On February 5, Justin Sun, global advisor of Huobi HTX and founder of TRON, gave a passionate talk on Huobi HTX Twitter Space, with the theme of "Can we still trust Brother Sun in this USDD wave?" He gave an in-depth interpretation of USDD 2.0 and answered questions from the community about USDD and Huobi HTX. The live broadcast event received a warm response from the crypto community, with the highest number of people online at the same time exceeding 12,000.

Pegged 1:1 to the US dollar, multiple mechanisms make USDD "as stable as an old dog"

Official information shows that USDD 2.0 is a decentralized stablecoin project on the TRON chain and was launched on January 25 this year.

Justin Sun mentioned in the live broadcast that although there are stablecoins such as USDT and USDC in the current crypto market, there is still a lack of a stablecoin that truly achieves zero trust, zero censorship, is fully decentralized, never frozen, and is safe and reliable. This is why he insisted on launching USDD.

According to its introduction, USDD 2.0 ensures its 1:1 peg with the US dollar through multiple mechanisms such as over-collateralization, liquidation and auction, risk management and real-time monitoring, PSM (peg stability module), decentralized governance, etc., making USDD as stable as an old dog.

The most important of these is the PSM module. The PSM module is the key technology to ensure that USDD is pegged to the US dollar at a 1:1 ratio, allowing users to exchange USDD with other stablecoins at a 1:1 ratio in seconds without loss, and only need to pay a small gas fee. This mechanism greatly reduces the arbitrage risk and can also quickly adjust the price to stabilize when there is an imbalance between supply and demand.

In addition, users who have minted USDD know that they need to use qualified assets (TRX, USDT) for over-collateralization before they can start minting. This mechanism is relatively controllable even when there are market fluctuations. Thanks to the stability of USDT and the high market liquidity and ecological support of TRX as a mainstream public chain token, the overall price fluctuation range is relatively controllable, and the value of the collateral will always be higher than the amount of USDD minted, thus providing sufficient stability and minimizing risks.

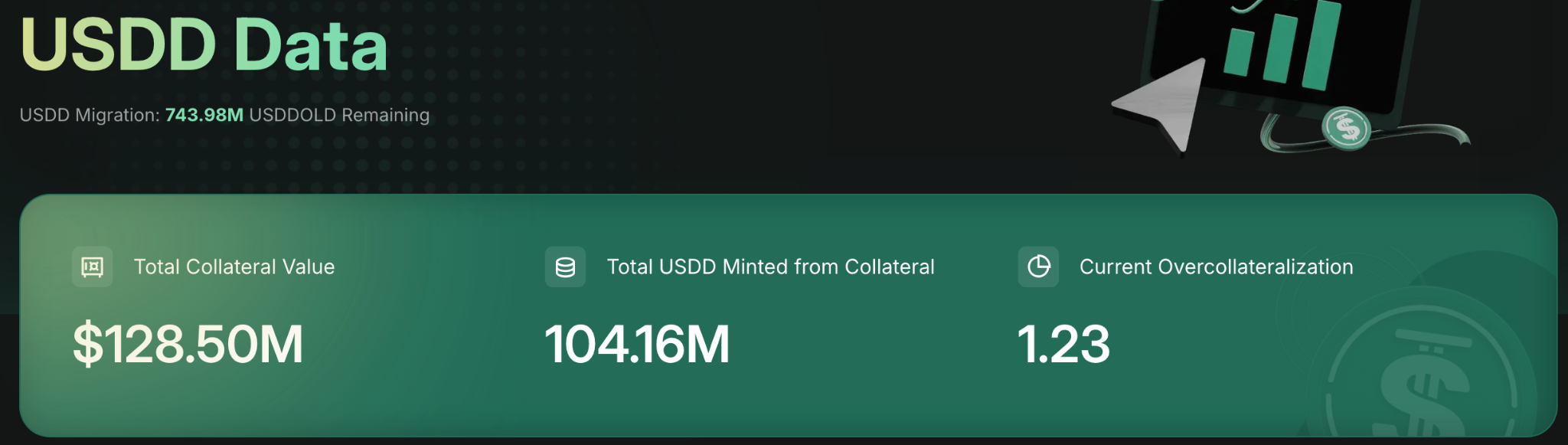

Official data shows that as of 16:30 on February 6, the total collateral of USDD was close to 130 million US dollars, with an over-collateralization of 1.23 times.

Justin Sun emphasized in the live broadcast, " If you don't understand USDD, just think of USDD as a mirror proxy of USDT ."

APY subsidy is as high as 20%, and the fully decentralized USDD is trustworthy

During the live broadcast, Justin Sun analyzed that USDT can be exchanged at an unlimited amount at a 1:1 ratio at any time, and the main feature is smooth, imperceptible, and without threshold. Using USDD on TRON is no different from using USDT, except for the higher interest rate.

How high is the interest rate? It is reported that the annualized return of the USDD staking activity in the T1 phase is 20%, and these returns come from the subsidy of TRON. In addition, Huobi Zhuanbi currently provides a limited-time interest rate subsidy for USDD current products, and the adjusted APY is also 20%. It is reported that after Huobi Zhuanbi launched the subsidy, the outstanding amount of USDD current products increased by nearly 10 times month-on-month. This means that you can earn a steady interest of 20% by directly depositing USDD in Huobi HTX or Justlend DAO. Of course, users can also borrow USDT through USDD mortgage, exchange it for USDD and then pledge it, or directly borrow USDD and deposit it to amplify the income.

It is reported that the USDD equity address TDrc3zH9wWufmQJyS7QLxBYH8GS27drW5N marked as "LendSafeVault" has deposited USDD worth $1,380,822.00.

During the live broadcast, community users were particularly concerned about the security of the 20% USDD revenue subsidy. Justin Sun said bluntly, "How much is a completely decentralized stablecoin worth on the TRON chain? Think about it, this is the only decentralized option for the 60 billion USDT on TRON, and you will understand the value of USDD."

Talking about the application scenarios of USDD, Justin Sun revealed that USDD will first serve scenarios that are difficult for USDT on the TRON chain to support. At the same time, it will actively promote cooperation with centralized exchanges, such as Huobi HTX and Poloniex, which may support the use of USDD-USDT equal margin to open contract transactions, launch one-click USDD exchange functions, and the USDD version of Yubibao. In addition, the cooperation between USDD and RobinHood is also being promoted.

Sun also pointed out that it is only a matter of time before the Trump family’s crypto project World Liberty Financial (WLFI) increases its holdings of USDD.

Huobi HTX is developing strongly, $HTX will be listed on a compliant exchange soon

It is worth mentioning that Justin Sun revealed in the live broadcast that $HTX will be launched on a large compliant exchange in the near future, and will continue to empower $HTX in the future, which is difficult for other centralized exchanges to match.

In addition, when talking about the development of Huobi HTX, Justin Sun said that its listing strategy pays great attention to the wealth effect, and all listing decisions are completely based on the team's independent investment and research judgment. At the same time, special attention is paid to the listing efficiency, which is a unique competitive advantage of Huobi HTX. Based on the above two points, Huobi HTX has maintained a strong momentum in the past two years. In the future, Huobi HTX and he himself will focus on the AI track and may launch AI projects.