Written by: danny

“True safety lies not in predicting the future but in designing a structure that can survive whatever the future brings.” — Mark Spitznagel, Safe Haven: Investing for Financial Storms

If you take too much risk, it will likely cost you wealth over time. And at the same time, if you don't take enough risk, it will also likely cost you wealth over time.

Mark Spitznagel is one of the most famous hedge fund managers on Wall Street and a partner of Nassim Taleb (author of The Black Swan and Antifragile). Universa Investments, founded by him, is one of the very few funds in the world that truly focuses on "tail risk hedging" and made huge profits in 2008 and 2020. (He is known as the King of Black Swan)

The core of this book is: how to build an investment portfolio (Safe Haven Portfolio) that can protect principal in extreme events .

Introduction: We are approaching the next big rift

History doesn't repeat itself, but it does rhyme.

Today in 2025, we are standing at a paradoxical point in time: US stocks continue to hit new highs, but long-term bond yields are above 4.5%; the dollar is strong, but consumption is weak; AI makes capital revel, but the world is caught in fragmentation and war risks; PumpFun has just been banned by X, and TRON has boarded the president's ship and boarded NASDAQ...

Israel and Iran have just finished a round of drone war; India and Pakistan have increased their troops on the border; Russia's Black Sea Fleet was blown back, and the Ukrainian Air Force obtained authorization from the West to directly attack the Russian mainland; and in the United States, Trump's "madness" may make a comeback, and the era of tariffs + monetary easing may return.

1. The ultimate truth about wealth in troubled times: It’s not about making the most money, but about being able to afford to lose.

Mark Spitznagel, the author of Safe Haven, has a unique position in the financial circle. He is not a slow-burning compounder like Buffett, nor a speculator like Soros.

He only does one thing: designing investment portfolios that can survive "black swan events . "

This sounds plain, but it is an extremely rare wisdom - especially when everyone is talking about "growth", "innovation" and "AI" today. In the book, he puts forward a cruel but true fact:

His famous quote: "What really determines your wealth is not the average rate of return, but whether you can avoid a "zero return" moment."

He used mathematics and history to prove that even if an investment portfolio earns 15% every year, it will never recover if a black swan event occurs that loses 80%. There is no such thing as a safe haven asset, only an investment structure that can afford to lose.

It’s not about holding one “gold” or “bitcoin”, but about building a portfolio structure that can survive the storm.

Compound interest does not break in growth, but in disaster.

2. 5 life-saving investment rules from Safe Haven

In this book, Spitznagel not only criticizes the blind spots of traditional asset allocation, but also proposes five very hard-core risk-averse strategies suitable for "extreme times":

1. Safe assets ≠ low volatility assets

Many people misunderstand "stability" as "security".

In 2008, gold and bonds both fell at one point, and the only thing that rose was the long-term deep put option (SPX PUT) .

A true safe haven asset is one that can explode in the face of a systemic collapse . A true “safe haven” asset is one that rises when everything is bad.

2. When the Black Swan arrives, the magic of compound interest will backfire on you

If you lose 50% at a time, you need to gain 100% to get your money back. But a black swan is often not a loss of 50%, but a sudden drop to zero.

His conclusion was simple: instead of just gambling on survival, you have to design a structure that ensures survival.

" The compounding effect is the most destructive force in the universe." (Different thinking from Buffett)

3. Don’t predict the future, but prepare for the “worst” structurally

"You can't predict. You can only prepare."

"Prediction" is an illusion for most investors, and preparation is the real way to control risks.

You can’t predict wars, financial crises, or regime changes—but you can allocate your assets so that they “will not die” in any of the outcomes.

4. Convex return structure is the real safe-haven magic weapon

A convex payoff structure means:

Small loss or break-even in normal times

In extreme cases, the number can double or even increase by dozens of times.

For example: VIX long, SPX deep put, gold forward bullish, USD/non-sovereign asset hedging positions

5. “Geographic diversity + custody diversity” is the dividing line between life and death

In which country do you place your assets, who holds them in trust, and whether you have control over them - it is far more important than you think - your geographical location determines whether your assets are yours when a crisis comes?

Don’t trust your assets in just one country, don’t trust your assets in just a bank, and don’t go all in on system assets (such as local currency, local stocks, and local real estate). Insurance doesn’t exist in troubled times.

In addition, crypto's self-custody and convenience are also a good choice.

3. What is the structure of a “safe haven portfolio”?

The structure that Spitznagel advocates is:

90–95%: Low-risk, stable compounding assets (such as short-term U.S. Treasuries, cash, basic dividend stocks)

5–10%: Highly leveraged “tail hedge” positions (e.g. VIX long, SPX forward put, gold/bitcoin backup)

Examples from the book:

80% invested in the S&P 500 and 20% in gold

50% in the S&P 500 and 50% in Trend-following CTAs

66% in the S&P 500 and 34 in long-term Treasuries

85% in the S&P 500 and 15% in Swiss Franc

This structure has mediocre returns in normal times, but explodes in black swan events (for example: in March 2020, when the epidemic stock market crashed, the Universa Fund rose by 4,000%).

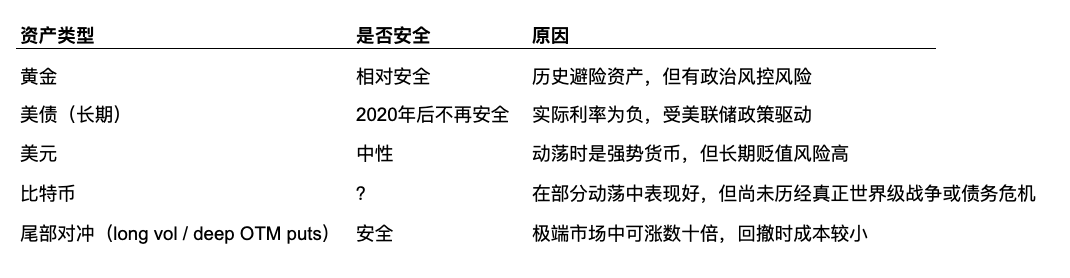

Combining his articles and reports, his evaluation of different asset classes

"The net portfolio effect – or the cost-effectiveness of a safe haven – is thus driven by how little of that safe haven is needed for a given level of risk mitigation."

4. The “Black Swan Survival Package” for 2025: What should you do?

Considering the current risk environment, a possible “tiered asset structure”

Layer 0: Healthy body

No infectious diseases, long-term diseases, body fat should not be too low, develop exercise habits, cultivate a mobile body; be able to drive different means of transportation and cook.

Layer 1: Assets that are resistant to systemic risk (self-custodial assets)

Used to save lives when the system completely collapses

Type Proportion Recommended Features Physical gold (gold coins preferred) 5–10% Does not rely on political system recognition, can be used for "running away" BTC (cold wallet storage) 5–10% Digital gold, can be carried around the world but has regulatory risks Overseas land/passport 5–10% Can be rebuilt and transferred if necessary

Layer 2: Tail Risk Hedging Positions (High Leverage Hedging Assets)

Used to surge in black swans and replenish the portfolio

Type Proportion Recommended Features SPX Deep Put 1–2% Long-term options, the largest alpha source VIX Long 1–3% High explosive power when market volatility soars Gold Call Options 1–2% Rise in a scenario of large inflation or war

Layer 3: Liquidity + Growth Assets (Normal Source of Income)

For stable living and cash flow when the economy does not collapse

Type Proportion Recommended Features Short-term US Treasury ETF / Treasury bond money fund 20-30% Safe and stable, guaranteed liquidity Diversified global high dividend stocks 20-30% Income source, reduce the risk of a single country's thunderbolt Emerging market real estate + US dollar-denominated REITs 5-10% Diversified cash flow

"In investing, good defense leads to good offense."

5. Conclusion: Everything can collapse, but you don’t have to collapse with it

What Safe Haven really wants to tell us is:

You can't prevent wars, collapses, revolutions - but you can design an asset structure in advance that will not return to zero under any circumstances.