Author: Nianqing, ChainCatcher

In February of this year, with the exposure of LIBRA and the conspiracy group, the carnival era of Pump.fun and Memecoin officially came to an end.

Memecoin was originally an interesting and relatively pure PvP game, but with the "industrialization" of coin issuance, Memecoin has evolved into a predatory game dominated by an internal "cabal group". At first, the occasional wealth effect could temporarily cover up the manipulation methods of the dealer, but the game makers became more and more greedy, retail investors were repeatedly cut, and liquidity eventually dried up, and no one was willing to participate in such a game anymore.

In addition to the conspiracy group, many current token issuance platforms (including Pump.fun) face serious fairness issues, such as the existence of a large number of sniper robots and fake trading volume robots, tokens being snapped up at low prices to push up prices, falsifying market trends, and attracting retail investors to take over.

Memecoin clearly needs a fairer launch.

Kyle Samani, managing partner of Multicoin, once raised a question: Is there a memecoin launch platform that discovers the initial price through auction?

At present, DeFi protocols such as Hyperliquid have introduced Dutch auctions in their issuance strategies to improve the fairness and transparency of token issuance and reduce insider trading and price manipulation, but they do not target Memecoin assets alone.

Pure Markets, the first native token launch platform of Unichain ecosystem, is a launch and trading platform built for a purer Memecoin. Pure uses the "hooks" function of Uniswap v4 to conduct liquidity-guided auctions in hook contracts, aiming to allow tokens to quickly find a fair market price. In addition, Pure is based on the bond curve dynamics of the Dutch auction to prevent robots from running ahead.

Pure is mainly supported by the Doppler protocol. The Doppler protocol was developed by Whetstone Research, which completed a $1.3 million Pre-Seed round of financing in February this year. Austin Adams, a core member of Whetstone and a researcher at Uniswap Labs, is also a researcher at Uniswap Labs.

Unichain Ecosystem's First Native Token Launch Platform

In mid-February, the Unichain mainnet was officially launched. Unichain is an L2 designed specifically for DeFi. In cooperation with Flashbots, it uses a trusted execution environment (TEE) for block construction. Its goal is to improve market efficiency and fairness by capturing the maximum extractable value (MEV) and protecting users from problems such as front-running.

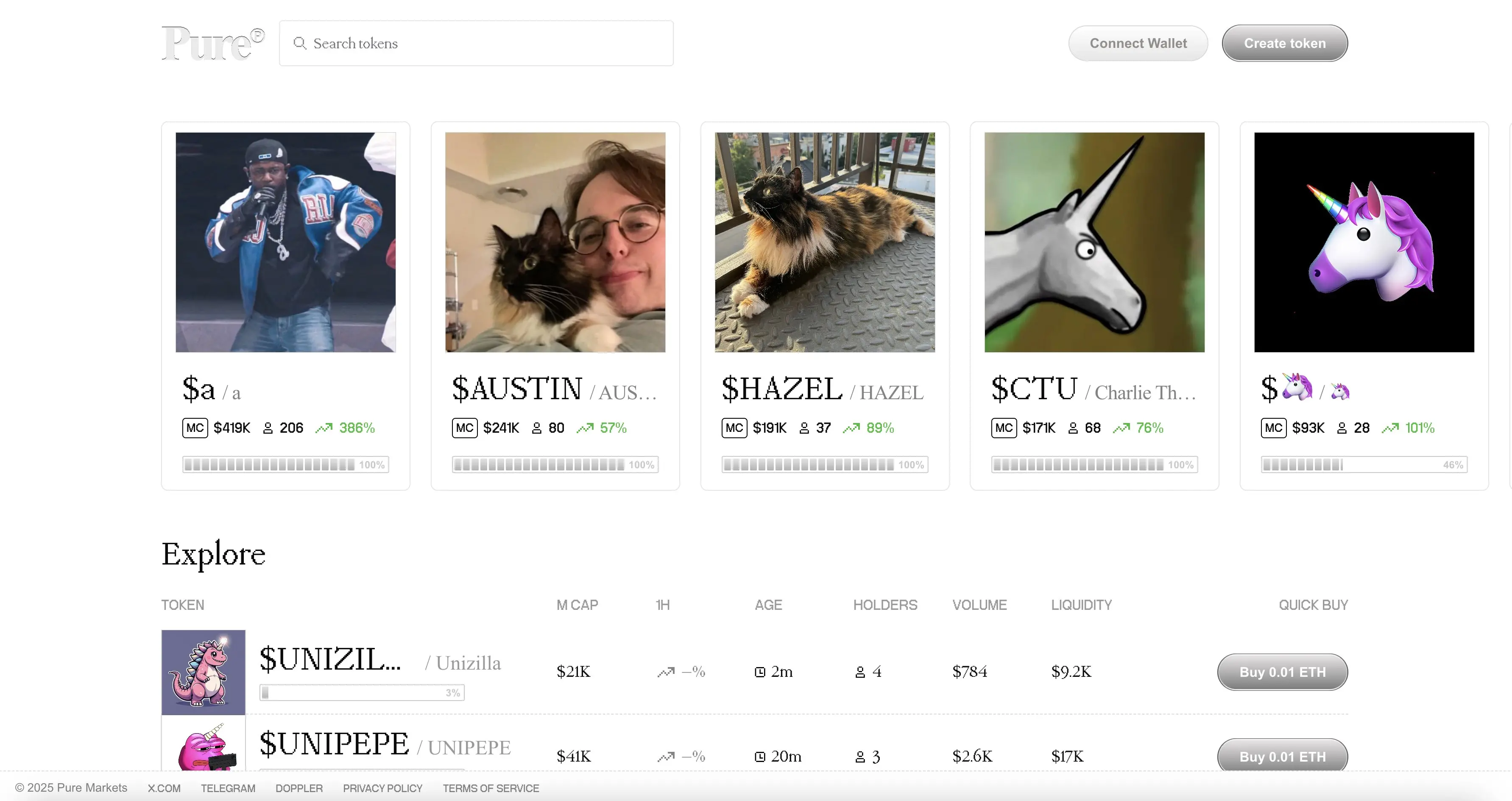

Pure Markets is the first native token launch platform of the Unichain ecosystem. It was launched after the launch of the Unichain mainnet and has also been expanded to Kraken's L2 ink and Coinbase's L2 Base.

Currently, there are relatively few assets on Pure Markets, after all, Unichain's mainnet has only been online for more than a month. Its Twitter account currently has only more than 1,000 followers. Most of the well-known followers are people related to the Uniswap team and ecosystem, including Hayden Adams, CEO and founder of Uniswap Labs. Alon, co-founder of pump.fun, also followed this early-stage competitive project.

There is very little official information disclosed by Pure Markets, but based on the interaction with other projects, Pure Markets should be founded by Whetstone, the developer of the Doppler protocol. In addition to Pure Markets, the Doppler protocol is also worth noting. Ohara, the application and game creation and asset trading platform of the Base ecosystem, also uses the Doppler protocol, which supports users to create applications and publish App coin assets in one stop.

Doppler: The protocol behind Pure

The Pure Markets application is mainly supported by the Doppler protocol and is also the first front-end application built on the Doppler protocol.

Doppler is a token launch platform and liquidity bootstrap protocol based on the Ethereum Virtual Machine (EVM), supporting the creation of any asset such as Memecoin, RWA, governance tokens, etc. Doppler uses the "hooks" function of Uniswap v4 to simplify the work of integrators by executing liquidity bootstrap auctions in hook contracts. This design aims to optimize the liquidity provision process and help users get more accurate pricing at a lower cost while retaining more token value.

Whetstone Research, an on-chain protocol development team, designed and developed Doppler. Austin Adams, one of the founders of Whetstone Research, was a researcher at Uniswap Labs and contributed code to the development of Uniswap v4. He is still an advisor to Uniswap Labs and leads mechanism design work at Whetstone Research. In addition, Whetstone's team members also include experts who have worked in other well-known DeFi projects (such as Primitive), who have close ties with the Uniswap ecosystem.

In February, Whetstone announced the completion of a $1.3 million Pre-Seed round of financing. Investors included Variant, Nascent, Credibly Neutral, Uniswap Ventures, Ambush, Figment and several angel investors.

According to official documents, Doppler design principles are as follows:

- Capital efficiency: Doppler, like Uniswap, is optimized to allow tokens to quickly find a fair market price.

- MEV protection (anti-sniping): Based on the dynamics of the Dutch auction bond curve (the starting price is high and then gradually decreases over time until there is a buyer willing to buy at the current price), it can prevent robots from front-running.

- Programmability: Smart contracts are completely on-chain and can be combined with other programs. Project owners can design how to issue and manage coins, such as setting vesting periods, airdrop rewards, incentive mechanisms, DAO management, etc.

- EVM and DeFI native: Based on EVM (Ethereum Virtual Machine), it can automatically integrate with the DeFi protocol on Ethereum, and the issued tokens can be directly integrated into larger protocols and pools.

- Uniswap Compatible: Tokens created on Doppler will automatically migrate to their own Uniswap v2 or Uniswap v4 pools once they reach a certain liquidity level and can be traded from a Uniswap-powered interface.