OM plummeted 90% in just one hour, from $6.2 to $0.6, which is comparable to the typical scene of a "local dog" running away.

This is not an accident. This is not a sentimental collapse or a technical glitch, but a systemic release that can be predicted from on-chain data.

🧩 All signs have already appeared

✅ Question 1: The price was abnormally stable before the crash

When the entire market was correcting, OM remained stable in the $6~7 range. It seemed strong, but in fact, there were obvious signs of artificial control.

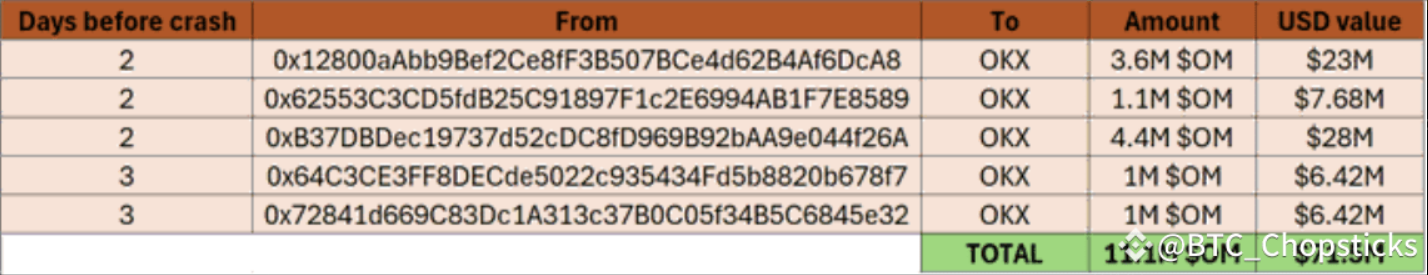

✅ Question 2: A huge amount of money was transferred to OKX three days ago

On-chain data shows that more than 11 million $OM (worth about $71 million) were transferred to OKX in three days.

This wave of deposits is 5 times the previous daily average, and there is no corresponding withdrawal action, which is obviously abnormal behavior.

🧠 Who is transferring money? Where are the funds coming from?

These wallets were created almost at the same time and funded through Binance, so it is highly suspected that they are controlled by the same entity.

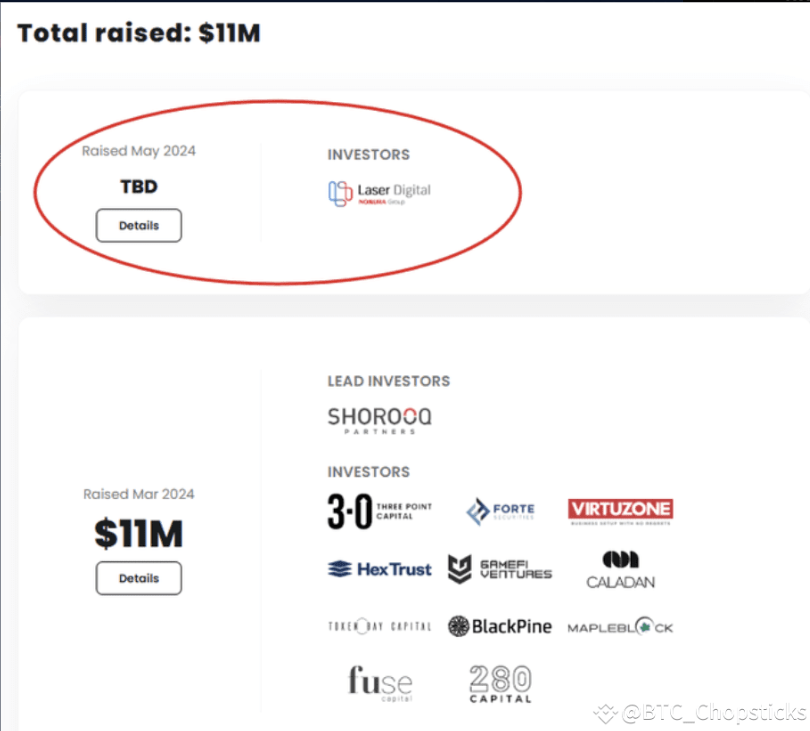

One of the key wallets 0xB37D... was marked on the chain as @LaserDigital_ - one of Mantra 's core investors and market makers.

🔍 Note:

LaserDigital invested in May 2024, when the price was exactly $0.7. After this plunge, the price "just returned" to their cost position. This is more like a precise harvesting closed loop.

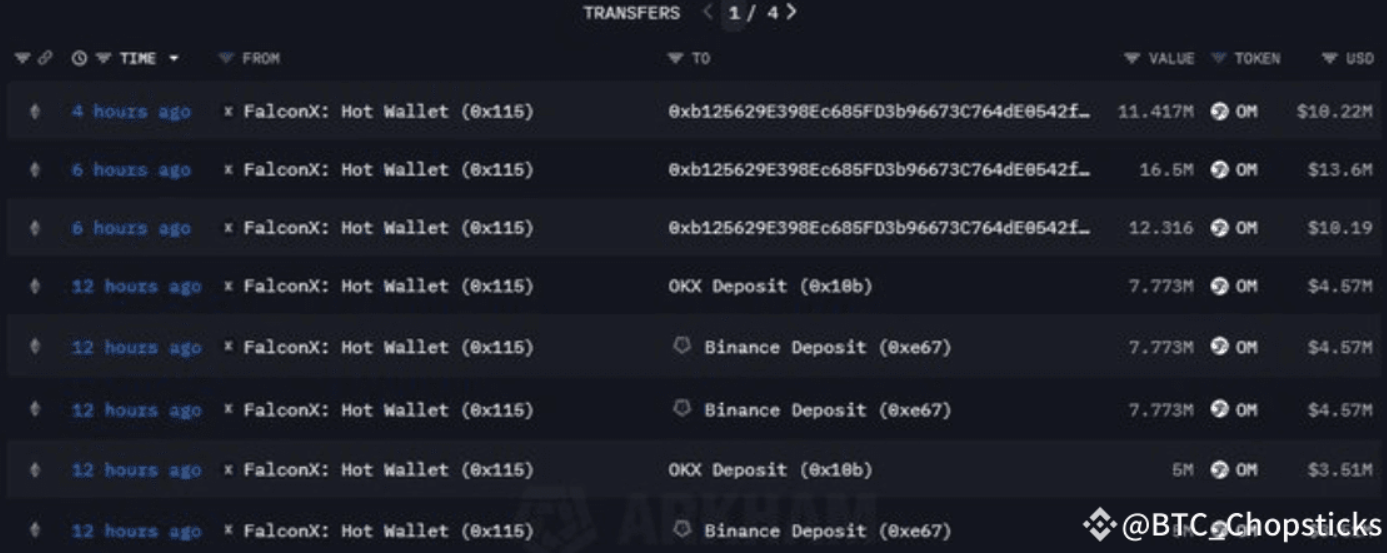

💥 The OTC chain begins to break

Soon after, another large amount of funds came from @falconxnetwork, which was sold through OKX and Binance.

FalconX is a well-known over-the-counter broker (OTC Broker) in the industry. These funds are likely to come from private placements or OTC buyers who purchase OM at a discount.

Most OTC buyers only pay 50% of the market price for their purchases. When prices fall below their cost line, panic selling triggers a stampede.

🧨 Chain reaction explodes

✅More than $70 million of OM was liquidated on the chain

✅Millions of funds slippage severely impacts the liquidity pool

✅Most retail investors do not have any exit opportunities

Although Bitcoin's daily liquidation is higher, don't forget that BTC has thousands of times more liquidity . OM is essentially an asset with extremely low liquidity and high control.

🔻 Hidden structural risks

Very low liquidity

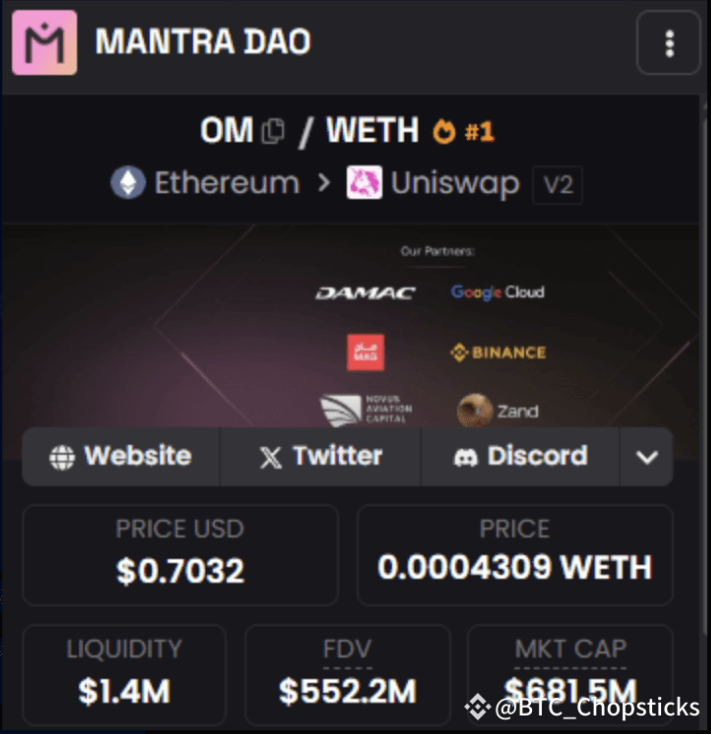

The current liquidity of Uniswa OM is only about $1.4 million, while the market value is still over $700 million, a ratio as high as 500~700 times, which is extremely fragile.

Centralized control is serious

The team holds nearly 90% of the circulating supply, but retail demand is extremely low, creating the illusion of false scarcity + market capitalization inflation.

Investors and teams ship in the same direction

The market creates FOMO, teams sell off-market, investors sell on-market, and ultimately retail investors pay for it all.

🧾 Conclusion:

This is a foreseeable "slow $OM" crash. This crash is not a "black swan", but the inevitable result of the long-term accumulation of structural problems:

OTC discount sales + market maker withdrawal + centralized control + extremely low on-chain liquidity = a collapse model that is extremely easy to trigger.

This incident once again reminds us:

✅The so-called "high market value" does not mean safety

✅OTC distribution + centralized currency holding structure is a hidden time bomb

✅The increase without on-chain liquidity support is just paper wealth

If the on-chain data is transparent, the real question is never "whether it is foreseeable", but whether you are willing to see the truth.