Author: Nancy, PANews

As early entrants such as MicroStrategy have firmly established their voice, it is difficult for new institutions to replicate their market recognition and capital returns, and more companies are beginning to turn their attention to Ethereum. Compared with simple asset appreciation, Ethereum is opening its doors to institutions in another way, not only providing stable and sustainable on-chain income, but also allowing these institutional pledgers to become "miners" and deeply participate in ecological construction, and promoting the entire pledge track to accelerate its evolution towards compliance and scale.

Institutions bet on Ethereum, from asset reserves to pledged "big miners"

Bitcoin hit a new record high, and the driving force behind it has shifted from retail investors to institutions. The approval of the Bitcoin spot ETF has built a compliance bridge for Wall Street to enter the market; listed companies represented by Strategy have realized a significant increase in book assets after listing BTC as a financial reserve asset, which has been highly recognized by the capital market and enhanced the credibility of Bitcoin as an asset allocation, thus attracting more institutions to follow suit.

However, the Bitcoin reserve story has matured. MicroStrategy has the advantage of early position building, voice and capital advantages, and its model is difficult to replicate, making it difficult for latecomers to achieve similar brand premiums and market recognition by allocating BTC. For most traditional institutions entering the market, allocating BTC is more like a diversified asset allocation rather than a growth strategy.

A new round of growth points and strategic windows are gradually migrating to Ethereum, and more institutions are starting ETH reserve strategies. However, in terms of reserve logic, Bitcoin and Ethereum have taken different routes.

As we all know, in Bitcoin, newly produced BTC is directly distributed to miners through mining rewards. From the perspective of the proportion of coins held, if the institution is not a miner, it must continue to buy BTC to maintain the relative holding ratio without dilution. In Ethereum, since the switch to the PoS consensus mechanism, as long as you stake ETH and participate in network verification, you can get new ETH as a reward. For institutions, staking ETH can hedge the dilution risk caused by the increase in ETH. According to ultrasound.money data, as of July 18, 35.8 million ETH were staked, with an annualized rate of return for stakers of 2.8%, while non-stakers faced an annualized destruction rate of about 1.4%.

In other words, compared to waiting for Bitcoin to appreciate after purchase, Ethereum reserve institutions can profit by participating in the network. Many listed institutions have taken the lead. SharpLink Gaming, BitMine, Bit Digital and GameSquare have started Ethereum strategic reserve attempts and have achieved initial results. Among them, BitMine and Bit Digital have even transformed from Bitcoin to Ethereum strategic reserves. For them, ETH is not just a book asset, but a productive asset that participates in the ecosystem, and it is also a channel for them to become institutional "miners".

Ethereum's destruction mechanism further strengthens this logic. When the Ethereum network is active (high transaction volume and high basic fees), the amount of ETH destroyed increases. If the destroyed ETH exceeds the newly issued ETH, the network will enter a deflationary state. This not only enhances the scarcity of ETH, but also increases the actual benefits of stakers and validators, including MEV and fee income, and strengthens the intrinsic value of ETH assets.

It can be foreseen that as more institutions flock in and participate in the Ethereum staking market, they will no longer be just fund providers in the market, but will also play the role of large miners.

At present, Ethereum's strategic reserve layout is in its early stages. For companies that want to build financial voice, ETH is still a fair competition that has not yet been monopolized.

Ethereum staking will enter the institutional era, and the staking track will usher in new opportunities

As the Ethereum market becomes increasingly institutionalized, the staking market will also shift from crypto-native to institution-driven, and move towards a new stage of compliance and scale.

In addition to Ethereum micro-strategists actively participating in staking through free reserve assets, ETF issuers are also accelerating their layout. In recent months, Ethereum spot ETF issuers including BlackRock, Grayscale, Fidelity and Bitwise have also submitted applications to the SEC to add staking functions.

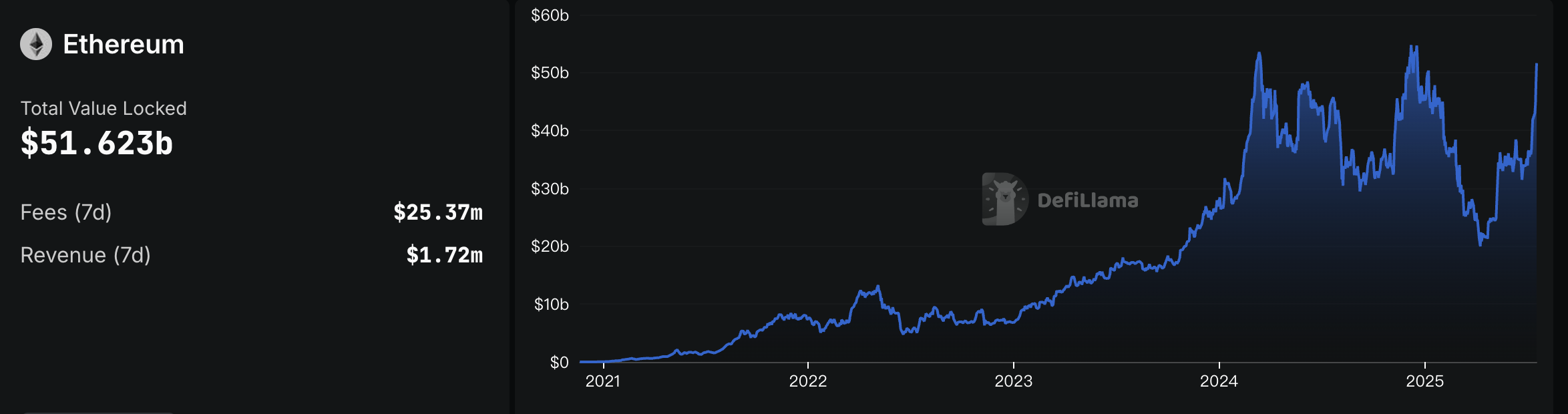

Once these ETFs are flooded with institutional liquidity, the market size of the Ethereum staking track will be further expanded. According to DefiLlama data, as of July 18, the TVL of the liquidity staking track on Ethereum reached US$51.62 billion, close to a record high and up 142.5% from the low point in April.

According to Mindao, the founder of dForce, Ethereum's coin-share companies have two special financing facilities. In addition to using staking income as cash flow to support interest-paying financing, they can also use staking income and on-chain DeFi operations as another dimension of the valuation model, which may have a greater premium than the pure NAV model. For example, GameSquare currently plans to cooperate with Dialectic to invest ETH reserves in DeFi basic businesses such as lending, liquidity provision and re-staking; BTCS also uses Aave for DeFi lending, etc. This means that staking and other DeFi tracks may usher in a revaluation of value.

At the same time, although the attitude of institutions has gradually turned positive, they have also put forward high standards for the security, compliance and liquidity management capabilities of the protocol. At present, many institutions have clear selection criteria for pledge partners. For example, 21Shares chose Coinbase as a partner in the pledge application documents, demonstrating its requirements for its compliance capabilities and technical reliability; SharpLink Gaming adopts a diversified cooperation method, conducting pledge business through Figment, Liquid Collective and Coinbase. This type of strategy also shows that institutions pay more attention to risk diversification and service provider capabilities when deploying pledge business, which may lead to further marginalization of pledge agreements for small and medium-sized nodes.

At present, the Ethereum liquidity pledge market also shows an obvious head effect. According to DefiLlama data, as of July 18, 2025, the TVL of the entire liquidity pledge track reached US$51.62 billion, close to a record high. Among them, Lido occupies a dominant position, with a TVL of more than US$33.18 billion and a market share of more than 60%, far ahead of other protocols. Binance, Rocket Pool, StakeWise, mETH Protocol and Liquid Collective form the second echelon, with TVLs at the US$1 billion level. The TVLs of the remaining projects are mostly at the level of tens of millions of dollars or even lower. In addition, Ethereum pledge projects also include EigenLayer, Swell, Renzo, Puffer Finance, SSV Network and Pendle, covering subdivided tracks such as re-staking, infrastructure and LSTfi.

From the accelerated entry of various "micro-strategies" to the continued advancement of ETF issuers, Ethereum's market sentiment has been ignited, but whether the reserve narrative can continue to support the continued development of the staking market still needs time and practice to test.