Author: Monchi | Editor: Monchi

1. Bitcoin Market

From May 10 to May 16, 2025, the specific trend of Bitcoin is as follows:

May 10 : Bitcoin showed a slow upward trend on the day. It once broke through $103,347 during the session, then there was a technical correction, falling back to around $103,000. Then the bulls regained their strength, pushing the price up to the day's high of $103,963. In the late trading, it fell slightly due to profit-taking and closed at $103,189.

May 11 : Bitcoin continued its upward trend, reaching an intraday high of $104,916, and then entered a consolidation phase, fluctuating in a narrow range of $103,460 to $105,000. The market's long-short game intensified, and the overall trend was slowly upward, with the intention of accumulating momentum to break through the upper pressure.

May 12 : The trend continued the previous day's volatile pattern, and once achieved an upward breakthrough during the day, reaching a high of $105,493. However, it immediately encountered significant selling pressure, and the price quickly dropped to $103,860 and $102,536, and finally fell to a minimum of $101,311, losing the key support level of $102,000. Short sentiment prevailed in the short term.

May 13 : After a slight rebound to $103,119 in the morning, it fell back to a low of $101,650. The market then resumed its corrective rise, rebounding to $102,848 and $103,879. Despite a slight technical correction during the period, the overall trend showed that bulls still had a certain willingness to support.

May 14 : Bitcoin continued the rebound momentum of the previous trading day, reaching a high of $104,965 during the session, a staged high. However, it encountered significant resistance near this level, and the price immediately fell under pressure to around $103,500. Subsequently, the market further dropped to $103,010, but received short-term support at this position, and the price quickly rebounded to $104,269, but failed to stabilize effectively, and instead fluctuated downward, reaching a low of $102,923 at the end of the session, indicating that the game between bulls and bears intensified.

May 15 : Bitcoin opened at about $103,400 on May 15. After a slight correction to $102,888 in the morning, it rebounded in the short term and reached a high of $103,840. However, due to insufficient upward momentum, it failed to break through the key pressure level and then turned into a rapid decline. The price fell below the key support level of $102,000 and reached a low of $101,682, indicating that short-term bearish sentiment was dominant. Although it rebounded to $102,801 in the evening, it failed to stabilize and fell again to $101,698. In the late trading stage, the market's bullish power recovered, and the price rose rapidly, forming a strong rebound.

May 16 : Continuing the upward momentum of the previous trading day, Bitcoin surged to $104,083. It then pulled back to a low of $102,701. Since then, the price has fluctuated and climbed. As of the time of writing, Bitcoin is temporarily reported at $103,893. If the current bullish sentiment continues, the market is expected to further challenge the key resistance range above.

Summarize

This week, Bitcoin showed the overall trend of "rushing high-falling back-oscillating repair". The price continued to fluctuate upward at the beginning of the week. After the high impact failed, the price quickly fell back and briefly lost the support of $101,000. The bearish sentiment was once dominant. Although it entered the technical repair stage and rebounded several times to a maximum of $104,965, it lacked sustained buying support, the rebound was weak, and selling pressure appeared. Then the trend returned to the oscillating downward rhythm and bottomed out again on May 15 to $101,698, forming the second low point of the week. Entering May 16, the market bullish momentum has recovered. The short-term oscillation pattern is maintained, and the breakthrough of the upper pressure zone still needs to be paid attention to in the future.

Bitcoin price trend (2025/05/10-2025/05/16)

2. Market dynamics and macro background

Fund Flows

1. Market Overview: Bitcoin’s Market Share Declines

As of May 14, 2025, according to TradingView data, Bitcoin's market share has dropped to 62.01%, down about 3% from 63.93% at the beginning of this week.

A decline in Bitcoin's market share could indicate that funds are shifting from Bitcoin to other crypto assets, or that market demand for Bitcoin has weakened.

2. Changes in exchange fund flows and investor structure: both retail investors and whale funds enter the market

Centralized Exchange (CEX) Net Outflow

According to Coinglass data, as of May 10, 2025, centralized exchanges had a net outflow of 6,198.60 bitcoins in the past 24 hours. The top three exchanges in terms of outflow were: Bithumb: outflow of 2,792.60 BTC; Bitfinex: outflow of 2,221.76 BTC; Kraken: outflow of 1,331.13 BTC; in addition, Binance had a net inflow of 421.73 BTC in the same period, ranking first in the inflow list.

Whale Trading Dynamics

May 11: According to Lookonchain monitoring, a whale address deposited 900 bitcoins to Binance 6 hours ago, worth approximately US$93.75 million.

May 12: The same whale address purchased another 821 bitcoins, worth about $85.42 million. Data shows that the address purchased a total of 1,721 bitcoins in two days, with a total value of about $179 million.

Institutional capital outflow

May 13: According to André Dragosch, Bitwise’s head of European research, 9,739 bitcoins have just been transferred out of Coinbase, setting a record for the highest net outflow this year, showing that institutional demand for Bitcoin is accelerating.

Retail investors' enthusiasm for investment rebounds

During the same period (April 28 to May 13), according to CryptoQuant analyst OroCrypto, retail traders are clearly returning to the Bitcoin market. Retail investors' buying volume has increased by +3.40% since turning positive on April 28, indicating that the interest of small investors has increased significantly and is forming a resonant return trend with whale funds.

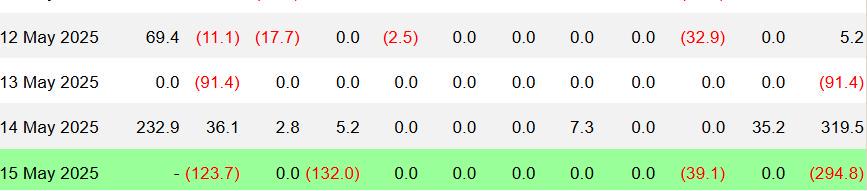

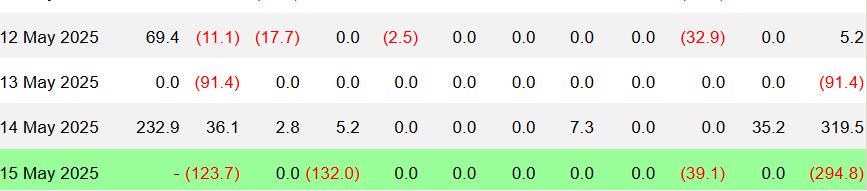

3. Bitcoin ETF fund flows: net outflow trend

According to CoinGlass data, as of May 16, 2025, Bitcoin spot ETFs have seen a cumulative net outflow of $426 million in the past seven days.

This week's daily ETF fund inflow/outflow details:

May 12: +$0.052 billion

May 13: -$91.4 million

May 14: +$319.5 million

May 15: -$294.8 million

ETF Inflow/Outflow Data Image

Despite the inflows on May 14, the overall trend still shows a weakening of investor interest in Bitcoin ETFs, which may be affected by market volatility and macroeconomic factors.

Technical indicator analysis

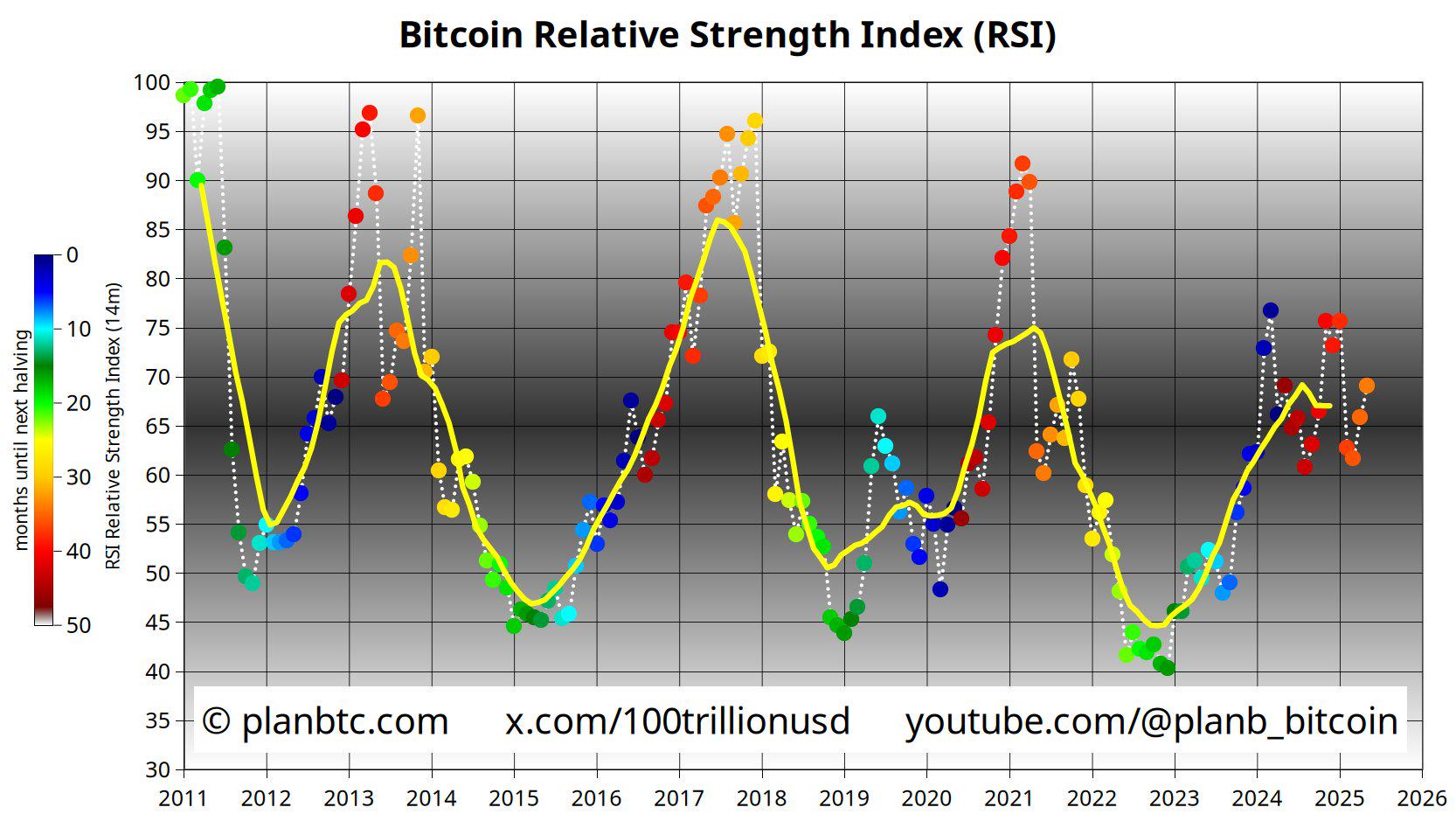

1. Relative Strength Index (RSI 14)

According to Investing.com data, as of May 16, 2025, Bitcoin's 14-day relative strength index (RSI) was 58.99, which is in the neutral to strong area, indicating that the price still has room to rise and has not yet entered the technical overbought range. At the same time, the platform's comprehensive technical indicator signal is "Strong Buy", reflecting that the overall bullish sentiment in the market is dominant.

Earlier on May 12, BTC Markets analyst Rachael Lucas pointed out that although there are no typical signs of overbought at present, there is a possibility of short-term consolidation or retracement in the market after continuous rise. "If Bitcoin can fully consolidate above $100,000 and confirm support, it will help consolidate the basis for the rise and promote further breakthroughs in the future."

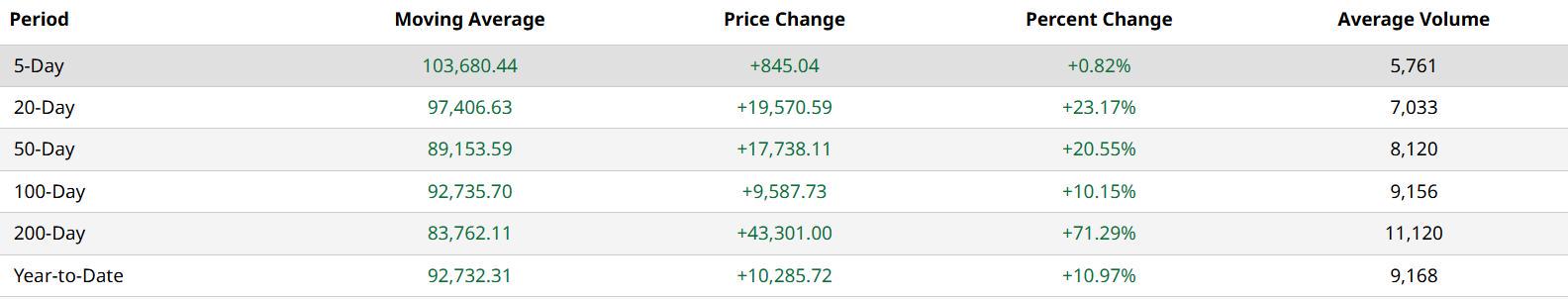

2. Moving average (MA) and MACD linkage analysis

5-day moving average (MA5): $103,680.44

20-day moving average (MA20): $97,406.63

50-day moving average (MA20): $89,153.59

200-day moving average (MA200): $83,762.11

Current market price: $103,893

MA5, MA20, MA20, MA200 data pictures

The current price has stood above all major moving averages and is slightly above the short-term MA5, indicating that the short-term trend is still strong. At the same time, MA20 and MA50 show a clear upward trend, further confirming the upward medium-term trend. MA200 is far away from the current price, indicating that the long-term bullish structure is still solid. The overall moving average system is in a bullish arrangement (MA5 > MA20 > MA50 > MA200), which is a typical strong upward signal.

This technical structure usually means that the trend continuity is strong. If there is no major negative shock in the short term, the market may continue to maintain an upward trend.

What is more noteworthy is that the weekly MACD also released an important bullish signal. According to Coindesk analyst Omkar Godbole, as of May 14, the weekly MACD bar chart of Bitcoin has successfully broken above the zero axis, indicating that the medium- and long-term bullish momentum has been strengthened again. This technical breakthrough coincides with the key node of Bitcoin's rebound from the 50-week simple moving average (SMA), which is highly similar to the trend in early 2023 and mid-2024-when BTC ushered in a significant rise after this structural signal.

Historical data shows that MACD has only entered the positive zone five times in the past five years, and only once (March 2022) was a false signal, suggesting that this technical indicator has a high reliability in judging trend reversals. If this round of signals continues the historical pattern, the market is expected to usher in a new round of medium- and long-term rising prices.

In summary, the resonance between the short-, medium- and long-term moving average system and the MACD weekly signal strengthens the current bullish trend. If there is no major negative event in the market, Bitcoin is expected to continue its upward trend and continue to challenge its historical highs.

3. Key support and resistance levels

Support level: The current main support range of Bitcoin is between $101,000 and $101,600. This area is an important support range in the short term. If the price falls back to this area, it is expected to attract some long buying orders and may form a technical rebound.

Resistance level: The initial resistance levels above are concentrated around $104,000 and $105,000. If it can effectively break through and stabilize above $105,000, it will be expected to open up further upside space.

Based on the above analysis, Bitcoin is currently at a critical technical position. If the price can break through $105,000 and the trading volume increases, it will be expected to challenge the high of $107,000. On the contrary, if the price falls below the psychological barrier of $101,000, it may trigger further adjustments. Investors should pay close attention to the performance of prices at key support and resistance levels, as well as changes in trading volume and technical indicators, in order to formulate corresponding trading strategies.

Market sentiment analysis

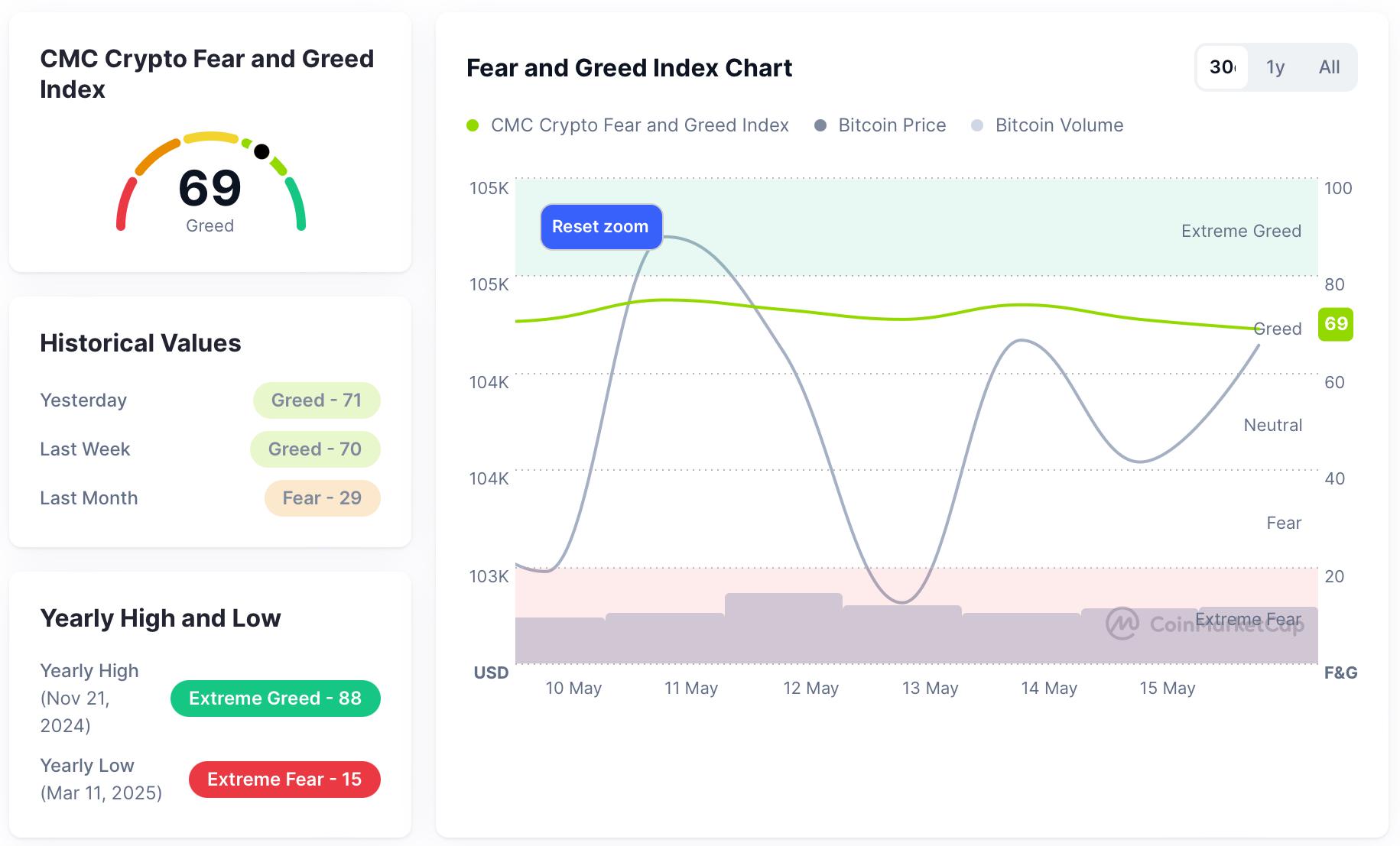

1. Optimism and greed, sentiment remains high

Affected by the high volatility of Bitcoin prices, the overall market sentiment this week was optimistic and greedy. The Fear & Greed Index remained in the "greed" range, reflecting that investors are still positive about the market outlook and are risk-averse. However, the sentiment index did not rise further, indicating that the market was in a tug-of-war between cautious sentiment and optimistic expectations in the absence of new upward momentum. This "high greed but not blind optimism" pattern shows that the market is waiting for more clear signals to determine the direction of the next stage of the trend.

2. Key Sentiment Indicators (Fear and Greed Index)

According to CoinMarketCap data, as of May 16, the Fear & Greed Index was 69, in the "greed" zone, indicating that investor sentiment is relatively positive. This week's sentiment index: May 10: 71 (greed); May 11: 75 (greed); May 12: 73 (greed); May 13: 71 (greed); May 14: 74 (greed); May 15: 71 (greed). This week's index fluctuated between 69 and 75, and remained in the "greed" zone as a whole, indicating that market sentiment is relatively stable, but potential volatility risks still need to be paid attention to.

The Fear and Greed Index is an important tool for measuring market sentiment, with a range of values from 0 (extreme fear) to 100 (extreme greed). The current index is at 70, which is in the "greed" zone, indicating that investor sentiment is relatively positive and there is a certain expectation of a rise in the market. However, excessive greed may indicate an overheated market, and we need to be alert to potential pullback risks.

In addition, the stability of the index also reflects the market's recognition of the current price level, but in the absence of new driving factors, the market may enter a period of volatile consolidation.

Fear and Greed Index Data Picture

Macroeconomic Background

Fed Policy and Inflation Outlook

Although recent U.S. inflation data was lower than expected, indicating that price pressures have eased, Federal Reserve Vice Chairman Philip Jefferson still expressed caution about future inflation in his speech on May 14. He pointed out that the new round of tariffs recently announced by the Trump administration may hinder the downward trend of inflation and cause consumer prices to rise in the short term. Jefferson emphasized that the long-term impact of tariffs depends on the implementation of trade policies, the response of the supply chain, and the overall economic performance. Although economic growth may slow down, he believes that the current monetary policy stance is still moderately restrictive and suitable for responding to future economic developments.

The U.S. Bureau of Labor Statistics (BLS) released the Consumer Price Index (CPI) data for April on Tuesday, May 13, 2025. The data showed that the CPI rose 2.3% year-on-year in April, the lowest level since February 2021 and lower than the market expectation of 2.4%. On a month-on-month basis, the CPI rose 0.2%, while the core CPI (excluding food and energy) rose 2.8% year-on-year. Although overall inflation has slowed, analysts point out that this may only be temporary. The "Liberation Day" tariff policy recently announced by the U.S. government may put upward pressure on prices in the coming months, especially in categories that rely heavily on Chinese imports, such as furniture and household goods.

At present, the Federal Reserve has kept interest rates unchanged and continues to wait and see economic performance, waiting for clearer economic signals. The market generally expects that there may be two interest rate cuts of 25 basis points each in the second half of 2025, with the first one likely to take place in September. However, if future inflation data is higher than expected, these interest rate cut expectations may be postponed or canceled, showing the Federal Reserve's cautious attitude in adjusting monetary policy.

Trump Administration’s Trade Policy

In terms of tariff policy, on May 12, 2025, President Trump announced a 90-day tariff suspension agreement with China. According to the agreement, the United States will reduce its average effective tariff on Chinese imports from 145% to 30%, while China will reduce its tariff on American goods from 125% to 10%. This temporary agreement is intended to provide both sides with room for further negotiations and ease ongoing trade tensions.

However, Federal Reserve officials and economists warned that if the tariff policy continues, it may hinder the decline in inflation, especially in the context of incomplete supply chain adjustments. The prices of some imported goods may remain high, which will be transmitted to end consumers and push up the overall price level.

3. Hash rate changes

Between May 10 and May 16, 2025, the Bitcoin network hash rate fluctuated as follows:

On May 10, the hash rate of the entire Bitcoin network rose steadily from 820.36 EH/s, reaching a maximum of 985.34 EH/s, which was a staged high point in this cycle. It then began to fluctuate downward, closing at 883.38 EH/s at the end of the day. On May 11, continuing the downward trend of the previous day, the hash rate dropped to a minimum of 796.58 EH/s, but gradually recovered in the subsequent period, and rebounded to 905.66 EH/s at the close, showing signs of recovery of miner participation in the short term. On May 12, the hash rate continued to rise, reaching a maximum of 940.22 EH/s, but then there was a correction, briefly falling back to 937.91 EH/s and then falling rapidly, dropping to a minimum of 844.72 EH/s, and closing at 832.34 EH/s for the whole day, showing the pressure of computing power withdrawal. On May 13, the trend of the day showed an obvious oscillating downward structure. The hash rate first dropped to 827.07 EH/s, then rebounded to 869.09 EH/s, but then fell again to 803.47 EH/s, and after a slight rebound to 850.74 EH/s, it finally fell back to 750.14 EH/s. On May 14, 2025, the hash rate of the entire Bitcoin network once dropped to 706.81 EH/s, hitting a staged low. Subsequently, the computing power recovered rapidly, rebounding to 813.24 EH/s and 867.34 EH/s, showing that the network computing power is gradually recovering. Entering May 15, the hash rate continued its upward trend, reaching 987.94 EH/s during the session, setting a recent high, reflecting the recovery of miners' participation and the enhancement of network stability. After that, the hash rate fell slightly, and it was adjusted back to around 828.11 EH/s on the same day, showing a technical shock adjustment. On May 16, the hash rate rose again, continuing the phased recovery trend, indicating that the computing resources of the Bitcoin network continued to recover and the overall computing power structure tended to be stable.

Overall, in this cycle, the Bitcoin hash rate showed a trend of "retreat followed by repair". The fluctuations may reflect the impact of miners' strategic adjustments, changes in electricity costs, or geographical migration of computing power. Although there is a certain retracement in the medium term, the rapid rebound at the end of the stage shows that the overall computing power of the network has a certain resilience. In the future, we still need to pay attention to key on-chain indicators such as computing power distribution, miners' yield rate and block generation time to judge the sustainability of the computing power trend and the health of the market.

Bitcoin network hash rate data

4. Mining income

According to YCharts data, the total daily income of Bitcoin miners this week (including block rewards and transaction fees) is as follows: May 10: $48.9 million; May 11: $49.49 million; May 12: $50.19 million; May 13: $42.59 million; May 14: $48.03 million; May 15: $48.12 million. Overall, the average daily total income of miners this week remained roughly in the range of $48 million to $50 million, showing a mild fluctuation trend. Although there was a decline in the middle and late stages, the overall income remained at a relatively stable level, indicating that there was a benign interaction between block rewards and transaction fees, and the network activity was basically stable.

From the perspective of unit computing power income, as of now, the Bitcoin hash price (Hashprice) is $55.59 per PH/s/day, and it rose to $56.39 per PH/s/day on May 13, which is the interim high point of this cycle. From the perspective of the trend, from May 10 to 13, Hashprice showed a steady upward trend, reflecting the increase in on-chain transaction activity and fee income; from May 13 to 16, Hashprice fell slightly and then recovered, which may be related to the fluctuation of Bitcoin prices.

From the medium-term trend, the current Hashprice is at a relatively high level in the past month; from a quarterly perspective, the current level is also at a high range in the past three months, reflecting that the current mining profit environment is relatively favorable.

Overall, Bitcoin mining revenue has performed steadily during this cycle. Although affected by market price fluctuations and changes in network computing power in the short term, the overall blockchain operating efficiency and miners' profitability are still at a reasonable level. We need to pay attention to Bitcoin price trends, changes in transaction demand, and adaptive adjustments to the mining economic model after halving.

Hashprice data

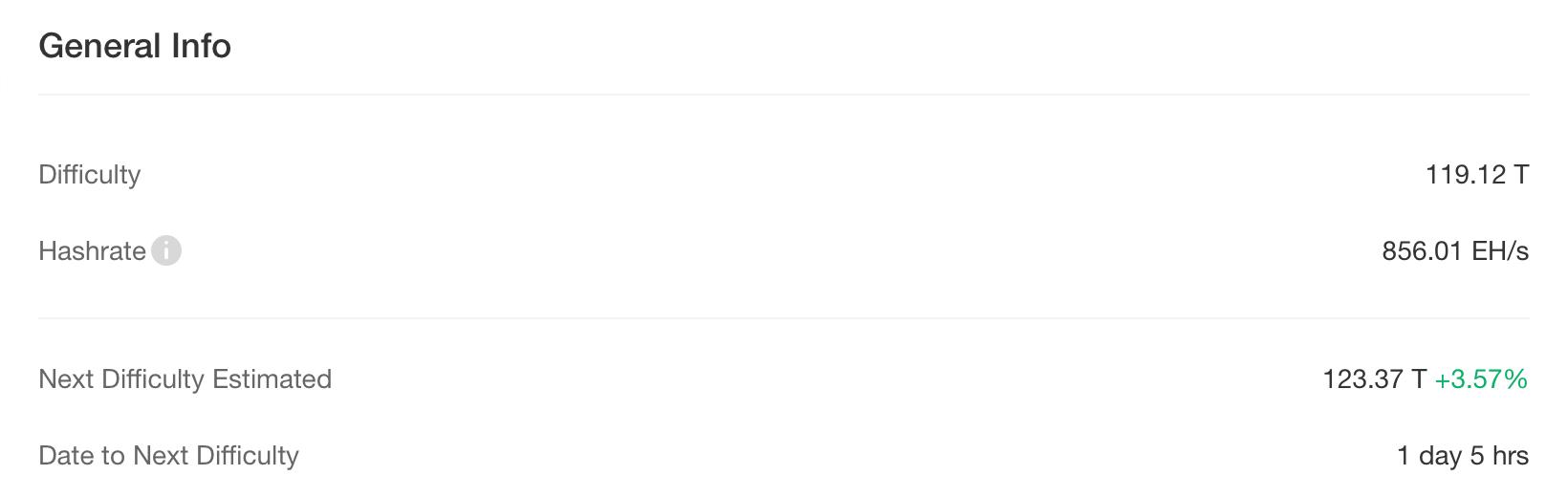

5. Energy costs and mining efficiency

According to CloverPool data, as of May 16, 2025, the total Bitcoin network hashrate is 856.01 EH/s, and the current mining difficulty is 119.12 T. The next round of difficulty adjustment is expected to take place on May 17, with an estimated increase of 3.57%, and the difficulty will rise to 123.37 T. This trend reflects the continued growth of the Bitcoin network hashrate, indicating that more hashrate is being connected to the network and competition among miners is intensifying.

From the perspective of mining costs, according to the latest MacroMicro model calculation results, as of May 14, 2025, the unit production cost of Bitcoin is approximately US$93,416.67, while the spot price during the same period is US$103,539.42, and the corresponding mining cost-to-price ratio is 0.90. This ratio is less than 1, which means that the current mining activities are still profitable as a whole.

Overall, although the coin price is in a high-level fluctuation range, the continuous increase in the computing power and difficulty of the entire network shows that the miners are still positive about the medium- and long-term market prospects. However, under the dual pressure of rising energy costs and increased difficulty, the operating efficiency of some high-cost mines may face challenges, and the industry is entering a stage of survival of the fittest. In the future, we need to focus on electricity price fluctuations, policy and regulatory trends, and structural changes in the mining ecosystem during the halving cycle.

Bitcoin mining difficulty data

6. Policy and regulatory news

Brazil’s Belo Horizonte City Council Votes to Pass Bitcoin-Related Bill

On May 10, the Belo Horizonte City Council in Brazil voted to pass a Bitcoin-related bill with 20 votes in favor, 8 votes against, and 6 abstentions. The bill will provide incentives for businesses that accept Bitcoin payments, including promotion in city advertising campaigns and launching educational activities to help citizens adapt to digital transformation. The bill is now submitted to the mayor's office for final approval.

Ukraine Plans to Launch Strategic Bitcoin Reserve Under New Crypto Law

On May 15, Ukraine is developing a legal framework for holding Bitcoin in its national reserves, and a special parliamentary committee led by financial officials is finalizing the draft legislation. Senior MP Yaroslav Zhelezniak confirmed that Ukraine plans to establish a cryptocurrency reserve infrastructure, and he is responsible for overseeing the preparation of relevant draft laws. The proposal aims to regulate the way the country acquires, stores and manages Bitcoin reserves, and strives to be consistent with cryptocurrency regulations expected to be introduced in 2025. The law will support the holding of digital assets for national fiscal planning, and the authorities will ensure transparency, compliance and supervision by the central bank and regulators.

It is reported that Ukraine is receiving support from Binance to establish a national Bitcoin reserve. The cooperation includes providing guidance on the reserve mechanism and technical infrastructure, and the two sides are actively discussing the implementation of the reserve strategy. In addition, Ukraine plans to coordinate with the National Bank and the International Monetary Fund to pass a comprehensive digital asset law in early 2025, covering fiscal policy formulation, exchange regulations, anti-money laundering measures and capital gains tax, etc., to clarify the legal responsibilities of market participants and state institutions.

Related images

7. Mining News

Analysis: Bitcoin miners’ selling pressure drops to lowest level since 2024

On May 12, cryptocurrency analysis platform Alphractal revealed in an article on May 10th X that Bitcoin miners are becoming less active in the market, and they tend to accumulate mining rewards rather than sell them for profit. Lower values mean that miners are holding their coins - a positive sign for prices.

As prices move in the coming weeks, either higher or lower, we may see renewed selling interest.

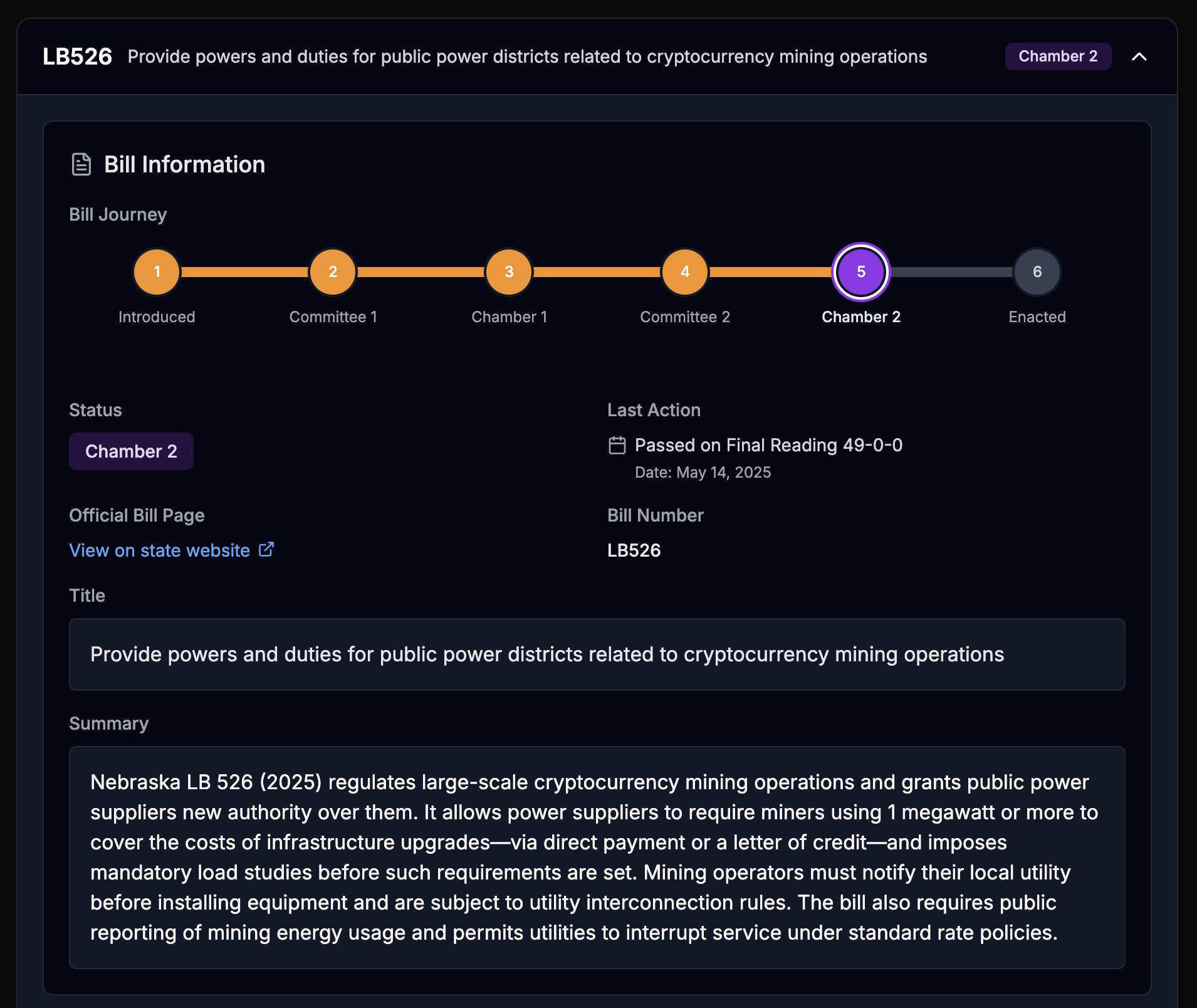

Nebraska passes new bill to make Bitcoin mining more difficult

On May 15, the Nebraska State Assembly just passed a bill to regulate Bitcoin miners. LB 526 requires large miners to bear the cost of infrastructure upgrades, requires miners to report energy usage, and allows authorities to interrupt services. The bill was passed unanimously by 49:0.

Nebraska’s Bitcoin mining bill, LB 526, isn’t a huge setback for companies in the state. The bill is just over two pages long and is pretty straightforward. Unlike the anti-mining bill, it doesn’t address carbon emissions or other environmental impacts. Instead, it focuses almost entirely on the electric grid.

Related images

8. Bitcoin related news

Bitcoin holdings of global companies and countries (statistics for this week)

1. Japan's MetaPlanet: On May 12, MetaPlanet, a Japanese listed company, announced that it had increased its holdings of 1,241 bitcoins at a total price of 18.426 billion yen, bringing its total holdings to 6,796 bitcoins with a market value of approximately 90.19 billion yen; the average holding cost was 13.27 million yen per bitcoin, and it also issued $15 million in interest-free bonds to continue purchasing bitcoins.

2. JPMorgan: On May 12, according to CryptoRover, JPMorgan Chase's total investment in Bitcoin ETF has exceeded US$1.7 billion (approximately RMB 12.2 billion).

3. El Salvador: On May 12, according to data from the website of the Ministry of Finance of El Salvador, El Salvador increased its holdings of 8 bitcoins in the past week. The country’s total holdings are currently 6,174.18 bitcoins, with a total value of approximately US$641.5 million.

4. Exodus: On May 12, crypto wallet service provider Exodus released its Q1 financial report, showing that it held 2,011 bitcoins (about US$166 million) by the end of the first quarter, an increase of 70 bitcoins from the end of last year; the total value of digital assets was US$238 million, including 2,693 Ethereums and a combination of US$62.8 million in USDC and Treasury bonds.

5. Twenty One: On May 14, Twenty One, a proposed Bitcoin core listed company, announced the purchase of 4,812 bitcoins through Tether at a cost of US$458.7 million, with an average price of US$95,300. The company plans to become a financial services and media platform with Bitcoin as its core, with an initial reserve of more than 42,000 bitcoins.

6. Semler Scientific: Nasdaq-listed company Semler Scientific released its Q1 financial report, showing that as of May 12, it held a total of 3,808 bitcoins with a fair value of US$387.9 million and a total purchase amount of US$340 million. The return on Bitcoin investment has reached 22.2% since the beginning of the year.

7. Australian Monochrome: As of May 14, the Australian Monochrome Spot Bitcoin Exchange Traded Fund (IBTC) had increased its holdings to 446 bitcoins, with a market value of approximately US$71.2947 million.

BlackRock CEO: Bitcoin is expected to reach $500,000 in 5-10 years

On May 10, BlackRock CEO Larry Fink predicted that Bitcoin will exceed $500,000 in the next 5 to 10 years, and its market value is expected to reach $10 trillion. Fink said: "We will see Bitcoin far exceed $500,000 in the next 5 to 10 years. It will be an asset worth more than $10 trillion."

This view reflects the growing confidence of institutional investors in Bitcoin. Currently, there are 11 Bitcoin spot ETFs in the US market, with a total asset management scale of US$118.59 billion, further promoting the mainstreaming of Bitcoin.

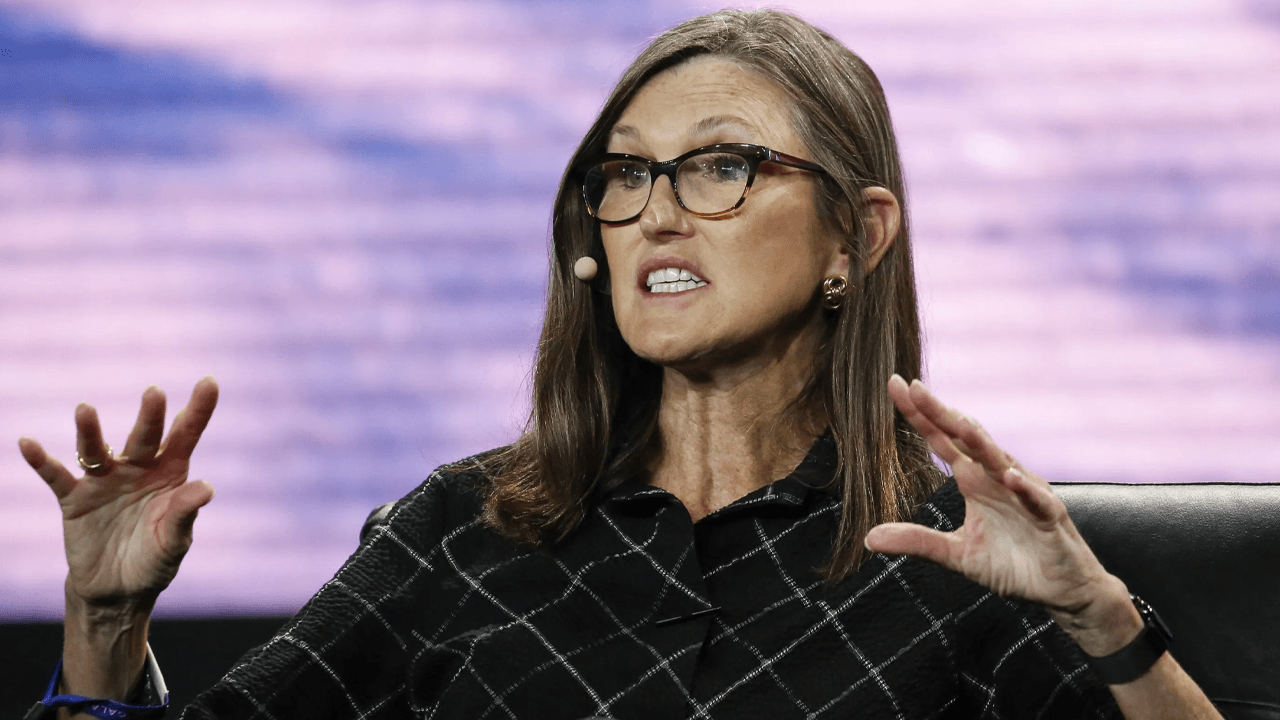

Cathie Wood: The recession is about to end, and Bitcoin is expected to reach $1.5 million

On May 11, Ark Invest CEO Cathie Wood said that the recession is about to end and Bitcoin's path to $1.5 million remains intact. Artificial intelligence is accelerating productivity and changing the rules of the game for investors.

Related images

Miller Value Partners Chief Investment Officer: Bitcoin has once again broken through the six-digit threshold and there is still a lot of room for development

On May 11, Bill Miller IV, chief investment officer of Miller Value Partners, told CNBC that cryptocurrency governance is evolving rapidly. He added that Bitcoin has once again broken through the six-digit threshold, and in his opinion, "there is still a lot of room for development."

Binance CEO: Adoption by institutional investors will strengthen Bitcoin’s “digital gold” and hedging attributes

On May 12, Richard Teng, CEO of Binance, wrote on the X platform: "Against the backdrop of global economic uncertainty, Bitcoin remains a flagship crypto asset and a resilient means of storing value. With the adoption of institutional investors, Bitcoin is expected to play a more important role as a hedging tool and digital gold in a diversified portfolio."

PlanB predicts Bitcoin will see a strong 4-month rise

On May 12, Bitcoin analyst PlanB posted on a social platform that the current Bitcoin relative strength index (RSI) is 69, and it is expected to enter a bull market phase that will last at least 4 months and RSI will exceed 80. Referring to the market conditions in 2013, 2017 and 2021, the average monthly increase of Bitcoin in the months when RSI was above 80 was more than 40%. If the trend repeats, the price of Bitcoin may rise from the current approximately US$104,000 to US$400,000.

Related images

Tim Draper predicts that Bitcoin price will reach $250,000 by the end of the year

On May 13, billionaire venture capitalist Tim Draper predicted that by the end of 2025, the price of Bitcoin will rise to $250,000 and replace the dominance of the US dollar within a decade. Draper recommends that every corporate finance department hold Bitcoin reserves to cope with legal bank runs and the global shift to the Bitcoin standard.

Strategy: I believe Bitcoin will break $1 million within 10 years

On May 14, Strategy analyst Jeff Walton said in the documentary "Michael Saylor's $40 Billion Bitcoin Gamble" produced by the Financial Times that with the financial strength given by Bitcoin, MicroStrategy will eventually become the world's listed company with the highest market value.

MicroStrategy currently holds about 568,840 bitcoins (worth $59 billion), and analysts believe that this advantage will enable it to surpass all listed companies in the future. Michael Saylor himself also said in the documentary that the price of Bitcoin will definitely exceed one million US dollars in 10 years and increase tenfold in 20 years.

Coinbase executives: Intensified global trade protectionism is reshaping capital flows, and Bitcoin may usher in a $1.2 trillion market value growth opportunity

On May 15, according to the monthly outlook report released by David Duong, head of institutional research at Coinbase, the intensification of global trade protectionism is reshaping capital flows and posing a challenge to the status of the US dollar as a global reserve currency. The report pointed out that the United States is facing fiscal and trade double deficits and unsustainable debt problems, which may lead to continued weakening of investors' confidence in the safe-haven status of the US dollar.

The report believes that in the current evolution of the currency landscape, value-storage assets such as gold and Bitcoin have become credible alternatives. In particular, Bitcoin, as a sovereign neutral asset, is not subject to sanctions or capital controls and is expected to become a supranational accounting unit for international trade. If countries begin to disperse their international reserves, it may bring $1.2 trillion in market value growth to Bitcoin.

Russia's Central Bank ranks Bitcoin as the best performing asset in the country's financial markets in April 2025

On May 16, the Russian Central Bank rated Bitcoin as the best performing asset in the Russian financial market in April 2025, with the price of Bitcoin rising by 11.2% that month. The bank also emphasized that Bitcoin's performance from the beginning of the year to date has also topped the list, with a return rate of 17.6%, exceeding stocks, bonds and gold. Despite a short-term volatility drop of 18.6% in Bitcoin between January and April 2025, Bitcoin has been identified as the world's best performing investment product since 2022, with a cumulative return rate of 121.3%.

Over the past year, Bitcoin has been recognized by the Russian Central Bank as the most profitable investment product with a return rate of 38%. Since 2022, Bitcoin's cumulative return rate has reached 121.3%, significantly surpassing traditional assets such as gold, stocks and the S&P 500. This recognition comes at a time when institutional interest in Bitcoin is at an all-time high.