On April 22, 2025, Bitcoin rose rapidly again, reaching a high of $88,850 this morning, a new high in nearly a month. According to BTCC market data , BTC is currently trading at $88,400, up 1.11% in 24 hours.

As U.S. stocks fell across the board and gold rose on Monday, Bitcoin strongly followed the rise of gold, showing a trend of decoupling from U.S. stocks, while the safe-haven properties of "digital gold" are strengthening.

In the short term, $88,000 becomes the key attack and defense line

From the current short-term structure, $88,000 is an important barrier for long-short game. If BTC can stand firmly on this price and the trading volume continues to increase, it is expected to rise further, with the target directly pointing to the psychological barrier of $90,000. However, if the market fails to fall back after breaking through, we need to be alert to the risk of false breakthroughs, and there will be pressure for callbacks in the short term.

From the daily level:

MA30 (30-day moving average) is still trending flat, but the price is trying to stabilize above it.

The MACD fast line has crossed upward below the zero axis, and the slow line is about to cross the zero axis, indicating that market momentum is beginning to strengthen and a mid-term rebound structure is brewing on the technical side.

Operation ideas reference:

If 88,000 holds, long orders can be arranged with a light position, and the target positions are 89,000 / 92,450 / 94,600 respectively;

If it falls below 88,000 and fails to rebound: consider shorting, with support levels at 83,360 / 81,680 / 79,980 respectively.

In addition, from the perspective of trading volume, the current trading volume has rebounded compared to the level when the U.S. stock market was closed in the past few days, but it has not yet formed a breakthrough volume, and the market is still waiting for clear direction confirmation.

It is worth noting that the price is currently approaching the lower edge of the red zone where it has been blocked many times before. Every time it approaches this area, the price falls back to varying degrees. If it can effectively break through and step back to confirm that the support has been formed and stabilized this time, Bitcoin is expected to have a real "breakthrough market".

View: $91,000 to $92,000 range is a potential resistance zone

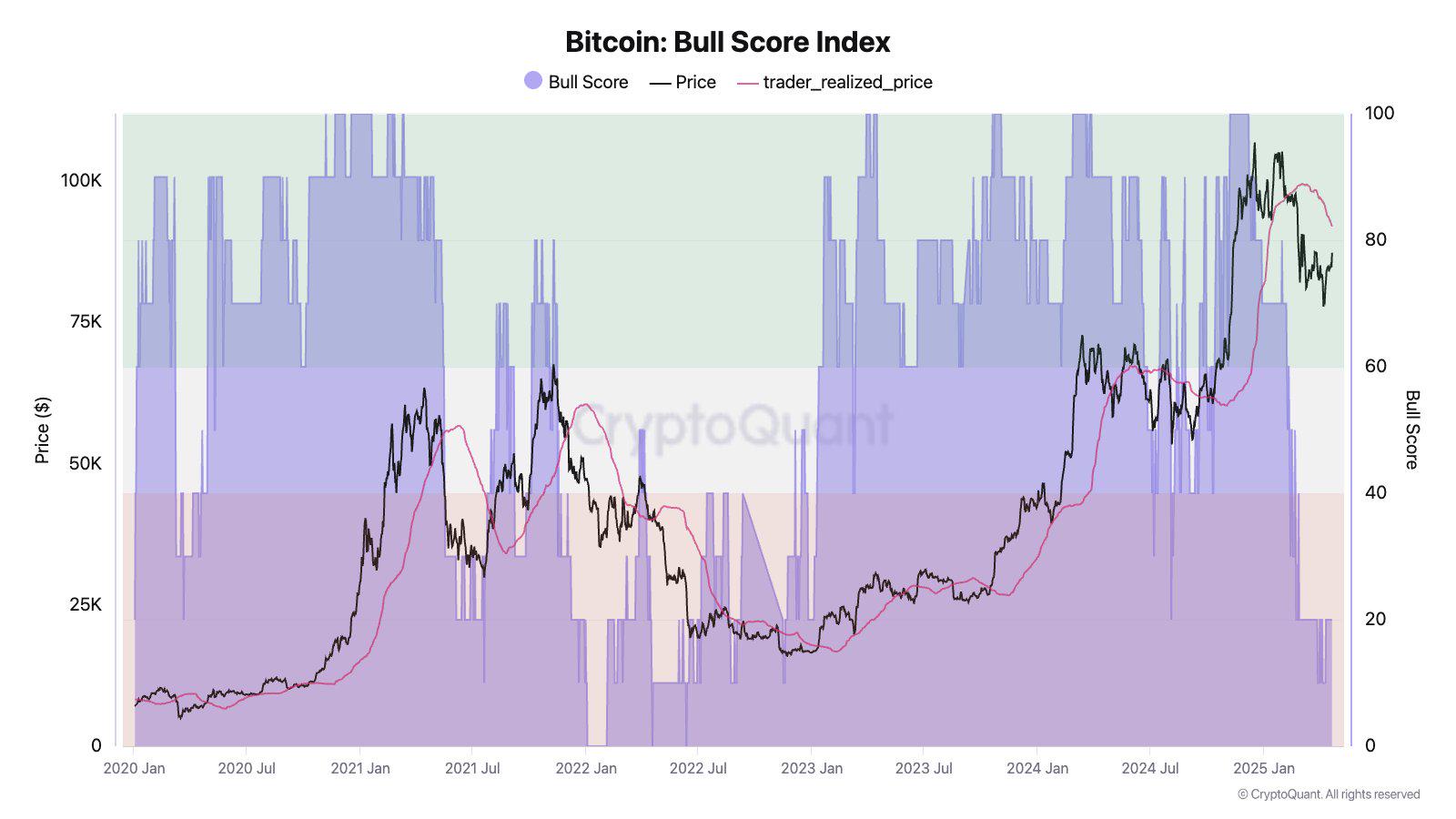

Julio Moreno, director of research at CryptoQuant, said on the X platform that the price of Bitcoin may be blocked between about $91,000 and $92,000, which coincides with the realized price on the trader chain.

According to the analysis, this realized price usually acts as support when the market is in a bullish state (green zone, bullish score ≥ 60);

When the market is bearish (red zone, bullish score ≤ 40), this price will serve as a resistance level. The market is still in the latter situation, that is, the bearish stage, so this price is more likely to be a resistance zone. This means that if Bitcoin wants to break through $92,000, it needs stronger market consensus and capital support.

BTC market share hits a four-year high, and altcoins may see a general rise

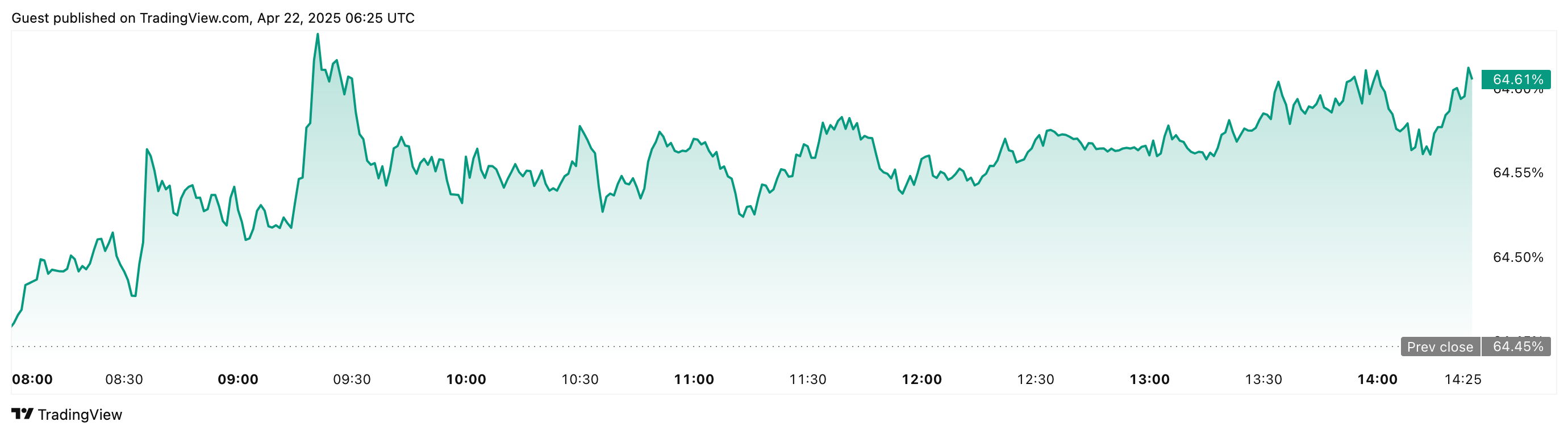

TradingView data shows that Bitcoin's market share (BTC.D) has risen to 64.6% today, the highest level since February 2021.

Bitcoin's market share continues to rise, indicating that more market funds are flowing into BTC, while the overall performance of altcoins is sluggish. However, from historical experience, this situation is often a prelude to altcoin rebounds.

For example, in November 2023, after BTC’s market share exceeded 60%, altcoins experienced a rapid rebound in the short term. Earlier in 2019 and 2021, when Bitcoin’s market share reached 70%, the cryptocurrency market subsequently experienced a comprehensive rise.

Therefore, if BTC subsequently stabilizes and successfully breaks through the $90,000 mark, it may trigger a rebound in market risk appetite and drive the overall rise of altcoins. Although history may not simply repeat itself, these patterns are worth paying attention to and can serve as an important reference for investment strategies.