1. Market observation

Trump announced that he had reached a major trade deal with Japan, under which Japan will invest $550 billion in the United States, while the United States will impose a 15% tariff on Japanese imports, a move that has a significant impact on industries such as automobiles and has driven up Japanese stocks. At the same time, the third round of US-China trade negotiations is scheduled to be held in Stockholm, Sweden next week, aimed at delaying a key tariff deadline. U.S. Treasury Secretary Bessant revealed that the negotiations may involve issues such as China's purchase of sanctioned Russian and Iranian oil. In addition, the Trump administration's upcoming "AI Action Plan" will focus on the three pillars of infrastructure, innovation, and global impact, and will promote the United States' leading position in artificial intelligence through "carrots rather than sticks" such as removing regulatory barriers and simplifying licensing processes.

In terms of domestic policy in the United States, President Trump and Treasury Secretary Benson have both publicly stated that the Federal Reserve should lower interest rates to stimulate the economy, and Trump has even bluntly stated that he hopes the interest rate will drop to 1%. In this regard, Ray Dalio, founder of Bridgewater Associates, believes that the essence of this debate is a game about the value of currency. Trump tends to stimulate the economy through currency devaluation, while Federal Reserve Chairman Powell tries to defend the value of currency. Dalio pointed out that market indicators such as the current record high of US stocks and the relative depreciation of the US dollar have shown signs of monetary policy easing, and he predicts that the US dollar will continue to weaken.

At the application level of cryptocurrency, Jeffrey Ding, chief analyst of HashKey Group, pointed out that the reason why stablecoins have taken the lead in causing a revolution in the field of cross-border payments is that they can effectively solve the pain points of the traditional financial system. Traditional cross-border payments rely on the SWIFT network, which is not only complicated and costly (the global average handling fee is as high as 6.2%), but also has a long period of arrival. Especially in countries such as Argentina and Nigeria where capital flows are restricted and the local currency has been depreciating for a long time, stablecoins provide an important way to obtain stable assets and conduct efficient transactions. It does not need to rely on the local banking system and can be completed through peer-to-peer transactions, avoiding the complex transformation of traditional financial infrastructure, so it is particularly suitable for emerging markets with weak financial services. In contrast, the application of stablecoins in areas such as retail payments or wealth management requires a comprehensive reconstruction of the existing banking system, which faces much greater resistance.

Bitcoin entered a consolidation phase after hitting a record high of $123,100. Glassnode data showed that the market was in a "healthy but fragile balance", with the $115,000-120,000 range absorbing a cumulative selling pressure of $640 million. Many analysts are optimistic about the market outlook, but there may be a correction in the short term. Analyst CJ believes that the price may first pull back to around $115,717 before hitting the high point. Mac pointed out that if the high time frame can be maintained above $113,000, the next target may be $130,000. Analyst Ali gave a bullish target of $131,200, provided that the support of $117,400 is maintained. Bitfinex Alpha and analyst Axel Adler Jr. set their sights on the resistance range of $136,000 to $139,000, believing that the market has not yet entered an overly optimistic stage. Some analysts, such as Titan of Crypto and Merlijn The Trader, predict that Bitcoin's ultimate target may reach $140,000 based on technical patterns such as "bull flags" and "head and shoulders bottoms".

Ethereum has experienced a pullback after eight consecutive days of growth. The current price is about $3,750, and its relative strength index (RSI) has entered the overbought zone. Analyst Tradermayne believes that Ethereum has not turned bearish, and a pullback to the $3,200-3,400 range would be an ideal long opportunity. Analyst Crypto Chase also said that the $3,400 range is a key support and liquidity resonance area. Analyst Yashu Gola predicts that Ethereum may pull back to the $3,000 to $3,200 range in August, and is expected to re-challenge the $4,000 mark. Some analysts are even optimistic that it will reach $8,000 in the next few months.

In the altcoin market, the price of Zora tokens has soared to a record high after being announced to be integrated by Base APP, with an increase of nearly 300% since July 17. In addition, LetsBonk's market share has surged from 5% to 64% in a month, in sharp contrast to Pump.fun's market share plummeting from 90% to 24%. The platform's token issuance continues to grow, and popular meme coins such as $TRUST (market value of $6.3 million) with the concept of a borderless e-commerce platform and $DNUT (market value of $3.4 million) associated with Reddit community culture have emerged in the past 24 hours.

2. Key data (as of 12:00 HKT on July 23)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)

Bitcoin: $118,684 (+26.9% YTD), daily spot volume $51.971 billion

Ethereum: $3,732.23 (+11.69% YTD), with daily spot volume of $48.862 billion

Greed Index: 75 (greed)

Average GAS: BTC: 0.58 sat/vB, ETH: 0.46 Gwei

Market share: BTC 60%, ETH 11.5%

Upbit 24-hour trading volume ranking: STRIKE, XRP, SOL, PENGU, ETH

24-hour BTC long-short ratio: 50.18%/49.82%

Sector ups and downs: NFT sector rose 10.67%; CeFi sector rose 3.29%

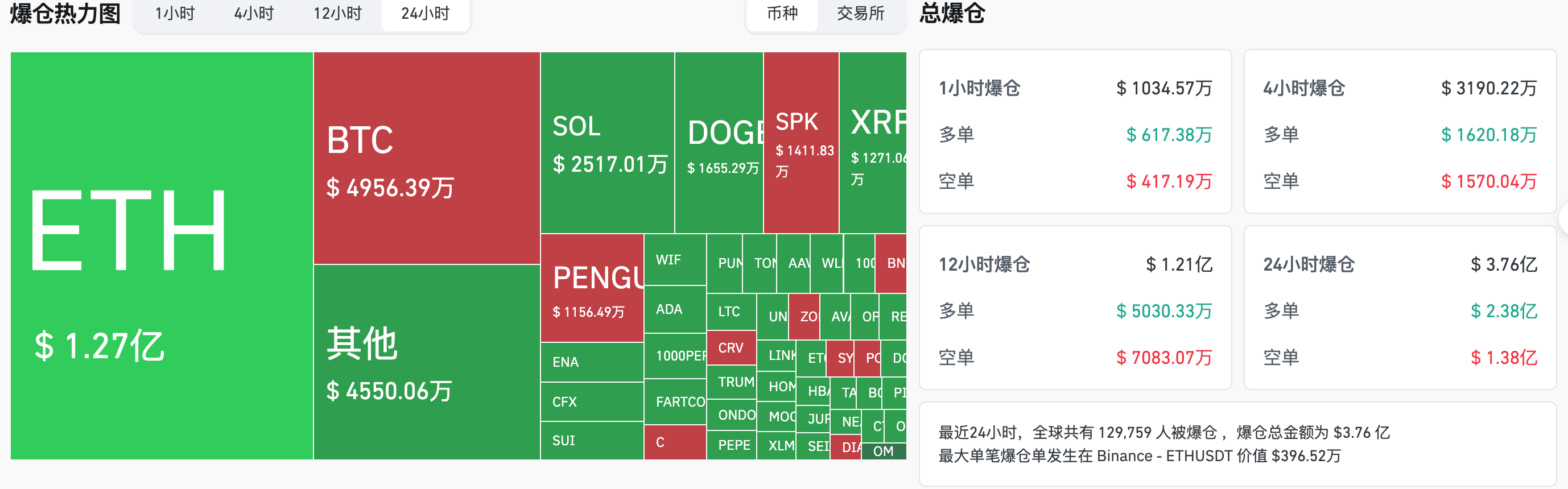

24-hour liquidation data: A total of 129,759 people were liquidated worldwide, with a total liquidation amount of US$376 million, including BTC liquidation of US$49.56 million, ETH liquidation of US$127 million, and SOL liquidation of US$25.17 million.

BTC medium and long-term trend channel: upper channel line ($118,302.75), lower channel line ($115,960.12)

ETH medium and long-term trend channel: upper channel line ($3427.96), lower channel line ($3360.08)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend; otherwise, it is a bearish trend. When the price passes through the cost range repeatedly within the range or in the short term, it is a bottoming or topping state.

3. ETF flows (as of July 22)

Bitcoin ETF: -67.9322 million USD, only Grayscale ETF GBTC achieved net inflow

Ethereum ETF: +$534 million, the third highest in history

4. Today’s Outlook

Jack Dorsey's Blockchain to be included in the S&P 500 Index on July 23

Avail (AVAIL) will unlock approximately 972 million tokens at 4 pm on July 23, accounting for 38.23% of the current circulation, worth approximately US$18.9 million;

SOON (SOON) will unlock approximately 41.88 million tokens at 4:30 pm on July 23, accounting for 22.41% of the current circulation and worth approximately US$6.1 million.

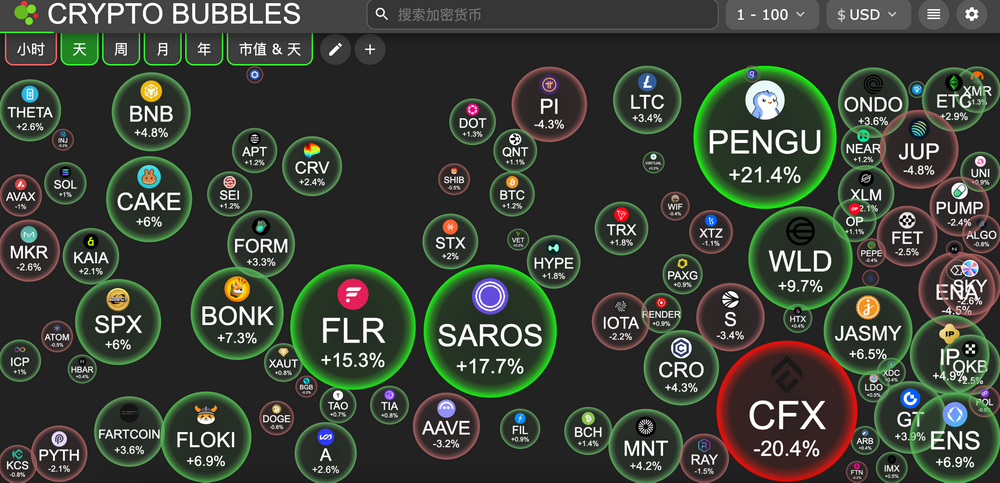

The biggest gainers in the top 100 by market value today: Pudgy Penguins up 21.4%, Saros up 17.7%, Flare up 15.3%, Worldcoin up 9.7%, and Bonk up 7.3%.

5. Hot News

Trend Research allocates ENS again after a year, withdraws $5.5 million worth of ENS from Binance

Arca transferred 2.183 million PENDLE to Kraken, with an estimated profit of $2.13 million

LetsBonk Grows Market Share to 64% on Solana Meme Token Launch Platform

21Shares Submits S-1 Documents Related to ONDO ETF to the US SEC

Nano Labs Increases BNB Strategic Reserve to $90 Million, Plans to Upgrade Reserve Strategy

SPACEX transfers $152 million worth of BTC for the first time in three years

Mexican Real Estate Company Grupo Murano Plans to Build $10 Billion Bitcoin Vault in Five Years

Mercurity Fintech reaches $200 million SOL funding agreement with Solana Ventures

Strategy spent about $740 million to buy 6,220 bitcoins last week

This article is supported by HashKey, the largest licensed virtual asset exchange in Hong Kong and the most trusted crypto asset fiat currency portal in Asia. HashKey Exchange is committed to defining new benchmarks for virtual asset exchanges in terms of compliance, fund security, and platform security.