Author: Nancy, PANews

In recent days, as the price of ETH continues to rise, the Ethereum reserve arms race has become more intense, and market confidence has significantly recovered. This wave of rebound is largely due to the active influx of institutional funds. However, with the accelerated entry of more institutional participants, Ethereum may usher in a capital change.

Wall Street enters the market through ETFs, and the reserve narrative of listed companies brings a new turning point

The launch of the Ethereum spot ETF was once seen as an important node towards Wall Street and traditional finance, and the market generally expected it to bring a significant boost to Ethereum prices and ecology.

However, since the launch of the Ethereum spot ETF in July 2024, the market has not seen the expected sparks, ETH prices have been weak, the ETH/BTC exchange rate has continued to fall, and investor confidence has suffered a significant impact. At the same time, some of the Ethereum Foundation's selling behavior has also caused market controversy. Although these sales may be due to operational needs, the sensitivity of market sentiment has caused the selling behavior to be magnified and interpreted, and the market has become increasingly bearish on Ethereum.

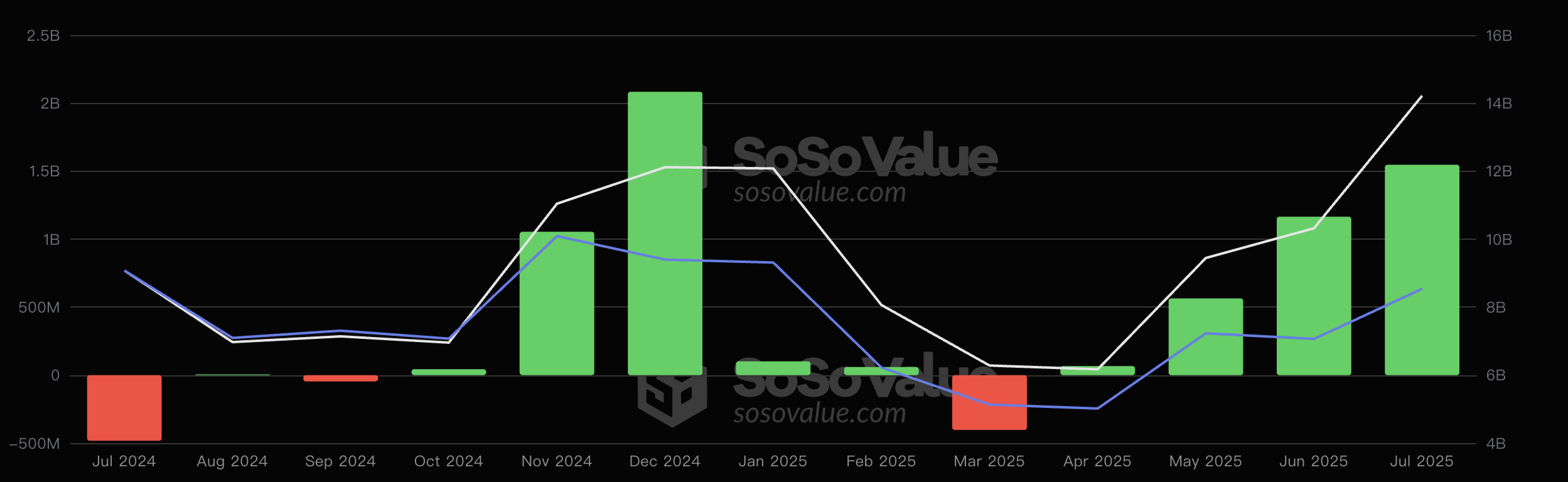

According to SoSoValue data, since the launch of the Ethereum spot ETF (July 23, 2024), the cumulative net inflow of funds has been approximately US$5.76 billion, accounting for 3.87% of the total market value of Ethereum. From the perspective of the pace of capital flow, in the past 13 months, there have been only three months of net outflows, with a cumulative outflow of US$930 million, showing an overall steady trend of capital absorption.

However, the steady inflow of ETF funds has not formed effective support at the ETH price level. According to Coingecko data, from the launch of the ETF to the announcement of the establishment of the Ethereum strategic reserve by SharpLink Gaming, the first ETH reserve company (May 27, 2025), the highest increase in ETH prices was only 16.55%, while the maximum decline was as high as 63.34%. In contrast, since the launch of the Bitcoin spot ETF on January 11, 2024, the BTC price has increased by as much as 153.3%, and the market performance is even stronger. The market performance of Ethereum and Bitcoin under the support of ETFs is in sharp contrast.

It was not until the last two months that the market trend began to gradually change. On the one hand, ETH experienced a technical rebound after a deep adjustment; on the other hand, the Ethereum Foundation initiated internal governance mechanism reforms, and listed companies began to include ETH in their balance sheets, injecting new narrative driving force into ETH.

Since SharpLink Gaming, Siebert Financial, Bit Digital and other companies announced their allocation of ETH, the price of ETH has recorded a cumulative increase of 22.29% (data statistics as of July 16), which is significantly better than the performance of Bitcoin (7.9%) in the same period. This round of rebound is not only based on asset revaluation, but also benefits from the gradual formation of a new story of strategic reserve assets.

The current market is bullish. For example, ARK Invest founder Cathie Wood recently publicly stated that the long-term value of Ethereum is seriously underestimated; Varys Venture Capital Director and Multicoin co-founder bet on whether ETH can reach $10,000 by the end of 2026. At the same time, institutions are accelerating their entry into the market. Ethereum spot ETFs have recorded net inflows of more than $1 billion in the past two months. Bitwise Chief Investment Officer Matt Hougan even said that the inflow of funds into Ethereum ETFs may accelerate significantly in the second half of 2025.

Institutional holdings exceed 1.6 million ETH, Ethereum will usher in capital changes

After traditional financial giants such as BlackRock, Fidelity, and ARK entered the spot ETF track, and after listed companies Strategy launched a wave of Bitcoin reserves, the narrative and pricing power of Bitcoin has shifted from the crypto-native community to Wall Street capital.

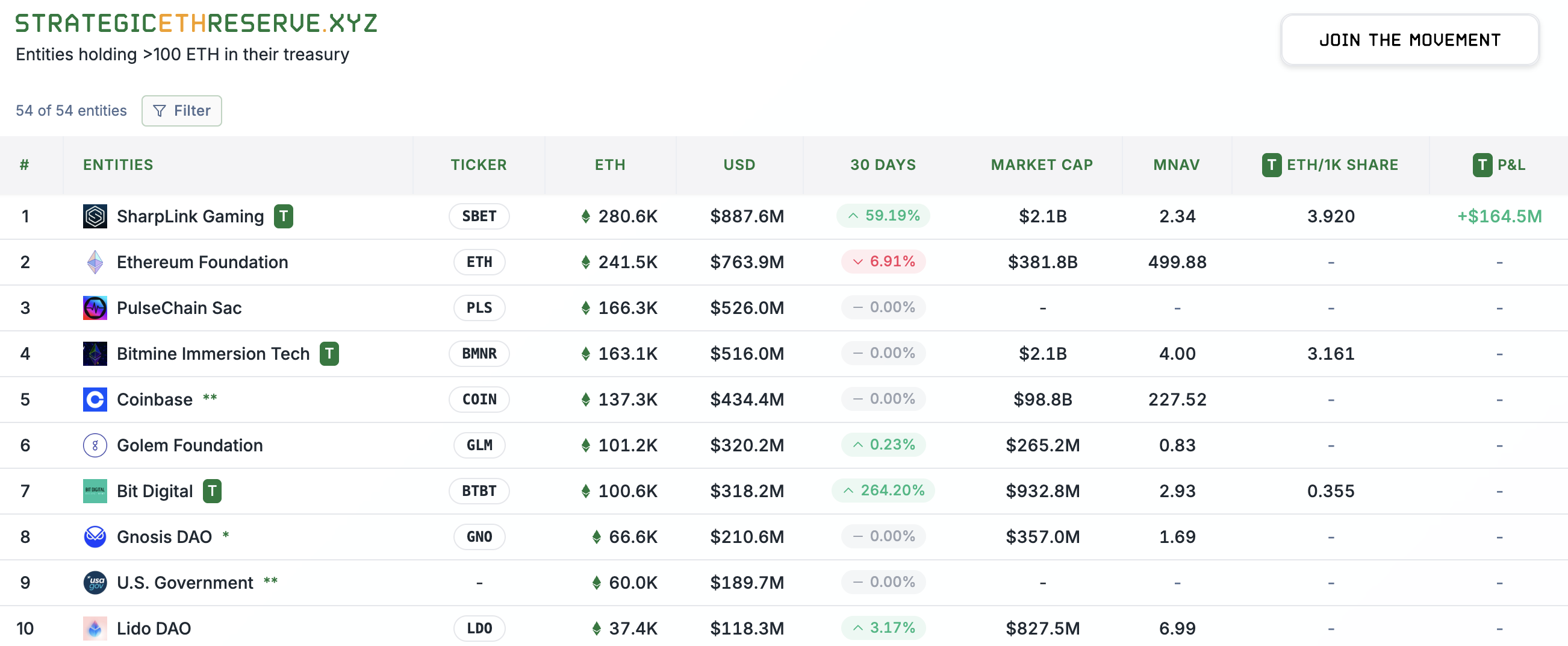

Today, this trend seems to be gradually repeating itself on Ethereum, with more and more listed companies making large-scale capital deployments around Ethereum. According to data from Strategic ETH Reserve, there are 54 entities holding more than 100 ETH, with a total of more than 1.6 million ETH, worth more than US$5.07 billion, equivalent to 35% of the overall size of the ETH ETF. In the past two months, listed companies such as SharpLink Gaming, BitMine, Bit Digital, BTCS, GameSquare and Bit Digital have announced that they will include ETH in their balance sheets.

From the perspective of the current institutional composition of Ethereum, there are mainly two camps. One camp is represented by SharpLink, which is backed by Ethereum supporters such as ConsenSys, Galaxy Digital, Pantera Capital, Electric Capital, etc. It is considered to be the early original forces of the Ethereum ecosystem who are banding together to save themselves. As of now, SharpLink has accumulated more than 280,000 ETH, surpassing the 242,500 ETH held by the Ethereum Foundation, and has become the world's largest institutional holder of ETH.

The other is the Wall Street approach represented by BitMine, which replicates Strategy's logic of Bitcoin reserves, includes ETH in financial reports and purchases it with leverage. Backed by Tom Lee, the "Wall Street Calculator" and Ethereum bullish, the institution includes ETH in the company's balance sheet while retaining its Bitcoin mining business. It currently holds more than 160,000 ETH, ranking among the top five in the world.

If the holdings of these institutions continue to expand, the pricing power, discourse power and even governance power originally held by developers and core researchers, the Ethereum Foundation and early OG investors may be reshuffled. However, judging from the current listed companies that have allocated ETH, most of them are generally facing financial pressure, intending to hedge inflation, boost stock prices or gain short-term excess returns. Especially with the successful cases of Strategy, they have not yet shown the willingness to be deeply tied to the construction of the Ethereum ecosystem. At the same time, these institutions are difficult to compete with the head institutions in terms of allocation volume, risk tolerance and holding period, which limits their substantial influence on the governance and long-term development of the Ethereum ecosystem. In other words, those who can truly dominate the future direction of the Ethereum ecosystem are still the top participants with strong financial strength.

Moreover, unlike the Bitcoin reserve boom, which had a soul evangelist like Michael Saylor (Strategy CEO), Ethereum has not yet seen a person who has both faith attributes and traditional capital influence. It remains to be seen whether Tom Lee can become a role like Saylor. This, to a certain extent, limits the overall dissemination of Ethereum as an institutional asset in the mainstream capital market.

Of course, Ethereum officials are open to institutional investment. Ethereum founder Vitalik Buterin recently said that institutions choose Ethereum because it is stable, secure, does not crash, and has a clear technical roadmap; and the new co-executive director of the Ethereum Foundation, Tomasz Stańczak, also pointed out that institutions favor ETH because it has "run uninterruptedly for ten years, continuously upgraded, and has always been committed to anti-censorship and security."

However, Vitalik has also recently emphasized the importance of dual governance mechanisms and decentralization. Vitalik pointed out that dual governance provides an additional independent defense layer to prevent the system from taking particularly harmful actions, while explicitly incorporating Ethereum users as stakeholders, rather than relying solely on informal alignment based on "atmosphere". He also emphasized that if decentralization remains at the slogan level, Ethereum will face a survival crisis.

In general, with the rise of Ethereum reserves, the market's attention and liquidity have undoubtedly been significantly improved. However, if the price increase lacks the strong support of the actual activity of the ecosystem, it will ultimately be just a castle in the air and a man-made mirage that is difficult to sustain. The core that truly drives the steady growth of ETH's value is still the continuous innovation and activity of the Ethereum ecosystem, which directly determines the frequency of network use and value precipitation. At present, the Ethereum Foundation is focusing on in-depth reforms in multiple dimensions such as organizational structure, ecological collaboration, and technological evolution, striving to reshape the ecological dominance, strengthen governance effectiveness, and thus reverse the negative evaluation of Ethereum by the outside world.