Author: YBB Capital Researcher Zeke

Preface

"The tokenization of real-world assets (RWA) aims to enhance liquidity, transparency and accessibility, enabling a wider range of individuals to access high-value assets." This is Coinbase's explanation of the term RWA, and it is also the general explanation of RWA in popular science articles. But this sentence is not clear or completely correct in my opinion. This article will try to interpret RWA in the context of this era from my personal perspective.

1. Broken Prism

The combination of Crypto and real assets can be traced back to Colored Coins on Bitcoin more than ten years ago. By adding metadata to Bitcoin UTXO to achieve "coloring", a specific Satoshi is given the attribute of representing external assets, thereby marking and managing real assets (such as stocks, bonds, and real estate) on the Bitcoin chain. This BRC20-like protocol is the first systematic attempt by humans to implement non-monetary functions on the blockchain, and it is also the beginning of the blockchain's move towards intelligence. However, due to the limited operation codes of Bitcoin scripts, the asset rules of Colored Coins need to be parsed by third-party wallets, and users must trust the definition logic of these tools for the "color" of UTXO. Centralized trust mixed with factors such as insufficient liquidity caused the initial proof of concept of RWA to fail.

In the following years, blockchain turned around with Ethereum, ushering in the era of Turing completeness. All kinds of narratives have had their crazy moments, but RWA has always been a case of thunder and rain in the past decade, except for the legal stablecoin. Why is this?

I still remember that I wrote in my article about stablecoins that there has never been a real dollar on the blockchain. The essence of USDT or USDC is just a "digital bond" given to you by a private company. USDT is theoretically much more fragile than the US dollar. The reason why Tether can succeed is actually due to the urgent need of the blockchain world and the helplessness of being unable to create a stable value medium.

In the world of RWA, there is no so-called decentralization. Trust assumptions must be built on a centralized entity, and the risk control of this entity can only rely on supervision. The anarchism in the Crypto gene is essentially contrary to this concept. The underlying architecture of any public chain is to resist supervision. The difficulty of supervision on the public chain is the primary reason why RWA has never been successful.

The second point is the complexity of assets. Although RWA includes the tokenization of all physical assets, we can still roughly divide them into two categories: financial assets and non-financial assets. For financial assets, they themselves have homogeneous properties, and the link between the underlying assets and the token can be established under a regulated custodian. For non-financial assets, this problem is a hundred times more complicated, and its solution can basically only rely on the IoT system, but it still cannot cope with sudden factors such as man-made evil and natural disasters. So in my understanding, RWA, as a prism of real assets, can not refract infinite light. In the future, if non-financial assets want to survive on the chain, they must meet the two prerequisites of homogeneity and easy valuation.

Third, compared with highly volatile digital assets, it is difficult to find assets with comparable volatility in the real world. The tens or even hundreds of APYs in DeFi make TradFi pale in comparison. Low returns and lack of motivation to participate are another pain point for RWA.

If this is the case, then why is the industry now focusing on this narrative again?

2. There are policies

According to the above, TradFi's promotion of supervision is the key factor for the existence of RWA. This concept can only be promoted when the trust assumption is established. Currently, regions that are friendly to the development of Web3, such as Hong Kong, Dubai, Singapore, etc., have basically implemented the relevant framework of RWA supervision in recent times. So when this starting point appears, the journey of RWA has just begun, but as far as the current situation is concerned, the fragmentation of supervision and TradFi's high vigilance against risks still cast a layer of fog on this track.

Below is a breakdown of the regulatory framework for RWAs in major jurisdictions around the world as of April 2025:

USA:

Regulatory agencies: SEC (Securities and Exchange Commission), CFTC (Commodity Futures Trading Commission)

Core regulations:

Security tokens: They must pass the Howey Test to determine whether they are securities and are subject to the registration or exemption provisions of the Securities Act of 1933 (such as Reg D, Reg A+).

Commodity tokens: regulated by the CFTC, Bitcoin, Ethereum, etc. are clearly classified as commodities. Key measures:

KYC/AML: BlackRock’s BUIDL fund is only open to accredited investors (net assets ≥ USD 1 million), with mandatory on-chain identity verification (such as Circle Verite).

Expanded securities recognition: Any RWA that involves dividends may be considered a security. For example: SEC’s penalty on tokenized real estate platform Securitize (unregistered securities offering in 2024)

Hongkong:

Regulatory bodies: HKMA, SFC

Core framework:

The Securities and Futures Ordinance brings security tokens under regulation and requires them to comply with investor suitability, information disclosure and anti-money laundering requirements.

Non-security tokens (such as tokenized commodities) are subject to the Anti-Money Laundering Regulations.

Key measures:

Ensemble Sandbox Program: Testing dual-currency settlement (HKD/offshore RMB) of tokenized bonds and cross-border real estate mortgages (in cooperation with the Bank of Thailand), with participating institutions including HSBC, Standard Chartered, Ant Chain, etc.

Stablecoin gate policy: Only stablecoins approved by the HKMA (such as HKDG and CNHT) are allowed to be used, and unregistered currencies such as USDT are prohibited.

EU:

Regulator: ESMA (European Securities and Markets Authority)

Core regulations:

MiCA (Market Regulation for Crypto-Assets): effective in 2025, it requires RWA issuers to set up an EU entity, submit a white paper and be audited.

Token classification: Asset Reference Tokens (ARTs), Electronic Money Tokens (EMTs), and other crypto assets.

Key measures:

Liquidity restrictions: Secondary market transactions require a license, and DeFi platforms may be defined as “virtual asset service providers” (VASPs).

Compliance shortcuts: Luxembourg fund structures (such as Tokeny gold tokens) become a low-cost issuance channel, and the compliance costs of small RWA platforms are expected to increase by 200%.

Dubai:

Regulator: DFSA (Dubai Financial Services Authority)

Core framework:

Tokenization Sandbox (launched in March 2025): divided into two phases (intention application, ITL test group), allowing testing of security tokens (stocks, bonds) and derivative tokens.

Compliance path: Exempt from some capital and risk control requirements, and you can apply for a formal license after a testing period of 6-12 months.

Advantages: Equivalent to EU regulation, supports distributed ledger technology (DLT) applications, and reduces financing costs.

Singapore:

Security tokens are included in the Securities and Futures Act and are subject to exemption clauses (small issuance ≤ 5 million Singapore dollars, private placement ≤ 50 people).

Utility tokens must comply with anti-money laundering regulations, and MAS (Monetary Authority of Singapore) promotes pilot projects through sandboxes.

Australia:

ASIC (Securities and Investments Commission) classifies RWA tokens that confer income rights as financial products, requiring a financial services license (AFSL) and risk disclosure.

In summary, European and American countries focus on compliance thresholds. Although Asia and the Middle East have attracted projects through experimental policies, the compliance threshold is still not low. Therefore, the current status of the RWA protocol is that it can exist on the public chain, but it must be supplemented by various compliance modules to adapt to the compliance framework. These compliance protocols cannot interact directly with traditional DeFi protocols. Secondly, based on different jurisdictions, a protocol that complies with the Hong Kong compliance framework cannot interact with compliance protocols in other regions. From the current status quo, the RWA protocol does not have sufficient accessibility and is extremely lacking in interoperability. It is like an "isolated island" and runs counter to the ideal form.

So is it really impossible to find a way back to centralization within these frameworks? Actually not. Let's take Ondo, the leading protocol in RWA, as an example. The team built a lending protocol called Flux Finance, which allows users to use open tokens such as USDC and restricted tokens such as OUSG as collateral for lending. Lend a tokenized bearer note called USDY (compound interest stablecoin), which avoids being classified as a security through a 40-50 day lock-up period. According to the Howey Test standard of the US SEC, securities must meet conditions such as "funds are invested in a common cause and rely on the efforts of others to obtain profits." USDY's income comes from the automatic compounding of underlying assets (such as treasury bond interest), and users can passively hold it, without relying on the active management of the Ondo team, so it does not meet the element of "relying on the efforts of others." Ondo then simplifies the circulation of USDY in the public chain through a cross-chain bridge, and finally realizes a path to interact with the DeFi world.

However, such a complicated and non-reversible approach may not be the RWA we want. Another key factor for the success of legal stablecoins today is excellent accessibility, which can achieve low-threshold inclusive finance in the real world. As for the island problem of RWA, TardFi and the project party still need to explore together how to first achieve interconnection in different jurisdictions and interact with the on-chain world within some possible scope. Finally, it can meet the general interpretation of the term RWA in the preface.

III. Assets and Income

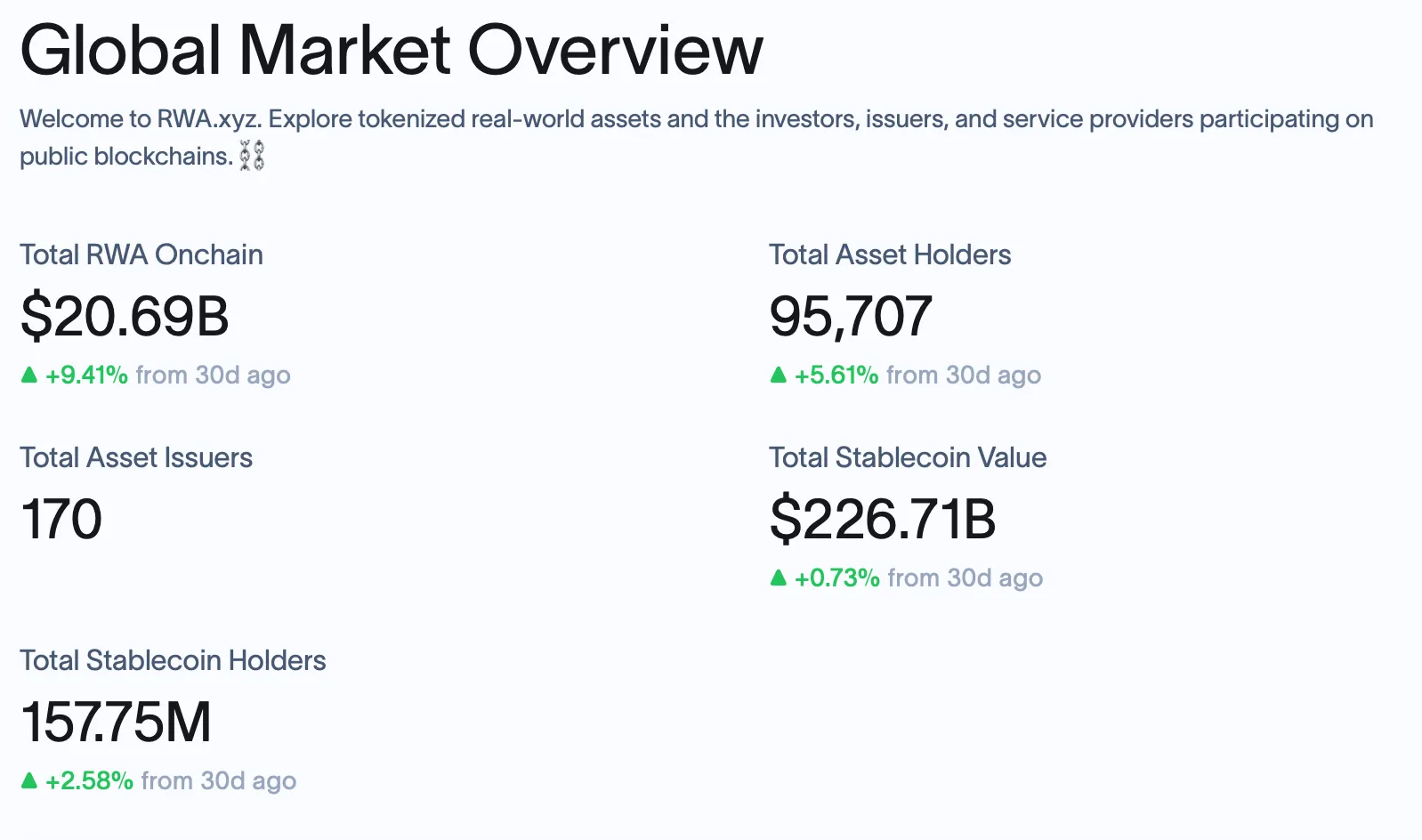

According to data from rwa.xyz (a professional analysis website for RWA), the total value of RWA assets on the chain is now US$20.69 billion (excluding stablecoins), and its main components are private credit, US bonds, commodities, real estate, and stock securities.

In fact, from the perspective of asset categories, it is not difficult to see that the main target group of the RWA protocol is not DeFi native users, but traditional financial users. Head RWA protocols such as Goldfinch, Maple Finance, Centrifuge, etc., their target customer groups are mostly small and medium-sized enterprises and institutional users. So why do we need to move this to the chain? (The first four points only take the advantages of these protocols as examples)

1.7*24 hours instant settlement: This is one of the pain points of traditional finance that relies on centralized systems. Blockchain provides an endless trading system. It can also realize instant redemption, T+0 lending and other operations;

2. Regional liquidity fragmentation: Blockchain is a global financial network that enables small and medium-sized enterprises in third world countries to attract funds from external investors at the lowest cost by bypassing local institutions;

3. Reduce marginal service costs: Through smart contract management, the cost of an asset pool serving 100 companies is almost the same as that of serving 10,000 companies;

4. Serving mining companies and small and medium-sized exchanges: Such companies generally lack traditional credit records and have difficulty obtaining loans from banking institutions. Through traditional supply chain finance logic, equipment and accounts receivable can be used for financing;

5. Lower the entry threshold: Although early successful RWA protocols were generally designed for enterprises, institutions or high-net-worth users, with the introduction of regulatory frameworks, many RWA protocols are now trying to segment financial assets to lower the threshold for investors.

For Crypto, if RWA can succeed, it does have Trillion-level imagination space. In addition, I believe that RWAFi will eventually come. For DeFi protocols, the underlying assets will be more solid after adding tokens with real returns, and for DeFi native users, new tricks have been added in asset selection and matching. Especially in this world of geopolitical turmoil and uncertain economic prospects, some real-world assets may be a better low-risk option than just using U for financial management. Here I provide some RWA product options that have been implemented, or options that may exist in the future: for example, the increase in gold from the beginning of 23 to this month of 25 is 80%; the fixed deposit rate of the ruble in Russia is 20.94% for 3 months, 21.19% for 6 months, and 20.27% for 1 year; the discount of energy assets in sanctioned countries is usually more than 40%; the yield of short-term US Treasury bonds is 4%-5%; various stocks that have been cut in half on Nasdaq may have better fundamentals than your altcoins; further refinement to charging piles or even Pop Mart's blind boxes may be some good choices.

4. Sword Holder

In the Three-Body World, Luo Ji uses his own life as a trigger mechanism to deploy nuclear bombs in the solar orbit, and uses the Dark Forest Law to build a deterrent system against the Three-Body Civilization. In the human world, he is the Swordsman of the Earth.

"Dark Forest" is also another name for blockchain by most people in the industry, which is also the inherent "original sin" of decentralization. For some special fields, RWA may be able to act as the sword-bearer of this parallel world. Although the story of PFP avatar and GameFi has now become a bubble, looking back at the crazy era three or four years ago, we have also produced projects such as Bored Ape, Azuki, Pudgy and other traditional IPs. But have we really purchased IP intellectual property rights? The fact is that we have never. NFT is more like a consumer product to some extent, and the definition of 10K PFP by blockchain is vague. It did create some brilliant IPs by lowering the investment threshold, but in terms of revenue and project development, "Three Body Man" has the sole power.

Let's take Bored Ape as an example. The original intellectual property rights of Bored Ape clearly belong to its issuer Yuga Labs LLC. According to the user agreement and official website information, Yuga Labs, as the project operator, owns the copyright, trademark rights and other core intellectual property rights of Bored Ape's works. The holder only obtains the ownership and use rights of the specific numbered avatar by purchasing NFT, not the copyright itself.

In terms of decision-making, Yuga Labs designed the Metaverse route for Bored Ape, which deviated from the original luxury narrative by issuing unlimited sub-IPs in exchange for funds. In this regard, NFT holders have neither the right to know, nor the right to make decisions, nor the right to profit. In the traditional world, when investing in an IP, investors usually have the direct right to use the entire IP, direct profit distribution, decision-making participation, and even development dominance.

Yuga Labs is at least one of the best PFP projects. There used to be a large number of NFT projects with more chaotic rights distribution. When a huge sword hangs over their heads, will they choose to respect their community more?

5. Above the carrier

In summary, RWA has the potential to reshape finance, and it can also bring opportunities in the real world to the chain, which may be a new way out for rectifying the chaos of blockchain. However, limited by the current regulatory framework of TradFi, its form is still like a private protocol stored on the public chain, which cannot burst out the highest imagination space. As time goes by, I hope that there will be a guide or alliance in the future to break through this barrier.

It is hard to imagine the brilliance that assets can release on different carriers. From the bronze inscriptions of the Western Zhou Dynasty to the fish scale atlas of the Ming Dynasty, asset rights confirmation ensures social stability and development. What if RWA can enter its final form? I can buy Nasdaq stocks in Hong Kong during the day, deposit money in the Russian Federal Savings Bank in the early morning, and invest in Dubai real estate with hundreds of shareholders around the world who do not know each other's names the next day.

Yes, a world running on a huge public ledger is RWA.