Over the past two years, the crypto industry has undergone tremendous changes, especially the Bitcoin ecosystem, which has shown new ecological characteristics. This is not only reflected in the emergence of the BTC Layer 2 network that carries TVL, but also in the BTC chain players who hope to obtain passive income, and the traditional compliant institutional groups that bought Bitcoin in large quantities after the Bitcoin spot ETF was approved, and gradually formed an ecosystem and infrastructure around these players and groups.

The popularity of the Bitcoin ecosystem has also driven the rapid development of the BTCFi ecosystem. By the end of 2024, the total market size of BTCFi will be close to US$50 billion, and the TVL of the Bitcoin network will be approximately US$2 billion (Layer2 and side chains have been included), accounting for only 0.1% of the total market value of Bitcoin, while Ethereum is 15.7% and Solana is 5.6%. Many institutions believe that BTCFi still has room for tenfold growth.

In the BTCFi track, typical projects include Babylon, BounceBit, Solv Protocol, Bedrock, Bitlayer, Lorenzo Protocol, Liquidium and Shell Finance, etc. BTCFi projects within the ICP ecosystem include Bitfinity Network, Omnity Network, Bitomni, Tap Protocol, Loka and BitSmiley, etc.

Today, let us get to know another heavyweight player in the BTCFi track - Side Protocol.

Side Protocol was built by crypto mafia godfather Dave Hrycyszyn in collaboration with early members of Binance Labs and several crypto geeks. It combines Bitcoin native script and signature technology with the underlying technical architecture of Cosmos to build a new type of financial infrastructure. The core products of the protocol include Bitcoin side chains with the same high performance as the public chain and native lending protocols.

On February 5th, Side Chain mainnet alpha was officially launched!

What is Side Chain

Side Chain is the first product of Side Protocol and the first Bitcoin-compatible dPoS sidechain built on the Cosmos stack, including Cosmos SDK and CometBFT.

Unlike other EVM-based Bitcoin sidechains, Side Chain natively supports Bitcoin Taproot and Native Segwit address types, allowing users to sign transactions directly from the Bitcoin wallet on the chain. In addition, Side Chain has its own Bitcoin representative sBTC, built on a threshold signature-based signature network operated by leading validators. Through integration with the IBC protocol, sBTC can also be used in other ecosystems.

With the official launch of Side Chain mainnet alpha, multiple products and integrations will be gradually launched. The most exciting one is the Bitcoin native lending solution - a liquidity protocol that utilizes DLC, allowing users to borrow and lend against BTC without relying on third-party custody or chain bridges. The protocol will be released later this year.

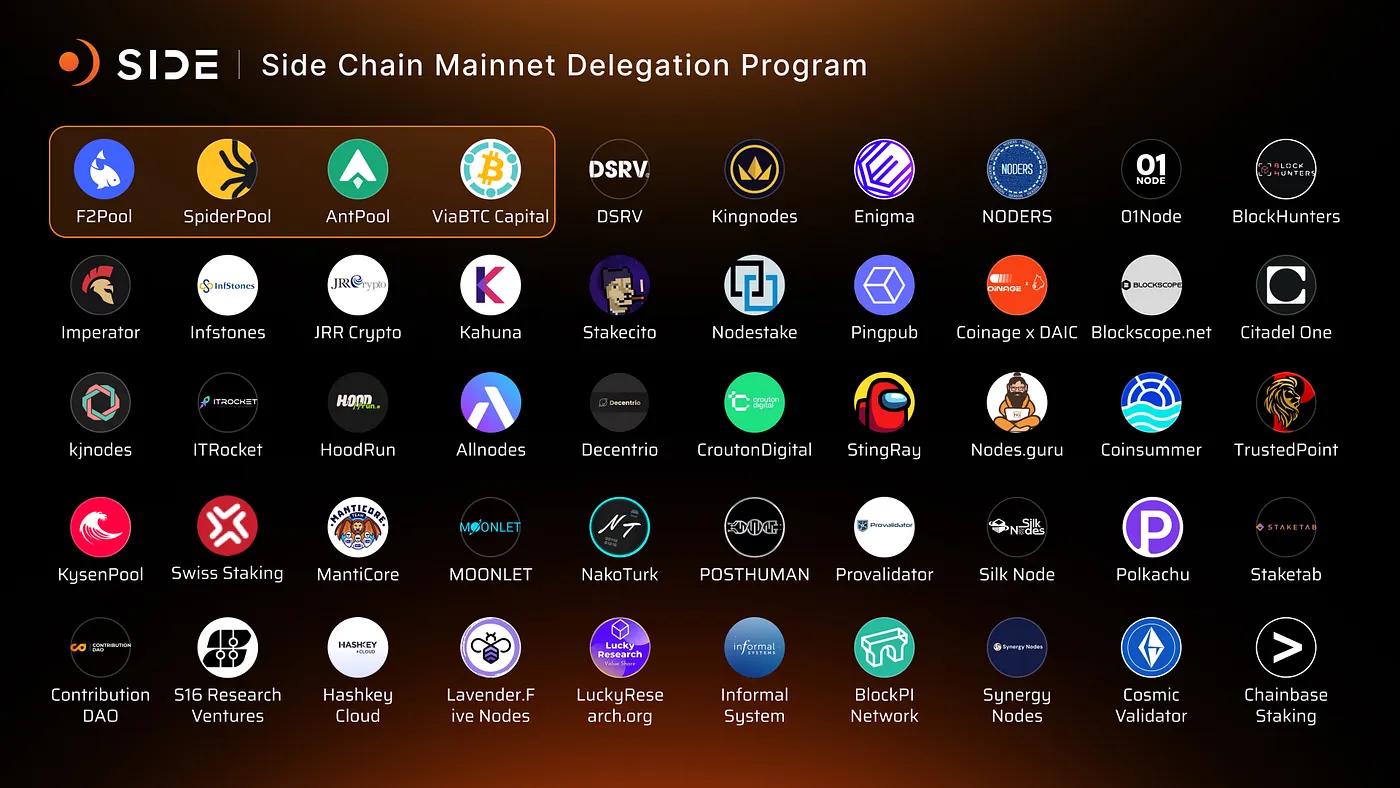

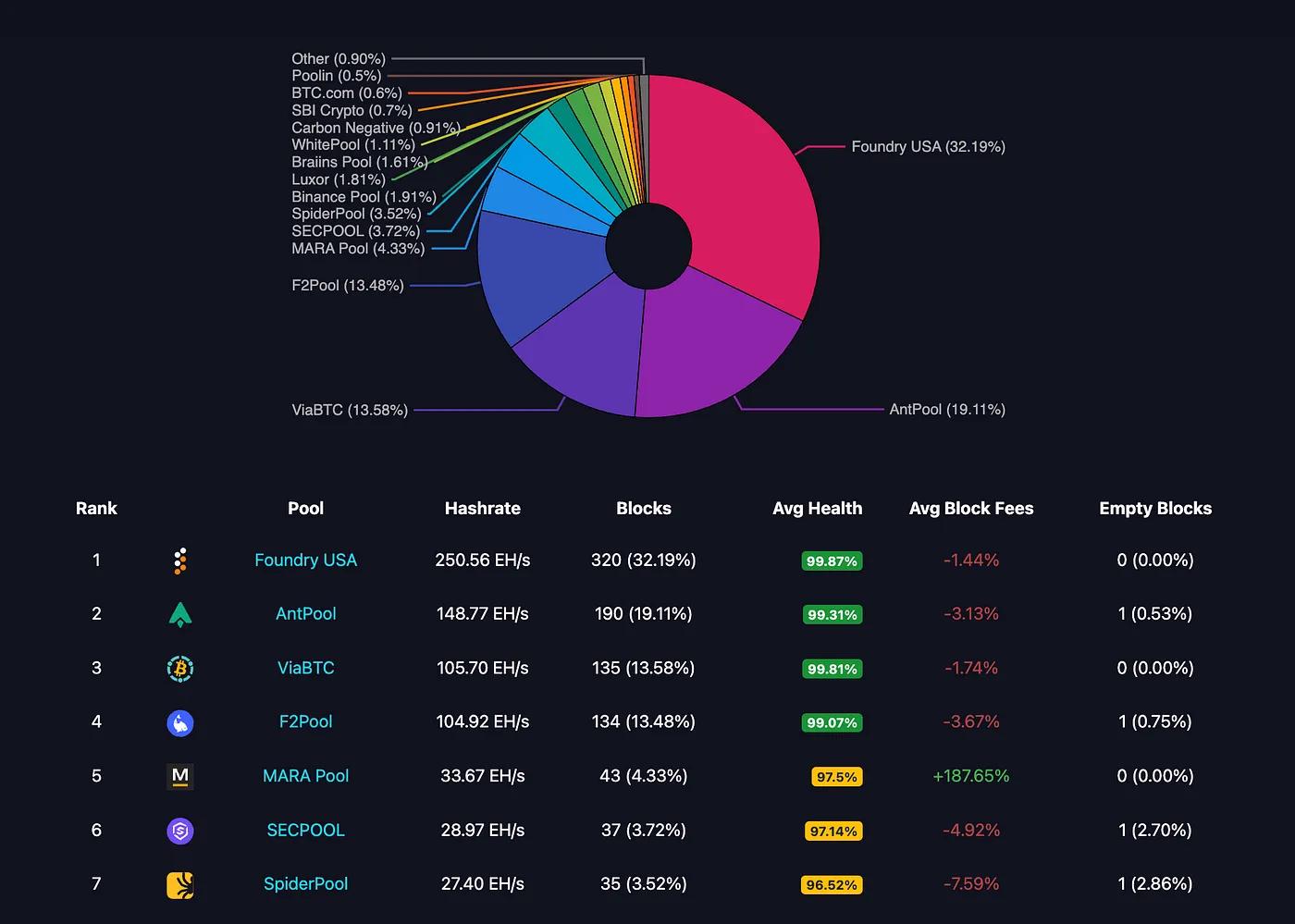

Side Chain is backed by leading Bitcoin mining pools including Antpool, F2Pool, ViaBTC Capital, and SpiderPool, which have confirmed their commitment to running validator nodes on Side Chain, and together these pools account for over 49% of the Bitcoin network hashrate.

Creative Team

Side Protocol has an impressive team background. Its core members are from well-known Web2 and Web3 companies such as Meta, Binance, and Google, and have rich industry experience and outstanding technical capabilities.

Among them, founder and CTO Dave Hrycyszyn is a senior expert in the encryption industry and one of the co-founders of Chainspace. He co-founded Chainspace with George Danezis (co-founder of Sui) and Mustafa Al-Bassam (co-founder of Celestia). The company was acquired by Facebook for its leading position in high-performance chain research.

Before joining Side Protocol, Dave served as CTO of the privacy protocol project Nym, where he successfully led the team to obtain more than $50 million in investment support from top institutions including a16z, Polychain and Binance, and promoted the project to successfully complete the mainnet launch.

Side Protocol has completed three rounds of private financing, with the last round of financing valuing it at $100 million. Investors include Hashkey Capital, KR1, Continue Capital, Symbolic Capital, Informal Systems, Dora Ventures, Charles Lu, Harry Halpin, Eric Chen, Mirza Uddin, Siddhartha Dutta and Vincent Niu.

Token Economics

While BTC is the primary asset for all Side Protocol products, the SIDE token is the protocol’s native utility token and plays a vital role in the following key areas:

Value accumulation : Side is positioned as the financial layer of Bitcoin with a clear protocol revenue model. The fees generated by products such as Side Finance, Side Chain, Side Hub, Side Bridge, native DEX and future products are used to repurchase and destroy SIDE, thereby creating a deflationary mechanism to increase its value.

Paying transaction fees : In addition to BTC, SIDE can also be used to pay network gas fees, which are applied to all network operations, rewarding participants and ensuring security by preventing spam and denial of service attacks.

Staking : Side Chain is an important part of the Side Protocol architecture. It operates as a permissionless network through a proof-of-stake mechanism and supports in-protocol delegation. Similar to other dPoS networks, users can delegate their SIDE tokens to side chain validators and receive a certain share of staking rewards while actively contributing to network security.

On-chain governance : SIDE empowers the community to participate in decentralized governance by voting on key network decisions, including protocol parameter adjustments, upgrades, community fund allocations, and other important initiatives.

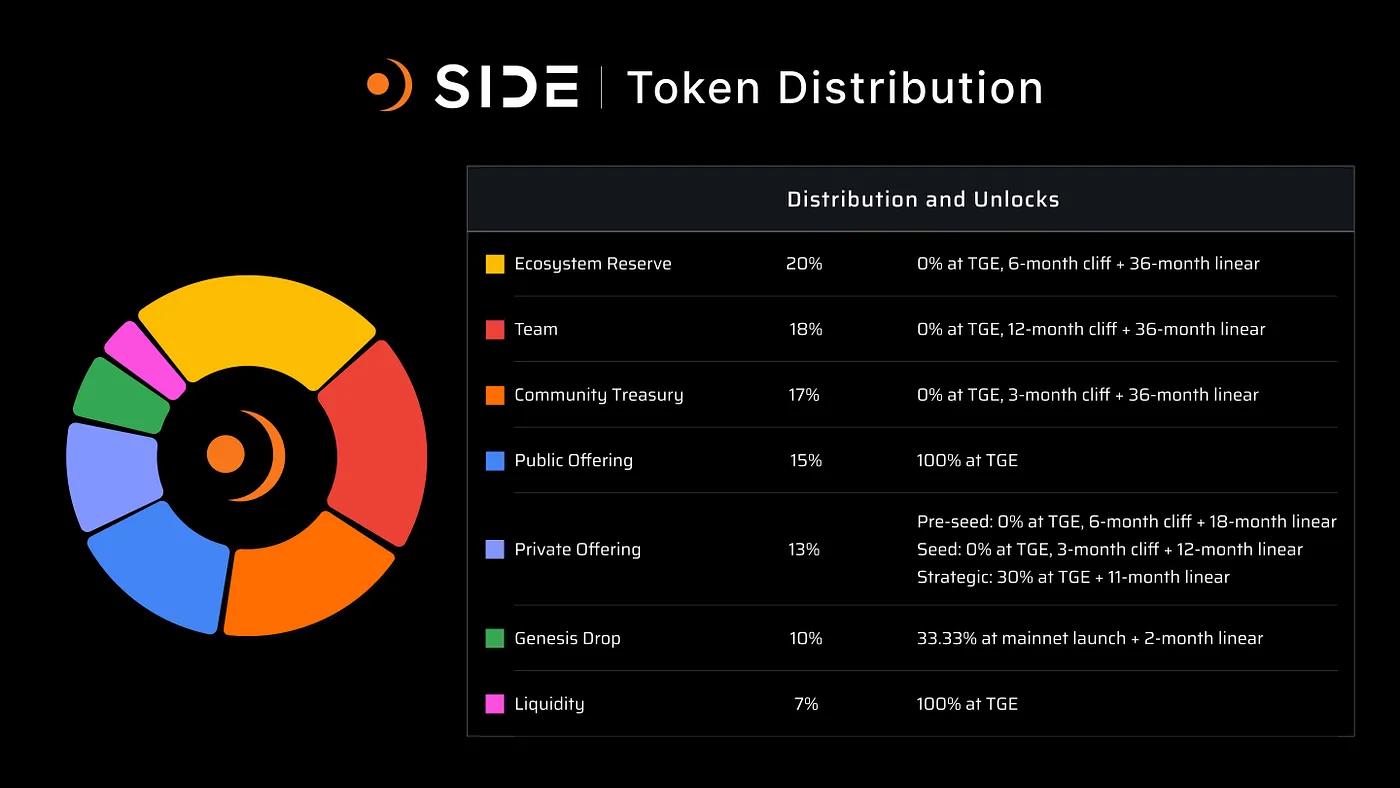

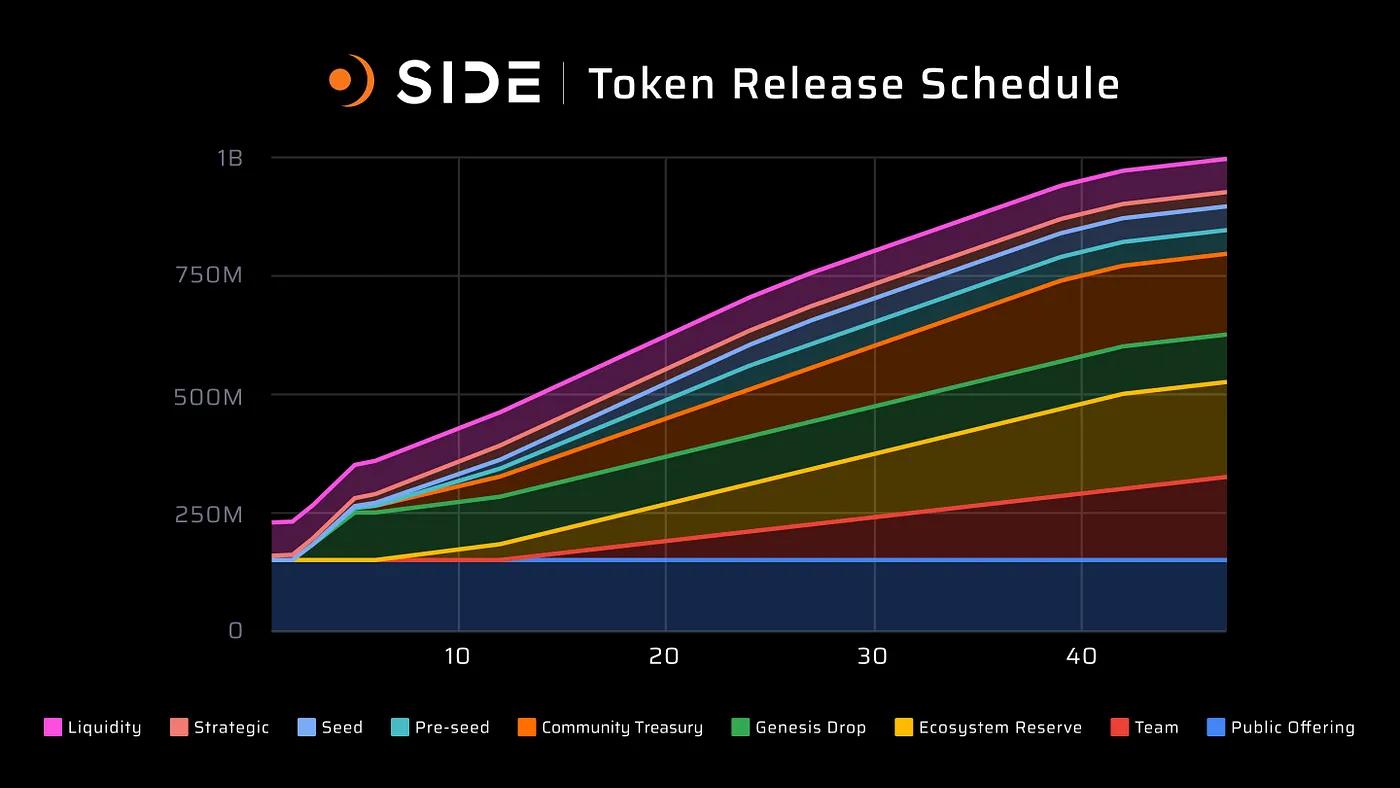

The total supply of SIDE is 1 billion, distributed as follows:

Ecological reserve: 20%

Team: 18%

Community Treasury: 17%

Public offering: 15%

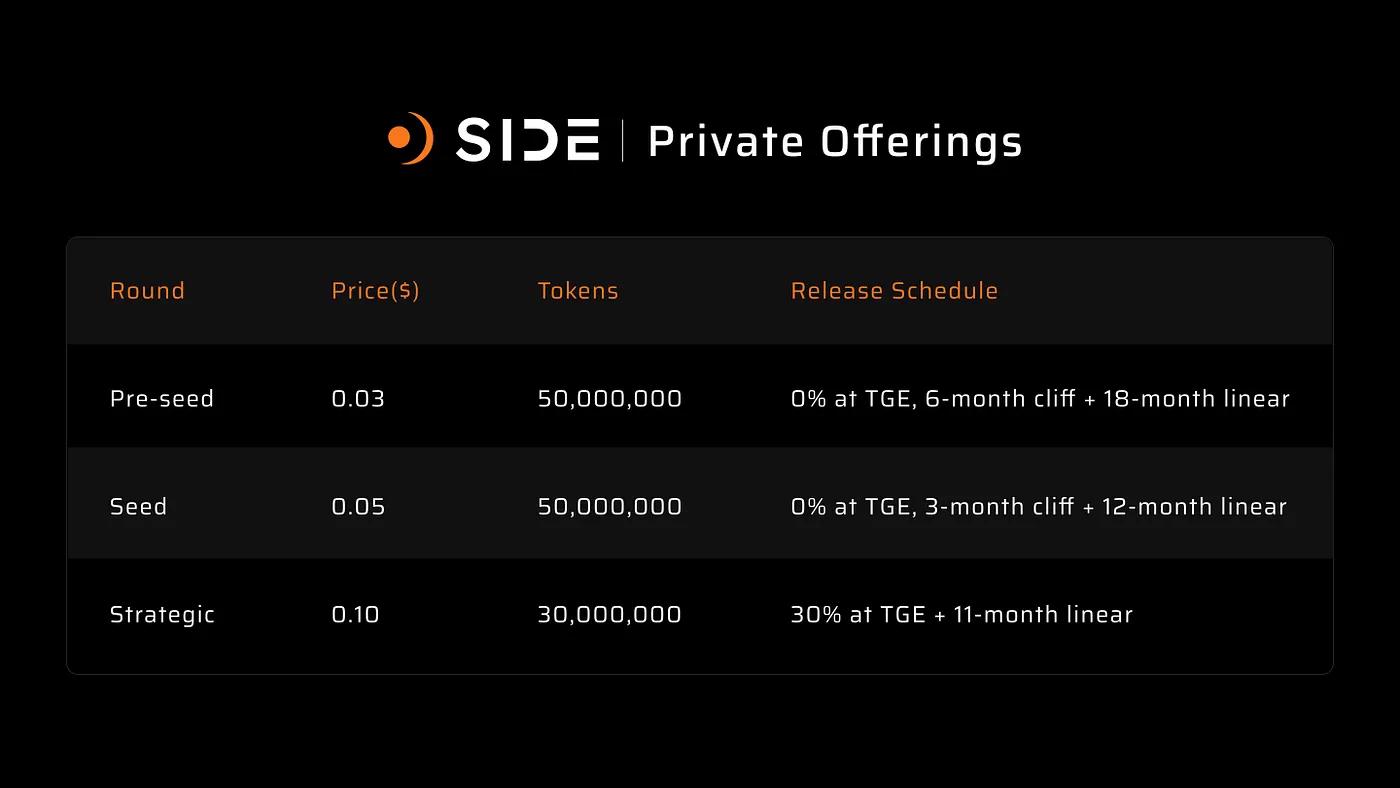

Private placement: 13%

Genesis Airdrop: 10%

Liquidity: 7%

The initial circulating supply is 229,000,000 tokens (22.90% of the total supply), and all tokens are expected to be fully unlocked four years after the TGE. The release schedule is as follows:

After the mainnet is launched, Side Protocol will issue 10% of the total, or 100 million SIDE tokens, as a genesis airdrop. Potential airdrop recipients are:

Active Bitcoin Users

NFT community (including Bitcoin NFT holders)

Cosmos Community

Testnet Users

Public Goods

The SIDE token airdrop distribution will start after the mainnet launch and will last for 3 months. You can check whether you are eligible for the airdrop now (genesis.side.one). Since the check and registration started on November 26, 2024, the airdrop activity has been extremely popular, and more than 200,000 user addresses have obtained qualifications.

sBTC Incentive Program

To celebrate the launch of sBTC on the Side Chain mainnet and encourage early adoption, we are excited to launch the sBTC Incentive Program!

sBTC Incentive Program Round 1

award:

Each bridge transaction earns 100 SIDE, and the reward per transaction will decrease in future rounds;

The initial total reward pool is 1 million SIDE and will be adjusted based on participation.

How to bridge

Both straddle-in and straddle-out trades are eligible for rewards, please follow the video instructions below:

Use Side Station (station.side.one) to transfer BTC or sBTC between Bitcoin and Side Chain;

After completing the bridge transaction, your eligible token rewards will be automatically sent to your wallet. You do not need to claim them. Simply connect your wallet to view the updated SIDE balance.

NOTE: For cross-out, if you do not have SIDE tokens to pay for gas fees on the Side Chain, you can switch your gas tokens to sBTC.

How to track your bridge progress?

Note that bridging each transaction may take up to an hour, as each transaction requires six confirmations on the Bitcoin network for security reasons.

To check your bridging progress:

Visit Explorer on Bridge -> Side Station to check your transaction status;

Enter your Bitcoin address into the "User" filter to display all of your bridge activity.

How to handle SIDE tokens

For those who have signed up for the Genesis Drop, you can now view your balance on Side Station, simply connect your Bitcoin wallet using the address you registered, and you can now send or stake your SIDE tokens.

We recommend staking SIDE tokens to a validator of your choice, as a delegated proof-of-stake (dPoS) chain, staking not only earns you additional rewards, but also helps secure the network.

As of the time of this article’s publication, SIDE’s annual staking interest rate is over 25%.

Looking ahead

The blockchain went live on January 24, but it wasn’t fully operational until the Side Bridge (sBTC) was up and running, and it took a few days to coordinate the DKG ceremony and complete testing of the bridge and incentive program.

As mentioned earlier, we prioritize launching products to drive usage and adoption, which is why the current mainnet is still in alpha. Before onboarding more partners and completing further integrations, we want to ensure that the sidechain is reliable and resilient in a production environment. During this process, we will collect product feedback and mitigate potential risks. Once these steps are completed, the community can look forward to the arrival of token liquidity events.

Conclusion

Looking into the future, as technology develops, Layer2 technology will continue to develop and improve, and solutions such as Rollups will become more mature, bringing significant improvements to Bitcoin's transaction processing capabilities.

With the emergence of more solutions that do not require cross-chain bridges, asset transfers and interactions between Bitcoin and other blockchain networks will be safer and more efficient, and Bitcoin will be able to participate more widely in DeFi applications on different chains.

With the help of solutions such as rsk, avm, bitvm, etc., Bitcoin's smart contract function will be enhanced to support more complex financial business logic and applications.

The advancement of the above technologies will provide stronger technical support for decentralized financial services in the Bitcoin ecosystem, enabling more flexible financial products such as staking, lending, and derivatives trading.

With the revival of DeFi, we may see BTCFi’s connection with real finance become closer. For example, the application of stablecoins in the BTCFi ecosystem will continue to expand, which will provide more efficient and low-cost solutions for cross-border payments and international trade.