Author: Deron Lu

On May 30, the Hong Kong government published the Stablecoin Ordinance in the Gazette, marking the countdown to the official issuance of the Hong Kong version of stablecoins. For those who are concerned about the Hong Kong version of stablecoins, I think the most concerned issues may be these two: First, I have a certain amount of capital and experience, do I have the opportunity to become a Hong Kong version of stablecoin issuer and participate in this lucrative business? Second, as a user, how can I effectively use the Hong Kong version of stablecoins to facilitate my life?

How to become an issuer of Hong Kong version of stablecoin

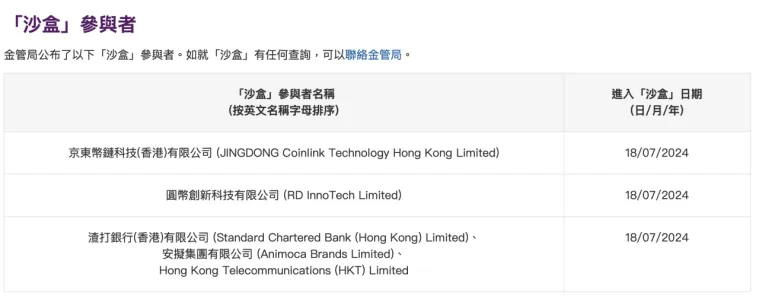

According to the currently available information, the Hong Kong Monetary Authority has selected three entities as potential issuers of the Hong Kong version of stablecoins, namely JD CoinChain Technology (Hong Kong), Yuanbi Innovation Technology, and a consortium of Standard Chartered Bank (Hong Kong) and Animoca and Hong Kong Telecom. Since July 18, 2024, the Hong Kong Monetary Authority has allowed the above three entities to test their stablecoin issuance plans within a specific scope through the "regulatory sandbox" and communicate with regulators in real time. So far, the Hong Kong Monetary Authority has not announced any new participants other than the three entities. According to the requirements, the issuance of stablecoins in Hong Kong or the issuance of stablecoins pegged to the Hong Kong dollar outside Hong Kong requires the permission of the Hong Kong Monetary Authority.

Figure 1 Sandbox participants

1. Key points of application conditions

Applicant: A company registered in Hong Kong or a recognized corporate body registered outside Hong Kong must provide its principal business address and contact information in Hong Kong.

Personnel requirements: The CEO, directors, stablecoin managers and other management of the licensed company need to have appropriate knowledge and experience.

Funding requirements: minimum paid-in capital of HKD 25 million or equivalent currency, and sufficient high-quality, high-liquidity reserve assets to ensure the full redemption capacity of stablecoins under any circumstances. In principle, an applicant can issue multiple categories of stablecoins, and the corresponding reserve assets should be held with the same reference assets as those of the stablecoins. In other words, if the Hong Kong dollar stablecoin is issued, the corresponding reserve assets should generally be Hong Kong dollar assets.

Asset Custody: Reserve assets are stored in a government-approved custodian institution and are isolated from other types of assets.

Redemption mechanism: The redemption mechanism shall be disclosed to the public in a timely manner, and no restrictions shall be placed on redemption, and no redemption fees other than handling fees shall be charged.

Risk control system: Have AML&CTF compliance plans and measures, and security risk control policies regarding user information and records.

Information disclosure: Each type of stablecoin issued must publish a white paper, and monthly and annual reports (financial status, reserve asset status) must be disclosed. If there are major changes in operating conditions (including loss of debt repayment ability, change of filing address, difficulty in maintaining the minimum standards for licensing, etc.), the HKMA must be notified in advance.

Audit requirements: undergo independent audit every year.

Compliance requirements: including paying license fees within the prescribed time, displaying the license number on marketing materials, always meeting the minimum standards for license issuance, reporting in a timely manner when unable to fulfill redemption obligations, reporting changes in address in a timely manner, and reporting major changes in business conditions in a timely manner.

2. Application Procedure

Competent authority: Hong Kong Monetary Authority.

Judging from the information currently released, if you want to become the issuer of the Hong Kong version of the stablecoin, you generally need to go through the following two steps.

The first step is to apply to become a participant in the "regulatory sandbox". The HKMA will consider a series of factors in evaluating the "sandbox" application, mainly including: the applicant has a genuine intention and reasonable plan to issue a legal currency stablecoin in Hong Kong, the applicant has a specific plan to participate in the "sandbox", and the applicant has a reasonable expectation of meeting regulatory requirements.

The second step is to apply for a stablecoin issuance license. Applicants must submit application materials in accordance with the above application conditions.

3. Application results

The HKMA may grant a licence without conditions, grant a licence with conditions, or reject an application based on the applicant's application. Once a licence is granted, it remains valid unless revoked.

How to use Hong Kong version of stablecoin to facilitate production, operation and life

At present, there is no official introduction from the Hong Kong Monetary Authority or the three entities selected to participate in the "regulatory sandbox" on how to exchange and use the Hong Kong version of stablecoins. However, from an interview with Liu Peng, CEO of JD CoinChain Technology, after the Hong Kong Legislative Council passed the Stablecoin Bill on May 21, we can see some of the general operating modes of JD Stablecoins.

According to reports, JD Stablecoin is based on the public chain. The first phase of the plan is to issue a stablecoin anchored 1:1 between the Hong Kong dollar and the US dollar. It has now entered the second phase of sandbox testing and provides mobile and PC application products for retailers and institutions, mainly including cross-border payments, investment transactions, retail payments, etc. JD Stablecoin is positioned to become a global payment infrastructure.

In the field of cross-border payments, transactions can be completed in seconds, eliminating most of the intermediate costs of cross-border payments, and services are provided uninterrupted throughout the year.

In the field of investment and trading, JD Stablecoin will provide services by cooperating with leading compliant exchanges. It is worth noting that, as of now, the Hong Kong Securities Regulatory Commission has issued a total of 10 virtual asset exchange licenses, and there are 8 applicants waiting for the approval of the Hong Kong Securities Regulatory Commission.

Figure 2 Licensed virtual asset exchanges announced by the Hong Kong Securities and Futures CommissionIn the field of retail payments, JD Stablecoin is mainly connected and tested through payment collection scenarios such as JD Hong Kong and Macau Station.

Be aware of the risks of differences in regulatory policies between the Mainland and Hong Kong

Currently, the legislation and testing of stablecoins in Hong Kong are in full swing, and the official issuance of the Hong Kong version of stablecoins is no longer far away. The Hong Kong courts have also passed a number of precedents to clearly protect the legitimate rights and interests of parties involved in currency disputes.

Typical cases include: in the case of investors suing JPEX platform for compensation, the judge determined that the platform had breached its fiduciary duty and ordered the platform to compensate investors for their losses; in the case of WORLDWIDE A-PLUS LIMITED against two wallet addresses for fraud, the Hong Kong court approved an injunction against the wallet address holder when the plaintiff could only provide the defendant's wallet address but was unclear about the defendant's true identity, and sent the injunction to the wallet by tokenizing it. Any failure to comply with the injunction and conduct transactions with the wallet address constitutes contempt of court.

Correspondingly, the mainland's current regulatory attitude towards virtual currencies, including stablecoins, has not shown any trend of relaxation or shifting. In the mainland, virtual currencies are still not regarded as currencies under any circumstances. Once disputes arise regarding the sale, investment, and trade settlement of virtual currencies, the vast majority of courts still tend to not accept or reject the claims, requiring the parties to bear the risks themselves. This is particularly evident after the relevant guiding cases were launched in the People's Court case database, which is a great test of the skills of the lead lawyers in representing related disputes. However, for criminal cases involving theft, deception, and robbery of virtual currencies, in general, the public security department will regard virtual currencies as an asset and will still file a case for handling.