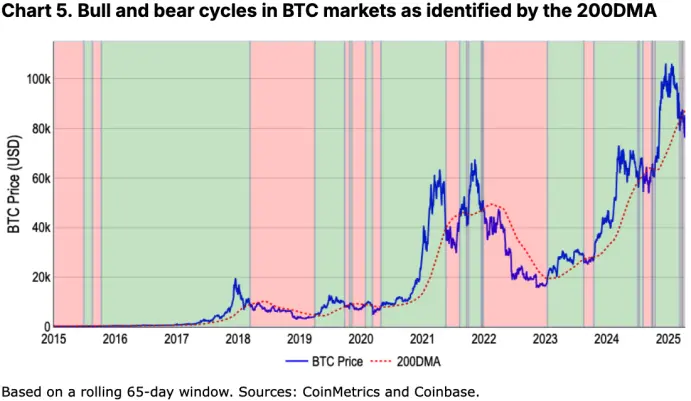

Rather than relying on rules of thumb such as the “20% rule,” we prefer to use two types of risk-adjusted metrics: (1) risk-adjusted performance measured by standard deviation; and (2) the 200-day moving average (200DMA). For example, from November 2021 to November 2022, Bitcoin fell 1.4 standard deviations from its average performance over the previous 365 days; during the same period, U.S. stocks fell 1.3 standard deviations. From a risk-adjusted perspective, Bitcoin’s 76% drop is comparable to the S&P 500’s 22% drop.

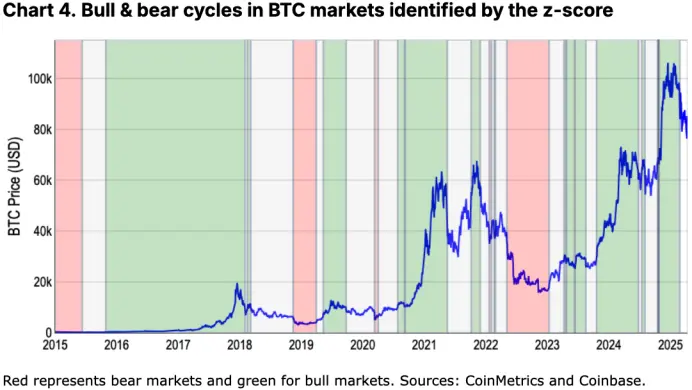

Since the standard deviation indicator naturally reflects the high volatility of the crypto market, the z-score (standard score) is very suitable for crypto asset analysis. However, it also has certain limitations: on the one hand, the calculation is relatively complex; on the other hand, when the market trend is relatively stable, there are fewer signals and the reaction to trend changes may not be sensitive enough. For example, our model shows that the most recent bull market cycle ended in late February, and the market status was classified as "neutral" thereafter, which reflects that the model may have lags during periods of volatile market fluctuations.

In contrast, the 200-day moving average (200DMA) provides a more concise and robust way to identify ongoing market trends. Because it is calculated based on long-term data, it can effectively smooth out short-term fluctuations and adjust in time according to the latest price trends, thus providing clearer momentum signals.

The judgment method is also relatively intuitive:

- When the price is continuously above the 200DMA with upward momentum, it is generally considered a bullish market;

- When prices remain below the 200DMA for a long time with downward momentum, it often means the formation of a bear market.

This approach is not only consistent with the broad trend signals reflected by the "20% rule" and the z-value model, but also improves the practicality and foresight of insights in a dynamic market environment. For example, it successfully captured key downturns such as the early stage of the epidemic in 2020, the Fed's interest rate hike cycle from 2022 to 2023, and also reflected the crypto winter from 2018 to 2019, and the correction caused by the Chinese mining ban in 2021.

In our view, this approach not only aligns with the broad trend signals embodied in the “20% rule” and z-score models, but also improves the accuracy of extracting actionable insights in dynamic market environments.

In addition, we also found that 200DMA can better reflect the sharp fluctuations in investor sentiment in different periods. See Figure 5 and Figure 6 for details.

Crypto winter?

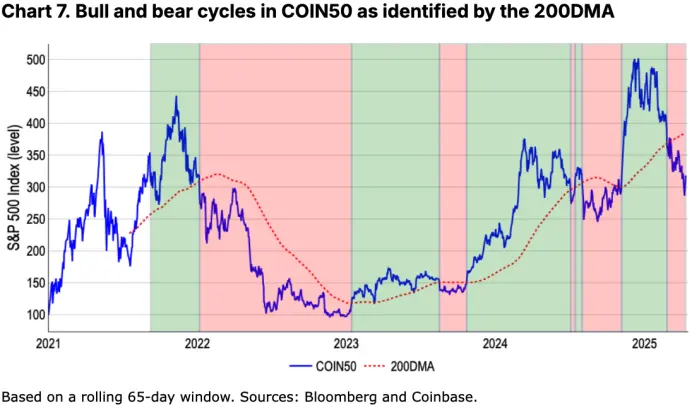

So have we entered a crypto bear market? Previous analysis has focused on Bitcoin because it has enough historical data to compare with traditional markets such as the U.S. stock market. However, as the crypto asset class continues to expand into emerging areas (such as Meme coins, DeFi, DePIN, AI agents, etc.), Bitcoin is no longer fully representative of the overall market trend.

For example, Bitcoin's 200DMA model shows that its sharp correction has entered a bear market since late March. Using the same model to analyze the COIN50 index (covering the top 50 tokens by market value) shows that the asset class as a whole has been clearly in a bear market since the end of February. This is consistent with the trend that the total market value of cryptocurrencies other than Bitcoin has fallen 41% to $950 billion from its high in December 2024; in contrast, Bitcoin has fallen less than 20% over the same period. This gap reflects the higher volatility and risk premium of altcoins at the end of the risk curve.

in conclusion

As Bitcoin's "store of value" attribute continues to strengthen, we believe that in the future, a more systematic and comprehensive approach will be needed to evaluate the overall performance of the crypto market in order to more accurately define its bull or bear market status, especially in the context of increasingly diverse asset classes. Nevertheless, both Bitcoin and the COIN50 index have fallen below their respective 200-day moving averages, a signal that the market may be in the early stages of a long-term downward trend. This is consistent with the trend of declining total market capitalization and shrinking venture capital, both of which are important features of the possible arrival of a "crypto winter."

Therefore, we recommend that a defensive risk management strategy should be maintained at this stage. Although we still expect crypto asset prices to stabilize in the middle and late second quarter of 2025 and lay the foundation for improvement in the third quarter. At present, the complex macro environment still requires investors to remain highly cautious.