Source: Talking about Li and other things

Yesterday (March 16), a friend left me a message and sent me a screenshot, which roughly means that Buffett's Berkshire plans to invest part of its $334.2 billion cash position in Bitcoin. As shown in the figure below.

Then this friend left a message asking me if the news was true, and if it was true, he planned to buy some Bitcoin now. My reply was: Don’t participate in transactions based on any news that you are not sure about, and don’t ask me directly about this kind of question. If you ask me, then I will not recommend you to buy.

Why did I reply like this? Because if the other party didn't buy and missed out, at most he would call me a fool, but if I let him buy, and if he lost money and came to me to defend his rights, then I would be a real fool and it would be unpleasant for myself.

Then, I took a closer look with curiosity. The person who posted this message (the screenshot of Twitter above) is Crypto Rover, a crypto KOL with 1.1 million followers on the Internet. I don’t know this KOL and I don’t comment on him. I just want to say that I didn’t find the media source of his message. It may be some gossip he got himself, or it may be that he said it casually to attract attention (traffic). We can just take a look at this kind of personal remarks or messages.

1. Warren Buffett and Bitcoin

If you want to pay attention to any news, it is best to do some research or understanding from multiple angles. Next, we can briefly add some data about Buffett and his company. You can make your own judgment based on more information:

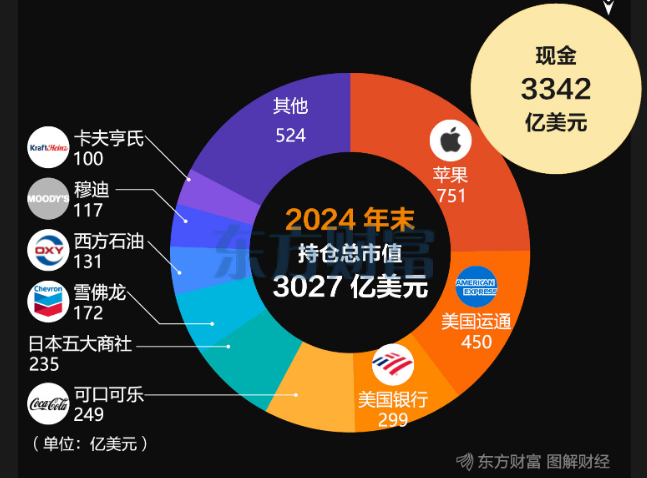

According to public data, Berkshire Hathaway, a company owned by Warren Buffett, will have a net profit of US$88.995 billion in 2024, and 71% of the total fair value of its equity investments are concentrated in American Express, Apple, Bank of America, Chevron and Coca-Cola.

As of the beginning of 2025, the company led by Buffett has accumulated a cash reserve of approximately US$334.2 billion, setting a new record high. As shown in the figure below.

Therefore, the $334.2 billion figure mentioned in Crypto Rover’s tweet is correct. Here we make an assumption (guess), if Berkshire Hathaway can really consider investing part of its $334.2 billion cash reserves in Bitcoin in the future, then this will definitely be a positive for the development of the crypto market (but it is not very friendly to ordinary people, because more and more traditional institutions are entering the market, which also means that it will become more and more difficult for ordinary people to make money), and may promote the wider acceptance and adoption of cryptocurrencies in the traditional financial field.

But judging from Buffett's past public comments, he himself does not seem to be interested in Bitcoin, for example:

In 2018, Buffett bluntly stated at the shareholders' meeting: Bitcoin is a bubble with no practical use.

In 2022, Buffett also said at the shareholders' meeting: Even if you hold all the Bitcoin in the world and sell it to me at $25, I won't take it because it won't be of any use.

At the same time, Berkshire Hathaway has been indirectly enjoying the "benefits" of cryptocurrencies in recent years, such as:

Berkshire invested approximately $735 million in Snowflake in 2020. Snowflake is a company that provides cloud data storage and analysis solutions. Although its main business is not directly involved in cryptocurrency transactions, they also provide some basic services to many companies in the crypto industry.

In 2021, Berkshire invested in Brazilian digital banking company Nu Holdings twice (the first investment was $500 million in June 2021, and the second investment was an additional $250 million in December 2021). As of March 15, 2025, Nu Holdings' market value is approximately $65.85 billion, and Berkshire holds approximately 86.439 million shares of Nu Holdings, currently valued at approximately $1.014 billion. Nu Holdings is the largest digital bank in Latin America and also provides cryptocurrency trading services, allowing users to buy and hold crypto assets such as Bitcoin and Ethereum (Nu Holdings has also launched a cryptocurrency platform, Nubank Cripto).

To sum up, on the one hand, Buffett himself said that he is not interested in Bitcoin, on the other hand, the company he leads will also invest in some companies with encryption businesses. Doesn’t it feel very conflicted?

In fact, I think there is nothing to be entangled about this matter. No one (company) will have a problem with making money. Although Buffett himself is famous for his "stable" investment, it does not rule out that there are some more radical investment managers in Berkshire Hathaway. There is nothing wrong with them spending a few billion to invest in some cryptocurrency-related companies.

Therefore, we don’t need to be too surprised to see news such as “Warren Buffett is investing in Bitcoin”. We can just treat it as entertainment news. An indirect investment of more than one billion US dollars cannot change the trend of the crypto market, unless Berkshire Hathaway directly invests in companies such as MicroStrategy or personally buys Bitcoin. But at this stage, this seems unlikely.

2. What is your investment style?

In the previous series of articles of Hualihuawai, we have sorted out many investment strategies and methodologies. Different people may have different investment styles based on different capital sizes and risk preferences.

If we divide it from a broad perspective, we can roughly divide investment styles into 4 types:

- Technology-oriented investment

- Value investing

- Macro Investment

- Blind investment

Technical investment is more suitable for short-term investment, mainly based on various indicators for trading, such as they will look at trends, volume-price relationships, and various K-line patterns, in order to get returns in transactions. Value investment focuses more on long-term investment, and is more concerned about the long-term fundamentals and development vision of the "target", and pursues long-term profits. Macro investment is mainly similar to the methods used by bigwigs such as Soros, emphasizing sensitivity to global economic and political events, and looking for investment opportunities by analyzing the potential impact of these events on currency, stock and commodity markets. As for the blind school, it is mainly those who follow the crowd, like to blindly follow the hot spots, or mindlessly follow others to trade, have no investment strategy of their own, and never do their own research.

Of course, investment is a complex matter. In the actual operation process, some people may also combine technology, value, and macro perspectives for comprehensive consideration. But as far as I am concerned, I think a good investment strategy must be simple, that is, it can simplify complex things and then allow oneself to repeat them efficiently. In other words, it is necessary to form a trading system of one's own.

Then, on the basis of forming our own trading system, what we need to do is to continuously cycle and optimize strategies.

In addition, another very important aspect is to continue to strengthen your psychological construction. We have already sorted out a lot about psychological construction in last year's e-book "Blockchain Methodology". Here we continue to briefly list a few points, such as:

- Don't be afraid of selling at a loss. Compared to selling at a loss, the most painful thing is to be trapped in a profit decline. Selling at a loss only misses some potential gains, but being trapped in a decline may lose everything (many copycats or local dogs end up with zero profits).

- If you are worried about selling out, then the best way is to implement a profit-taking strategy of selling in batches. Withdrawing the principal and keeping the rest to form a pattern, and all-in principal to form a pattern, these are two completely different mentalities, and the latter is more like gambling.

- Don't compare yourself with others. Just because someone says to wait until Bitcoin reaches 150,000, it doesn't mean you have to do the same. For example, do you know what other people's holdings and costs are? Do you know their investment style?

- People who can really make a lot of money will not take leeks to make money casually. Some (I am not saying all people here to avoid being scolded) people who claim to be able to make you rich are more likely to collect your tuition (or even cheat you) and then use it as their principal. For example, people who claim to be whales and easily make hundreds of millions of dollars a year, will they really broadcast live for a long time every day just to spread knowledge? Isn’t the ultimate goal still to collect your thousands of dollars in group fees or tuition! In fact, many active so-called KOLs in many fields are laymen. The reason why these people are active is to get more traffic, because traffic is their income or principal (of course, there is no derogatory meaning here, it’s just that everyone’s ideas and ways of making money are different). Or, you can also think about it calmly, taking the example of Lu Mao, if a project Lu Mao can easily make A6, why should they painstakingly sell you a copy of A6 cheats for dozens of dollars?

- Rationally optimize your goals. If you can get a 4% return from buying financial products from banks, you will be very happy. Why are you not satisfied with a 1x return in the crypto field? You want to pursue 10x, 100x... Is the money in this field blown by the wind and specially prepared for you to get rich? If you are a financial consumer in the stock market, you may become a new liquidity provider in the crypto market.

- Selling during an uptrend is a difficult choice, but it is often a wise choice. Never try to sell at the top (and buy at the bottom).

That’s all for today. The sources of the images/data cited in the text have been added to Notion. The above content is only personal opinion and analysis, and is only for learning records and communication purposes, and does not constitute any investment advice.