Original text: vinay sabarad

Compiled by: Yuliya, PANews

As the crypto market enters 2025, the Web3 launchpad ecosystem has evolved into a diversified landscape, with various platforms developing differentiated layouts around different types of projects, users, and financing models. From issuance platforms supported by centralized exchanges to decentralized IDO mechanisms, to new solutions such as LBP (liquidity-guided auctions), Launchpad has become the core carrier for early investment and project launches in the crypto world. This article deeply compares the eight major Launchpad platforms, including Binance Launchpad, DAO Maker, ChainGPT Pad, Virtuals, CoinTerminal, Fjord Foundry, CoinList, and Seedify, covering their project overviews, issuance mechanisms, return performance, track positioning, and unique innovations.

DAO Maker: A startup platform that combines retail friendliness with VC-style screening

Platform positioning and vision

DAO Maker connects retail users with a VC-like project screening system through its original "Strong Holder Offering" (SHO). Users need to stake $DAO tokens and have a long-term holding record to be eligible for allocation, emphasizing the concept of "loyal staking" to align investors with the long-term interests of the project. Since 2019, DAO Maker has promoted more than 179 token issuances, raising a total of approximately US$107 million, with representative projects including My Neighbor Alice and XCAD. The platform has gradually expanded from a one-time offering to an "accelerator ecosystem", with new features such as DAO Farms and Vaults allowing users to continuously obtain token rewards during the staking period (annualized returns of up to 300–1500%), thereby extending the lock-up period of community funds. Its core vision is to create a retail-friendly Web3 launch platform with VC-level screening and continuous incentive mechanisms.

Representative projects in 2025

DAO Maker has recently focused on projects with clear narratives and diverse types, including:

- SpeedThrone: A AAA-level racing GameFi project that integrates AI elements and supports staking mining for 6–12 months.

- 0xFútbol: A football-themed blockchain fantasy sports platform that combines collection and prediction gameplay to cater to the World Cup hotspots.

- Kayen Protocol: Provides DeFi data verification and modular security services suitable for re-staking and DePIN systems.

- Fusio: An enterprise-level DePIN platform equipped with AI monitoring mechanism, targeting enterprise verifier operation scenarios.

These cases show that DAO Maker is compatible with GameFi, sports/fan economy and AI/infrastructure projects, covering a wide range of topics.

Return on investment performance

In the first half of 2025, the overall revenue of the DAO Maker project was mediocre, with an average current ROI of about 0.14× the IDO price, and the highest historical ROI average of 3.65×. The prices of most projects fell rapidly after listing, although there were still a few breakthrough results. The platform alleviated the losses from price declines through the staking mining mechanism, and token holders can continue to gain income even if the price falls. The SHO mechanism has suppressed selling behavior to a certain extent, but it is still difficult to completely hedge the overall weakness of the market. It is worth noting that DAO Maker has had better returns in the past (such as Orion Protocol's several-fold growth), and the current low ROI is more a reflection of the overall market environment rather than a defect in the platform mechanism itself.

Highlights of Mechanism Innovation

- Strong Holder Offering (SHO): Reward long-term holders by staking $DAO tokens to obtain distribution rights.

- Yield Mining/Vaults: New projects often come with multi-month mining campaigns, distributing the tokens sold as revenue to DAO stakers or liquidity providers. This “stake and earn” model creates demand and liquidity for the IDO later.

- DAO token bonding: DAO Maker participants must hold $DAO to participate, thereby cultivating loyalty. The "DAO Power" system records user holding points to prevent rapid selling.

These mechanisms not only maintain market enthusiasm but also strengthen the sustainability of IDO in the later stage, and also reflect the dual positioning of DAO Maker that combines the breadth of retail investors with the depth of project review.

Track focus and strategic positioning

DAO Maker focuses on emerging narratives and practical projects. Its project layout in 2025 covers GameFi 2.0 (SpeedThrone), sports/fan interaction (0xFútbol), DeFi infrastructure (Kayen) and AI/enterprise services (Fusio). Compared with the "Meme-type platform" chasing hot spots, DAO Maker prefers to build a project ecosystem with real value and reward mechanism. Its strategy is to create a "community-driven accelerator" to attract entrepreneurs who want to balance retail traffic and long-term healthy development.

Seedify: The next generation of community-driven Launchpad

Platform positioning and vision

Since 2021, Seedify ($SFUND) has been committed to promoting the incubation of high-quality projects in the fields of NFT, games, AI and DeFi through a community consensus mechanism. So far, Seedify has facilitated the issuance of more than 100 tokens, with a total fundraising of approximately US$40-55 million. The platform combines the advantages of CEX and DeFi, adopts the $SFUND pledge tiering mechanism to protect user allocation rights, and introduces community review instead of closed private placement screening. In 2025, Seedify continued its technological innovation, launched a permissionless bond curve issuance platform, a decentralized curation DAO, and an on-chain social distribution mechanism, becoming one of the most cutting-edge Launchpads in the technology stack.

Representative projects in 2025

- Stable Jack (JACK): A fixed/leveraged income protocol deployed on Avalanche. It completed its IDO in April 2025 with a FDV valuation of $20 million and raised approximately $300,000. All tokens were unlocked after TGE, but the market response was weak.

- Aiki (AIKI): An AI×game prediction platform on the Solana chain, launched in May 2025, adopts the $SFUND+public offering dual-channel model, raising approximately US$175,000. Early user participation was high, but the coin price performance was mediocre.

- P33L (P33L): AI satirical meme project, issued through a bond curve in April 2025, with a total valuation of $250,000, 28% of the supply sold, and raised approximately $70,000, reflecting Seedify's strategy of supporting cultural innovation projects.

Return on investment performance

Despite the overall market cooling, the historical average highest ROI of Seedify projects remains at around 8x. In 2025, many projects were initially popular when they were listed, but then prices generally fell back. This phenomenon has become the norm for current IDOs. Seedify strives to avoid severe selling pressure and promote long-term value by introducing a bond curve and a flexible unlocking mechanism.

Highlights of Mechanism Innovation

- Smart Joint Curve Issuance: Token prices rise dynamically with purchasing demand, and a $SFUND-project token LP pool is automatically generated after it is sold out, achieving liquidity as soon as it goes online, and built-in anti-"Rug Pull" and anti-"sniping" safeguards: 24-hour refund window and progressive pricing prevent robots from snapping up tokens and protect buyers' rights.

- Layered access mechanism (staking + social): In the early stage, $SFUND stakers and users with high "social scores" (obtained through recommendations, Kaito-like interactions, and community activities) are given priority, and later it is open to the public, forming a gamified entry logic to encourage active contributors. This "social distribution layer" rewards community builders, not just whales.

- Investor-friendly unlocking/refund mechanism: Each project can choose a flexible vesting plan, and Seedify provides instant unlocking or short-term linear unlocking (1-4 weeks) to balance trust and sales pressure. In addition, each token issuance has a 24-hour refund window, allowing buyers to choose a refund in case of uncertainty. This mechanism is similar to the downside risk protection of the CoinTerminal model, providing users with additional confidence protection.

- Decentralized Curator Program: A curator network consisting of KOLs, VCs, guilds, and DAOs screens projects for the platform and can obtain revenue sharing, allocation quotas, and community whitelists.

- $SFUND Incentive Flywheel: Every issuance event injects new use cases into $SFUND. Staking Levels → Token Allocation → Token Issuance → Liquidity Creation → Buying Pressure and Token Destruction. As the number of issuances grows, the intrinsic demand for $SFUND tokens also grows. Seedify is designed to ensure that its native token benefits from the ecosystem it drives.

Track focus and strategic positioning

Seedify takes games and culture as its core starting point and is gradually expanding into the fields of AI and DeFi. Its recent project lines (Stable Jack, Aiki, P33L) cover multiple sectors such as DeFi income, AI games and Meme culture. The platform claims to be a leader in the field of "Web3 culture and games" and gradually embraces cutting-edge trends such as on-chain AI and DePIN protocols. Seedify positions itself as a community-first alternative: more open than Binance, more interesting than CoinList, and more orderly than Virtuals. By integrating joint curves and refund mechanisms, it strives to increase investor protection while providing upside potential for new projects.

Summary of unique strategies

Seedify has created an "open and protected" issuance model by integrating the advantages of multiple mechanisms. Its permissionless bond curve platform, which is planned to be launched at the end of 2025, can be used by any team to issue coins independently, combined with automatic liquidity and anti-buying mechanisms, similar to the openness of CoinTerminal, but with more protection. Curation DAO absorbs the "censorship spirit" of DAO Maker and uses social incentive mechanisms (such as Kaito or Ethos points) to increase user activity, ultimately forming an integration of CoinTerminal's openness, Fjord's fair mechanism, DAO Maker's interest binding and community-oriented culture, heralding the prototype of a new generation of Launchpad.

ChainGPT Pad: An incubation launch pad focused on artificial intelligence

Platform positioning and vision

ChainGPT Pad is the launch pad of choice for AI-first Web3 startups. It is part of the ChainGPT ecosystem (known for its AI chatbots and developer tools) and is deeply incubated through technical support (smart contract audits, AI analysis) before projects go live. Participation requires holding or staking $CGPT tokens, which are themselves supported by the platform's AI product fees (a portion of user fees are burned). ChainGPT Pad's vision is to become the premier DEAI (decentralized AI) issuance tool: any project issued on it will receive customized guidance for AI, and $CGPT stakers will receive participation in token sales.

Representative projects in 2025

ChainGPT Pad’s 2025 project portfolio incorporates AI infrastructure and some GameFi:

- Omnia Protocol (OMNIA): A privacy-focused blockchain access provider (RPC relay), critical for AI data feeds. ATH ROI ~5x.

- Arcade (ARC): An interoperable, NFT-based competitive gaming platform that heralds the new GameFi trend.

- Flash Protocol (FLASH): A DeFi utility token for ultra-fast DEX transactions with AI predictive analytics.

- NextGem AI (GEMAI): AI-driven encrypted content discovery platform (an "alpha feed" platform). Released via whitelist in April 2025.

- AdixAI (ADIX): An AI advertising optimization network. Uniquely, ADIX is distributed to eligible $CGPT stakers via a “Launchdrop” airdrop (not a sale) in May 2025.

- Matchain (MAT) & Blink Game AI (BLINK): Two Launchdrops in May 2025 — a zk-rollup chain (MAT) and a gamified AI battle game (BLINK) — are offered free to community members to promote adoption.

Return on investment performance

ChainGPT Pad is very active, having conducted ~35 IDOs in the past 6 months, raising ~$10.2M in total (~$290K each). These are mostly micro-cap, early-stage rounds. Recent projects have averaged an ATH ROI of ~7.6x at peak price. Some projects that launched on ChainGPT in early 2023 achieved returns of over 40x, but the market has cooled in 2025. Today, the average ROI is only ~0.36x (i.e. most tokens are below their IDO prices). In other words, high initial doublings are followed by declines. Despite this, ChainGPT Pad continues to produce some multi-fold returns - a few recent IDOs have soared "well over 20x" before falling back. Overall, the ROI is volatile, but occasionally spectacular, reflecting its focus on emerging AI projects.

Highlights of Mechanism Innovation

ChainGPT Pad combines traditional IDO with a novel distribution method:

- $CGPT staking participation: Only $CGPT holders/stakers can obtain the whitelist qualification of IDO. Higher staking level guarantees the allocation quota.

- Launchdrops: Free airdrops of tokens to loyal $CGPT community members (such as AdixAI, Matchain, Blink). This rewards participation and expands token distribution beyond paying participants.

- High degree of incubation support: Unlike many launchpads, it provides technical consulting (audits, AI tools) to projects before IDO.

- Anti-sniping function: By tying the allocation to the staking period and using the destruction mechanism of $CGPT, it suppresses fast selling and robot behavior.

Track focus and strategic positioning

ChainGPT Pad focuses on AI-related fields, with about half of its projects centered on AI, including AI-driven agents, DeFi combined with AI, and AI games; the other half focuses on new projects that "redefine GameFi", such as Arcade and Blink, which emphasize real gaming experience and high fidelity, and often incorporate AI elements. ChainGPT Pad also innovates in distribution methods, adopting initial airdrops and cross-chain priority strategies, such as launching the Berachain project, showing its desire to occupy a place in the AI and large-scale DeFi narrative. It is positioned as the "preferred launch platform for DeAI enthusiasts" and attracts user participation through a strong community incentive mechanism and advanced token mechanism.

Virtuals Launchpad: Gamified AI Agent Platform

Platform positioning and vision

Virtuals is a decentralized AI agent launch platform based on Base, allowing users to fund AI agents with autonomous behavior (i.e. tokenized automated bots) in "Genesis" mode. Anyone can come up with an AI agent idea, and community members can jointly fund it through on-chain sales. The vision of this platform is to create an "AI version of Pump.fun" - a high-risk, high-return community participation park that combines staking and task systems to achieve a gamified issuance mechanism. Unlike most IDOs, all tokens on Virtuals are 100% unlocked at TGE, making the sales process instantly full of liquidity and volatility.

Representative projects in 2025

- IRIS ($IRIS): On-chain autonomous governance AI agent, 50% community airdrop, issued FDV of only about $200,000, peak market value of $80 million, ROI up to 400 times.

- Backroom ($ROOM): Decentralized InfoFi creator economy protocol (tokenizing the "knowledge base"), with an initial ROI of 3 times.

- Maneki AI ($MANEKI): DeFi strategy AI assistant, which has risen by about 10 times from the pre-sale low.

- WachXBT ($WACH): On-chain DeFi security AI proxy, up 3–4x since launch.

- h011yw00d ($HOLLY): AI movie character token that connects NFT and narrative content, and is an early sample of AI+media integration.

Return on investment performance

Virtuals' first batch of Genesis projects are extremely explosive. According to Gate.io analysis, the average return rate of its first 24 projects was as high as 32 times, and the highest was even 128 times. Social platforms have also widely reported multiple 10-20 times trading cases. However, these short-term high returns are often accompanied by sharp pullbacks. The platform has introduced a "cooling-off period penalty" mechanism (if users sell within 7-10 days of profit, their scores will be reduced) to reduce selling, but overall, Virtuals is still a volatile issuance field with both risks and returns.

Highlights of Mechanism Innovation

- Points-based allocation mechanism: Users accumulate Genesis points by staking $VIRTUAL tokens and completing tasks (invitations, answering questions, social activities). The higher the points, the larger the allocation amount, similar to the "earn while playing" game experience.

- NFT staking mechanism (veVIRTUAL): Holding veVIRTUAL (voting trust) can obtain "Virgen points", and 37.5% of the token share is used for the distribution of such community points.

- Fully unlocked sales mechanism: All tokens are 100% released at TGE (no vesting period). Although liquidity is improved, the risk is increased. A cooling penalty system is set up to prevent rapid arbitrage.

- No centralized review mechanism: Any AI agent can go online as long as it passes basic compliance review, which is completely decentralized, thus democratizing the financing of AI projects.

Track focus and strategic positioning

Virtuals focuses on the "agent AI" economy - covering automated trading bots, information assistants and social AI tools. Its gamified sales style (points + prediction elements) and deep community participation have made it the preferred launchpad for AI agent + InfoFi projects. Its media image is similar to the "AI version of Pump.fun", providing extreme popularity and community exposure for projects, and representing high volatility potential opportunities for users.

CoinTerminal: A barrier-free IDO platform for the general public

Platform positioning and vision

CoinTerminal will be launched at the end of 2023, featuring barrier-free participation. No need to pledge, no need to hold coins, and extremely low KYC requirements. You only need to connect your wallet to participate. Its core innovation lies in the "buy now, pay later" (BNPL) model: users who win the lottery can pay the token fee at the time of listing. If the token price drops, they can choose not to pay or claim the token. This mechanism, coupled with the full refund option on the day of listing, makes investors almost free of downside risk, and the platform and project parties bear the losses. CoinTerminal is committed to building a "universal equal rights" project launch platform, breaking the capital threshold and allowing any retail investor to participate in early investment.

Representative projects in 2025

- Favrr ($FAVRR): A "token issuance + prediction market" platform for community-based economy, launched in May 2025.

- Pump AI: AI-driven token generation and branding tool for NFT/GIF culture. (Launch in January 2025)

- AIT Protocol: A decentralized AI protocol, whose 2023 IDO will achieve up to 80 times return.

- RWALayer: RWA tokenization market. (Sales ongoing in June 2025)

- GIANTAI: An upcoming AI-based meme project.

Return on investment performance

Most of CoinTerminal's projects have amazing returns. Since its launch, 75 sales have been completed, with a total of approximately $65 million distributed to investors, with an average return of 1590% (i.e. 15.9 times). The 80x returns of projects such as AIT Protocol are widely circulated in the community. During the mid-2024 mini bull market, many projects recorded 20x, 50x, and even 100x increases. So far, more than 500,000 users have participated, and CoinTerminal has become one of the most popular issuance platforms for retail investors.

Highlights of Mechanism Innovation

- Zero barriers to participation: no need to stake tokens, no KYC required (for most sales), no entry fees.

- VRF lottery mechanism: Chainlink VRF is used to ensure fair distribution and prevent manipulation by robots and whales.

- BNPL + Refund Mechanism: The platform will advance the IDO purchase cost for the winners. On the day of TGE, if the price does not meet expectations, users can give up the subscription and get a full refund with almost no loss.

- Anti-whale cap: Each person is allocated a limited amount, and there is no pledge threshold to prevent whale monopoly.

- Charge by profit: The platform has no native tokens and only charges a portion of the profits (e.g. 25%) when users make a profit.

Track focus and strategic positioning

CoinTerminal widely absorbs AI, DeFi, Gaming and even Meme projects, and is especially popular among small and medium-sized projects and creators. Its open, fair and decentralized characteristics are in sharp contrast to platforms with higher thresholds such as Binance, and it has become a representative of "universal IDO".

Fjord Foundry: A fair issuance platform based on LBP

Platform positioning and vision

Fjord Foundry (formerly Copper) focuses on using Liquidity Bootstrap Pools (LBP) as the main issuance mechanism. The LBP model uses the Balancer pool to achieve a price reduction from high to low, allowing investors to buy at a more ideal price point and avoid front-running and high-frequency manipulation. Fjord supports project-defined parameters, and can choose pure LBP or mixed issuance methods such as pricing rounds/lock-ups, and has expanded to multiple chains such as Ethereum, Polygon, and Arbitrum. The platform focuses on "price discovery first, fair issuance" and provides services for projects that value long-term construction and broad community distribution.

Representative projects in 2025

- Analog ($ANLOG): Cross-chain interoperability protocol (issued in January 2025), sold about 1.9% of tokens through LBP, no lock-up, stable off-chain transactions, no price gouging, market value of approximately $1 million-3 million.

- Form Network ($FORM): SocialFi project (launched in February 2025), with only 0.5% in public sale and small initial fluctuations, demonstrating the community's interest in SocialFi.

- Stabble ($STB): A ve model DeFi platform on the Solana chain (issued in February 2025), sold about 1.5% through LBP on Solana, and the price fell from $0.05 to $0.013 (46% lower than the sales price), with moderate trading volume and a market value lower than expected.

- Arcadia Finance ($AAA): Yield aggregator on the Base chain (issued in April 2025), raised $289,000 in Dutch auction, price surged 1086% to $1.71 before pulling back to $0.237 (+64%). This illustrates the volatility of LBP - huge short-term gains followed by a sharp pullback.

- BurrBear ($BURR): AMM governance token on Berachain (issued in April 2025), 20% of the supply was sold at $0.44 (fully unlocked), and the price plummeted to about $0.005 after listing, a nearly 99% retracement. 100% unlocking led to immediate liquidity depletion and collapse.

Return on investment performance

The overall returns of projects issued by Fjord are mixed. Analog has performed steadily, while high-Gas fee projects like Arcadia showed huge short-term ROI (10x), but then gave up sharply. Some fully unlocked LBP projects have the opposite effect (BurrBear's -99%). Overall, Fjord emphasizes "fairness" and "low fraud risk" rather than short-term speculative returns.

Highlights of Mechanism Innovation

- LBP mode: Prevent robots and whales from manipulating the market through a price mechanism that opens high and closes low, and achieves a more balanced distribution.

- Adjustable parameter mechanism: supports customized weights and time windows, and can also be mixed and matched with airdrops, etc. The platform will provide issuance recommendations.

- No permission is required to start: The project needs to undergo basic review, allowing DeFi teams, DAOs, etc. to go online freely, emphasizing the spirit of decentralized startup.

- Anti-sniping/Robot: The initial price is relatively high, and whales need to wait for the price to go down to avoid early buying.

Track focus and strategic positioning

Fjord focuses on technology and infrastructure projects such as DeFi, DAO and DePIN, and attracts construction-oriented developers such as Hivemapper and Rollup teams. Since it is not popularity-oriented, Fjord is more favored by protocol native developers and long-term communities, and is a representative of Launchpad that "prioritizes infrastructure and issues fairly".

CoinList: A compliance-driven infrastructure issuance platform

Platform Overview and Vision

CoinList is the most mature ICO/ITO platform, known for its compliance. Unlike many IDO platforms, CoinList implements strict KYC/AML requirements and often restricts US retail investors from participating (only open to qualified investors). The platform does not require staking or holding tokens, only registration and passing KYC review. Its vision is to "connect high-quality Web3 infrastructure projects with global compliant investors", emphasizing formal channels, fairness and transparency.

Representative projects in 2025

CoinList conducted only a handful of major sales (8) in the first half of 2025, focusing on underlying technology:

- WalletConnect (February 2025): A decentralized wallet-dApp protocol that uses a "bottom-up allocation" lottery mechanism, fully unlocked, with a peak return of 6.7 times and currently about 1.5 times.

- Obol Network (February-March 2025): A decentralized validator network (DVN) for Ethereum staking, using a mixed public + discount sale, 50% unlock + linear unlock mechanism, peak return 1.5x, current price about 0.6x. Good fundamentals, but trading performance is flat.

- Aligned Layer (January 2025): A ZK-EVM scaling project that uses a fixed-price, first-come, first-served (FCFS) token sale (two price tiers). It is not yet available as of mid-2025, but has attracted a lot of attention in the crypto developer community.

- Fleek (May 2025): An AI-driven cloud service for creators, 100% sales unlocked, with launch performance yet to be announced.

- Arcium (March 2025): Privacy-focused MPC/AI supercomputing platform, random public sale, fully unlocked. Waiting for listing.

- Enso (June 2025): Multi-chain execution platform, random allocation mechanism, raised $5 million+, not yet listed.

- Pipe Network (June–July 2025): DePIN content network on Solana, dual option sales (with/without lockups). After listing, it plummeted 99.9%, which is a warning case of overvaluation.

- DoubleZero (April 2025): Web3 Fiber validation network, open only to validators and qualified users, with strict KYC (US qualified investors only). This is an exclusive offering that is popular in the trusted community.

Return on investment performance

CoinList's overall returns are generally stable and not dominated by short-term bursts. The best performers such as WalletConnect recorded 6-7 times returns, but the prices of many tokens are stable near or below the sales price. Pipe Network and others collapsed due to high valuations. On average, the average peak return in the first half of 2025 is 1.5×-6×, and the current price is mostly between 0.3×-1.5×. Although the returns are not as good as other platforms, CoinList has a high user repurchase rate, reflecting its good reputation and credibility.

Highlights of Mechanism Innovation

- Classless KYC: No staking is required, but comprehensive KYC and regional compliance are required, and US retail investors are often excluded.

- Hybrid allocation mechanism: 50% of the projects are randomly allocated from the bottom up to prevent panic buying and manipulation. There is also an FCFS mode and a validator-exclusive round.

- Flexible unlocking mechanism: Some projects have 100% unlocking (such as WalletConnect and Enso), while others have linear release and lock-up options (such as the 1-year lock-up option provided by Pipe for US investors).

- Institutional docking mechanism: CoinList often serves as a docking platform between institutions and projects, providing exclusive channels for users with compliance backgrounds.

Track focus and strategic positioning

CoinList is highly focused on infrastructure construction, and its projects in 2025 mostly involve DeFi staking, ZK expansion, cross-chain execution, privacy computing, and DePIN. It does not involve Meme or simple GameFi content, and is positioned as a "compliance-first, infrastructure-oriented" platform. It is one of the few Launchpads that can still attract institutions and high-quality developers.

Binance Launchpad: The definitive representative of CEX

Platform Overview and Vision

Binance Launchpad is the gold standard for centralized exchange issuance platforms. Since 2018, it has completed more than 80 token issuances, raising a total of more than $133 million, and has launched star projects such as Axie Infinity, Polygon, and The Sandbox. Users need to stake BNB to participate in the lottery or proportional distribution. It is positioned as a "high threshold, high quality" issuance platform, sacrificing issuance frequency and retail convenience in exchange for project quality and institutional trust. The vision is to empower core infrastructure and high-quality assets through the Binance ecosystem.

Representative projects in 2025

- AEVO (March 2025): Layer-2 derivatives trading platform.

- ether.fi (ETHFI) (March 2025): Non-custodial liquidity staking platform.

- Omni Network (OMNI) (April 2025): A re-staking Rollup platform in the EigenLayer ecosystem.

- Renzo (EZ) (April 2025): Liquid re-staking manager for EigenLayer.

- Notcoin (NOT): A meme project launched in 2024, showing that Binance occasionally tests the waters with light projects.

Return on investment performance

Binance projects often surge during TGEs due to oversubscription and instant CEX listings. Historically, some projects have reached astonishing heights (e.g., Axie Infinity’s peak price was ~1,600x its Launchpad price).

However, the market has cooled down in 2025. Although the recent Binance listed projects have strong initial trading, they usually retreat sharply. For example, ETHFI retreated 20% after soaring after listing. In fact, rapid retreat after ATH (even 80-90% drop from high point) is common. Binance participants can still make considerable profits if they grasp the timing accurately, but most of the gains require holding coins and patiently waiting for the correction period.

Highlights of Mechanism Innovation

- BNB staking participation: Binance Launchpad is tightly integrated with its exchange, with BNB as the underlying asset, and the quota is allocated in the form of lottery or subscription.

- Launch protection mechanism: Introduce initial price limits (such as the initial price limit for Arkham IDO in 2023) to prevent excessive volatility.

- Centralized and compliance-oriented: No new IDO model has been tried, KYC and BNB requirements are high, and not all retail investors can participate.

Track focus and strategic positioning

Binance prefers the themes of infrastructure and staking. In 2025, it will mainly promote expansion (AEVO, Omni), re-staking (ether.fi, Renzo) and other protocols. Consumer-level or Meme projects are rare, and the overall goal is still to build ecological basic components. Binance Launchpad has become a platform representing "blue chip project issuance" in centralized exchanges.

Platform comparison and key trends summary

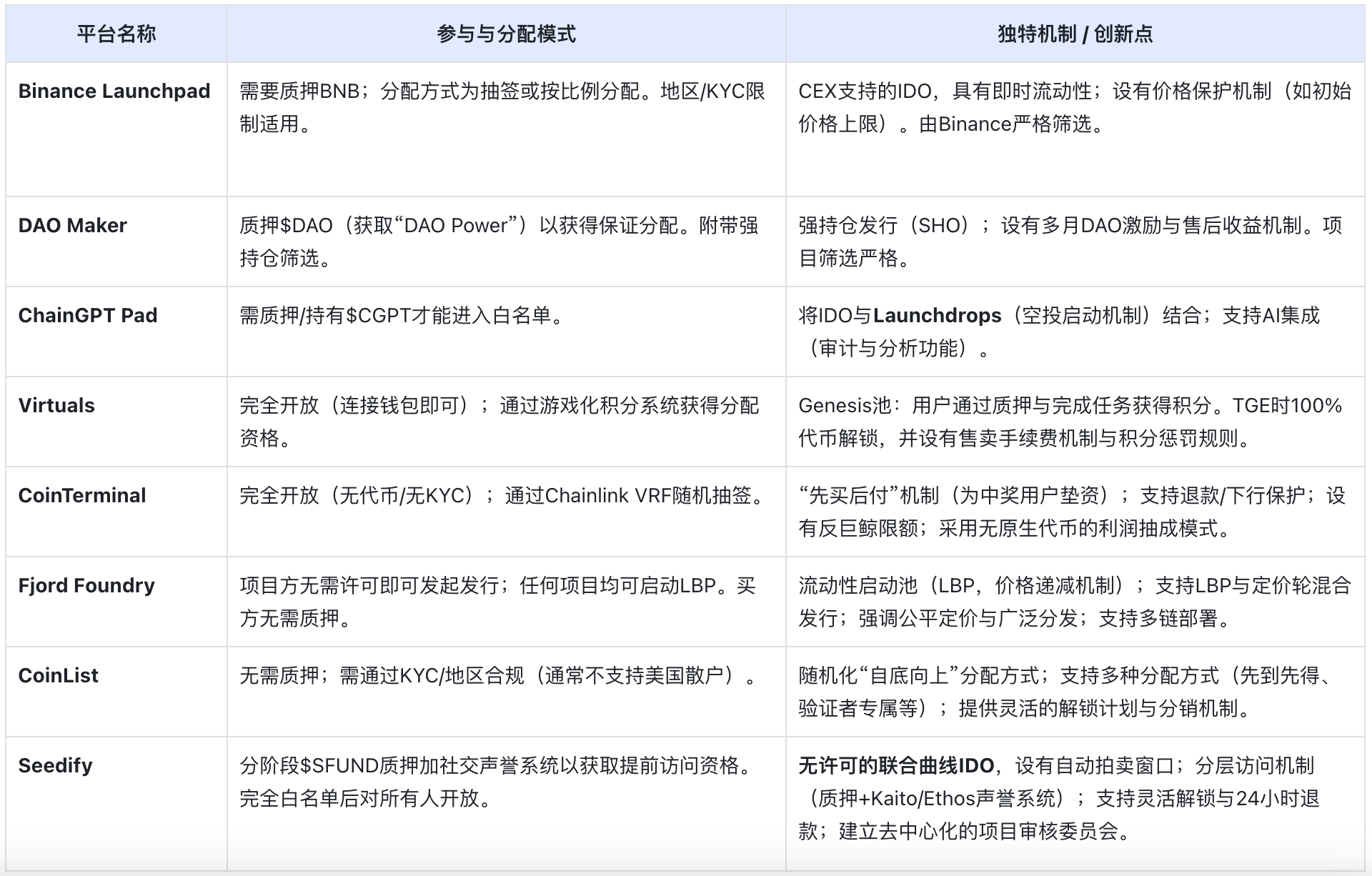

To help understand the differences and commonalities among the major Launchpad platforms, the following comparison is conducted from four dimensions: participation threshold, mechanism characteristics, track focus, and average revenue:

Key trends and future prospects

The crypto Launchpad ecosystem is evolving rapidly, and its core trend has shifted from "pull-up as soon as it goes online" to "fair mechanism + user participation". The following are the seven most representative structural trends in 2024-2025:

1. Increased user engagement and zero threshold trend

Users have a surge in demand for the "wallet-to-participate" issuance model. CoinTerminal and Virtuals have significantly lowered the threshold by canceling pledges and removing KYC, attracting large-scale retail investors to participate. Fjord's LBP model has also won the favor of developers with its decentralization and free configuration. Platforms with "frictionless entry + risk protection" will continue to have an advantage in the context of lack of market trust.

2. The rise of the hybrid model of “open participation + community screening”

Open participation does not mean giving up quality, and the industry is shifting to a hybrid curation model that combines permissionless infrastructure with decentralized threshold mechanisms. DAO Maker's SHO and Virtuals' community-driven audits show the embryonic form of this trend. In this model, curators (including DAOs, influencers, and expert groups) are responsible for discovering and evaluating projects, while the broader community has access to early participation opportunities. This crowdsourcing due diligence approach can align incentives without inhibiting innovation and reduce the risk of "running away".

3. Fair issuance mechanism becomes the industry standard

Anti-whale, anti-bot, and fair distribution mechanisms are becoming the basic standard of each platform. Fjord's LBP mechanism, CoinTerminal's VRF lottery, Virtuals and Seedify's dynamic joint curve with refund logic and other mechanisms all ensure fairness in different ways. The popularity of these designs reflects the increased demand for "price protection" and "downside buffer" from users after the sharp pullback in 2022.

4. Shift from “TGE rewards” to “long-term incentive” structures

The current focus of the crypto space is shifting from "launch" to "long-term development". Various platforms are trying to extend the use value of tokens by optimizing token economics design, such as DAO Maker's introduction of liquidity mining, SocialFi's tokenized social staking, and NFT-based reward layers, which are designed to increase user participation and retention after the project is launched. In the future, there may be deeper Info-Fi integration, which will affect token unlocking, staking ratios, or NFT casting through factors such as user behavior, on-chain operations, and content creation, thereby encouraging user participation rather than pure speculation.

5. Track rotation and verticalization of Launchpad

The 2024-2025 cycle shows a clear theme rotation trend, and the Launchpad of AI-related projects, such as ChainGPT Pad and Virtuals, is particularly outstanding. It is followed by DePIN (such as Fjord, CoinList), and SocialFi/creator economy-related projects. At the same time, the gaming sector has shown strong resilience, and related platforms are building infrastructure adapted to streaming native and cultural awareness to support new projects. The Launchpad platform is gradually moving towards verticalization, and it is expected that verticalized platforms focusing on AI agents, on-chain data economy (Info-Fi) or RWA will appear in the future. In this trend, projects that "build culture and consensus in segmented narratives" are expected to become the ultimate winners.

6. Compliance and openness in parallel

CoinList has demonstrated the attractiveness of compliant platforms on the institutional side, and its compliance and quality endorsement are favored. However, on the other hand, a fully open platform can better serve the next batch of billions of potential on-chain users. The future Launchpad ecosystem will tend to be "modular": providing KYC optional paths for different geographies and investor types, and supporting flexible regulatory layers. Some platforms may introduce a "distribution by country/investment grade" mechanism to balance openness and compliance.

7. Info-Fi becomes the core of Launchpad competition

As opportunities to participate in new projects early on become more common, the competition between platforms will no longer be about who can get you on board, but will instead turn to an "information war" for user attention. The winners in the future will be those platforms that can provide "Info-Fi" tools that can help you clearly see the public sentiment of a project, which big Vs are standing in the team, how popular social media is, and real user behavior data. Just as search engine optimization (SEO) once dominated website traffic, this intelligence data will determine the success or failure of future crypto projects. Platforms that can incorporate this intelligence into the issuance, staking, and reward mechanisms will surely win more attention and conversions.