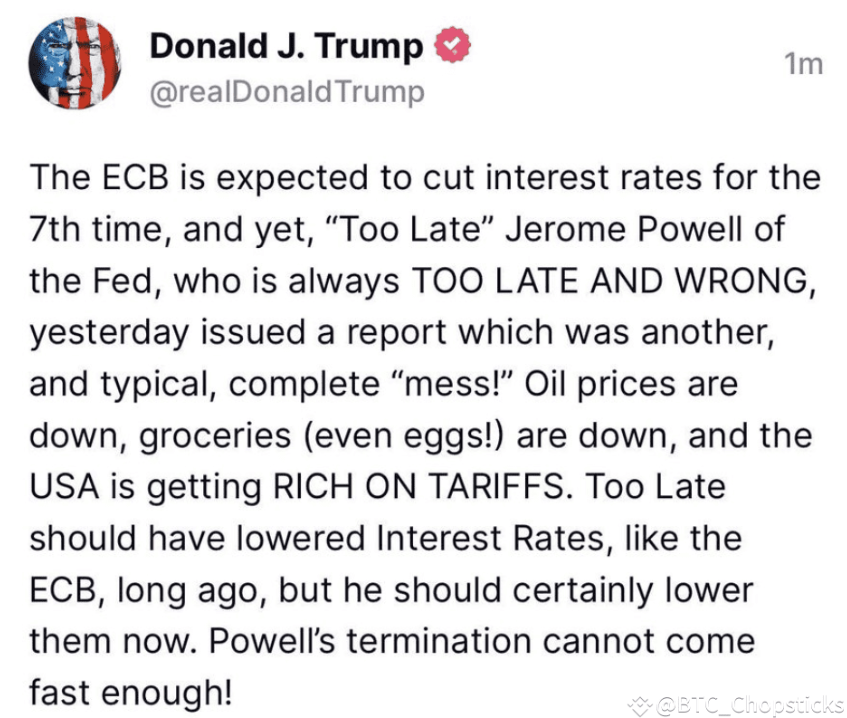

Meanwhile, Trump is suing the Supreme Court for the power to remove the leaders of independent agencies, including Powell, a move that, if approved, would set a historic precedent for presidential intervention in monetary policy.

💰Trump's economic proposition: high tariffs + low interest rates

Since April, Trump has announced tariffs ranging from 10% to 49% on imports from 185 countries, with tariffs as high as 145% on Chinese goods. He claimed that the United States is generating billions of dollars in revenue every week through tariffs, providing a fiscal buffer for interest rate cuts.

His logic is: "Now that US inflation has fallen and tariffs have brought in strong revenue, interest rates should be lowered significantly to stimulate the economy." He praised the European Central Bank for "cutting interest rates seven times in half a year", while accusing the Federal Reserve of "being slow to act, putting the United States at a disadvantage in global competition."

📉Powell responded: The independence of the Federal Reserve cannot be interfered with

Powell responded strongly, emphasizing that the Federal Reserve is an independent institution and the president has no right to remove its chairman, and said that he will serve until May 2026. He also warned that a rash interest rate cut could fuel inflation, increase supply chain risks, and undermine market confidence.

He insisted on the principle of "making decisions based on data" and warned that political interference could undermine the market's long-term trust in the Federal Reserve.

📊Market reaction: Cautious optimism but hidden risks

After Powell's statement, the US dollar index fell slightly, and US stocks rose by 0.2% to 1.6%. Investors are optimistic about the short-term expectations or pre-pricing of interest rate cuts, but concerns about the independence of the Federal Reserve are also deepening.

The next Fed meeting is scheduled for May 6-7, when the market will pay close attention to whether the interest rate is actually cut by 2%, or whether Powell will continue to maintain a hawkish tone to "depoliticize" it.

Crypto Market Potential: BTC $150,000? ETH $5,000?

If the interest rate cut is implemented, or the Federal Reserve loses its policy independence, confidence in the US dollar may be shaken, and capital will once again seek safe-haven assets - cryptocurrencies will become the first choice:

📈 Bitcoin ( $BTC ) is expected to hit $150,000

📈Ethereum ( $ETH ) could break $5,000

📈 Solana ( #SOL ) could reach $500

In particular, Bitcoin, which has long been regarded as "digital gold" to combat the excessive issuance of legal currency and policy uncertainty, is very likely to start a new round of major uptrend under this background.

✅ Conclusion:

New opportunities behind the power struggle

This dispute between Trump and Powell is not only a difference in economic policy, but may also rewrite the independence of the Federal Reserve and the operating model of the U.S. monetary system.

✅ If the Fed succumbs to political pressure or cuts interest rates ahead of schedule, the crypto market may usher in an unprecedented boom

❗️But if political interference gets out of control, financial markets may also enter an era of high volatility and increased uncertainty

For investors, this is both a risk and a major opportunity. Please pay close attention to the May FOMC meeting and the Supreme Court ruling, which may determine the real tipping point of the crypto bull market.