1. Market Observation

On Thursday, US President Trump signed an executive order establishing "reciprocal" tariff rates covering goods from multiple countries, ranging from 10% to 41%. Countries without an agreement will face higher rates, including India at 25%, Switzerland at 39%, and South Africa at 30%. Tariffs on Canadian goods will be raised from 25% to 35%, and transshipped goods will be subject to a 40% transshipment tax. The White House stated that this move is intended to protect US manufacturing and address trade imbalances.

According to the latest data, the core PCE price index rose 2.8% year-on-year in June, exceeding market expectations and hitting a five-month high, indicating persistent inflationary pressures. However, the economy is showing signs of weakness. Consumer spending growth has slowed, and real disposable income has remained flat, which has constrained consumer spending and kept the household savings rate at a relatively cautious 4.5%. Although the FOMC held interest rates steady for the fifth consecutive time this week, two members voted in favor of a rate cut, a rare first in more than three decades. Federal Reserve Chairman Powell clarified after the meeting that the current resilient labor market is the primary determinant of monetary policy, with the unemployment rate becoming the core determinant. With only 24 hours remaining in the "super 72 hours," the market is holding its breath for tonight's non-farm payroll data, which may be crucial in determining the ultimate direction of Powell's policy. Currently, the probability of a September rate cut has dropped to 50-50.

Against the backdrop of active regulatory developments, Hong Kong's upcoming Stablecoin Ordinance, which is expected to be implemented in August, is also attracting much attention. Jeffrey Ding, Chief Analyst at HashKey, noted that this move marks the official entry of stablecoin technology into regulatory oversight. Its clear framework and credibility are attracting numerous strong companies to apply for issuance licenses. This signals the technology's transition from proof-of-concept demonstrations to large-scale commercial deployment. To this end, HashKey is actively developing and striving to simultaneously enhance its comprehensive capabilities across trading, custody, clearing, and risk management, aiming to build an infrastructure capable of efficiently facilitating cross-border capital flows and thus promoting the deep integration of stablecoins with the real economy. Bitcoin briefly dipped below $115,000 this morning but has since rebounded above $115,500. Analyst Altcoin Sherpa noted that market conditions could deteriorate if Bitcoin falls below the key support level of $114,000. TheBreakoutZone believes that if the current downward trend fails, the next high-risk-reward zone of concern is between $111,700 and $113,500. At the current price, data from Hyblock Capital indicates $115,883 is a key liquidation level. KillaXBT, based on analysis of buy and sell orders, suggests that if the price forms a higher low at $115,700, it may struggle to reach $113,800. Looking ahead to the upside, analyst Captain Faibik suggests that if bulls can successfully break through the descending wedge resistance at $118,000, it will open the door to a new all-time high. Swissblock also noted that while Bitcoin has encountered resistance at $118,000, the market is absorbing selling pressure, preparing for the next breakout. KillaXBT further predicts that if a breakout occurs, short strategies may need to wait for the price to reach the $125,000 to $127,000 range before considering it. Fundamentally, Charles Edwards, founder of Capriole Investments, observed a significant increase in corporate buyers over the past six weeks, with the buy-to-sell ratio reaching an astonishing 100:1. Meanwhile, spot ETFs have seen a resumption of net inflows, and news of the White House's plan to establish a strategic Bitcoin reserve has significantly boosted market sentiment.

Furthermore, Ethereum briefly dipped to around $3,600 this morning. Analyst Big Smokey noted that despite continued selling pressure at the $4,000 mark, ETH's rebound has outpaced Bitcoin's, primarily due to aggressive buying by retail investors following long-term liquidation pressure around $3,600. Its cumulative funding rate briefly turned negative, a signal for buying. However, market caution persists. CryptoQuant analyst Axel Adler Jr. noted that Ethereum has repeatedly failed to break through the psychological barrier of $4,000 since March of this year. Furthermore, its ecosystem TVL and DEX trading volume share have declined compared to competitors like Solana and BNB Chain. Weak on-chain activity has heightened investor concerns. Despite this, Axel Adler Jr. also proposed a potentially positive scenario: if companies continue to increase their ETH reserves, the price could potentially reach $5,000. In terms of trading strategy, analyst 0xSun adopted a hedging strategy, going long on Ethereum while shorting a basket of altcoins. The logic behind this is that institutional funds tend to flow into ETH, the main market driver, while altcoins face greater uncertainty. The most eye-catching development yesterday was undoubtedly the SEC's policy shift. SEC Chairman Paul Atkins announced the launch of "Project Crypto," a commission-wide initiative aimed at establishing the United States as a global hub for crypto assets by revising securities rules. The plan includes establishing clear token classification standards, updating custody rules, streamlining trading licenses, establishing a principled regulatory pathway for DeFi and tokenized assets, and introducing an "innovation exemption." There was also significant news in the traditional financial sector: Bridgewater Associates founder Ray Dalio officially resigned from the board, ending his tenure at the firm. Bridgewater Associates also introduced the Brunei Sovereign Wealth Fund as a new major shareholder. Furthermore, design giant Figma successfully went public and revealed a significant Bitcoin holding. Its stock surged 250% at the opening and rose another 25% after hours, currently trading at $115. It is reported that Figma holds 700,000 BTC and plans to increase its holdings. On-chain data shows that its founder Dylan Field's address holds 2.3 million AGLD tokens, worth US$1.76 million.

2. Key Data (as of 12:00 HKT, August 1)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)

-

Bitcoin: $115,619 (+23.51% YTD), daily spot trading volume: $52.244 billion

-

Ethereum: $3,682.83 (+11.05% YTD), daily spot trading volume: $34.676 billion

-

Fear of Greed Index: 65 (Greed)

-

Average Gas: BTC: 3 sat/vB, ETH: 0.23 Gwei

-

Market Share: BTC 61.1%, ETH 11.8%

-

Upbit 24-hour Trading Volume Rankings: XRP, STRIKE, ETH, BTC, ENA

-

Sector gains and losses: NFT down 8.98%; Meme down 8.73%

-

24-hour liquidation data: 160,329 people worldwide were liquidated, totaling $630 million, including $151 million in BTC, $182 million in ETH, and $37.32 million in SOL.

-

3. ETF Flows (as of July 31)

-

Bitcoin ETF: -$115 million, the first net outflow after net inflows over the past five days

-

Ethereum ETF: +$16.9996 million, continuing a 20-day trend. Daily Net Inflow

4. Today's Outlook

-

Trump Says Tariff Deadline Will Not Be Extended, Ends on August 1

-

Indonesia will increase cryptocurrency transaction taxes on August 1st

-

Binance will delist the XVS/TRY and YGG/TRY spot trading pairs on August 1st

-

Sui (SUI) will unlock approximately 44 million tokens on August 1st, representing 1.27% of the current circulating supply and valued at approximately US$188 million;

-

-

Ethena (ENA) will unlock approximately 40.63 million tokens at 3:00 PM on August 2nd, representing 0.64% of the current circulating supply and valued at approximately $25 million.

-

US July unemployment rate: Previous value: 4.10%, expected value: 4.20% (August 1st, 8:30 PM)

-

US July seasonally adjusted non-farm payrolls (10,000): Previous value: 14.7%, expected value: 11

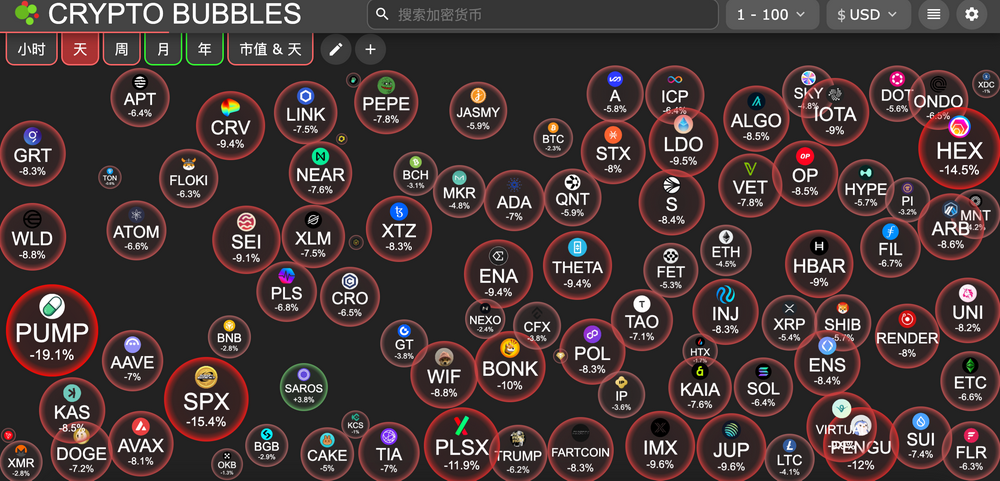

The biggest decliners in the top 100 stocks by market capitalization today: Pump.fun fell 19.1%, SPX6900 fell 15.4%, HEX fell 14.5%, Pudgy Penguins fell 12%, and PulseX fell 11.9%.

5. Hot News

-

Strategy Achieves $14 Billion in Operating Revenue and $10 Billion in Net Profit in Q2

-

US Stock Market Closes: All Three Major Indexes Fall, Newly Listed Figma Soars 256%

Coinbase Increases Bitcoin Holdings by 2,509 in Q2, Bringing Total Holdings to 11,776

"Ancient whale holding 3,963 BTC after 14.5 years" sells another 180 BTC

US Core PCE Price Index Annual Rate: 2.8% in June, Month-over-Month Rate: 0.3%

Data: The cumulative value of ETH treasury reserves held by 64 entities has exceeded $10 billion

Listed company xTAO holds $16 million in TAO, becoming Bittensor's largest public coin holder

DoubleZero has launched a 3 million SOL staking pool and released the staking token dzSOL

This article is supported by HashKey. HashKey Exchange is the largest licensed virtual asset exchange in Hong Kong and Asia's most trusted crypto-to-fiat gateway. It is committed to setting new standards for virtual asset exchanges in terms of compliance, fund security, and platform assurance.

-