Author | Zack Pokorny

Compiled by GaryMa Wu Talks about Blockchain

On May 7, 2025, Ethereum's Pectra upgrade went live on the mainnet. Among the series of Ethereum Improvement Proposals (EIPs) implemented this time was an increase in the target and maximum number of blobs per block proposed by EIP-7691. Blobs were introduced through EIP-4844 (proto-danksharding) in last year's Dencun upgrade to provide a dedicated data publishing space for rollups. Since the launch of Dencun, the network has maintained a target number (Target) of 3 blobs per block and a maximum value (Max) of 6; each blob is 128kb, which is equivalent to providing about 5.5GB of data capacity per day through blobs. After Pectra, the target and maximum number of blobs per block were increased to 6 and 9 respectively, bringing the blob data capacity to about 8.15GB per day. This change has an impact on the blob market, rollups, and Ethereum validators, as the reduction in blob space scarcity reduces competitive pressure between rollups while increasing the network's data availability (DA) capacity through blobs. The following will explore the impact of Pectra's changes to Ethereum's blob parameters on the blob market, rollups and their users, Ethereum validators, and ETH supply.

Summary of key points

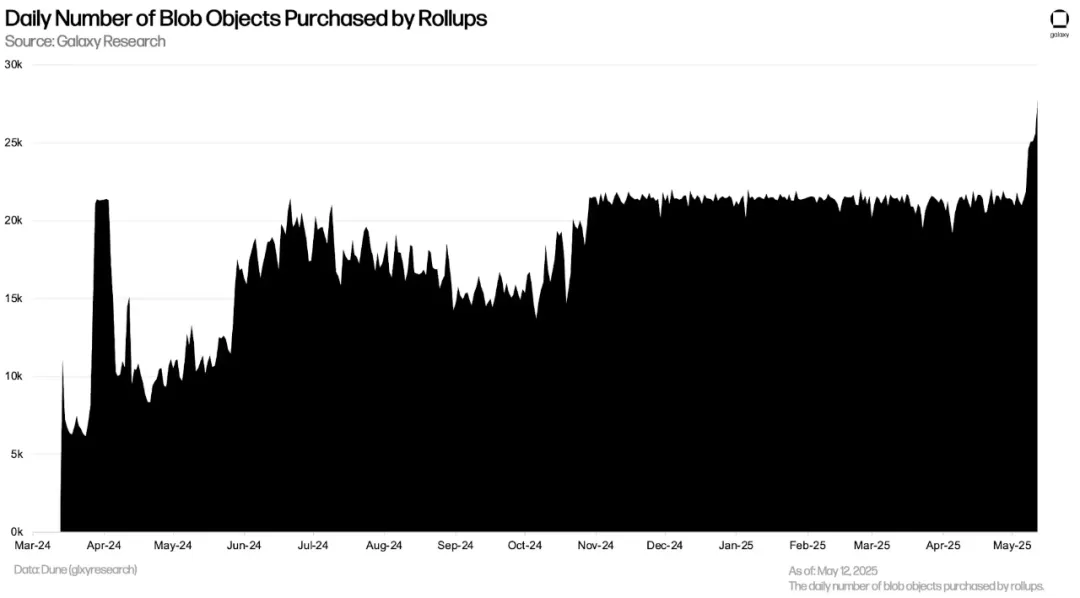

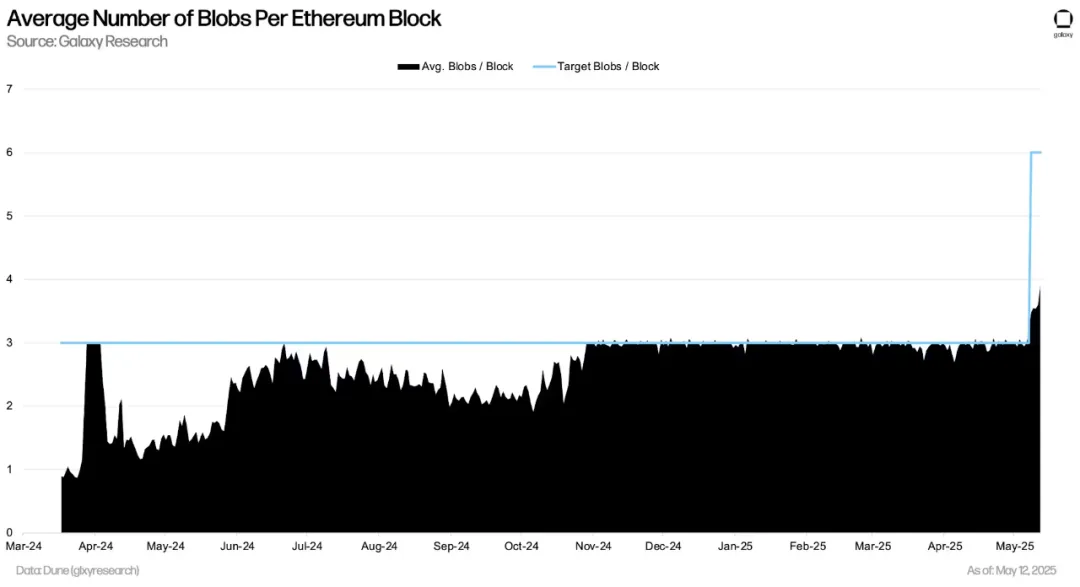

- In the five full trading days since Pectra went live, the number of blobs purchased by rollups per day increased from approximately 21,200 to 25,600, although the average number of blobs per block was still 33% below the new target of 6.

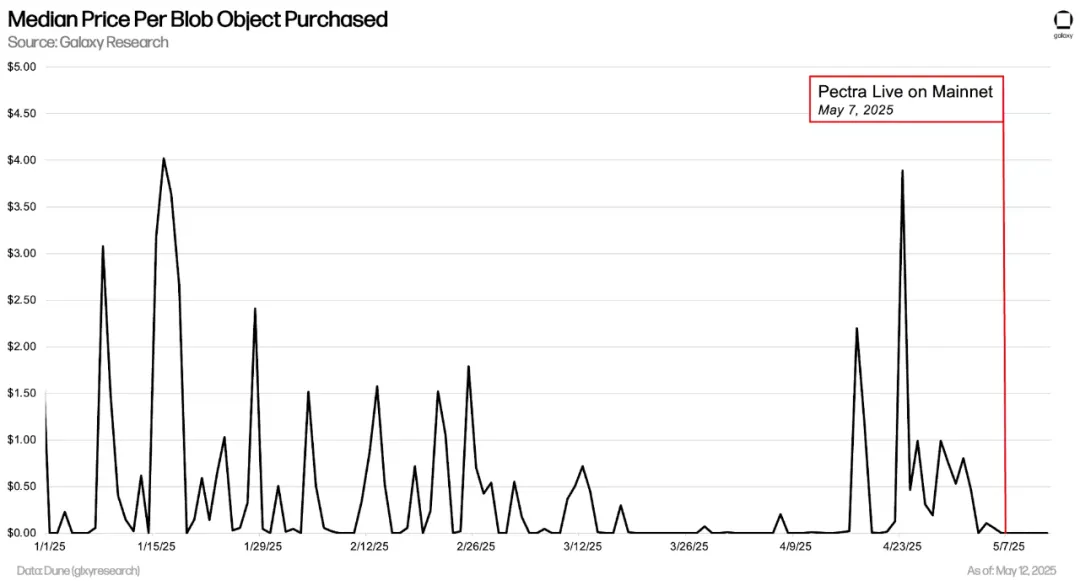

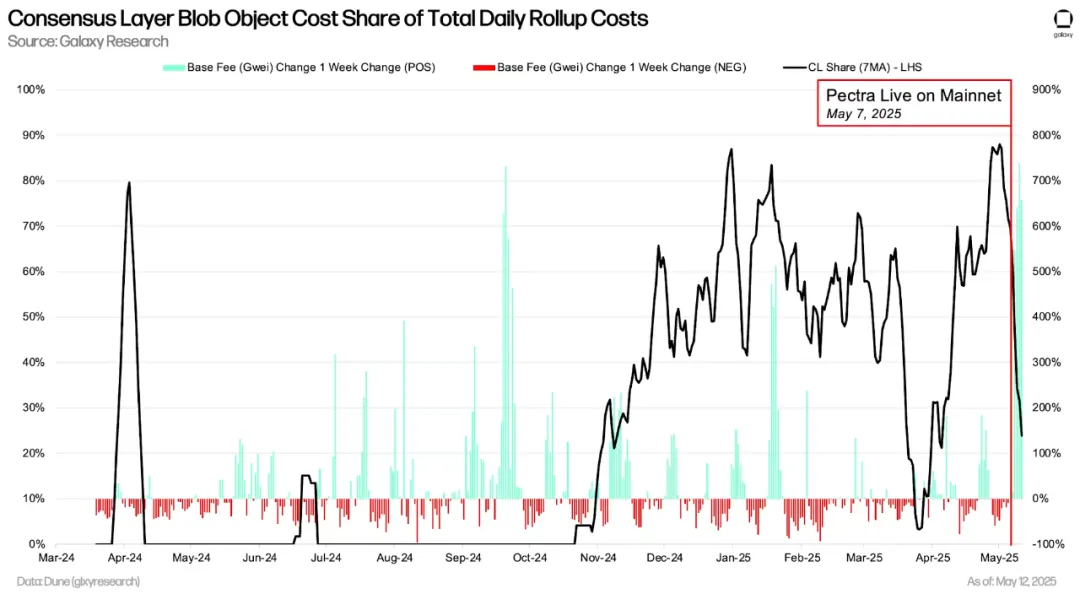

- With the actual number of blobs per block well below the updated target, blobs are nearly free again, the first time this has happened since mid-April 2025. Rollups are paying less than one thousandth of a cent per blob per day, and only four thousandths of a cent cumulatively since Pectra went live. This significantly reduces the amount of ETH that rollups burn for data space usage and publishing on Ethereum.

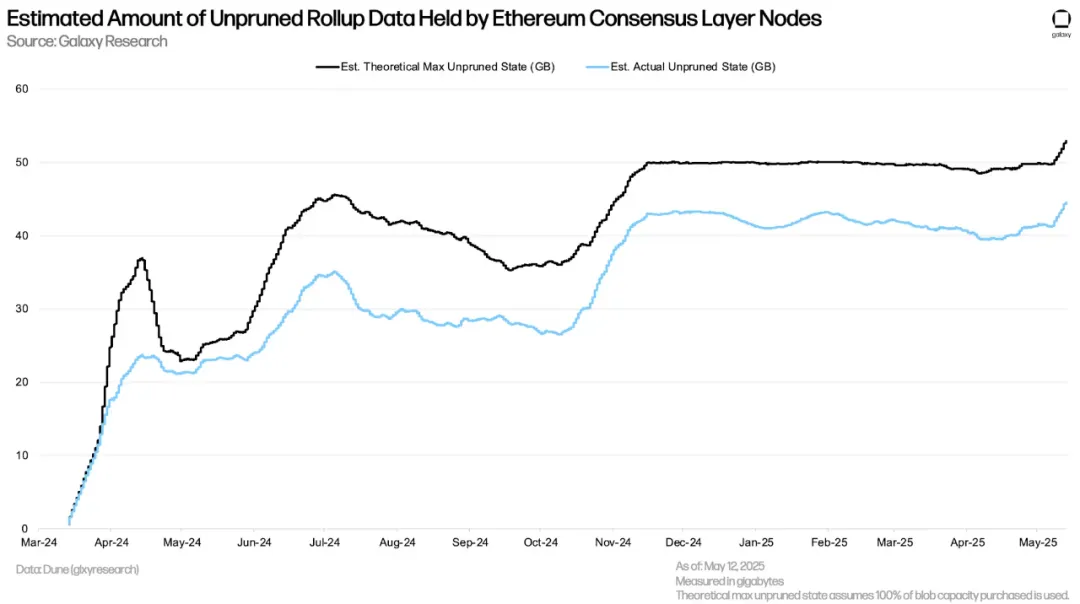

- Nodes must retain rollup blob data for at least 18 days before removing it from the device. The increase in the number of daily blob purchases has brought the amount of data that consensus layer nodes need to retain before data pruning to a new high, estimated at 44.6GB.

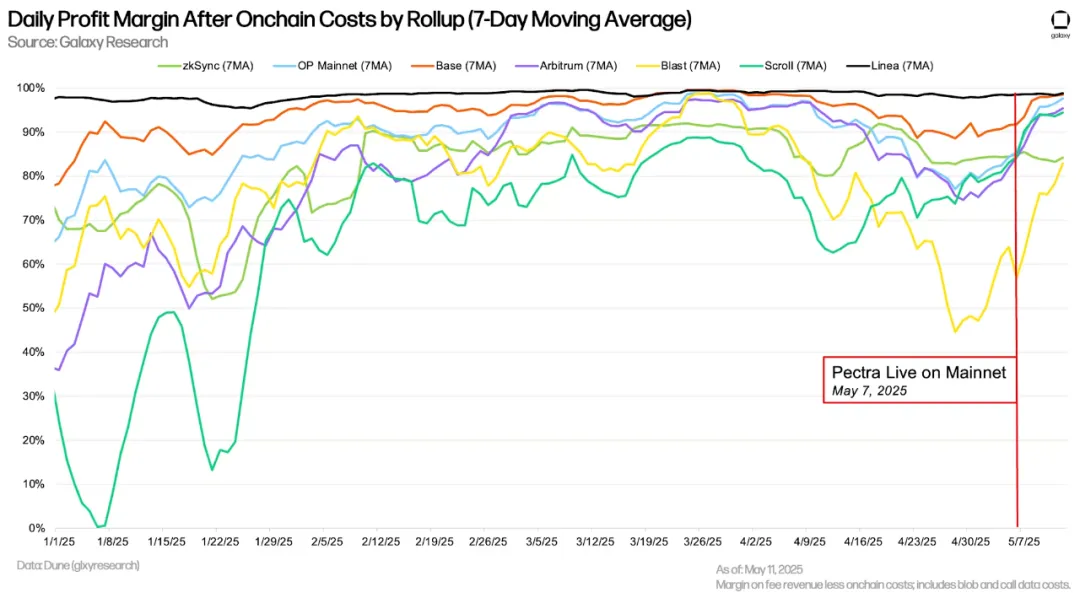

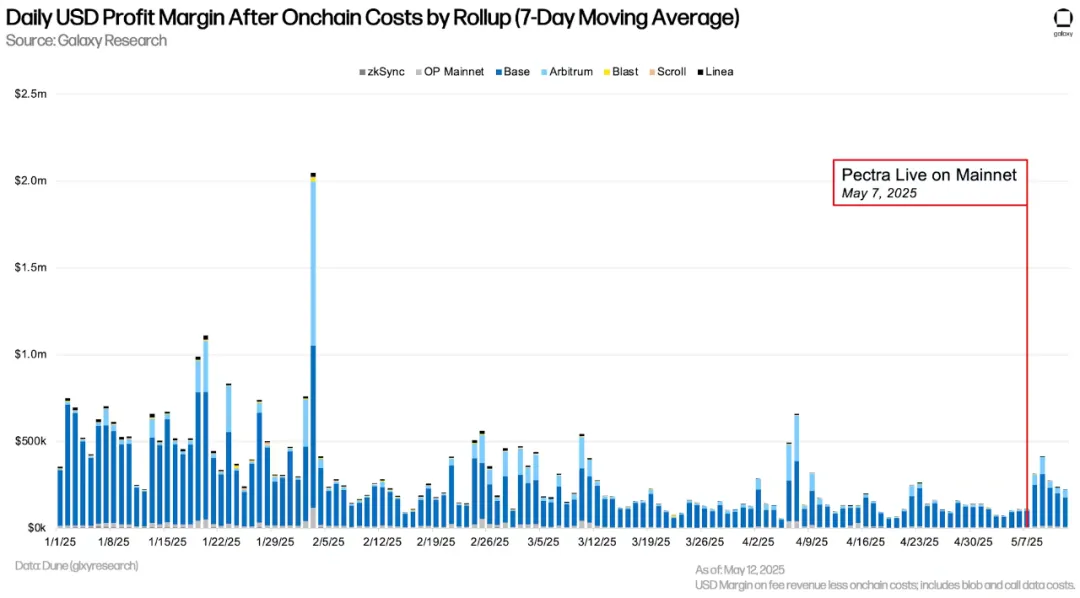

- The reduction in blob costs has improved rollup margins (both relative and absolute), with Base benefiting the most in terms of net revenue after deducting on-chain costs. Nonetheless, transaction costs for some major rollups have remained the same or even increased slightly since Pectra launched.

- All data used comes from the Galaxy Research public dashboard on the Ethereum blob market and its impact on rollups.

Blob Market

Since Pectra went live on May 7, 2025, the number of blobs purchased by rollup per day has increased by 20.8% compared to before the upgrade. In the first 60 days of Pectra, rollup purchased an average of 21,200 blobs per day. In the five full trading days after the upgrade, an average of 25,600 blobs were purchased per day. The corresponding daily data capacity has increased from 2.7GB before the upgrade to the current 3.3GB.

Despite the increase in blob purchases, only two-thirds of the new target number of blobs have been used on average each day since Pectra went live. So while Pectra's average blob usage was consistent with the target, the rollup has not yet reached the level of demand to consistently achieve the new target rate.

As a result, blobs are nearly free again, as only two-thirds of the target number of blobs are used per block. This is the first time blobs have been this cheap since mid-April 2025. The median price per blob since Pectra went live has been just $0.00000000035 (9 zeros). This means that a rollup is only paying a maximum of $0.0000092 per day, for a total blob cost of just $0.0000395. In other words, the rollup is paying less than one thousandth of a cent per day, and no more than four thousandths of a cent in total. Note that this fee does not include the type-3 transaction fee required to execute the blob on-chain, only the cost of the blob itself.

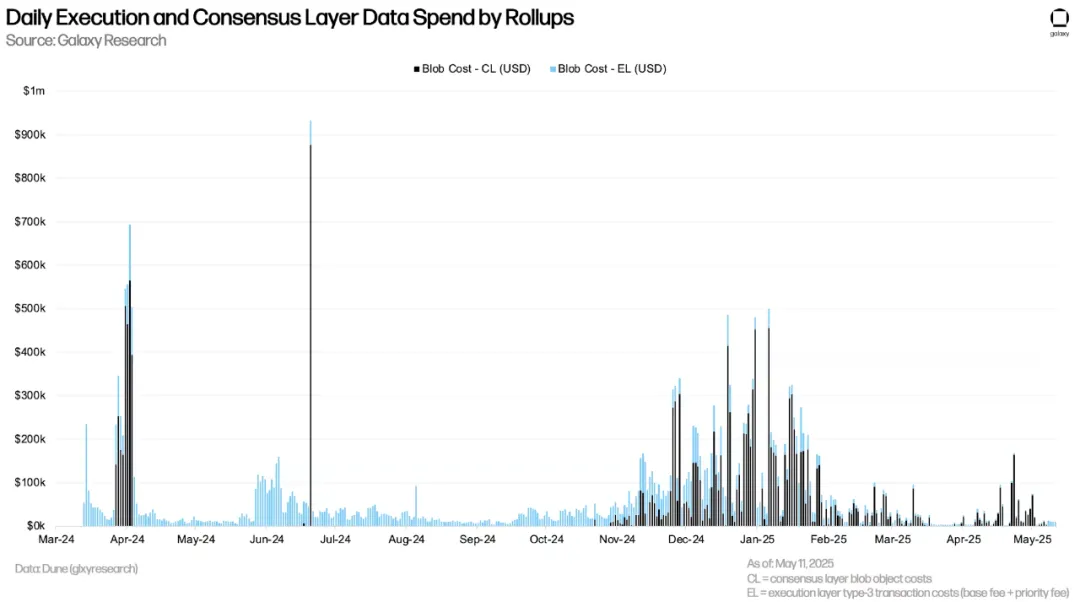

In the first 60 days of Pectra, the rollup paid an average of $16,250 per day in blob fees, totaling about $1,095,000. This fee reduction is close to 100%.

Data Capacity and Impact on Ethereum Nodes

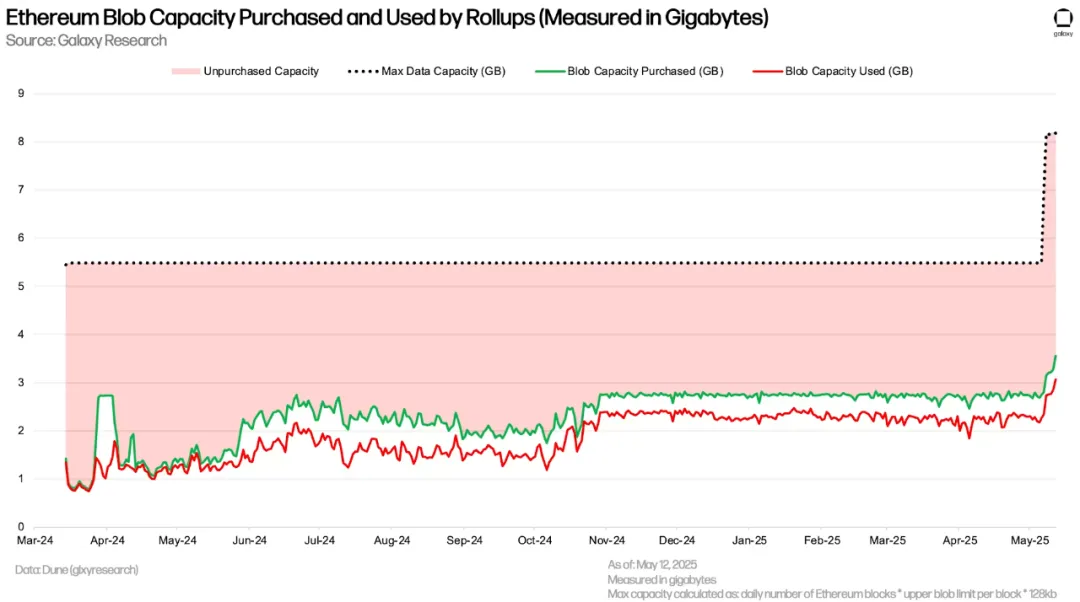

After Pectra was implemented, a larger fraction of the total data capacity available on Ethereum via blobs per day was not purchased. As a result, even though rollups purchased more blobs and more data space, the relative fraction of total daily capacity was used less. Once rollup demand reaches the new target level, the blob market will operate more efficiently from a capacity perspective, as the new target rate is only 33% below the maximum, compared to 50% under the old parameters.

Ethereum generates about 7,100 blocks per day, each of which can contain up to 9 blobs, meaning the maximum daily blob capacity is about 8.17GB, with a target of 5.45GB; this value fluctuates with the actual number of blocks. However, only 3.3GB of data space has been purchased, which is equivalent to 40% of the maximum daily capacity and 61% of the target capacity. In comparison, in the previous month, Pectra purchased an average of 50% of the total capacity and 99% of the target capacity every day.

Each blob can hold up to 128KB of data. A rollup does not have to use the full 128KB (e.g., 100KB is fine), but a single blob cannot exceed this limit. The difference between the purchased blob capacity (green line on the chart) and the actual usage (red line on the chart) shows the gap between the actual data filled by the rollup each day and the limit. The average blob fill rate after Pectra is 86%, while it was 82% 60 days before the upgrade.

The increase in the amount of blob data purchased daily requires consensus layer nodes to store more rollup data. Nodes need to retain this data for at least 18 days before deleting it. Before Pectra, this meant that nodes needed to retain 40GB to 44GB of data. In the days after Pectra, this value continued to rise, reaching an all-time high of 44.6GB as of May 12, 2025. If the current blob demand continues, nodes are expected to store about 60GB of rollup data; if the target rate is achieved, it may need to store about 95GB to 100GB.

Rollup Costs and ETH Burn

Since Pectra launched, rollups have spent an average of $11,015 per day on blob-related costs (including blob objects and type-3 execution layer transaction fees), compared to $20,660 in the 60 days before the upgrade, a 51% decrease.

The sharp rise in Ethereum L1 fees has kept the cost of rollup in blob activities at a certain level. Within a week after Pectra went online, the Ethereum L1 base fee rose by more than 650%. Without this wave of increases, the cost of rollup execution of blobs would be lower, and less ETH would be burned through blob activities.

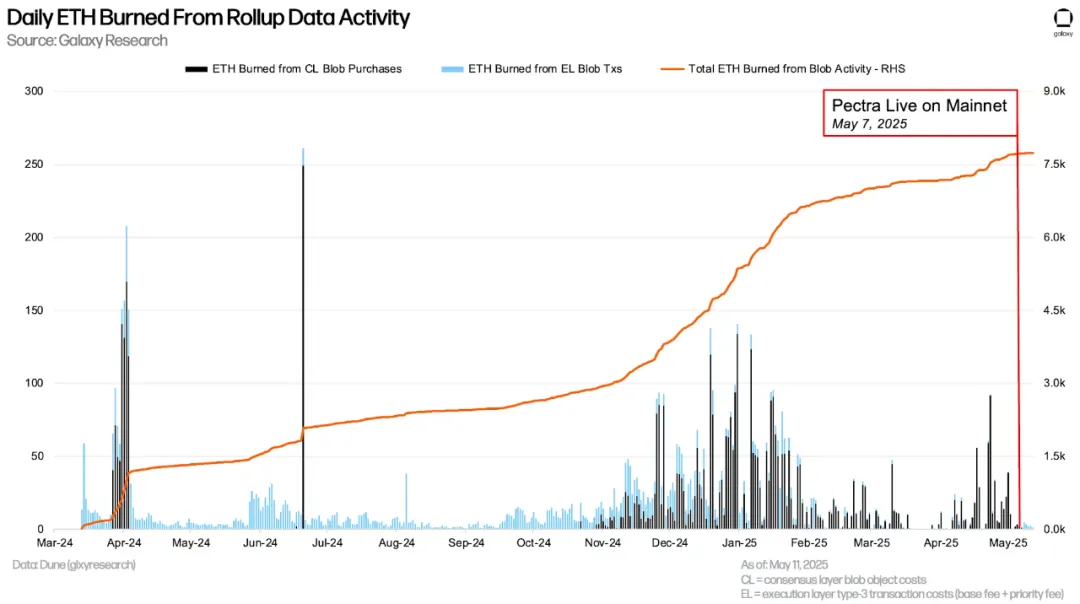

The ETH burned for data publishing activities via blobs (including the cost of purchasing blobs and executing transactions using type-3) has dropped significantly since Pectra launched. In the 60 days before the upgrade, an average of 11.22 ETH was burned per day, of which only 37.1% came from execution layer fees. After the upgrade, an average of 3.26 ETH was burned per day (a 71% drop), of which 99.99% came from the execution layer base fee.

Impact on L2

After deducting on-chain costs, the relative and absolute profit margins of most rollups have increased. Linea and Base have the strongest profit margins among the observed rollups, with seven-day moving averages of 98.86% and 98.54%, respectively. Blast has the most significant improvement in profit margin after on-chain costs, from more than 50% in the first few days of Pectra to more than 80% at present.

After on-chain costs, net revenue from rollups has increased after Pectra, due to lower data costs and higher activity and transaction fees. Each rollup has at least doubled its revenue and net income, with Base having the highest absolute income, generating $1.22 million in revenue under current market conditions and $1.12 million net after on-chain costs.

in conclusion

Rollups are not currently fully utilizing the Ethereum data availability expansion provided by Pectra. As a result, it reduces the fees rollups pay daily for blob DA activity. The upgrade currently provides a more favorable financial environment for rollups while also increasing the number of blobs used daily. Pectra's adjustment of Ethereum's blob parameters also raises a key issue: nodes must bear more pressure to store blob data. As Ethereum expands its blob DA, node operators need to take on more data storage responsibilities.