A choice at a crossroads

The market is holding its breath, almost regarding the Fed's rate cut as the starting gun for a new round of asset mania. However, a warning from JPMorgan Chase is like a boulder thrown into a calm lake: What if this is the "wrong type of easing"?

The answer to this question is crucial. It determines whether the upcoming event will be a "soft landing" comedy that everyone is happy with, or a "stagflation" tragedy where economic growth stagnates and inflation soars. For cryptocurrencies, which are intertwined with the fate of the macro economy, this is not only a choice of direction, but also a test of survival.

This article will explore these two possibilities in depth and try to outline how the future will unfold if the "wrong easing" scenario comes true. We will see that this scenario will not only reshape the landscape of traditional assets, but is also likely to trigger a profound "great differentiation" within the crypto world and put DeFi's infrastructure through an unprecedented stress test.

Scenario 1: The two sides of interest rate cuts

How the script unfolds depends first on how we interpret history. Interest rate cuts are not a panacea, and their effectiveness depends entirely on the economic environment in which they are released.

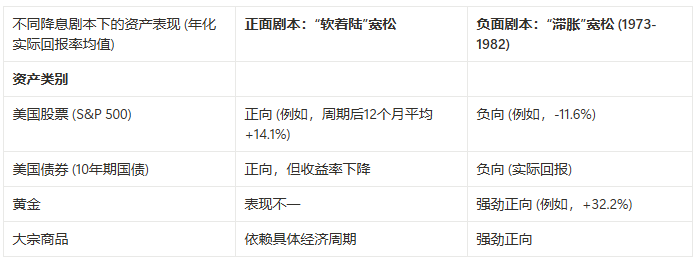

Positive Scenario: Soft Landing and Full Prosperity In this scenario, economic growth is steady, inflation is under control, and the Fed cuts interest rates to add fuel to the economy. Historical data is a loyal supporter of this scenario. Research by Northern Trust shows that since 1980, U.S. stocks have averaged a 14.1% return in the 12 months after the start of such a "correct rate cut" cycle. The logic is simple: the cost of capital is reduced, and consumption and investment enthusiasm are high. For high-risk preference assets such as cryptocurrencies, this means taking a ride and enjoying a liquidity feast.

Negative Script: Stagflation and Asset Disaster But what if the script goes the other way? With weak economic growth and stubborn inflation, the Fed is forced to cut interest rates to avoid a deeper recession. This is the "wrong rate cut" and is synonymous with "stagflation." The United States in the 1970s was a preview of this script, with the oil crisis and loose monetary policy jointly directing a disaster of economic stagnation and hyperinflation. According to the World Gold Council, the annualized real return rate of US stocks in that era was a dismal -11.6%. In this drama where almost all traditional assets suffered, only gold stood out, recording an annualized return rate of up to 32.2%.

Goldman Sachs recently raised the probability of a US recession and predicted that the Federal Reserve may cut interest rates in 2025 due to an economic slowdown. This warns us that the negative scenario is not an exaggeration.

Scenario 2: The fate of the US dollar and the rise of Bitcoin

In the macro drama, the US dollar is the undisputed protagonist, and its fate will directly affect the direction of the script, especially for the crypto world.

A rule that has been repeatedly verified is that the Fed's easing is usually accompanied by a weakening of the US dollar. This is the most direct benefit to Bitcoin. When the US dollar depreciates, the price of Bitcoin denominated in US dollars will naturally rise.

But the "wrong easing" scenario is much more than that. It will be the ultimate test of the theories of two macro prophets in the crypto world, Michael Saylor and Arthur Hayes. Saylor sees Bitcoin as a "digital property" that fights against the continued depreciation of legal currency and a Noah's Ark to escape the doomed traditional financial system. Hayes believes that the huge debt of the United States has left it with no choice but to pay for the fiscal deficit by "printing money." A "wrong interest rate cut" is a key step in this prophecy becoming a reality, when capital will flood into hard assets such as Bitcoin to seek shelter.

However, this scenario also hides a huge risk. When the weakening of the US dollar makes Bitcoin the king narrative, the cornerstone of the crypto world - stablecoins - is facing erosion. Stablecoins with a market value of more than $160 billion have reserves almost entirely made up of US dollar assets. This is a huge paradox: the macro forces that drive Bitcoin's rise may be hollowing out the actual value and credibility of the financial instruments used to trade Bitcoin. If global investors' confidence in US dollar assets is shaken, stablecoins will face a severe crisis of confidence.

Scenario 3: The collision of yields and the evolution of DeFi

Interest rates are the baton of capital flow. When the "wrong type of easing" scenario is staged, the yields of traditional finance and decentralized finance (DeFi) will experience an unprecedented collision.

The U.S. Treasury yield is the global "risk-free" benchmark. When it can provide a stable return of 4%-5%, similar yields with higher risks in DeFi protocols pale in comparison. This opportunity cost pressure directly limits the flow of money into DeFi.

In order to break the deadlock, the market has given birth to "tokenized U.S. Treasury bonds" in an attempt to introduce the stable income of traditional finance to the chain. But this may be a "Trojan horse". These safe Treasury assets are increasingly being used as collateral for high-risk derivative transactions. Once the "wrong rate cut" occurs, the Treasury yield will fall, and the value and attractiveness of tokenized Treasury bonds will decline accordingly, which may trigger capital outflows and chain liquidations, accurately transmitting the macro risks of traditional finance to the heart of DeFi.

At the same time, economic stagnation will weaken the demand for speculative lending, which is the source of high returns for many DeFi protocols. Faced with internal and external troubles, DeFi protocols will be forced to accelerate their evolution from a closed speculative market to a system that can integrate more real-world assets (RWA) and provide sustainable real returns.

Scenario 4: Signal and Noise: The Great Differentiation of the Crypto Market

When macro "noise" overwhelms everything, we need to listen to the "signals" from the blockchain. Data from institutions such as a16z show that no matter how the market fluctuates, the core data of developers and users are still growing steadily. Construction has never stopped. Senior investors such as Pantera Capital also believe that as regulatory headwinds turn into tailwinds, the market is entering the "second stage" of the bull market.

However, the “error-based easing” scenario could become a sharp knife that splits the crypto market in two, forcing investors to choose: Are you investing in a macro hedge or a tech growth stock?

In this scenario, Bitcoin's "digital gold" attribute will be infinitely magnified, becoming the first choice for capital to hedge against inflation and fiat currency depreciation. The situation of many altcoins will become precarious. Their valuation logic is similar to that of growth technology stocks, but in a stagflationary environment, growth stocks tend to perform the worst. Therefore, capital may withdraw from altcoins on a large scale and flock to Bitcoin, causing a huge differentiation within the market. Only those protocols with strong fundamentals and real revenue can survive this wave of "leap to quality".

summary

The crypto market is being pulled by two huge forces: on one side is the macro-gravity of "stagflationary easing", and on the other side is the endogenous driving force driven by technology and applications.

The future will not be a one-line scenario. A "wrong rate cut" could simultaneously make Bitcoin successful and bury most altcoins. This complex environment is forcing the crypto industry to mature at an unprecedented speed, and the true value of the protocol will be tested in the harsh economic climate.

For everyone involved, understanding the logic of different scripts and the complex tension between macro and micro will be the key to traversing future cycles. This is no longer just a bet on technology, but also a grand gamble on which script you choose to believe at a critical juncture in global economic history.