1. Market observation

The core inflation data in the United States was lower than expected for the fifth consecutive month, but the transmission effect of Trump's tariffs on prices has not yet fully emerged, and the market has significant differences in future trends. Nick Timiraos, a Fed observer, pointed out that although the CPI data in June was slightly lower than expected, it failed to change the basic judgment of policymakers - those who support the lag in the impact of tariffs believe that there will be more significant price pressure in July and August, while those who advocate the limited transmission theory emphasize the pricing restraint of enterprises under weak demand. This contradiction is reflected within the Fed: Chairman Powell hinted that the threshold for interest rate cuts may be lowered, while Dallas Fed President Logan insisted on maintaining a tight policy for a longer period of time, while leaving room for interest rate cuts in the event of simultaneous weakening of inflation and the job market. In the current policy deadlock, the Fed is more inclined to wait and see. Dallas Fed President Logan particularly emphasized the need to be vigilant against short-term data misleading, and reiterated the strategic value of central bank independence. He believed that although short-term interest rate cuts can boost employment, they may trigger long-term inflation risks.

In terms of regulation and industry development, Jeffrey Ding, chief analyst at HashKey, revealed that the U.S. Congress has accelerated the legislative process by establishing "Cryptocurrency Week", among which the GENIUS Act constitutes the core pillar of the regulatory system. The bill incorporates the hundreds of billions of dollars of stablecoin markets into the regulatory framework, and requires that reserves be cash and short-term U.S. Treasuries. This move achieves dual strategic goals while regulating the market: on the one hand, by supporting compliant stablecoins such as USDC to weaken offshore competitors such as Tether and consolidate the digital hegemony of the U.S. dollar; on the other hand, it creates a trillion-dollar U.S. Treasury demand pool and transforms global capital flows into a continuous driving force for alleviating fiscal deficits. The more far-reaching impact lies in the reconstruction of the global payment system. Giants such as Amazon and JD.com have deployed USD/HKD stablecoins, trying to bypass the SWIFT system to establish an efficient cross-border settlement network. Jeffrey Ding believes that this regulatory paradigm shift will not only reduce policy uncertainty, but will also strengthen Bitcoin's position as an asset allocation for digital gold.

Bitcoin has entered a period of adjustment after hitting a record high of $123,000. Many analysts are focusing on the technical repair of the CME futures gap. Many analysts, including Rekt Capital, Mikybull Crypto, Merlijn The Trader and UNKNOWN TRADER, believe that the price of Bitcoin may fall back to the range of $113,800 to $117,000 to fill the gap, after which it may usher in a new round of increases, even hitting $140,000. Crypto Chase suggested that Bitcoin is currently consolidating near the bearish gap (FVG) on the 4-hour chart. If the price cannot fall quickly and break through this area, this pattern may fail, instead pushing the price of Bitcoin back to around $120,000. In addition, Glassnode said that the market has not yet peaked. Although the short-term holder profit indicator is in an overheated stage, the top of the cycle is usually lagging. The next key level is $136,000, and there is strong support in the range of $93,000 to $109,000 below. Swissblock and Bitcoinvector judged from a cyclical perspective that the current expansion has only lasted for 12 days, and there is still room for the historical cycle of 15-30 days.

Ethereum's market capitalization has exceeded 10%. Thomas Lee of FSInsight pointed out that although its performance this year is weaker than Bitcoin, stablecoins and Wall Street's accelerated tokenization trend are driving the growth of ETH demand. Lee called it the "ChatGPT moment" in the crypto field. On the technical side, many analysts such as yourfriendSOMMI and Kingpin Crypto are also paying attention to its CME gap, believing that after filling the gap in the range of $2,830 to $2,925, Ethereum is expected to break through $3,200. Sean Farrell of Fundstrat added that the increase in Ethereum trading activity and the increased linkage with small stocks have the momentum to make up for the increase in the context of expected loose liquidity.

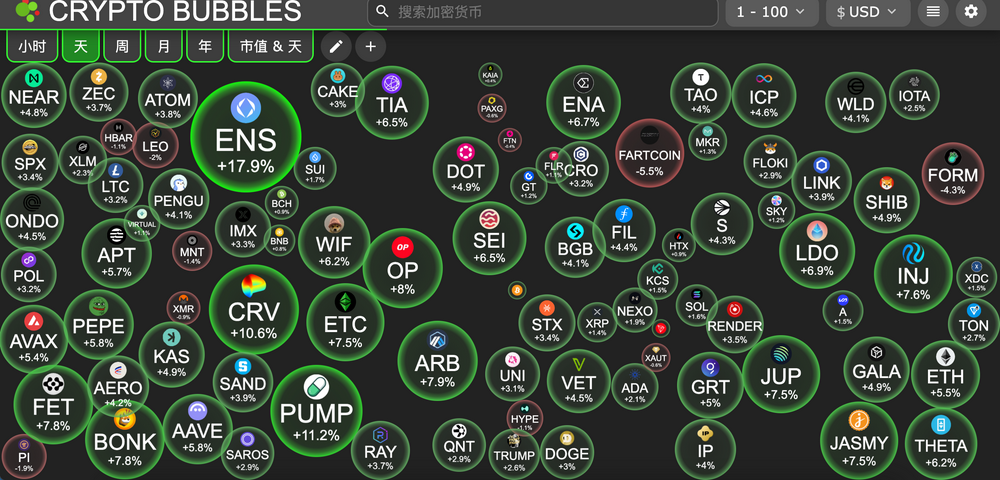

In the altcoin market, Momentum 6 partner VirtualBacon pointed out based on historical rules that 3-5 weeks after Bitcoin breaks through a new high is usually the altcoin market window, and the current cycle may last for 1-2 months. Market funds show obvious sector rotation: payment tokens XRP and XLM are the first to start, BNB, LINK and other large-cap currencies are ready to go, and Solana's BONK, PENGU and Layer1 projects SUI and APTOS form a relay team. Pump.fun started to repurchase after the token was launched, pushing PUMP up 20% in 24 hours. The recent Chinese Meme narrative is also hot. "Bee Dog", "Pump" and "Wang Chai" all hit record highs today, among which "Pump" rose 440% in 24 hours and "Wang Chai" rose to a maximum market value of 18.4 million US dollars. In addition, the market value of AI companion $Ani rushed to 30 million US dollars, up 51% in 24 hours.

2. Key data (as of 12:00 HKT on July 16)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)

Bitcoin: $117,798 (+26.05% YTD), daily spot volume $66.923 billion

Ethereum: $117,798 (-5.91% YTD), with daily spot volume of $41.523 billion

Fear of Greed Index: 71 (greed)

Average GAS: BTC: 0.52 sat/vB, ETH: 0.9 Gwei

Market share: BTC 62.9%, ETH 10.2%

Upbit 24-hour trading volume ranking: XRP, PENGU, BTC, ETH, XLM

24-hour BTC long-short ratio: 49.4%/50.6%

Sector gains and losses: DeFi sector rose 5.98%; GameFi sector rose 4.52%

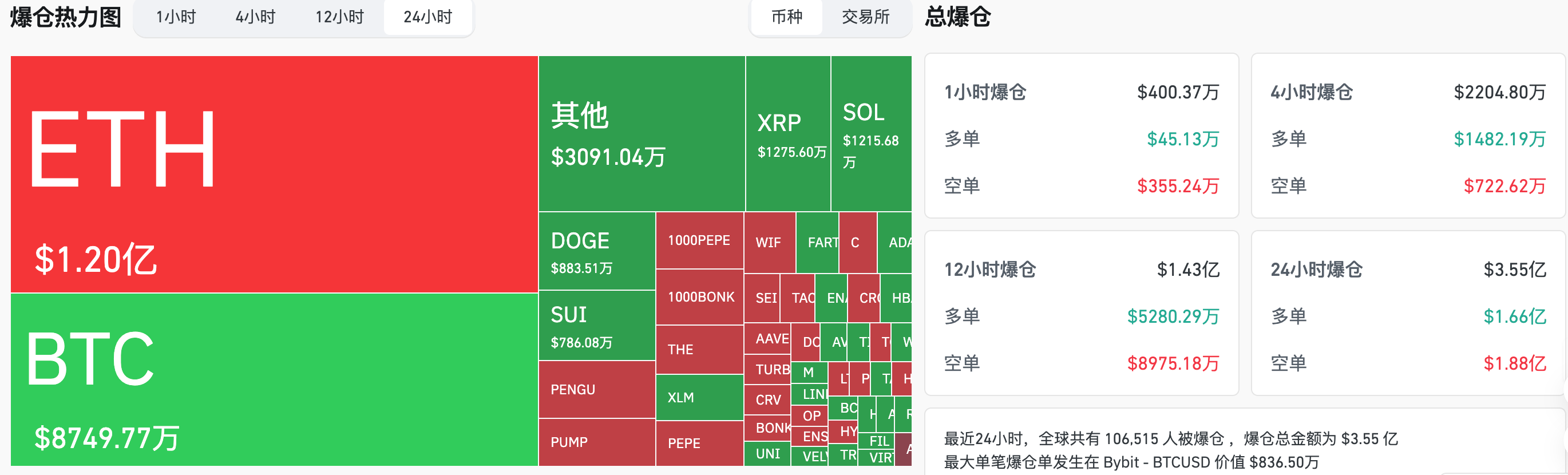

24-hour liquidation data: A total of 106,515 people were liquidated worldwide, with a total liquidation amount of US$355 million, including BTC liquidation of US$87.4977 million, ETH liquidation of US$120 million, and DOGE liquidation of US$8.8351 million.

BTC medium- and long-term trend channel: upper channel line ($115,557.67), lower channel line ($113,269.40)

ETH medium and long-term trend channel: upper channel line ($2887.31), lower channel line ($2830.14)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend; otherwise, it is a bearish trend. When the price passes through the cost range repeatedly within the range or in the short term, it is a bottoming or topping state.

3. ETF flows (as of July 15)

Bitcoin ETF: +$403 million, 9 consecutive days of net inflows

Ethereum ETF: +$192 million, 8 consecutive days of net inflows

4. Today’s Outlook

Binance Wallet to Conduct Hyperion (RION) Bonding Curve TGE on July 16

The Federal Reserve released the Beige Book on economic conditions. (July 17, 02:00)

FOMC permanent voting member and New York Fed President Williams delivered a speech on the US economy and monetary policy. (July 17, 05:30)

Arbitrum (ARB) will unlock approximately 92.65 million tokens at 9 pm on July 16, accounting for 1.87% of the current circulation and worth approximately US$38.2 million;

UXLINK (UXLINK) will unlock approximately 37.5 million tokens at 8:00 am on July 17, accounting for 9.17% of the current circulation and worth approximately $14.2 million;

Solv Protocol (SOLV) will unlock approximately 252 million tokens at 6 pm on July 17, accounting for 17.03% of the current circulation, worth approximately $11.3 million;

ApeCoin (APE) will unlock approximately 15.6 million tokens at 8:30 pm on July 17, accounting for 1.95% of the current circulation and worth approximately US$10.3 million;

ZKsync (ZK) will unlock approximately 173 million tokens at 4 pm on July 17, accounting for 2.41% of the current circulation, worth approximately $9.6 million;

The biggest gainers in the top 500 by market capitalization today: Staika (STIK) up 124.33%, Osaka Protocol (OSAK) up 38.46%, PepeCoin (PEPECOIN) up 28.96%, CoW Protocol (COW) up 25.74%, and Aevo (AEVO) up 20.84%.

5. Hot News

Ondo Finance announces acquisition of Strangelove to accelerate full-stack RWA platform development

A whale organization sold 15,000 ETH through Wintermute in the past 8 hours

This article is supported by HashKey, the largest licensed virtual asset exchange in Hong Kong and the most trusted crypto asset fiat currency portal in Asia. HashKey Exchange is committed to defining new benchmarks for virtual asset exchanges in terms of compliance, fund security, and platform security.