Read this article’s public information: https://sk6xgpp38n.feishu.cn/docx/PLA0dmrKrop0ihxUljccUoh5nSc?from=from_copylink

Continuing from the previous article, the logic of the interest-bearing stablecoin (YBS) is to imitate the banking industry. This is only the appearance. It also needs to solve many problems such as where the user income comes from, how to distribute it, and how to maintain the long-term operation of the project. The collapse of DeFi projects is a daily routine in the financial industry. SBF can just go to jail, but Silicon Valley Bank is the embryo of systemic risk, and the Federal Reserve needs to act immediately.

The era of excess leverage

Seeking profits is product thinking, the financial expression is speculation, large price differences are the source of arbitrage, and long-term fluctuations require hedging risks.

After the introduction of computer technology, the financial industry has gone through three stages in quantitative speculation:

• Portfolio insurance: diversify investment targets to preserve value, quantify risk levels and price them;

• Leverage (LTCM): Small profits from small transactions can be magnified by borrowing money;

• Credit default swaps: CDS is not evil, but the risk control of derivatives has failed and has become pure gambling;

In the current financial world, large price differences in space have disappeared, and daily, small-scale and decentralized transactions have become the norm. On-chain MEV and off-chain CEX are Web3's imitations of TradFi.

Long-term value preservation over time is no longer the mainstream. Leverage, extremism and speculation are the goals. Hedging itself has become an end, and long-term risks will never be brought into the future.

In the above context, YBS project parties are basically facing a dilemma: if the APY/APR is not high enough, it will be difficult to attract funds to increase TVL; but if the promise is too high, it will inevitably become a Ponzi scheme, and eventually collapse in any link of TGE, financing, margin trading, scoring, VC and exchange.

The essence of hedging is arbitrage, and momentum cannot be avoided.

Image description: Stablecoin school Image source: https://x.com/zuoyeweb3/status/1935242935634903275

First, let’s take YBS out of the stablecoin market. Currently, there are three branches of stablecoins:

• The first is for institutions only, mainly clearing networks, used for cross-border, cross-industry and cross-entity transactions, with the goal of complementing and replacing existing products such as Visa and SWIFT, such as JD.com or JP Morgan;

• The second is the USDT-like products promoted by TradiFi, which can be divided into stablecoins anchored to the US dollar and non-US dollars, as well as alternative attempts by large financial institutions, such as USD1;

• The third is Ethena’s competitors, such as Resolv, which is also the main body of our article.

The market always has an "impulse" to rise as much as possible when it can, and continue to fall when it is expected to bottom out. This is called momentum, and YBS is just the right name for it. Many projects will play the same game with Ethena, pushing APY to the highest, and then clearing the market to leave the king of this track. Hedging will eventually converge with arbitrage and become difficult to distinguish between the two.

Image description: YBS issuance guide Image source: @zuoyeweb3

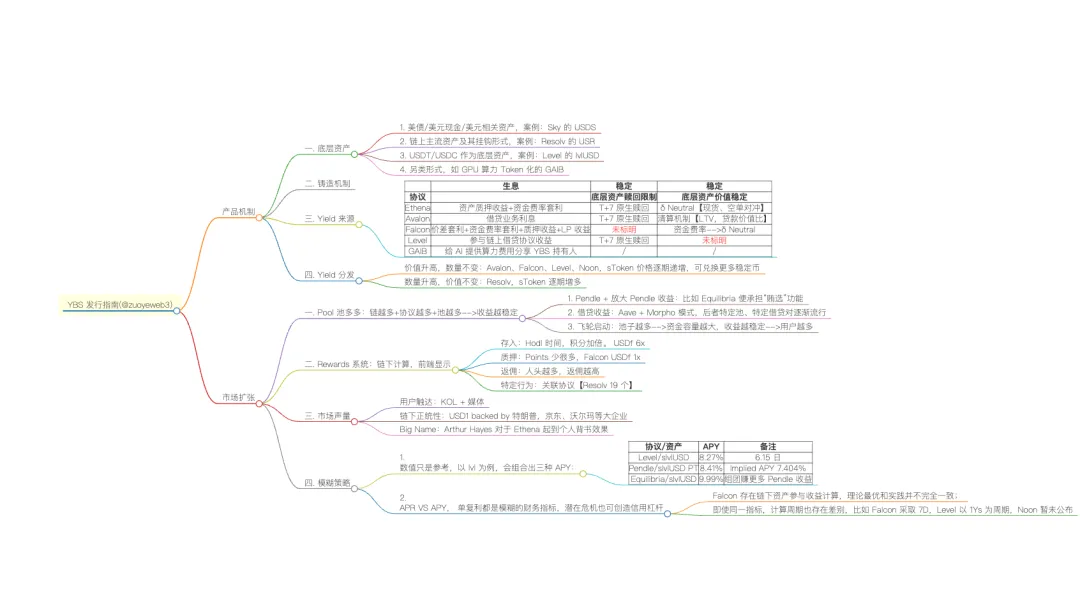

It is still a familiar formula. After analyzing more than 100 YBS projects frame by frame, we extracted the issuance guide for interest-bearing stablecoin projects and roughly divided it into two parts: product mechanism and market expansion. Among them, the product mechanism consists of four parts: underlying assets, minting mechanism, source of income and distribution. This is the general formula of the YBS project. The only difference is the ratio and web page packaging.

The second is the market. In the era of formula convergence, the market is essentially a handicraft, which tests the aesthetic taste of the project party. It can only roughly outline four aspects: Pool strategy, Rewards design, market voice and fuzzy strategy.

Let’s start with the product. After Delta Neutral, it’s nothing more than a magical modification of Ethena.

The product has no characteristics, and the US debt is divided into large

Interest-bearing stablecoins are different from USDT's "historical stability". Year after year of FUD has created resilience. YBS requires extremely strong asset reserves, and the cycle of the credit leverage model is difficult to cold start. Let me explain it briefly.

In the early stablecoin market, project owners could "claim" to have assets equivalent to $1, and then issue a $1 stablecoin, then pledge it and transfer it off-chain, thus circulating indefinitely.

After the collapse of UST and FTX, the above operation is too difficult. Although there is still a disconnection between the on-chain and off-chain, in the context of real-name entrepreneurship and increasingly mature supervision, it can be assumed that most YBS project parties have relatively sufficient reserves.

The YBS project team would rather use the bank's credit leverage model, that is, the reserve system to deal with supervision, insufficient liquidity to deal with withdrawals, and the rest to lend out for interest. This is the fundamental reason why the US dollar/US debt has become the mainstream choice for YBS. Only the US dollar/US debt can flow seamlessly in Web2 and Web3 to maximize the profit of the income portfolio.

The GENIUS Act is not the beginning of regulation but a summary of past practices.

1. Underlying assets

In terms of underlying asset selection, the US dollar/US Treasury bonds are the mainstream choice, but directly raising funds through MakerDAO/Sky to buy US Treasury bonds is still a bit rough. The market space left here is to help Web3's YBS project party buy real assets and help Web2 financial giants issue compliant YBS.

For example, Compound founder’s new work SuperState not only helps DeFi old money manage their finances, but one of its important businesses is USTB, the tokenization of compliant U.S. debt, and Resolv is its client.

For example, since Ondo introduced Kaite Wheeler, who used to work at BlackRock and Circle, its relationship with Wall Street has become closer. Wheeler was in charge of the fixed income product business for iShares institutional clients at BlackRock, and his title at Ondo was in charge of institutional cooperation.

If we sort out the forms of representation using US dollars/US bonds, we can divide them into the following four types:

• US Treasury bonds/USD cash/USD related assets, example: Sky’s USDS

• Mainstream assets on the chain and their hook forms, example: Resolv’s USR

• USDT/USDC as the underlying asset, example: Level’s lvlUSD

• Alternative forms, such as GAIB, a tokenized GPU computing power

Among them, Resolv's BTC/ETH reserves are a hypothetical state, and are currently more closely related to USDC and US bonds. Just like Ethena was originally conceived to use BTC, but ultimately chose ETH, compromise is the norm.

The reserveization of mainstream assets on the chain, especially BTC/ETH/SOL and other YBS, has not progressed well. It should be noted that Ethena's ETH hedging is a stability mechanism and is not completely consistent with the reserve.

Personally, I believe that mainstream assets on the chain need to be accepted by a wider range of traditional financial markets before they can be directly used as reserves by YBS. This can be observed from three angles: ETF, national reserves, and (micro) strategies. It is simply black humor that on-chain stablecoins need to have off-chain recognition first.

The most interesting are new forms such as GAIB. They do not use a certain asset as a reserve, but a certain "practicality". The essence of currency is a general equivalent. The computing power in the AI era does have this feature. I hope to gain something.

2. Casting mechanism

In the previous article, the minting and interest-bearing processes of YBS were confused, but the minting of YBS should specifically refer to the one-way process of "issuing stablecoins based on underlying assets" and should not involve subsequent reverse operations such as interest-bearing mechanisms and redemption.

Drawing on the CDP (collateralized debt position) mechanism of lending products, we include all YBS in this scale, but it can be positive or negative to accommodate YBS types that are not fully reserved.

In theory, unlike MakerDAO (DAI), Aave (GHO) and Curve (crvUSD) which generally adopt an over-collateralization model, the new-era YBS is generally 1:1 fully collateralized, at least in terms of mechanism design. However, the reality is unknown to outsiders, and this is what YBSBarker hopes to penetrate.

In addition, a few non-fully mortgaged products basically adopt credit or guarantee mechanisms, which are unlikely to become the mainstream choice in this cycle, so they will not be introduced.

3. Yield Source

Based on the underlying assets and minting mechanism, we consider two dimensions of income sources: interest-bearing mechanism and stability, thereby forming a complete process of minting, interest-bearing and redemption of interest-bearing stablecoins.

Taking Ethena as an example, the Delta mechanism consists of ETH spot and short position hedging. The hedging itself is a mechanism to ensure that USDe is anchored at 1:1 to the US dollar, and the funding rate arbitrage of the short position itself is a source of interest, which is used to pay the income of sUSDe holders.

Image description: Source of income Image source: @zuoyeweb3

Ethena also chooses ETH, which has its own staking and interest-earning version, such as stETH, to enhance its ability to capture profits. The above is the minting process of sUSDe and USDe, and the redemption process also needs to be considered.

1. sUSDe is rolled back to USDe. After unstaking, there is a 7-day cooling-off period before the withdrawal process can be started, or it can be directly exchanged in real time on DEX;

2. USDe falls back to ETH, and there is a T+7 restriction. Of course, USDe itself is a stable currency and can be directly exchanged for any asset on CEX or DEX, but this is not an official asset redemption function.

Apart from Ethena, the remaining YBS projects are nothing more than more interest-bearing scenarios and improved asset value stabilization mechanisms. The only slight difference is Avalon's liquidation mechanism, which is more like traditional lending products and is used to control the price stability of stablecoins.

4. Yield Distribution

There are only two distribution mechanisms: one is that the value remains unchanged but the quantity increases, and the other is that the value increases but the quantity remains unchanged:

• Increased value, unchanged quantity: Avalon, Falcon, Level, Noon, sToken prices increase period by period, and can be exchanged for more stablecoins

• The quantity increases, but the value remains unchanged: Resolv, the number of sTokens increases period by period, but the price of sTokens and its own stablecoin remains 1:1 anchored.

Looking at the entire product mechanism design of YBS, there are two most difficult points. One is the establishment of reserves. For other DeFi projects, such as DEX, under the AMM mechanism, adding liquidity is a user behavior. DEX itself is mainly engaged in technology development, product design and marketing promotion. It is difficult to say that it needs its own funds to make a successful product.

YBS is naturally a pegged asset or equivalent form of "currency". Too little capital reserve cannot gain user trust. In other words, people like to use YBS issued by rich people. At this point, YBS will naturally exclude ordinary entrepreneurs, but it is particularly suitable for big VCs to make heavy bets to cultivate the second Ethena, the second Circle IPO, or the second USDT money printing machine.

The second is the source of yield. Referring to the history of traditional financial quantitative analysis, only by being earlier than peers can one earn alpha returns. After that, one must either learn from Simons to keep the secret of the big medal, or compete in software and hardware resources, and eventually turn to the "law of large numbers", overwhelm opponents with capital scale, trigger a systemic crisis, and repeat the cycle until the end of the world.

The competition of benefits is loud and clear

Well, after organizing the team, you have built an excellent YBS team. After completing the project naming, front-end, back-end, and smart contract AI outsourcing, you have successfully obtained a huge amount of financing from Big Name VC. Now you need to attract large and retail investors to deposit funds and increase the rate of return and scale of revenue.

Then the big problem arises: yield and return scale seem to be incompatible.

1. Pool

The most effective way for YBS to acquire customers is to provide high returns, but the larger the scale of funds, the lower the stable high return rate will be. This is true from the investment returns of A16Z to the returns of BlackRock Asset Management. The Aave thousand-fold myth created by First Class Warehouse is only a thing of the past.

YBS must find its own flywheel: provide users with more income options, or to put it simply, look for all chains, protocols and pools that can build income.

There are three perspectives around the benefits of YBS:

• Coin standard: the issuance data of stablecoins and sTokens themselves;

• Pool standard: usage and interest-bearing data of stablecoins and sTokens;

• Protocol-based: The overall governance structure of the stablecoin and sToken protocols.

The three levels of abstraction and complexity increase in sequence. From the simplest perspective, the issuance volume, pledge volume, holding addresses, etc. of USDe and sUSDe are based on currency, while their trading pools in Pendle and Curve are based on Pool. The income, distribution mechanism and historical data involving USDe, sUSDe, ENA, sENA and the protocol are based on protocol.

The coin standard is very intuitive, and the complexity of the pool standard is reflected in the accumulation of cross-chain, multi-protocol and multi-pool.

Image description: YBS involved in the agreement Image source: @zuoyeweb3

Among them, Equilibria is Pendle’s “vote bribery platform”. Through Equilibria, users can collectively pledge ETH on Lido, reduce investment costs, and increase final benefits.

Following this line of thought, Chi Duoduo presents three characteristics:

• Pendle and Amplify Pendle Benefits: Pendle and Equilibria, similar to Curve and Convex;

• Aave and Morpho lending mechanisms amplify profits, and specific pools and specific lending pairs of the Morpho model are becoming increasingly popular;

• Get rid of the old and keep the new: Pendle/Morpho/Euler are replacing the importance of Curve and Uniswap, the old generation of DeFi protocols, to YBS.

Most importantly, Pendle has become the industry infrastructure for YBS. Only by logging into Pendle can YBS take root on the chain and achieve the same effect as USDC binding to Coinbase.

Flywheel startup: more pools --> larger fund capacity, more stable returns --> more users

2. Rewards System

The reward system is simple to summarize, but it is extremely complicated to implement. How to evaluate user behavior and try to strike a balance between anti-witch and real customer acquisition. Onekey and Infini have successively abandoned the U card business, which is also due to the uncontrollable profit model of C-end users.

Rewards in the YBS field are actually more like a points battle. Some users want to get financial returns, and some users want to get expected airdrops, so they try to make their behavior close to reality.

• Deposit: Hodl time, double your points. USDf 6x

• Staking: Much less points, Falcon USDf 1x

• Rebate: The more people you have, the higher the rebate

• Specific behavior: associated protocols, such as Resolv 19

However, the points system is not synonymous with airdrops and tokens. Under the usual "off-chain calculation, front-end display" mode, whether you can get the Farm rewards as scheduled is up to fate.

3. Market Volume

Ethena’s success is certainly due to its excellent design, but it is also inseparable from the support of Arthur Hayes himself. Referring to past successful cases, we can roughly summarize three models:

• User reach: KOL + media, playing a smaller and smaller role, closer to regular actions.

• Off-chain legitimacy: USD1 is backed by Trump, JD.com, Walmart and other large companies.

• Big Name: Arthur Hayes serves as a personal endorsement for Ethena.

I feel that I don’t fully understand the market voice. If you have any ideas, please feel free to share them in the comment section.

4. Fuzzy Strategy

APR VS APY, simple interest and compound interest are both vague financial indicators, and potential crises can also create credit leverage.

• Falcon has off-chain assets involved in profit calculations, so the theoretical optimum and practice are not completely consistent;

• Even for the same indicator, the calculation period is different, for example, Falcon uses 7D, Level uses 1Ys as the period, and Noon has not yet been announced

Even if the calculation method is the same, the off-chain parts of each YBS will also participate in the calculation, such as CEX order data, or foundations, audits, etc., which are black boxes that cannot be tracked in real time. There is a lot of room for manipulation of the details in the middle.

The YBS market is still a battle for yield data, and the use of specific strategies requires users to actively explore in order to amplify the yield and participate in this gold-digging feast.

Conclusion

The fewer your needs, the closer you are to God.

YBS looks extremely simple on the surface, and its 1:1 anchoring to the U.S. dollar provides lasting security, but the stacking behind it is extremely complex.

For the general public, deposit collection and lending have always been social and political events, both in the East and the West. Based on this, we have gone deep into YBS and explained the basic features of healthy project parties from the perspective of project parties. Starting a business is difficult. How many of the 100 YBS projects can survive?