CEX does have a lot of benefits, but from the bankruptcy of FTX to the attack on Bybit and the Bitget incident, CEX has also encountered many risks. Some of them were safe, some were full of controversy, and some have already disappeared...

Large CEXs are of course relatively safe, but the types of currencies that can be traded are limited.

Small CEX has many currencies, but it is hard to describe them in a few words...

I won’t talk about CEX today, as there are too many human relationships and accidents. The theme of this article is DEX, and the market has a rigid demand for DEX.

➤Competitive landscape of future exchanges

Brother Bee's point of view is:

✦ Large exchanges: The leading position of large exchanges such as Binance and EURUSD is very stable, and they will most likely continue to dominate the exchange competition in the future. Large exchanges are still dominated by CEX, mainly targeting the mainstream currency market and selected on-chain assets.

✦Small and medium-sized exchanges: Small and medium-sized exchanges should include some CEXs and DEXs with strong strength and good reputation, and be compatible with mainstream currencies and on-chain ecosystems.

✦Small exchanges: Small exchanges may be mainly DEX, mainly targeting the on-chain market.

Do you agree?

➤ User experience of medium-sized DEX

Compared with CEX, DEX avoids the risk of centralization, but at the same time brings user experience problems. In comparison, the advantages of CEX experience include:

First, CEX does not have a cross-chain experience, and you can trade seamlessly by recharging into the platform.

Second, CEX has a relatively rich range of trading strategy products.

Third, because CEX is executed off-chain, transaction fees are lower, thus creating economies of scale and better transaction depth.

As for Uniswap and PancakeSwap, they mainly serve as LP pools rather than exchange products.

For small DEXs, they mainly focus on on-chain or even single-chain liquidity, so there are not too high requirements for cross-chain, strategy products, fees and transaction depth.

However, for medium-sized DEXs, providing a better experience in these three aspects is both a competitive necessity and a user demand.

At present, in Feng Xiong’s eyes, there are two DEXs whose experience is closer to CEX, namely the current DeGate and the future UniversalX.

➤ Current DeGate

❚ Seamless cross-chain experience

DeGate is a Layer2-based DEX that supports transactions of mainstream currencies and assets on the Solana, Base, and BSC chains.

✦ Seamless cross-chain transactions

Transactions can be made directly using USDC or USDT without cross-chain operations.

Mainstream currency transactions use the order book model, supporting market price transactions or limit price transactions. The order trading experience is the same as CEX!

Using USDC, you can trade on Solana, Base, and BSC chains with one click without cross-chain operations.

✦ Universal Gas

On the other hand, using USDC, USDT or ETH as GAS does not require preparing public chain coins on each chain as GAS.

When selling coins, it doesn’t matter if there is no GAS in the account. After selling, you can directly deduct GAS from the transaction amount, which is very convenient.

❚ Grid and financial products

DeGate not only launched a grid product, but also launched a strategy square, where users can copy grid strategies with one click.

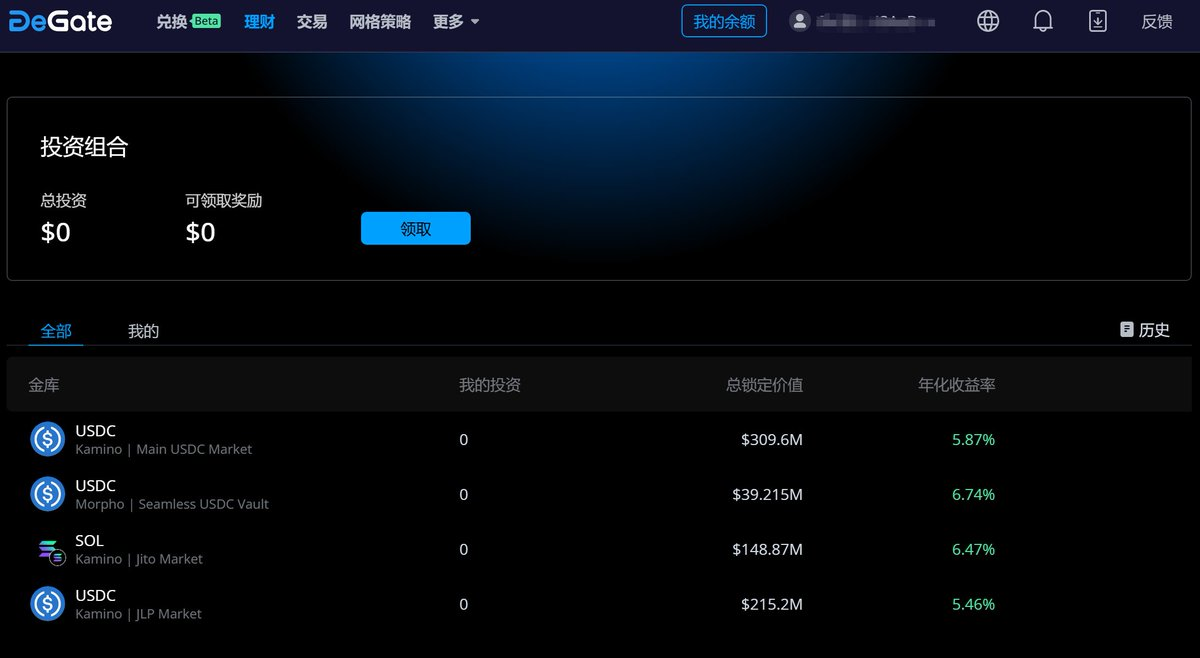

New on-chain financial products were launched this week:

The grid, strategy plaza and financial products make DeGate the most CEX-like DEX in terms of trading strategies, without a doubt.

❚ No transaction fee for placing orders, and the trading price difference is very small

The gas of DeGate Layer2 is very low and almost negligible. More importantly, when trading mainstream currencies, there is no handling fee for placing orders, which makes DeGate's transaction fees lower.

Let’s not look at the popular coins, but look at the trading interface of this coin ranked 40th on DeGate popularity. It is obvious that the difference between the buy and sell orders is very small:

As for DeGate's on-chain asset transactions, it depends on the liquidity of the on-chain LP pool.

➤Future UniversalX

❚ Universal Accounts and Universal Gas

UniversalX supports chain abstract alliance ecology, including Solana, Ethereum, Base, BSC, Sonic, Bear Chain, Avalanche, Arb, OP, polygon, Merlin and many other ecology.

Its underlying layer is the chain abstraction infrastructure that connects these ecosystems. The Particle chain abstraction technology realizes universal accounts and universal Gas for the entire chain.

Users can use universal accounts to trade assets on any chain in the chain abstraction alliance, just like trading in CEX. There is no need to purchase any public chain coins, and transactions can be completed using universal Gas.

User transactions actually still occur on the chain, but users are not aware of the cross-chain nature. This series of cross-chain actions are completed by cross-abstraction technology.

❚ Token Information and Data

In contrast, UniversalX focuses more on on-chain users. In order to assist users in transactions, it provides comprehensive token information, including liquidity, coin holding addresses, security status, etc.

There is still room for improvement in trading strategies, such as the doubling function and so on.

❚ Trading depth depends on liquidity

UniversalX does not support limit price trading for the time being. The counterparty of user transactions is the LP of each token on the chain. The trading depth of UniversalX depends on the liquidity of the LP pool on the chain.

➤Written at the end

The common points between DeGate and UniversalX are:

First, both support seamless cross-chain transactions and universal Gas.

Second, EVM and Solana abstract accounts will be automatically generated for users to complete on-chain transactions.

Third, when attacking the Earth Dog, the transaction depth depends on the depth of the LP pool on the chain.

Fourth, there are mobile applications that can be downloaded and used.

Fifth, they have all undergone code security audits by multiple auditing agencies.

The difference is:

@UseUniversalX

Based on chain abstraction infrastructure, it is fully decentralized and supports almost the entire chain ecosystem. Users can trade almost all chain assets with one click. Based on the development experience of the particle team, UniversalX has more room for imagination in product functions and user experience. Its future experience may be closer to CEX while maintaining a high degree of decentralization.

@DeGateDex

It is equivalent to the combination of Hyperliquid and UniversalX. The mainstream currency transactions use the order book model, similar to Hyperliquid, and there are grid transactions, grid strategy squares, and financial products. The trading market is not much different, and its experience is closer to CEX. On-chain transactions are similar to UniversalX, using chain abstraction technology to achieve seamless cross-chain transactions, and there is room for imagination in terms of on-chain token information and trading strategies.