📊 7 core indicators: the true state of the market

1️⃣ #bitcoin AHR999 indicator: The top is not yet reached 🚀

🔹 AHR999 < 0.45: Bottom-picking signal

🔹 AHR999 0.45 - 1.2: Fixed investment range

🔹 AHR999 > 1.2: The price is too high, not suitable for trading

📌 The tops of the past three bull markets all appeared when AHR999 > 4, and this cycle has not yet reached the high, indicating that the market still has room to rise📈

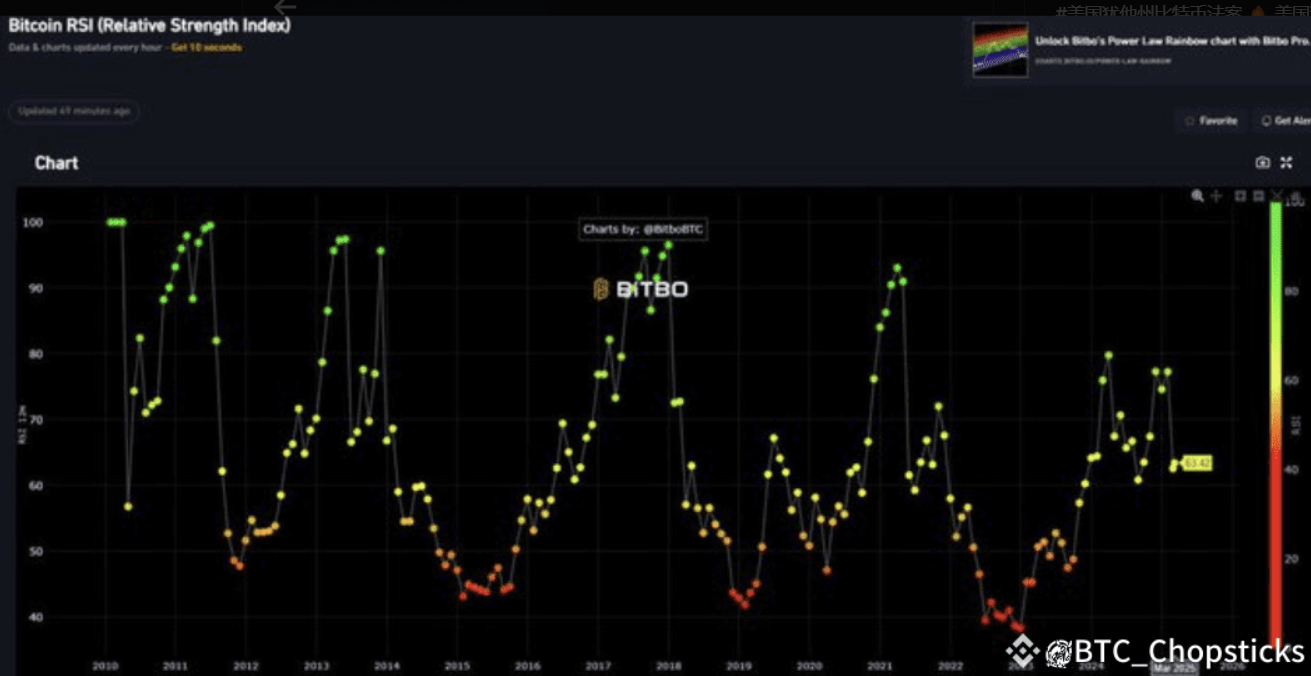

2️⃣ Bitcoin RSI: Not yet in overbought territory📊

🔹 RSI > 70: Overbought, market may correct

🔹 RSI < 30: Oversold, possible rebound

📌 The top of a bull market is often when RSI > 90, but this round’s highest is only 80, which means the market is not overheated🔥

3️⃣ #AltcoinSeasonalIndex : The bull market is far from over💡

🔹 If 75% of the top 50 cryptocurrencies outperformed BTC in the past 90 days , it is the alt season

📌 The current Altcoin Seasonal Index is only 14 (historical low), which means that the market is still in the BTC-dominated stage and has not yet entered a full bull market🚀

📌 In the past 90 days, only 5 old-fashioned altcoins outperformed BTC, and it is far from the end of the bull market🧐

4️⃣ BTC dominance rate: still on an upward trend📉

🔹 BTC dominance rate usually drops when bull markets peak, meaning funds are flowing into altcoins

📌 Currently, BTC dominance rate is still rising, which means that the market is still in a healthy stage led by BTC, and the bull market has not yet entered a bubble period📈

5️⃣ Bitcoin Bubble Index: The market is far from overheated 🔥

🔹 When the bubble index > 70, the market enters a high-risk state

📌 The current bubble index is still at a low level, Google search trends and social media discussions are far lower than the peak of the bull market in 2021, indicating that the market has not yet entered extreme FOMO 🏆

6️⃣ Golden Ratio Multiplier: Bull market target price has not yet been reached 💰

🔹 350 day moving average x3 = bull market top indicator

📌 Currently, BTC 350DMA x3 is at $150K, but the BTC price is far from reaching this level, indicating that the top has not yet been reached🚀

7️⃣ CBBI ( #BitcoinBullMarketIndex ): Still in the bull market🏦

🔹 When CBBI > 90, it is usually a bull market top signal

📌 Historically, CBBI has exceeded 90 when $ BTC peaked, but this round only reached 83, indicating that the market is still in a healthy upward trend📊

📢 Conclusion:

The bull market is not over, the market may usher in a new wave of increases!

✅ The current market is more like a mid-term adjustment rather than the end of the bull market

✅ Historical data shows that most key indicators have not yet reached the bull market top signal

✅ The market may still have one last wave of gains before entering a bear market cycle