Although Bitcoin and Ethereum fluctuate violently, stablecoins can quietly accumulate returns under the premise of "no volatility". Today, we focus on a new star in the emerging track - $USDe + Ethena protocol, a combination with an annualized return of more than 10%.

🧊 1/ Why is using stablecoins to earn passive income the future trend?

In the past few years, many DeFi protocols and CeFi platforms have collapsed one after another. People have gradually lost patience with highly volatile assets and began to seek a combination of "stable income + secure custody".

This is also the core logic behind why the market value of stablecoin staking protocols continues to rise: stability, compliance, and continuous cash flow generation.

🔍 2/ What does “trusted stablecoin” mean?

The “trustworthiness” mentioned in this article does not mean zero risk. Historical experience, such as $UST, tells us that even the most powerful projects may collapse.

True “credibility” should be based on:

High protocol transparency (real-time monitoring on the chain)

Reasonable mortgage structure (not purely algorithmic)

Strong community activity (TVL and locked-up growth are stable)

The income structure is sustainable (not relying on airdrops)

$USDe is one of the new emerging currencies in the market that meets these criteria.

💰 3/ What is the revenue structure of $USDe + Ethena?

Taking the Ethena protocol as an example, you can currently earn income in the following ways:

Basic income:

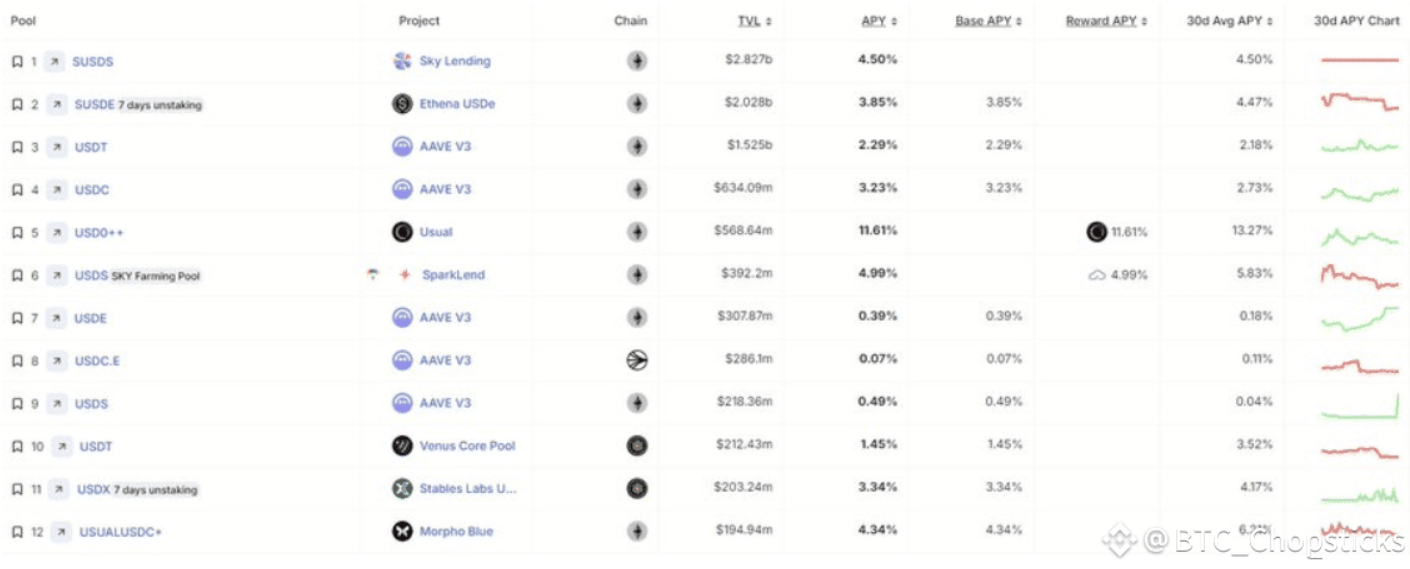

Pledge $USDe to Ethena to generate $sUSDe and obtain an average annualized return of 4.47% (30-day average).

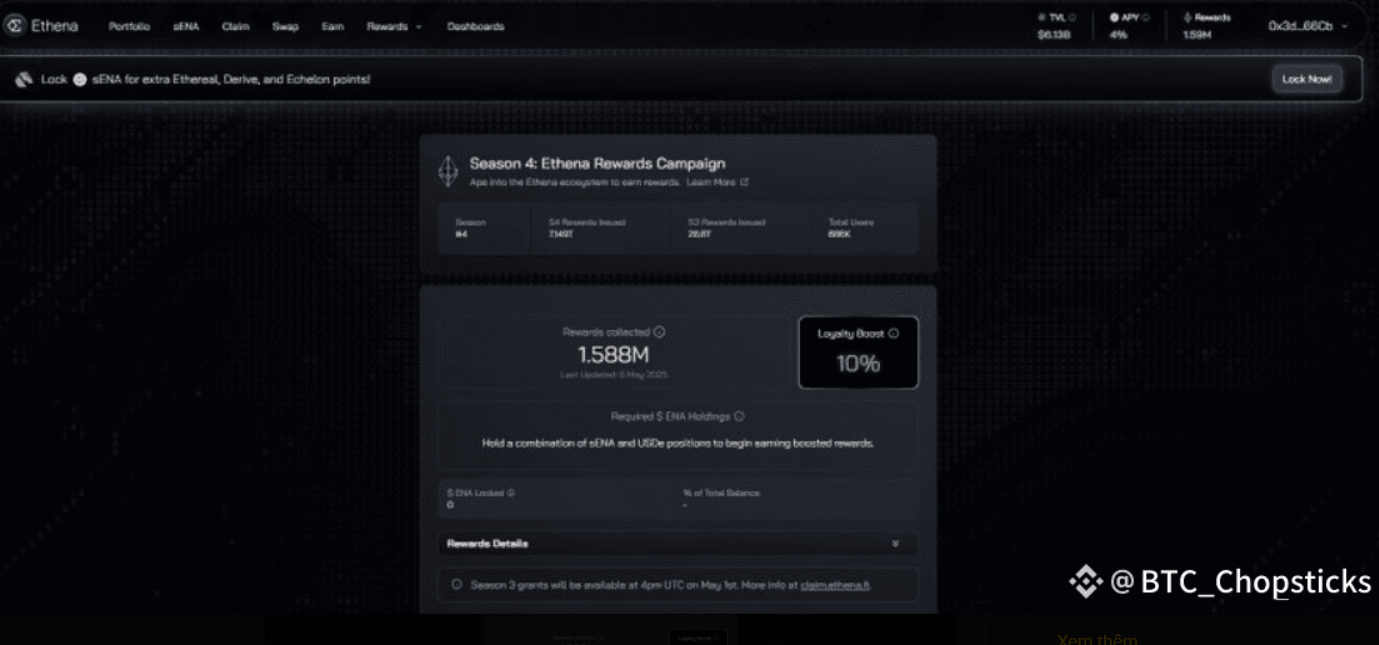

Additional rewards ($ ENA incentive):

Ethena distributes 3-5% of $ENA tokens to staking users every "quarter", and the duration is about 3-6 months.

💡 The comprehensive APY can usually reach between 9-11%.

⚙️ 4/ How to participate in the operation?

The operation steps are very simple and suitable for beginners:

Go to the official website: app.ethena.fi

In the Swap tab, exchange $USDT or $USDC for $USDe

In the Earn tab, stake $USDe to $sUSDe and start earning interest + airdrops

📈 For example:

With an investment of $10,000, it is conservatively estimated that a profit of around $1,000 can be earned in one year. This is no longer a game exclusive to whales, and ordinary people can also easily participate.

⏳ 5/ Are the benefits sustainable? When will they end?

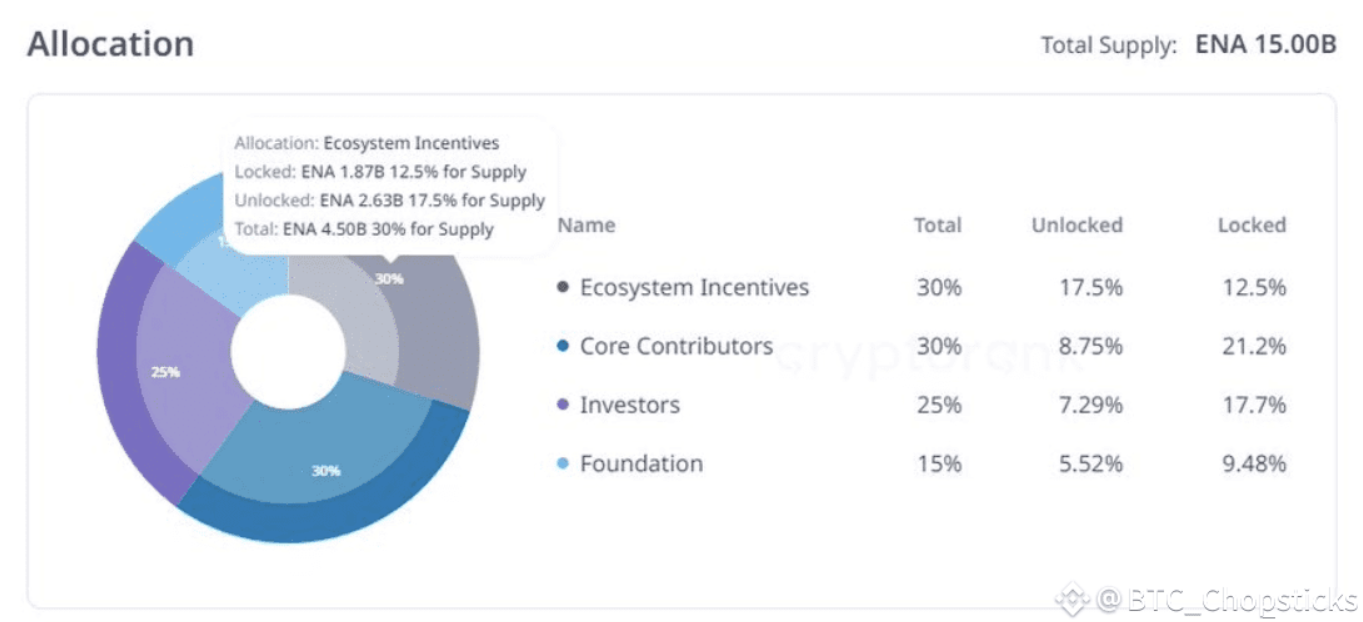

According to Ethena’s official token economic model (tokenomics), there are still 12.5% of $ ENA incentives that have not been unlocked, and it is expected to last until 2028.

In addition, the team may also continue reward incentives through market repurchases and other means to ensure the sustainability of returns.

✅ Summary and conclusion:

In the current era of high interest rates gradually reaching their peak and mainstream crypto asset prices fluctuating, stablecoin staking is becoming a new crypto "bond market":

Annualized returns are stable in the range of 8-12%

No need to bear the fluctuation of currency price

Low operating threshold and strong liquidity

The $USDe + Ethena combination is a representative project of this trend. Of course, all benefits are accompanied by risks - you still need to evaluate the security of smart contracts, the reliability of the stablecoin model, and changes in market demand.

But what is certain is that in the next cycle, low risk + sustainable returns will be the mainstream strategy of the "new rich" in the crypto circle.