🌾 1. Analytics Tools

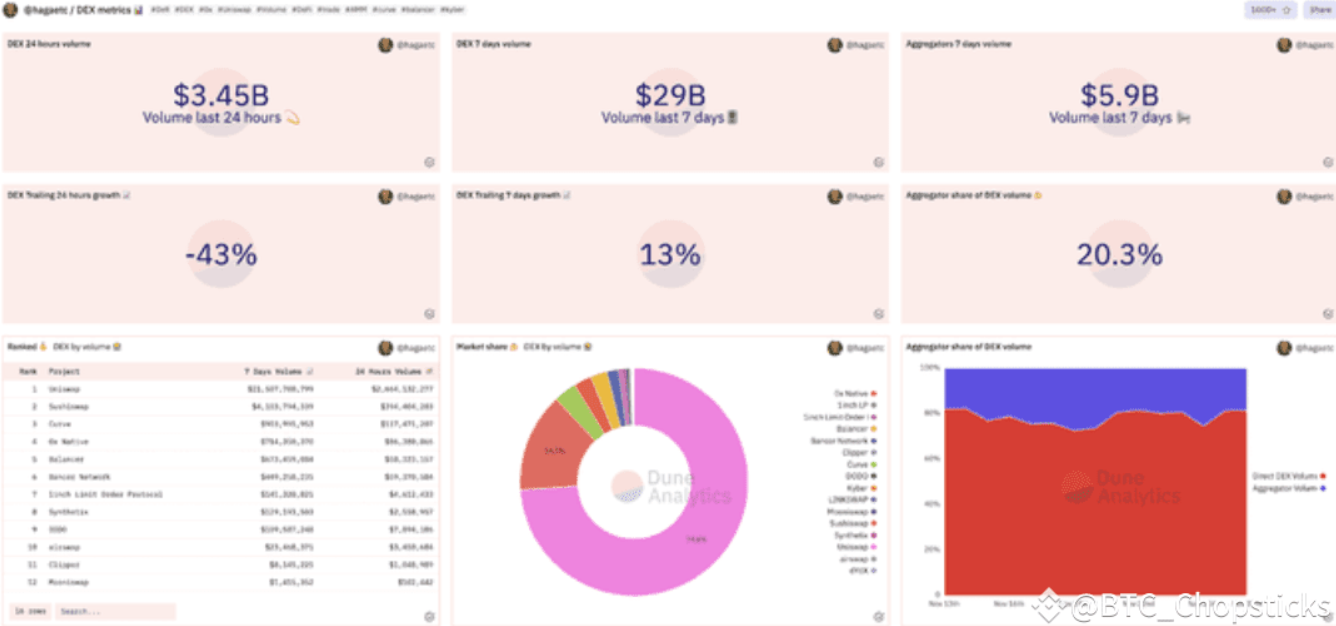

1. Dune Analytics

A powerful on-chain data dashboard platform that supports querying the number of users, transaction volume, protocol activity, etc. The visual interface is easy to use and suitable for making investment decisions.

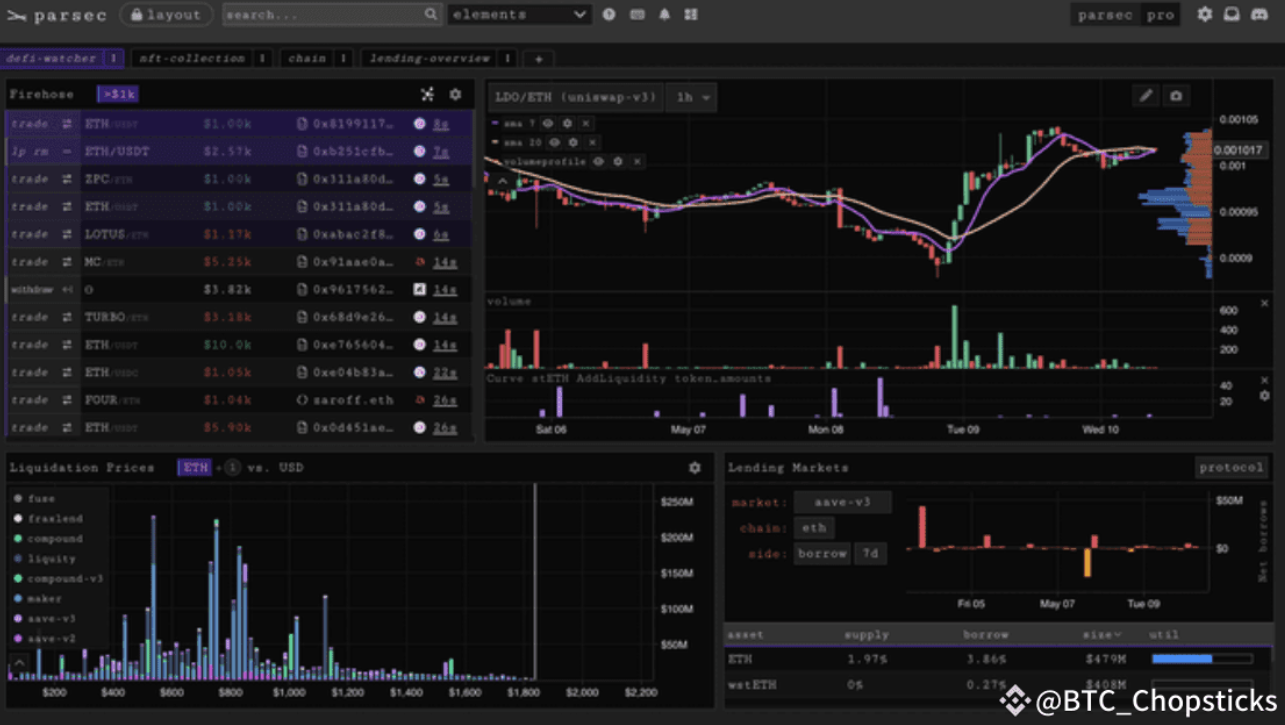

2. Parsec Finance

A DeFi / NFT analysis platform similar to Arkham . Supports quick viewing of on-chain wallet behavior, NFT transaction paths, etc. With a recommendation system, there may be points benefits in the future.

3. DefiLlama

DeFi protocol data overview platform, covering TVL, yield, cross-chain bridge data, etc. It is easy to use and a must-have for industry analysis.

4. Arkham

The wallet tag database supports filtering by transaction amount, time, token, etc., which is suitable for tracking the movements of whales and VCs on the chain.

🌾 2. Portfolio Trackers

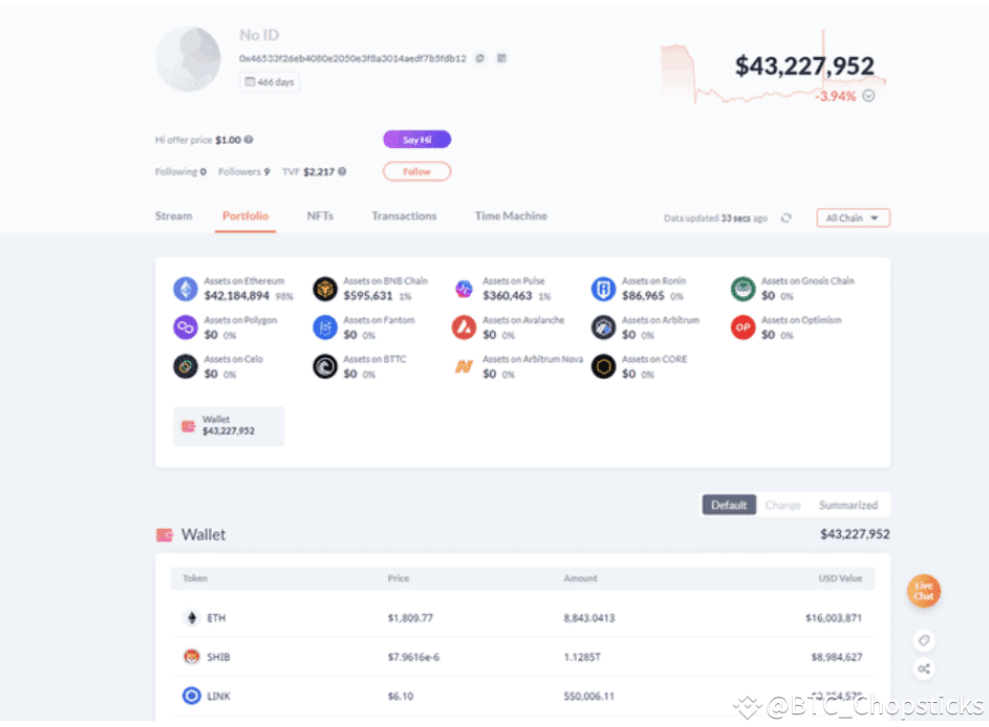

1. DeBank

The most popular Web3 asset tracker that supports viewing wallet asset portfolios and also has social and private messaging functions.

2. Zerion

It integrates wallet + investment tracking in one, has an excellent web version experience, and supports DeFi interaction.

3. Dropstab

The interface is user-friendly and suitable for tracking holdings, token price performance and historical returns, making it suitable for novices.

🌾 3. Market Analysis and Charting Tools

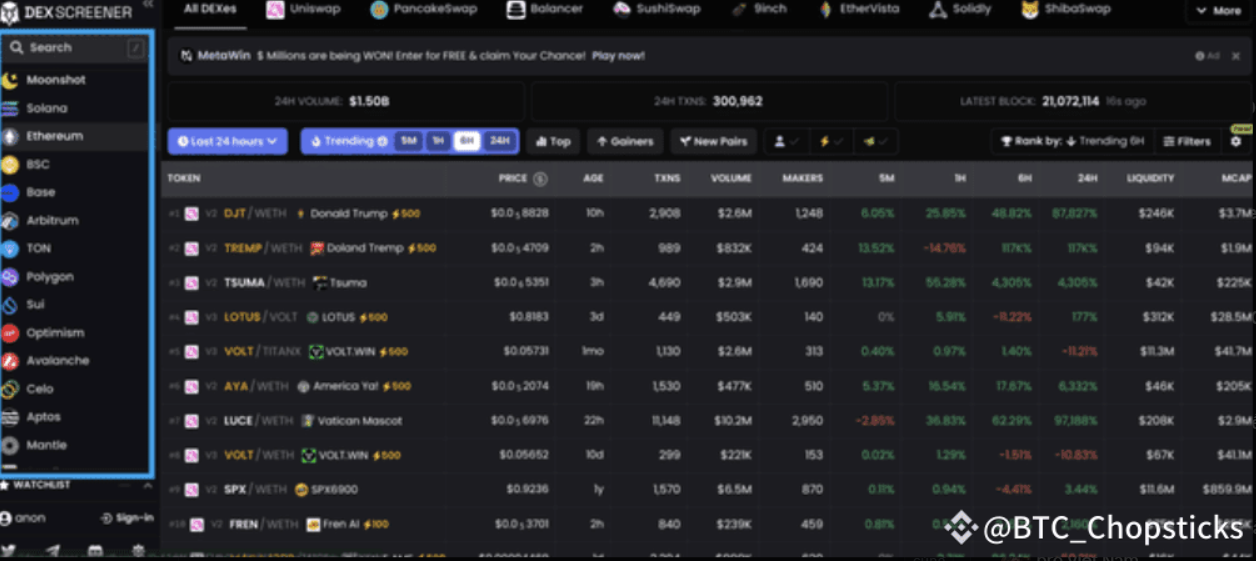

1. Dexscreener

Supports analysis of DEX trading pairs of 73 chains, with real-time K-line, buying and selling depth, and on-chain price fluctuations clearly visible.

2. Birdeye

The function is similar to Dexscreener, but it also has token security level analysis, which is suitable for risk control judgment.

3. DEXTools

A long-established charting platform, especially suitable for the analysis of small currencies and low-liquidity assets.

🌾 4. Sniping Bots

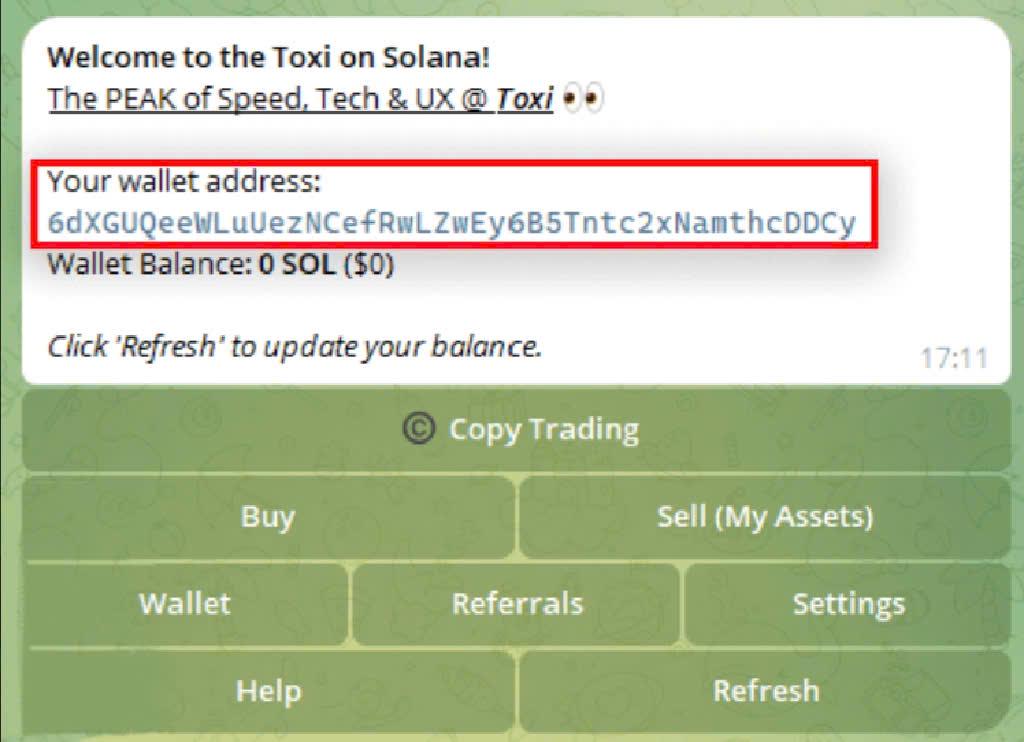

1. ToxiBot ( Solana )

The Solana front-running robot, used by many whales and insiders, is fast (completed within 2 blocks) and is extremely suitable for new listings.

2. BonkBot

Solana trading robot based on Jupiter Exchange , supporting memecoin quick transactions.

3. BananaGun

The EVM ecological front-runner artifact integrates automatic/manual trading and anti-rug mechanism, and has very comprehensive functions.

🌾 5. Mainstream DEX platforms (decentralized exchanges)

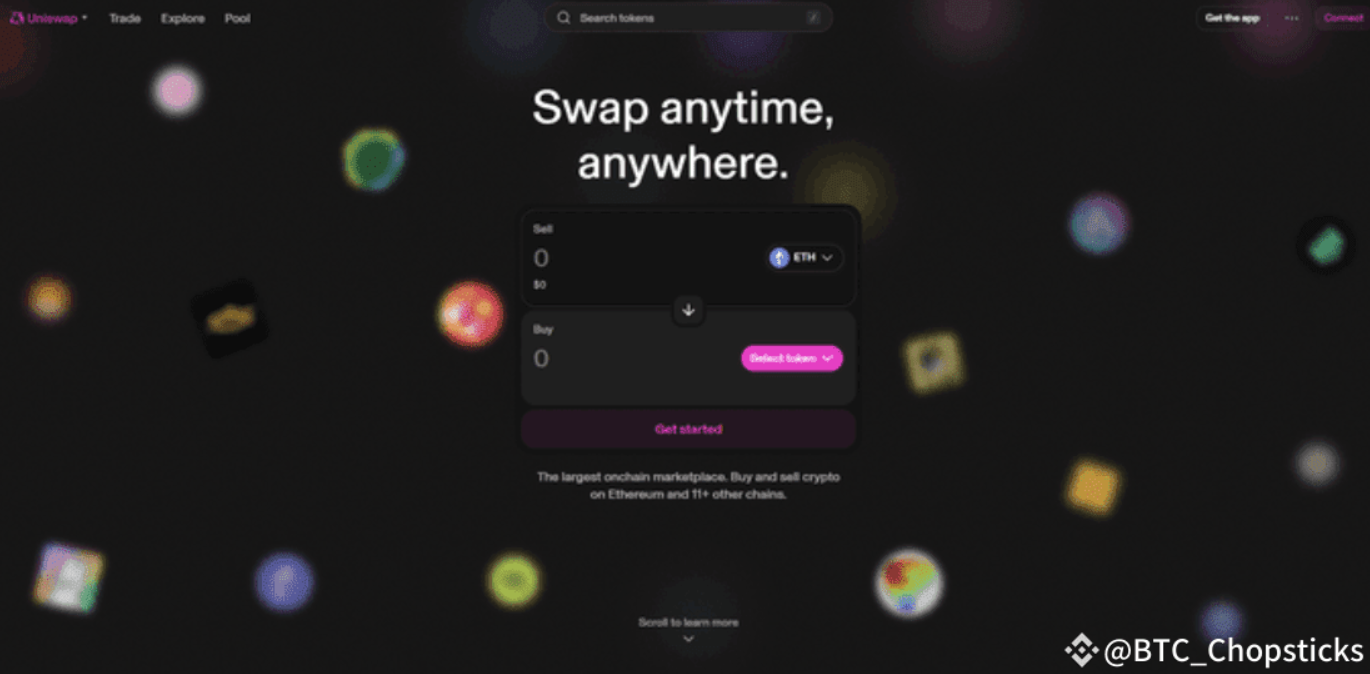

1. Uniswap

The creator of the AMM mechanism, the first choice for ETH users, and supports multiple chains.

2. SushiSwap

Multi-chain DEX uses LayerZero cross-chain communication, with a simple interface and good trading experience.

🌾 6. Security Tools

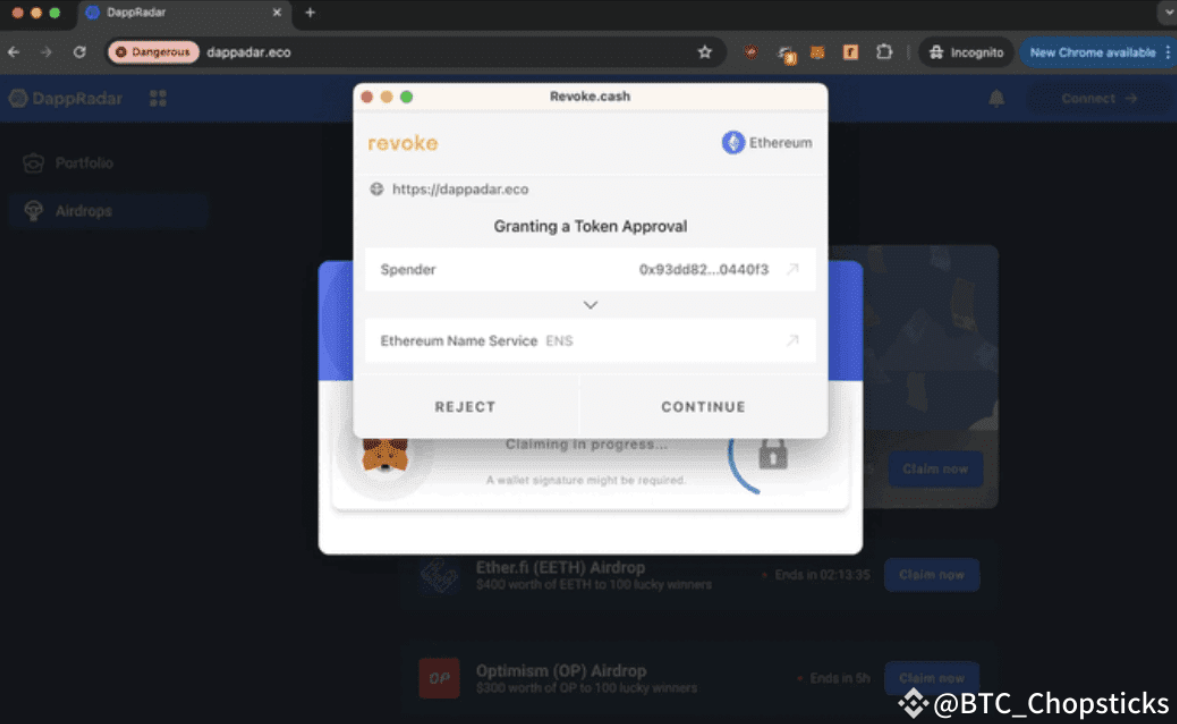

1. Revoke.cash

Check and revoke the wallet's authorization to the contract to prevent asset theft or project Rug.

2. CoinTool

Smart contract audit assistant that can scan high-risk authorizations in wallets and supports multiple chains.

🌾 7. On-chain activity tracking (Trackers)

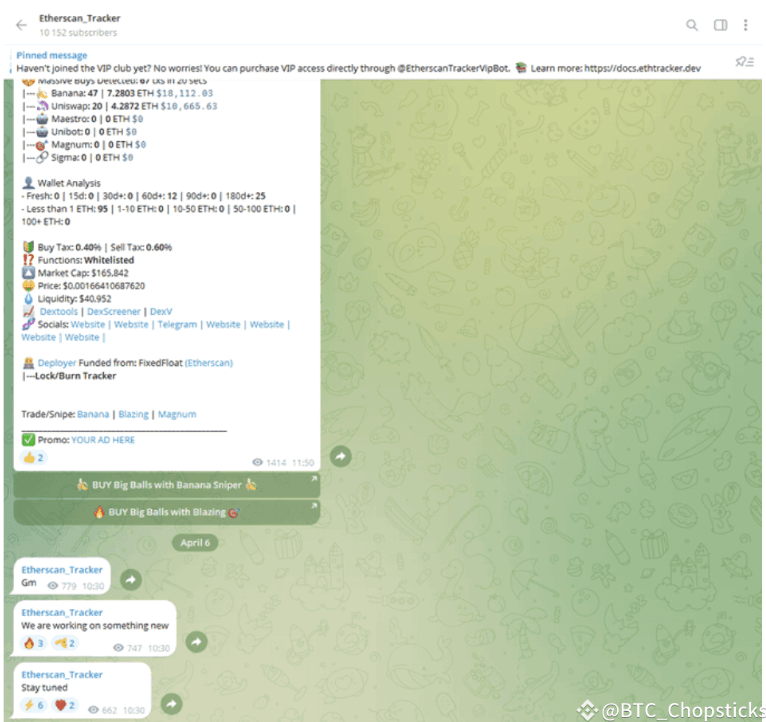

✅ #Ethereum tracking bot

Etherscan Tracker Bot: Track ETH transactions in real time based on Etherscan

EtherDrops: Tracking asset changes, wallet changes, NFT trends, etc.

✅ #Solana tracking bot

Solana Tracker: Discovering unusual buying events on the Solana chain and identifying potential dark horse coins

✅ Conclusion:

Use tools well and stand at the forefront of the information chain

You can make money once by luck, but real continuous profits depend on cognition and tools. These tools allow me to see traffic, funds and opportunities that others cannot see, to make early arrangements in the bull market and to protect assets in the bear market.