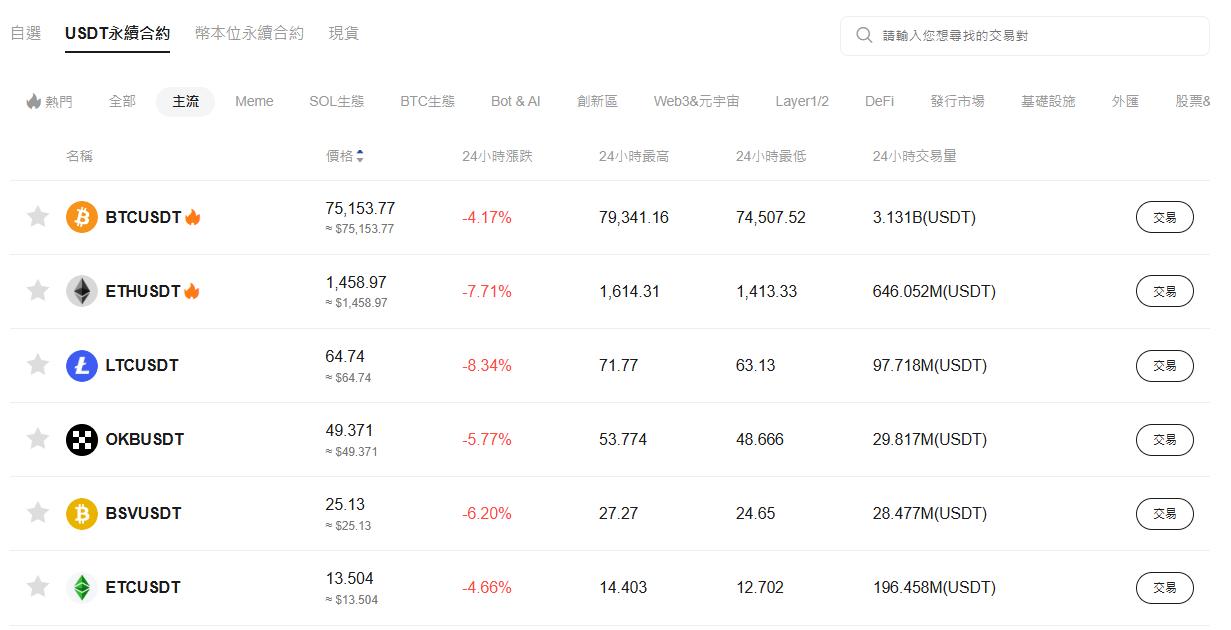

On April 7, 2025, according to BTCC market data, Bitcoin prices fell sharply today, falling to a low of $74,550 and now at $75,153, a 24-hour drop of 4.17%. Ethereum fell even more severely, falling below the $1,500 mark and now at $1,458, a 24-hour drop of 7.71%. At the same time, the altcoin market plummeted across the board.

According to Coinglass data, in the past 24 hours, more than 449,000 people were liquidated on the entire network, with a total amount of up to US$1.37 billion. Among them, the amount of long orders liquidated reached US$1.208 billion, accounting for as high as 86%; the amount of short orders liquidated was US$169 million. The market panic has further intensified.

The total market value of cryptocurrencies has shrunk significantly, from $2.6 trillion to $2.38 trillion, a drop of 10%. The total market value of Bitcoin has fallen below $1.5 trillion, currently at $1.49 trillion, a 24-hour drop of 9.8%; the market value of Ethereum has fallen below $180 billion, at $179.4 billion, a 24-hour drop of 18.2%.

Combined with recent macro and market changes, this round of crypto market decline may be mainly affected by the following three factors:

1. Downward transmission effect of US stocks

The recent performance of US stocks has continued to be weak, the Nasdaq index has officially entered the bear market range, and the overall market risk appetite has decreased. Crypto assets, as high-risk assets, are the first to bear the brunt of the global risk aversion sentiment, and their prices are under great pressure.

2. US tariffs raise concerns in global markets

On April 2, former US President Trump signed an executive order to impose a new round of tariffs on multiple trading partners. This move once again sparked global concerns about economic recession, leading to a collective pullback in risky assets, and the crypto market was not immune.

3. Market capital outflow and leverage high-level liquidation

The current market is in a high sideways phase, lacking new capital inflow support, resulting in fragile bullish sentiment. Once prices fall rapidly, the chain liquidation effect is quickly triggered, exacerbating panic selling and short-term plunges.

At present, Bitcoin has fallen below $75,000 in the short term, and the key support level is around $74,000. If the price falls below this level, it may fall further. For Ethereum, if it continues to fluctuate below $1,500, we need to be alert to further weakness. In the short term, investors should pay attention to the direction of the Fed's policy, US economic data and global geopolitical risk events, which will continue to affect market trends.