My lord, times have changed again and again.

After the tariff storm, the market has turned from bear to bull in a small cycle. In addition to the rise and fall of coin prices and sporadic project hotspots, there is also a main task that runs through the daily life of crypto users recently - how many points do you have on Binance Alpha today?

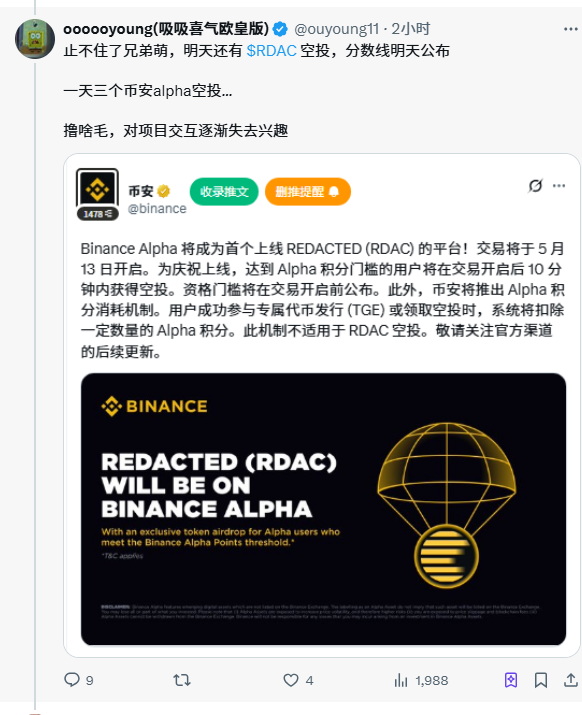

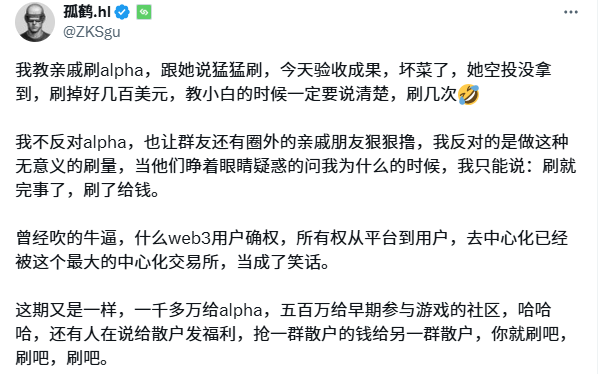

According to statistics from X user @btguagua , after the point system was launched on April 25, Binance has conducted 15 "money-giving" activities for users in the form of "airdrop + TGE activities" as of May 15. Yesterday, the $NXPC airdrop could achieve a single account profit of about US$700 at the highest price point.

If you have been tracking and participating in Alpha and your score has been up to standard, based on the highest price of Alpha tokens, the profit of a single account in 20 days is close to 2,000 US dollars. Even after deducting the transaction wear and tear costs, it is still a considerable profit.

In less than a month, the short-term returns from participating in Binance Alpha have already overwhelmed the current market’s increasingly unpopular field of hair-pulling.

From tasteless to popular

When Binance Alpha 1.0 was first launched, except for the initial few days when the concept of "Binance spot candidate" brought freshness to the market, which caused the tokens listed on the Alpha list to rise, the overall positioning of the Alpha sector seemed to be relatively tasteless. Either some popular Meme tokens on the chain at that time were launched, or tokens of their own wallet TGE activities were launched. Many Meme players and project parties even regarded Binance Alpha as the last stop for liquidity in a short period of time. Later, "listing on Binance Alpha" was not even an obvious positive. The trading volume of the Alpha sector quickly slumped, and it seemed to be getting further and further away from the "growth" goal that Binance wanted to achieve at the beginning.

Although Binance Alpha 2.0 transplanted the Alpha interface into the exchange, the data showed little effect. The real change in the data level was the "points-based admission system" that has always been on everyone's mind.

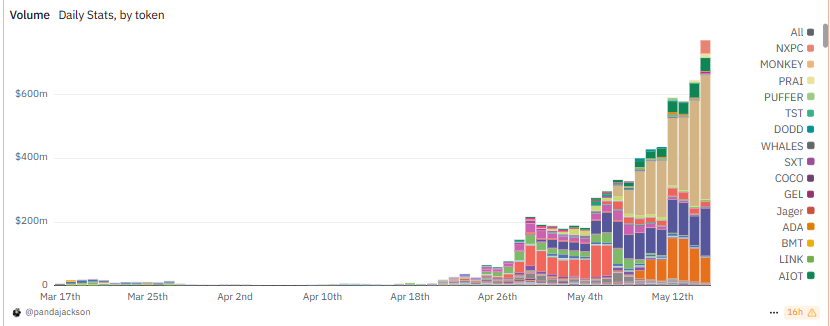

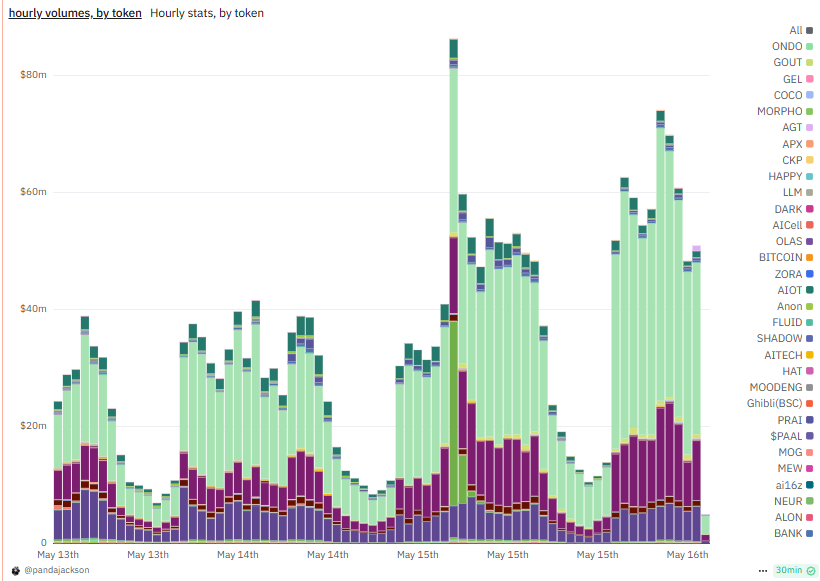

According to the data panel created by Dune user @pandajackson , the trading volume of Binance Alpha2.0 has increased exponentially since the introduction of the points system. As of May 15, Binance Alpha's daily trading volume has reached US$771 million.

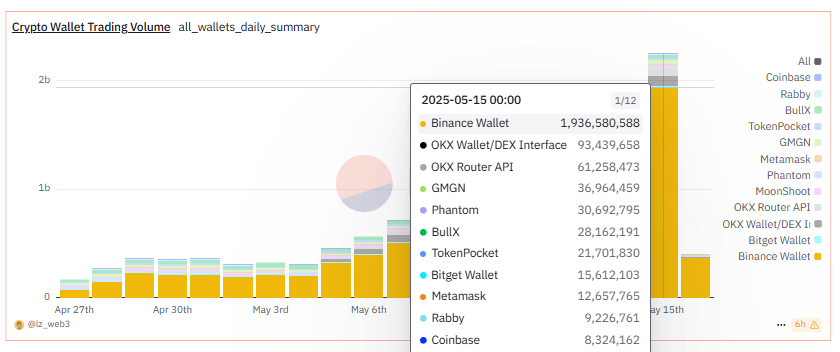

According to the data panel created by Dune user @lz_web3 , Binance Wallet's short-term transaction volume also dominates the entire wallet track.

Judging from the trading data alone, Binance's growth strategy has successfully made it a hot spot for market attention and funding.

With full market participation, who wins and who loses?

Judging from market discussions and user feedback, Binance's money-giving event satisfied most people, and many parties in the market benefited from it. Users who have reached the required points are the most direct beneficiaries. Whether it is retail investors or cluster studios, from some perspectives, they have stepped on this wave of Binance's artificial trend and earned the first wave of dividends from the "new asset issuance method."

For individuals who stay involved, daily discussion, checking, and earning Alpha points have become a regular task. Checking the steadily increasing Alpha points is like holding an asset with guaranteed returns firmly in your hands.

For individuals, the income from Binance Alpha is a short-term “stable happiness”. But for the group of studios that have the ability to create accounts in batches, this seems to be a real big opportunity.

"Many projects are reducing their manpower and capital investment, and are working hard on Binance Alpha." Brother Lu (pseudonym), who runs the LuMao studio, told TechFlow. The net income of the order number in 20 days is close to 2,000 US dollars, and the return cycle and rate of return have far exceeded more than 90% of the crypto projects. Compared with the model of most crypto projects that start with "half a year, no upper limit" and unknown returns, Binance Alpha's "instant feedback, one order to pay back" income model is exactly the dream way of participation for LuMao studios. Even the various "king-level" projects that have not yet been launched are inevitably bleak in comparison with the current high-density money-spending.

Judging from the feedback from many bloggers, it has become a short-term consensus that it is better to invest in Alpha than to invest in other projects...

For project developers, listing on Binance Alpha has become an excellent opportunity for traffic exposure. At the same time, it can be used as a "score brushing target" to obtain long-term liquidity. The trading volume of popular assets such as $ZKJ and $B² continues to grow.

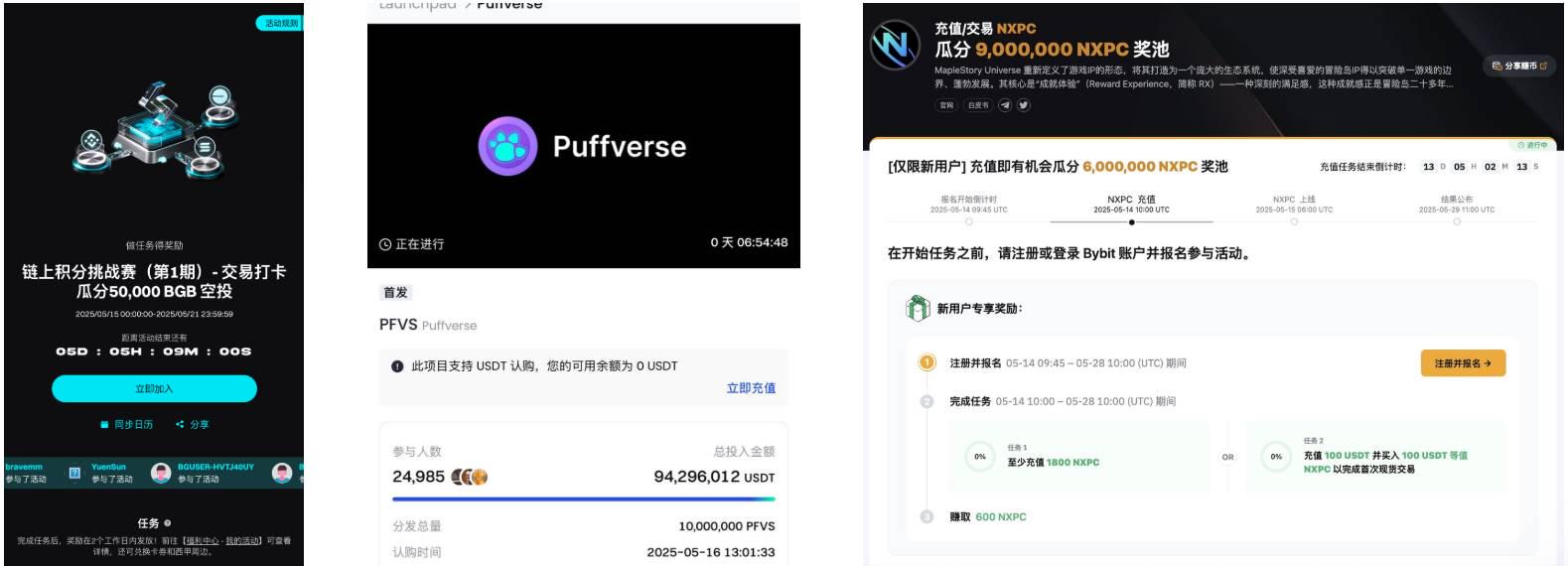

According to X user @_FORAB , the Binance Alpha initial coin listing schedule is currently scheduled to mid-June. Although there are many rules and restrictions, the project team is still willing to strive for this huge wave of traffic.

For peer exchanges, Binance's series of money-spending strategies and growth data are really eye-catching. When Binance Alpha activities were popular, various exchanges also launched their own money-spending growth activities.

Of course, even as everyone celebrates their gains, there are still people who are struggling to "lose money."

The first people who lose money most directly are those who endure trading wear and tear in order to gain points, but still do not receive airdrop rewards due to insufficient points.

According to X user Guhe.hl ( @ZKSgu ), under the catalysis of the Alpha points mechanism, many users choose to brush points without considering wear and tear. In this process, if the trading assets and slippage are not selected properly, they may suffer greater wear and tear. At the same time, the difficulty of obtaining trading points is increasing exponentially. There is only a few points difference between hundreds of thousands of transactions and thousands of transactions, but the wear and tear may be hundreds or thousands of dollars more.

At the same time, in addition to the users who directly lost money by brushing their scores, many users who actually participated in the project interaction for the project airdrop also suffered some "invisible losses" under the coverage of the Binance Alpha event: in order to ensure the benefits of users participating in the Alpha event, the projects that are launched on Binance Alpha need to give a considerable share of chips + lock liquidity. In order to pay the "Alpha fee", some project parties choose to deduct part of the token share originally reserved for the community and transfer it to Binance Alpha for the distribution of event airdrops. Between taking and deducting, part of the money belonging to the "project community users" was transferred to the pockets of the "Binance Alpha users". This behavior directly blocked the user growth of the Web3 project, and instead "enclosed" the native users in the exchange in a centralized way.

When will the scroll end?

I remember that before, everyone was still criticizing the point system of the project airdrop. This behavior of hanging users' time, energy, money and expectations and making participants crazy has never been decent. But perhaps because the positive feedback came quickly and was real, the market directly criticized Binance Alpha for its point system less, and praised its benefits more.

On the positive side, Binance Alpha has, to a certain extent, guided the market's enthusiasm in an environment without a main storyline, and the money-spending activities have benefited ordinary users. At the same time, the activities of coin listing on the assembly line have also gradually disenchanted the market with the idea of "listing on Binance" to a certain extent.

From a negative perspective, the main way to obtain Alpha points is to mechanically brush points, and in essence, brushing points does not have much meaning except for providing data for wallets and project parties. Many people have spent money and endured high slippage wear and tear on the chain, but have not received any returns in a crazy internal environment.

According to the current development momentum, the participation threshold for points required to obtain Alpha rewards will continue to rise in the future. In addition, Alpha activities will tend to be more actuarial and intensive . A single point difference may result in the loss of participation qualifications. The difficulty for ordinary users with small funds to participate will also increase exponentially.

summary

Binance Alpha's crushing momentum reminds people of the Qin State in "Records of the Grand Historian" - "sweeping the world, capturing princes, dividing the world, and annexing the eight wildernesses". It came with great momentum, and its scale and influence expanded extremely quickly.

It’s just that this expansion seems to be too fast. As the saying goes, “A prairie fire may not burn forever.” Any model that burns market expectations too quickly will face the test of sustainability. The current short-term high-yield returns are more like Binance paying for user education. As long as users’ time, money, energy, and attention are drawn to it first, the future planning can be considered in the long run.

It has indeed become more difficult for users to obtain benefits. The current point deduction system is already testing the investment and research capabilities of participants. The days of simply swiping points and getting airdrops are over. In the future, those who want to get appropriate returns from activities may be players who are good at investigating projects.

From the perspective of user participation, positive EV return opportunities with high certainty like Binance Alpha are rare even in a whole bull-bear cycle, so it is crucial to control the bonus window period. As for how long this bonus period can last and whether Binance Alpha will have a negative impact on the market in the future? "If there is really no bonus, look for the next opportunity. No one can predict what will happen in the future, but you must always seize the opportunity." Lu Ge of Lu Mao Studio said in an interview.