Author: Zuo Ye

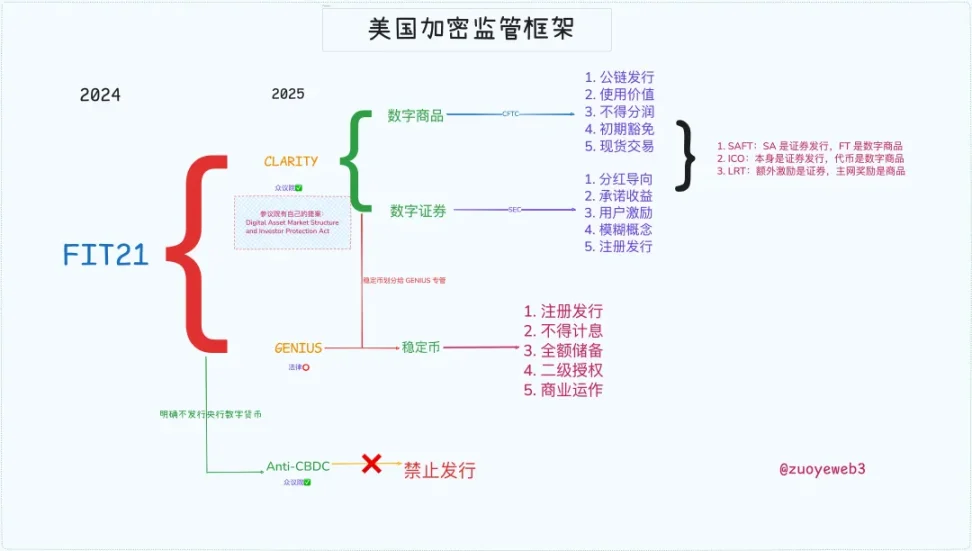

Crypto Week’s three-parter: the genius bill governing stablecoins has become law, while the anti-CBDC bill and the CLARITY bill are still in the legislative process.

Unlike the Genius Act, CLARITY focuses on the basic definition and authority allocation of crypto, especially public chains, DeFi, token issuance, and the powers and responsibilities of the SEC and CFTC, and is closely linked to the FIT21 Act of 2024.

Image caption: US crypto regulatory framework, Image source: @zuoyeweb3

Based on this, the United States has built a complete regulatory framework derived from past practices. Only by understanding history can we understand the future.

Financial liberalization, the wild new west

The right to coin money and inflation, the Fed sticks to the former in the name of controlling the latter, while Trump abandons the latter in the name of amplifying the former.

The genius bill ushered in the era of free stablecoins. The independent coinage right that Powell insisted on was divided and given to the Silicon Valley upstarts and Wall Street old money. But this is not enough. What Peter Thiel wants is the absolute freedom of libertarians.

In 2008, the financial crisis made financial derivatives the target of public criticism, and Obama urgently needed professionals to help him control the $35 trillion futures contract market and the $400 trillion swap market.

As a result, Gary Gensler was nominated as the chairman of the CFTC, and in 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act was introduced to incorporate the derivatives market into the existing regulatory system.

Gary claimed, "We have to tame the Wild West," and this was the first time Gary defeated the market at a regulatory level.

History is a cycle. In 2021, Obama's comrade-in-arms, then-President Biden, once again nominated Gary Gensler as chairman of the SEC, trying to cycle into a new western frontier - cryptocurrency.

There are two focuses:

1. The SEC has no dispute that BTC/ETH are commodities, but considers other tokens and IXO to be illegal securities issuance, including SOL and Ripple;

2. Regarding the high leverage behavior of exchanges, Gary believes that this is "inducing" users, and has initiated special regulatory actions against onshore and offshore exchanges such as Coinbase and Binance.

However, there is always a loophole, and Gary was ultimately defeated by ETF, a product that did not seem to be a regulatory focus. In 2021, the SEC approved the Bitcoin futures ETF, but it has always remained tight-lipped about the spot ETF proposed by Grayscale and others.

But unfortunately or not, after the SEC lost the lawsuit against Ripple's IXO part in 2024, the SEC finally approved the Bitcoin spot ETF, allowing MicroStrategy to openly play the coin-stock-bond cycle.

This time, cryptocurrency represents the wilder side, conquering the SEC, CFTC, the White House, Congress, the Federal Reserve, and Wall Street. An undefended era has arrived.

As a small footnote, SBF successfully sent himself to jail in 2022 by donating tens of millions of campaign funds to Biden, which may be an important reason that prompted Gary to be strict with the crypto industry.

Clarity Act: Encryption has a clear name

Trump will repay his kindness, and the crypto industry will be open and aboveboard from now on.

In 2025, as a relic of two Democratic presidents, Trump immediately chose Fired Gary as soon as he took office, and chose Paul Atkins, who had been friendly with him since 2016, to succeed him, starting a completely laissez-faire policy.

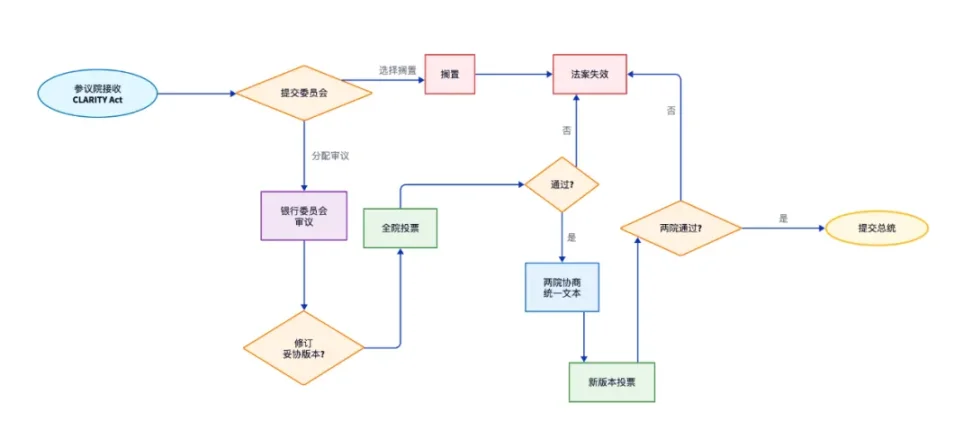

The Clarity Act was proposed against this backdrop, but it must be stated that the Clarity Act is still in the legislative process. It has now completed the House of Representatives process and still needs to be reviewed by the Senate.

The Senate also has its own Digital Asset Market Structure and Investor Protection Act, but under the framework of the Republican-led agenda, crypto-friendliness is inevitable.

Image caption: Clarity bill follow-up process, Image source: @zuoyeweb3

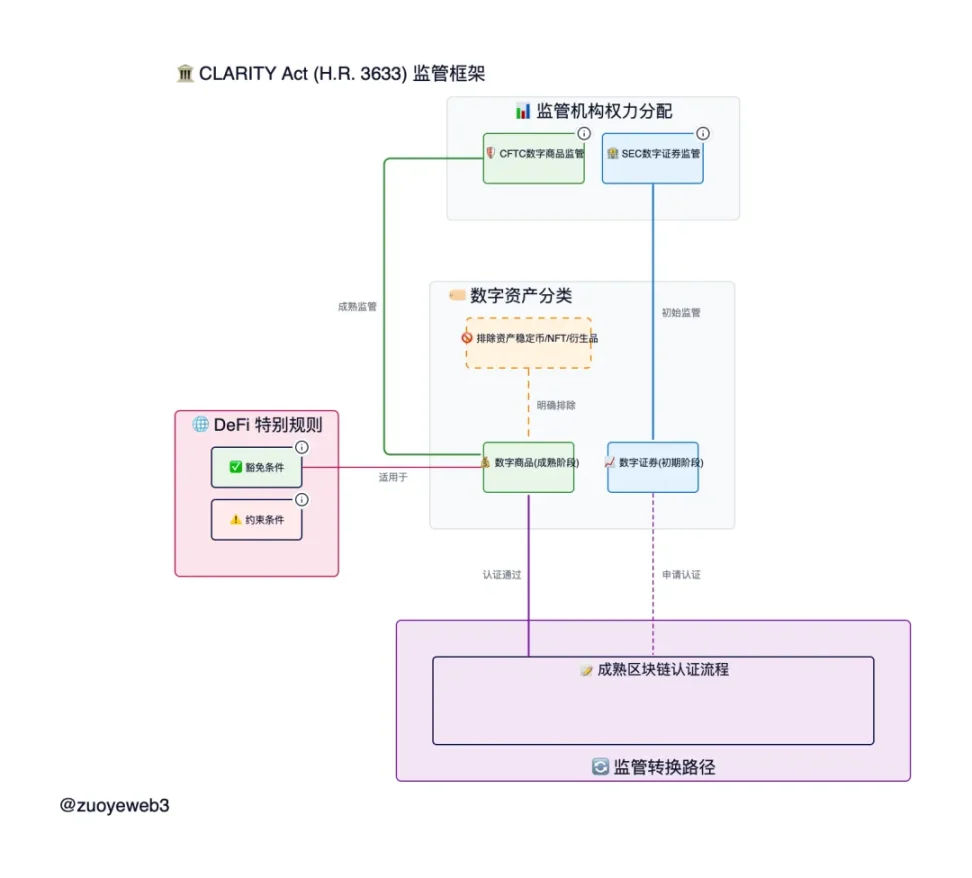

The current clear bill designs a framework for digital commodities, digital assets and stablecoins. The first priority is to limit stablecoins to payment forms, and the second is that digital commodities are managed by the CFTC and digital assets are handled by the SEC.

Image caption: CLARITY Act regulatory framework, Image source: @zuoyeweb

1. CFTC wins big: clarifies the status of ETH and CFTC, blurs the boundaries between SEC and asset issuance.

ETH is a commodity, and all truly decentralized public chain tokens are commodities. Their transactions are under the jurisdiction of the CFTC. Financing such as IXO and SAFT are still under the management of the SEC, but there is a $75 million exemption limit. If the issued tokens are decentralized within four years, they will be exempt from penalties.

2. Digital products are digital in form and commodities in content.

Keep up with technological development, no longer make a crude dichotomy between "physical goods" and "virtual assets", and acknowledge the existence of digital commodities. As long as they have practical value for the operation of public chains, DeFi, and DAO protocols, they are no longer securities.

However! NFT must be an asset, not a commodity, because each one is unique and only has "hype" or appreciation value, and cannot be used as a unified exchange medium similar to currency. Secondly, interest, rewards and profits must be valuable in maintaining the decentralized operation of the protocol to be not an asset, otherwise they will all be managed by the SEC.

This definition is still too abstract. In essence, the clear bill distinguishes between the token issuance process and the token operation process. The following three cases are my classifications. If there are any problems, please correct me:

- IXO issuance is a security, but issuing tokens that meet the conditions is not

- Airdrop points are securities, but airdrop tokens are not if they meet the conditions

- Exchange distributions are not securities, but promised returns are securities

Meeting the conditions refers to the definition and basis of digital goods, and the promise to switch to a decentralized protocol in the future, and there is no need to trade through an intermediary. However, it should be noted that participating in the project itself is an investment, and if a return is expected, it is participating in asset issuance.

It is not clear how it will be defined in the future, but many past cases can provide the basis for the division:

- ETH is a digital commodity, but using SAFT to finance a project is a digital asset issuance and is managed by the SEC. However, if it is converted into a fully decentralized protocol in the future, it will be a digital commodity and will be handled by the CFTC.

- ETH native staking is also a commodity, which is a "system behavior" that maintains the PoS characteristics of the public chain. However, it is unknown whether the tokens issued by third-party DeFi staking protocols can be considered commodities. For example, Lido is still under discussion, and EigenLayer may be more of a commodity, and regulatory details need to be clarified.

- Ethereum is a blockchain, but many L1/L2 issued by SAFT or IXO have four years to complete decentralization. The proportion of tokens or votes controlled by a single centralized entity does not exceed 20%. Now general foundations or DAOs may not be exempted from liability, and it is necessary to analyze the proportion of tokens held.

The Clarity Act is indeed very detailed and sets out a framework for joint supervision by the SEC and CFTC. Digital commodities take into account the different characteristics of both virtual securities and physical commodities, and indeed require the joint supervision of the two to be handled.

Conclusion

The Clarity Act is an important part of U.S. crypto regulation. It basically defines core issues such as tokens and public chains, clarifies the definition of digital commodities, and the rest are naturally assets, such as NFTs, stablecoins, and tokenized assets (RWA).

However, the operation of DeFi is still in a gray area. Although the Clarity Act has amended the definition of the Securities Act, DeFi is too important. Just like the Securities Act, the crypto market also needs a dedicated DeFi Act, rather than being squeezed together with stablecoins, public chains, and tokens.

This is not asking for too much. As the US crypto regulatory framework is being built, the Tornado Cash case is still ongoing, and the fate of Roman Storm, one of the co-founders, will become a touchstone for judicial-forced legislation.