I. Core Contents of the Reserve Plan

Before the Crypto Summit

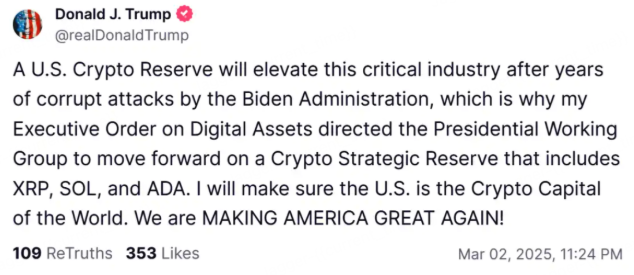

On March 2, 2025, US President Trump released a series of statements through social media platforms announcing plans to include BTC, ETH, XRP, SOL and ADA in the US national strategic reserve, and signed the "Digital Asset Executive Order" to establish a presidential digital asset working group to advance related plans. He also said that this move is seen as a direct response to the Biden administration's strict regulatory policy, aiming to build the United States into the "global cryptocurrency capital." After the news, Trump announced that he would hold the first White House Cryptocurrency Summit on March 7, inviting industry leaders and working group members to discuss the regulatory framework.

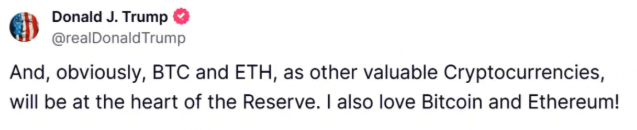

Trump emphasized in his statement that BTC and ETH will be positioned as the "core assets" of the reserve, while XRP, SOL, and ADA will serve as supplementary components. He specifically mentioned: "Bitcoin and Ethereum will become the core of the currency reserve, and other valuable cryptocurrencies will jointly support the US digital asset strategy." After the news was released, the cryptocurrency market soared across the board:

BTC broke through $95,000, with a daily increase of more than 10%;

ETH rose to over $2,500, an increase of about 13%;

XRP, SOL, and ADA performed particularly well, with ADA’s single-day increase reaching 72%, while XRP and SOL rose by 33% and 22% respectively;

MEME TRUMP, which is personally associated with Trump, also rose 25%.

After Crypto Summit

On March 6, 2025, Trump officially signed an executive order to establish a strategic Bitcoin reserve, funded by Bitcoin (200,000 BTC) confiscated by the federal government. These Bitcoins will be used as a store of value and will not be sold. In addition, the executive order also established the U.S. Digital Asset Reserve to store confiscated digital assets other than Bitcoin, but will not further acquire new assets. The reserve will be managed by the U.S. Treasury. However, the subsequent crypto summit caused the market to take a sharp turn for the worse again. This first cryptocurrency industry summit, which was highly anticipated, was promoted as "defining the direction of crypto regulation in the next four years", but the entire event did not release any substantive policy documents, and did not provide clear guarantees or timetables for the direct purchase of new cryptocurrencies. Most people only spoke to thank Trump. After the summit, the price of BTC immediately fell by about 3%, and the market was significantly disappointed.

2. Analysis of Trump’s Related Assets

Currently, Trump-related crypto assets can be divided into two categories: US asset reserves and WLFI (World Liberty Financial)-related assets. The US strategic reserve assets are announced by Trump himself in this announcement that he plans to include them in the national asset reserves. WLFI is a DeFi project supported by Trump and his family. The project holds a large number of altcoins. Previously, the head of WLFI announced plans to launch its WLFI asset reserves. Both of these projects have been questioned by the market for being related to political donations, and they have made political donations to Trump through different channels to obtain presidential advertising seats.

1. US strategic reserve assets (BTC/ETH/SOL/XRP/ADA)

US local government Bitcoin reserve legislation is blocked

Unlike the Bitcoin Reserve Act signed by Trump through the presidential executive power, state bills must go through the legislative process of the state legislature. Once passed, they become state laws and have stronger institutional binding force. About 25 states in the United States have proposed regional Bitcoin Reserve Acts, covering half of the states. Currently, bills in four states have been rejected (Montana, North Dakota, South Dakota, and Ohio), all of which are "red states" dominated by the Republican Party. It is worth noting that although the bills proposed by the states have great differences in terms, they can essentially add new liquidity to the Bitcoin market or reduce potential selling pressure. For example:

Pennsylvania proposed that the state treasurer invest 10% of the state fund (about $7 billion) in Bitcoin;

Texas allows residents to pay taxes and accept donations in Bitcoin to build reserves, and requires holding for at least five years.

Ohio plans to build reserves from seized assets, reducing potential selling pressure on Bitcoin.

Although the Bitcoin Reserve Act signed by Trump has set the tone for Bitcoin reserves at the national level, the progress of the reserve bills at the state level remains to be seen. At present, it is difficult to achieve in the short term. A large number of veto cases at the state level (such as the repeated attitudes of Republican red states) may shake the support of state legislators. In addition, the volatility of BTC is still under question.

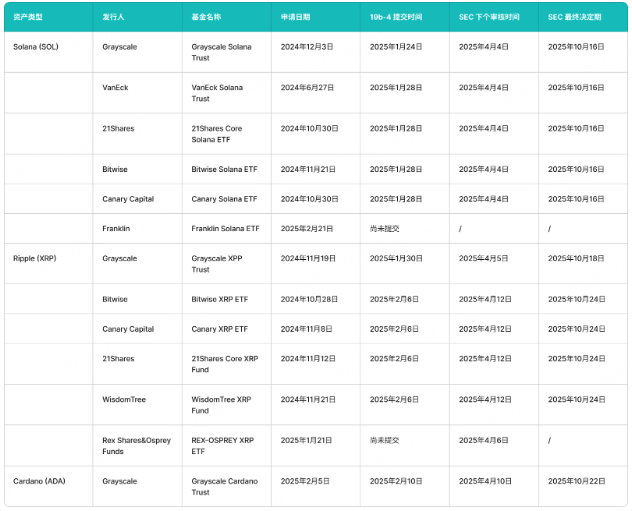

SOL, XRP, ADA National Reserve Assets plus Spot ETF Expectations

The narrative of SOL, XRP, and ADA being included in the reserve and ETF approval may be one of the important hot spots in 25 years, especially at key nodes such as April (SOL ETF initial response) and October (final decision). At present, it seems that the probability of the spot ETFs of the above three projects being approved in April is not high, mainly because they each have certain risks of unlocking and selling pressure, which may cause large fluctuations in the price of the currency and affect the decision of the SEC. SOL has recently fluctuated sharply in price due to events such as auction token unlocking and LIBRA black swan. As of March 5, the price of SOL has fallen from the high of $261 at the beginning of the year to $141, a year-on-year decrease of 45%. XRP is still worried about its subsequent selling pressure because 42% of the tokens are not unlocked. ADA is because its circulating market value is only US$33.1 billion, which is quite different from other projects included in the list of reserve assets.

2. WLFI related assets (TRX/ONDO/MOVE/ENA/LINK/AAVE, etc.)

The assets associated with World Liberty Financial (WLFI), a crypto project supported by the Trump family (such as TRX, ONDO, MOVE, ENA, LINK, AAVE, etc.) generally have small market capitalizations and violent fluctuations. The interaction patterns between these assets and WLFI show that the project party may induce the WLFI Foundation to purchase its tokens for market momentum through mechanisms such as "political donations" or "token swaps". For example, after receiving investment from Justin Sun, WLFI bought a large amount of TRX and WBTC, and its current holdings are worth approximately US$63.41 million. As of February 9, Justin Sun has invested a total of US$75 million, of which 84.5% of the funds were used to purchase its associated tokens. Judging from market performance, WLFI's position dynamics often cause violent fluctuations in the prices of related tokens. For example, after WLFI announced its purchase of ONDO, its price soared 16.33% in 24 hours, breaking the historical high to 2.1 USDT. This short-term pulse-like rise is highly correlated with WLFI's public disclosure of holdings, and was questioned by the outside world as the project party using WLFI's "Trump effect" to pull the market and then sell it for cash. It is worth noting that the WLFI token itself has serious liquidity defects - it is not transferable or tradable, and 75% of the project's net profit flows to Trump-related entities, further exacerbating the market's concerns about manipulation risks.

3. Potential impact on the future crypto market

Although the Bitcoin strategic reserve plan recently launched by the US government is significantly lower than market expectations in terms of specific scale and policy intensity, a vertical comparison of the policy trajectories of the two governments shows that the US crypto industry has achieved a historic turning point. Currently, under the reconstruction of the regulatory framework led by the Republican Party, crypto assets such as Bitcoin have not only obtained the legal status of compliant financial instruments, but have also been included in the investment portfolios of mainstream financial institutions.

Although the market's expectation of "the US government directly entering the market to purchase BTC" is difficult to achieve in the short term, there are still multiple possibilities for policy evolution: First, the US government will not sell the 200,000 bitcoins it currently owns, and the problem of the "Silk Road" confiscated funds being sold, which the market has been worried about for many years, has been solved, avoiding a large amount of selling pressure on the secondary market; second, local governments in the United States are promoting regional Bitcoin reserve plans. Although the progress is not smooth at present, Trump's signing of the Bitcoin Reserve Act has set the tone for the country, and local governments may be more smooth in the follow-up. In addition, the newly established cryptocurrency working group of the SEC is developing a more flexible compliance framework to pave the way for future strategic reserves at the federal level.

From a macro perspective, Trump's successful promotion of Bitcoin and other cryptocurrencies into the US strategic reserve may trigger a demonstration effect, prompting many countries to re-evaluate their reserve strategies. For example, Japan previously suspended its decision on the grounds that "the United States is still in the discussion stage". If the United States implements the reserve plan through legislation or administrative means, Japan may turn to a more positive stance. In addition, countries such as Russia, China, and Europe may accelerate their layout due to geopolitical competition, such as strengthening their voice in the field of digital currency by legalizing mining and supporting crypto reserve bills.

Note: All cryptocurrency investments, including income products, are highly speculative and involve significant risks. Past performance of a product does not guarantee future results. The cryptocurrency market is highly volatile. Before making any investment decisions, you should carefully evaluate whether it is appropriate to trade or hold digital currencies based on your personal investment objectives, financial situation and risk tolerance, and consult a professional financial advisor. The information in this article is for reference only and does not constitute any investment, legal or tax advice. The author and publisher are not responsible for any losses resulting from the use of the information in this article.