By Stacy Muur

Compiled by: Felix, PANewss

Crypto markets have always been driven by narratives. But in 2025, a new mechanism for attracting attention took center stage: KaitoAI Earn leaderboards. These incentive campaigns reward early researchers, commentators, and meme makers (colloquially known as “yappers”) for generating hype before a project launches in exchange for future token allocations.

The operating model is now well known:

- Reward early user recognition

- Make up a story

- Creating demand before TGE

It works. Leaderboards drive exposure, transactions, and social proof. But here’s the problem:

Will this attention last?

Once token issuance and airdrops are claimed, the noisy players will move on to the next token issuance. Prices fall, trading volume shrinks, and participation gradually decreases.

This article critically analyzes multiple Kaito-related projects, including $SKATE, $HUMA, $QUAI, and $SOON, to explore whether the hype can be sustained after the tokens are launched. A trend is emerging: narratives are designed to attract attention, not to maintain it.

Start with SKATE.

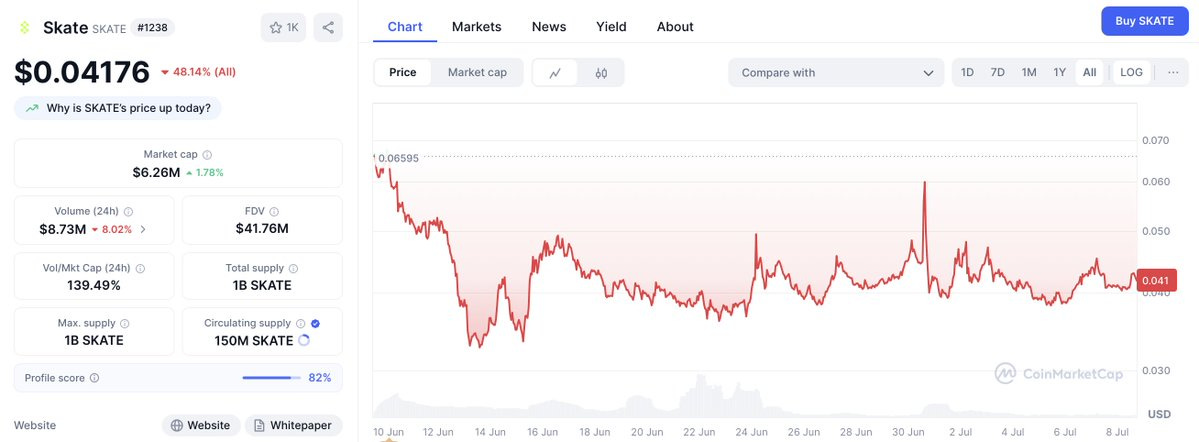

Skate: High Volume, Lots of Listings, and Stagnation after Kaito

$SKATE, a token associated with Solana’s modular gaming layer, has launched with strong momentum. With listing support from prominent exchanges including Binance and Bitget, as well as a well-promoted Kaito Earn campaign, SKATE has ample liquidity and high visibility at launch.

- TGE: June 10, 2025

- Issue price (opening price): $0.06506

- Closing price on the first day: $0.05094

- First-day trading volume: $41.46 million

- Initial FDV: Approximately $65 million

- Current price (July 7): $0.04065

- Current FDV: Approximately $40.65 million

- Decline after TGE: about 37.5%

- Current 24-hour trading volume: $8.46 million

- Volume/MC ratio (July 7): ~139%

SKATE’s early trading showed a good start. On June 10, the token’s attention increased sharply, and the price soared to $0.06539, but then quickly pulled back to around $0.05094, a retracement of about 22% on the first day alone.

Subsequently, similar trends emerged when other Kaito projects were launched:

- Mid-June: Supported by post-listing momentum, the price rebounded to $0.051-$0.048 (June 11-16).

- June 21-23: Large volume fluctuations (~$110 million in a single day), but lack of strong directional movement.

- June 30 to July 4: There was a brief fluctuation, with the price soaring to $0.06234 before falling rapidly.

- July 5-7: The price fell back to $0.04065, down about 37% since the TGE and about 22% since the July 4 high.

Social interest also peaked early on, but then quickly declined. Within 7 to 10 days of launch, Kaito contributors turned their attention to new leaderboard projects and token campaigns, resulting in a noticeable drop in mentions and engagement.

Summary: Rotation is more important than retention

SKATE has all the advantages: listing on a large CEX, high liquidity, and a reward-oriented Kaito ecosystem narrative. But SKATE's attention did not last. Although SKATE's daily trading volume is close to 140% of its market value, SKATE is still an asset with high turnover and no one holds it for a long time.

The story of SKATE is similar to other tokens in the Kaito Earn ecosystem:

- Pre-launch hype

- Immediately boost trading volume after going online

- Airdrop Claim and Quick Exit

- Narratives dried up within weeks

SKATE’s market performance further confirms the market’s criticism of projects promoted by Kaito: high exposure and low user stickiness.

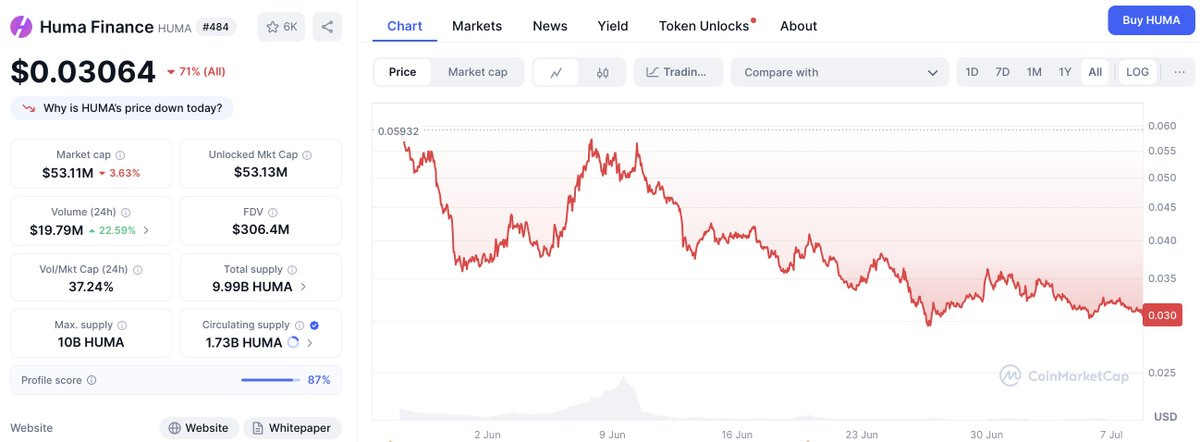

Huma: Launchpool hype, Kaito rewards 0.5%, first-day rotation amount reaches 300 million US dollars

Huma is a decentralized payment financing protocol (PayFi) that leverages the full technology stack of Binance and Kaito and will issue its native token HUMA on May 26, 2025.

The Binance Launchpool campaign lets users mine HUMA by staking BNB, FDUSD, or USDC from May 23 to 26. At the same time, Huma also launched the Kaito Earn campaign, which distributes 0.5% of the total supply into three "Seasons."

First quarter distribution:

- 0.1% is allocated to the top 500 participants in Kaito

- 0.1% is allocated to contributors in the Solana, DeFi, and RWA categories

- Distribute to holders of Kaito Ecosystem Tokens and registered through SOL wallet

Binance started trading at 21:00 (UTC+8) on May 26. As of May 27:

- TGE (opening price): $0.06683

- Closing price on the first day: $0.05936

- Opening retracement: about 11.2%

- Day 1 volume: $310.37 million

- Day 1 Market Cap: $102.89 million

- Current price (July 7): $0.03083

- Current market value: $53.44 million

- FDV: $308.6 million

- Volume/Market Cap Ratio (July 7): ~33%

Despite the popularity from Launchpool and Kaito Earn, HUMA is mostly traded in rotation. The first season rewards can be claimed from the first day, and the second season has been announced, which has led to increased selling pressure rather than long-term holding.

After briefly stabilizing at around $0.05 in early June, the price continued to fall over the next month, dropping 40% from June 9 to July 7. This trend reflects not only profit-taking, but also a lack of sustained demand. Daily trading volume has shrunk by more than 90% from its first-day high, while the gap between FDV ($308 million) and realized market cap ($53 million) continues to widen, further reinforcing the market's view that much of HUMA's appeal is driven by activity rather than product.

Summary : HUMA exhibits a typical Kaito Earn pattern: impressive data, huge liquidity, but lack of lasting appeal. Its launch is aimed at increasing exposure rather than winning firm support, and due to the lack of post-launch practicality and demand, the early attention came and went quickly.

Quai: Massive distribution, deep Kaito integration, strong launch… and then quiet

Quai, a decentralized multi-threaded blockchain protocol, has launched the most generous and deeply integrated Kaito Earn campaign to date. From January 17 to April 17, 2025, the project has allocated a total of 6 million $QUAI tokens to reward content contributors:

- 5.5 million QUAI for Kaito rankings

- 500,000 QUAI for Quai exclusive rankings

Users can claim it through the Kipper platform from April 29 to May 12. Weekly snapshots track contributors, among which top yappers such as @0xalank, @basedPavel and @Abhijeetcg have obtained up to 5.95% of personal awareness share, which is much higher than SKATE or HUMA.

Although the Quai mainnet was launched on January 29, the token was not freely tradable until February 22, when exchange data was released.

QUAI first day performance (February 22, 2025):

- Opening price: $0.09884

- Highest price: $0.2263

- Closing price: $0.1929

- Trading volume: $10.14 million

Subsequent trends: rotation, reversal and a long cooling-off period.

QUAI is one of the most eye-catching new projects among Kaito's tokens. Its price soared from $0.09884 to $0.2263 during the session, an increase of 129%, and finally closed at $0.1929, an increase of 95%.

But this is the highest point.

In the coming weeks:

- February 23-26: The price dropped rapidly, to around $0.17-0.18.

- March 1-15: Prices continued to fall to the range of $0.12 to $0.08, reflecting the normal performance of capital rotation after the hype.

- April-May: Despite a few minor rebound attempts, support gradually weakened.

- June-July: The token’s price ranged between $0.06 and $0.07, and as of July 7, it was trading at $0.05266, down about 73% from its closing price and about 76.7% from its highest price.

The volume also tells the story:

- From $10 million on the first day to around $3 million now, this shows a sharp drop in activity.

- Even the second phase of Kaito rewards did not significantly increase demand after the TGE.

Summary: QUAI has many advantages: large Kaito allocations, strong brand influence, a highly anticipated TGE, and strong early price action. But attention is shifting quickly. Even the top yappers have failed to solidify their secondary market interest.

QUAI is currently trading below its IPO price and has not seen a significant recovery since March, which fully demonstrates that early liquidity does not equate to lasting confidence.

Soon: Kaito Integration, Binance Alpha Platform Popularity, and Reality Check

Soon, a high-performance Solana Optimistic Network (SVM-based rollup), ran one of the most structured and community-cohesive Kaito Earn campaigns of early 2025. The project distributed 450,000 SOON tokens (~0.045% of the total supply) to the top 100 yappers over a 3-month campaign period.

- Event Date: February 19, 2025 - May 19, 2025

- Collection period: May 23, 2025 to June 23, 2025

- Eligibility: Kaito leaderboard contributors, early NFT holders, Builder badge owners

This event is not just a reward airdrop, but also a brand image that integrates SOON. Participating users will receive the "Sooner" role, badges and social status, which reinforces that Kaito yappers are the key force in the early dissemination of SOON.

TGE and market release: from hot discussion to soaring popularity

The SOON token was issued on May 23 and listed on Binance Alpha on May 24. The token opened at $0.4527, briefly touched $0.4776, and closed the day at $0.4007. The trading volume on the first day exceeded $103 million, reflecting a large amount of speculative activity and the amplification effect of exchanges.

Some market indicators (as of July 7, 2025):

- TGE Date: May 23, 2025

- Opening price on the first day: $0.4527

- Closing price on the first day: $0.4007

- First-day trading volume: $103.1 million

- Current price: $0.1529

- Market value: Approximately $26.9 million

- Opening retracement: about 66.2%

- Maximum retracement: about 68.0%

- Volume/Market Cap Ratio (July 7): ~97%

What happened after the first day?

After the initial excitement, SOON took the now familiar post-Kaito curve:

- Late May to mid-June: SOON remained in the range of 0.29 to 0.39 USD, with little fluctuation and a slow decline.

- Late June: The support level fell below $0.25, and the trading volume increased from June 27 to 30, showing an accelerated downward trend.

- July 5-7: SOON plunged 40% in 48 hours, from $0.22 to $0.13, before rebounding slightly to $0.15.

The plunge coincided with the end of the claim period (June 23), after which many recipients may have sold them and turned their attention to other Kaito activities.

Summary: The sooner you sell, the better?

SOON had all the ingredients for a successful launch: strong infrastructure publicity, exposure on the Binance Alpha platform, and community incentives. But the token is down 66% in six weeks, suggesting that hype has not translated into solid support.

Kaito Earn’s pattern has become predictable:

Narrative-driven airdrop → High first-day volume → Rapid rotation of airdrops → Price drops as attention shifts.

Although SOON sincerely tried to integrate into the community culture, its market performance has become a typical case of attention fragility. It got a high-profile start with Kaito's background, but could not prevent the subsequent silence.

Conclusion: Narratives are cheap, beliefs are scarce

The Kaito Earn model has proven to be a powerful engine for gaining attention for projects before launch, but across projects like SKATE, HUMA, QUAI, and SOON, a common pattern is emerging: a surge in attention at the TGE that fails to translate into long-term conviction.

Despite differences in industries (gaming, infrastructure, PayFi), listing platforms (Binance, Bitget), and reward mechanisms, the results are strikingly similar:

- Token surges on first day

- Airdrop Recipient Rotation

- Price action flattens out over the weeks

This is not a flaw in Kaito itself, as it works great as a content discovery layer, but the current model incentivizes narrative creation rather than long-term belief. Most tokens issued through this channel are stuck in an attention/exit cycle due to a lack of utility, retention mechanisms, or sustained product demand.

Unless this cycle is broken and tokens are designed that reward holding rather than just speculation, the Kaito model is likely to remain: a strong launch pad with little successful landing.

Related reading: Kaito platform full gameplay overview: Yap To Earn analysis