Author: Tindorr , Crypto KOL

Compiled by: Felix, PANews

It used to be thought that Ethena was just a stablecoin protocol - a synthetic dollar (USDe) that provided a stable yield and some nice integrations.

When Ethena Labs founder G announced Ethena’s “convergence” roadmap in January this year, he did not realize what was about to happen.

But as my research progressed, I gradually realized that my thinking was too narrow.

Ethena is not just building a better stablecoin, it is building the monetary infrastructure of the Internet: a system that combines the capital efficiency of cryptocurrency with the regulatory trust layer of traditional finance.

$ENA is becoming the face of this shift.

Rather than chasing a single narrative, Ethena now touches nearly every major macro vertical:

- Stablecoins

- RWA

- Perpetual Contract Trading and DeFi Application Ecosystem

It’s about the confluence of multi-billion dollar trends — stablecoin monetization, RWA tokenization, and the rise of on-chain financial infrastructure.

Here’s a breakdown of why Ethena may be the protocol best positioned to capture it all, from the release of the roadmap and the progress made since.

1. Ethena’s Stablecoin: The Liquidity Engine That Drives Everything

While most protocols only issue one stablecoin, Ethena has built an integrated stablecoin system - each asset plays a different role depending on market conditions or user characteristics, but all are driven by the same underlying engine.

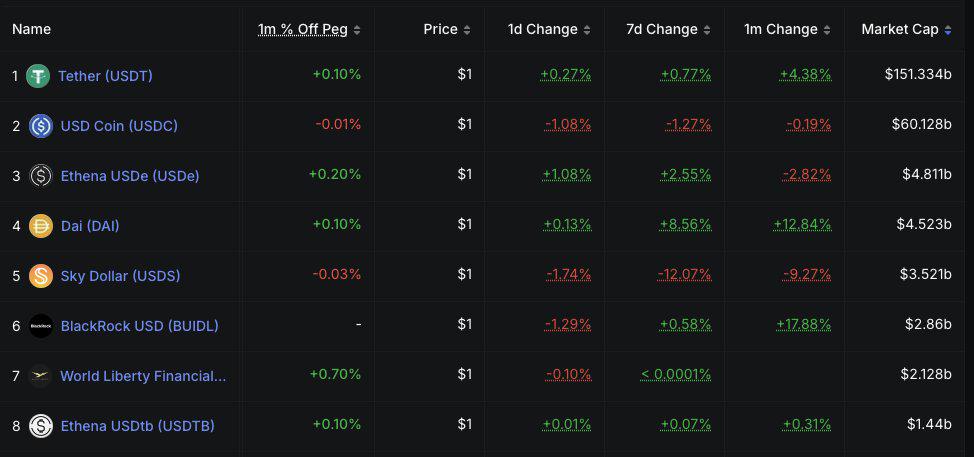

USDe and USDtb rank among the top ten stablecoins

USDe: The third largest stablecoin (market cap $4.81 billion)

USDe is the synthetic dollar that starts it all.

USDe is the base layer of DeFi liquidity. With a supply of over $4.8 billion, it thrives in risk-on markets - leveraging the perpetual funding premium to generate sustainable on-chain returns.

This is not just passive capital, this is efficient liquidity, plugged into every major DeFi stack.

USDtb: 8th largest stablecoin (market cap $1.44 billion)

USDtb comes into play when yields fall or volatility spikes.

USDtb is backed by tokenized U.S. Treasuries backed by BlackRock’s BUIDL fund, providing a safe-haven and yielding alternative for traditional finance (TradFi) users.

It enhances the resilience of the Ethena system and balances the dynamic returns of USDe and the stability of Treasury levels.

Today, both assets are ranked among the top ten stablecoins, and Ethena has secured its place at the heart of crypto liquidity.

2. sUSDe: The engine driving Ethena’s expansion

By staking USDe, you can get sUSDe, the yield version of Ethena's synthetic dollar. Supported by protocol revenue, sUSDe has become the core driver of Ethena's integration and liquidity growth.

As the market warms up, the annualized yield has rebounded to around 8%, and sUSDe has once again become one of the most combinatorial and reliable on-chain sources of income in DeFi.

Here’s how it works:

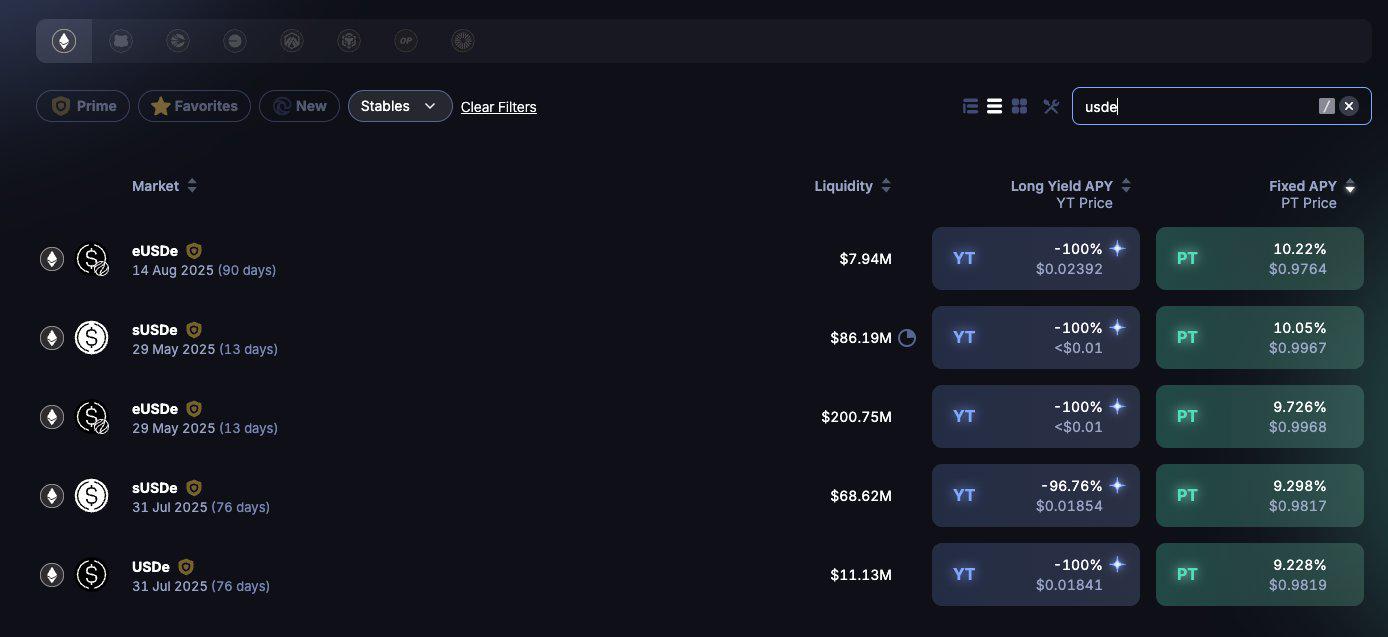

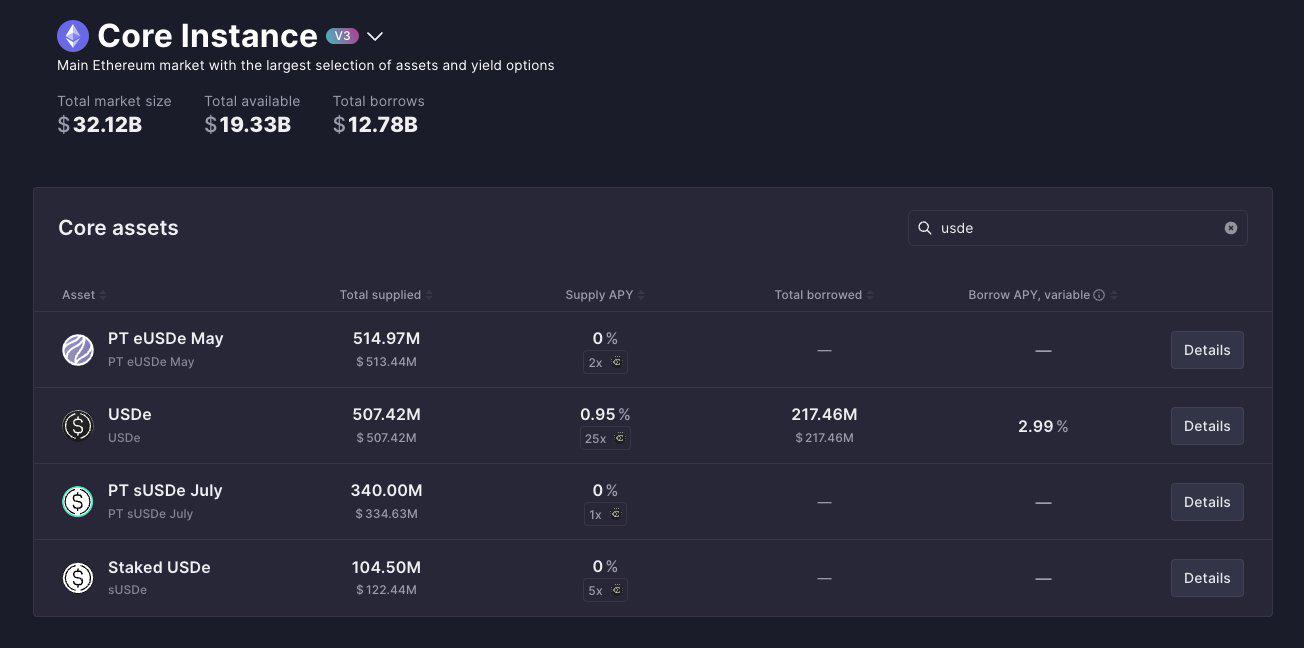

1. Pendle and Aave: Maximizing returns and capital efficiency

In Pendle and Aave, USDe/sUSDe has gradually become the preferred stablecoin for fixed income, lending, and leverage cycles:

- The yields of PT USDe, PT sUSDe and PT eUSDe have always remained in the range of 9-10%.

- These PTs are also supported on Aave, enabling native DeFi fixed income strategies.

- eUSDe, the version staked on Ethereal, further deepens liquidity and increases composability.

2. Hyperliquid x HyperEVM: New territory for USDe

Ethena’s move into Hyperliquid Exchange and HyperEVM kicks off significant distribution:

- USDe is listed on Hyperliquid and provides airdrop rewards to holders.

- USDe quickly became a top 4 asset by trading volume on the exchange.

- On HyperEVM, power Curve pools for USDe and sUSDe (such as feUSD/USDe) enhance anchor stability and cross-chain capabilities.

- Rewards are automatically distributed through Merkl and do not need to be claimed manually.

In short: Ethena is embedding into Hyperliquid’s native liquidity layer, the fastest growing ecosystem.

3. TON + Telegram: Internet Currency for One Billion Users

The biggest unlock?

Providing savings accounts to Telegram’s 1 billion+ users through the integration of Ethena x TON.

- USDe/tsUSDe has been launched in all major TON wallets (coming soon)

- Users can send, spend and save USDDe just like Toncoin or USDT

- The mini program allows users to earn up to 18% annualized rate of return (8% native income + 10% TON bonus through TON chain)

- Rewards are distributed seamlessly on-chain via tsUSDe

Ethena is more than just a DeFi application, it is becoming the native savings layer for emerging markets and mobile-first users around the world.

sUSDe is a scalable yield layer

From efficient DeFi strategies (Pendle, Aave) to the trading volume of centralized exchanges (Hyperliquid) and the scale of Web2 (TON), sUSDe is driving Ethena's transformation from the protocol layer to the currency layer.

Clearly, Ethena has become a savings engine for millions of users. Detailed below are two milestones that will further accelerate this growth.

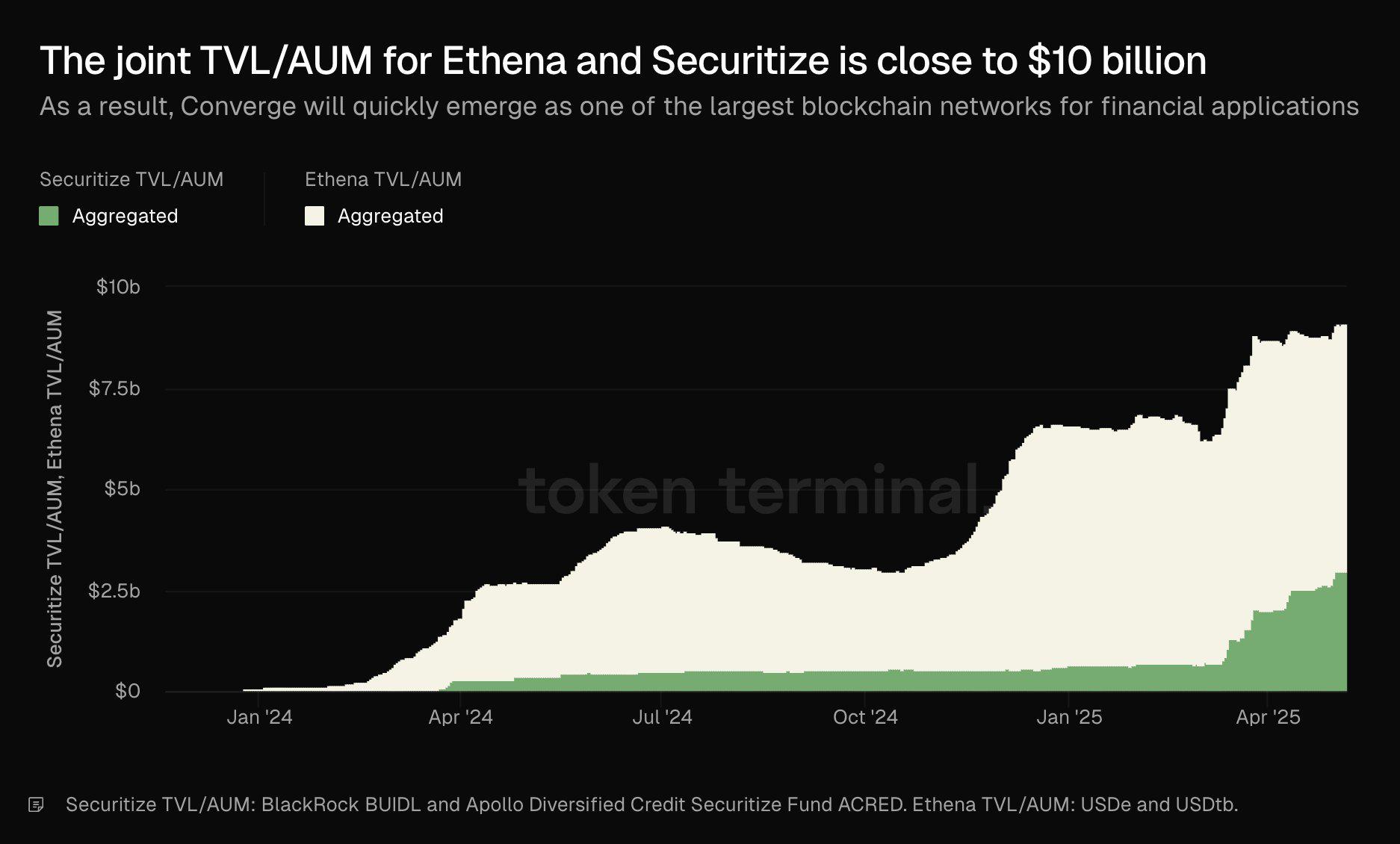

1. Real World Assets — Powered by Converge

Converge is a settlement layer built specifically for digital dollars and institutional finance, developed by Ethena Labs and Securitize. It aims to enable large-scale RWA tokenization by connecting regulated financial entities directly to Ethena's stablecoin infrastructure.

With Converge, TradFi is able to access on-chain finance at an institutional scale. And the scale is real:

Ethena and Securitize together manage nearly $10 billion in assets. This alone would make Converge’s launch comparable to Solana’s TVL.

Key details:

- Expected to be launched in the second quarter of 2025

- Gas Tokens: USDe and USDtb

- Staking/Validation: sENA staking via the Converge Validator Network (CVN)

- As regulation and real-world issuance continue to increase, Converge is positioning Ethena as the trusted backend for tokenized capital markets.

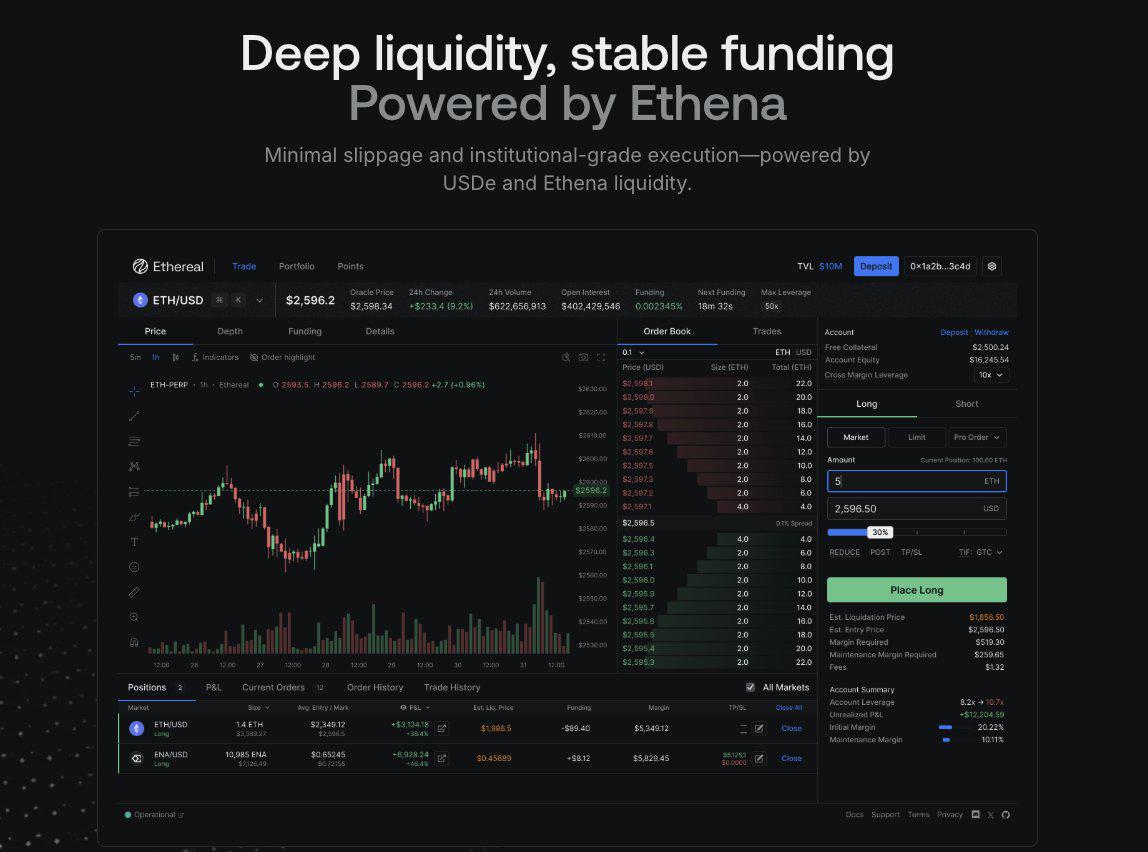

2. Ethereal: Native perpetual and spot DEX built on Ethena

Ethereal is the first mainstream application launched on the Ethena network. It is a next-generation spot and perpetual DEX with deep liquidity and institutional-grade execution.

It is fully powered by Ethena's ecosystem:

- USDe and sUSDe constitute the basic liquidity layer

- LP gets points and income rewards

- Execution mechanism designed to reduce slippage and provide order book transparency

Progress is currently good: more than $1.2 billion has been deposited during Season Zero.

$ENA: From Stablecoin to On-chain Financial Innovation

Staked $ENA is no longer just a governance tool, it is becoming the key to extracting value from Ethena's expanding entire ecosystem.

With sUSDe opening new yield tracks and applications like Ethereal and Converge coming online, $ENA is at the center of it all.

Ethena’s 2025 strategy:

- Product layer → Make USDe one of the most important stablecoins in the crypto space

- Application layer → Empowering DeFi native platforms such as Ethereal

- Token layer → Simulate the flywheel effect of BNB and return ecological value to $ENA holders

The strategy is already moving forward and more people will soon realize it.

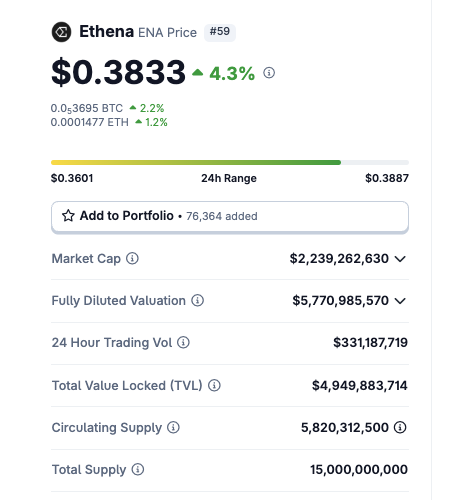

Valuation Assessment:

$ENA has a market cap of ~$2.2 billion and is still undervalued relative to its momentum:

- Backed by over $6 billion in USDDe liquidity

- Surrounded by an ever-expanding real-world and on-chain integration

The key to its valuation today is whether the market realizes what Ethena is becoming?

From digital dollars to institutional rails, Ethena is building the monetary backend of crypto-native finance. If successful? $ENA is not just a token, it will become the representative of Internet-native capital in the next cycle.

Related reading: ParaFi Capital: How did Ethena grow into the cornerstone of DeFi in a year and a half?