Author | @defi_monk

Compilation|Baidu Blockchain

Wall Street is embracing the crypto craze.

Traditional finance has exhausted its growth narrative. Everyone is overinvested in AI, and software companies are far less exciting than they were in the 2000s and 2010s.

For growth investors who raise funds to invest in innovative stories with huge market potential, they know that most AI stocks are trading at overvalued valuations, and other "growth" narratives are hard to find. Even the once highly regarded FAANG stocks are gradually transforming into "compound growth" stocks that focus on quality, maximize profits, and have an annualized return of around 15%.

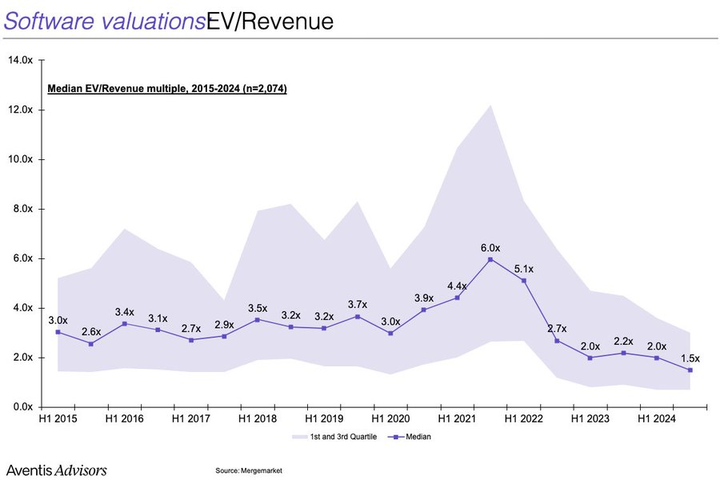

For reference, the median enterprise value/revenue (EV/Rev) multiple for software companies has fallen below 2.0x.

01. Crypto assets come on the scene

BTC broke through an all-time high, the US President vigorously promoted crypto assets at a press conference, and regulatory tailwinds pushed the asset class back into the spotlight for the first time since 2021.

Comparison of BTC, COIN, HOOD, CIRCL, SPY and QQQ (Source: Artemis)

But this time, it’s not NFTs and Dogecoin. This time, it’s digital gold, stablecoins, “tokenization” and payment reform. Stripe and Robinhood declared that crypto assets will be their main priority for the next stage of growth. COIN entered the S&P 500. Circle showed the world that crypto assets are an exciting enough growth story that growth stocks can once again ignore earnings multiples.

02. What does all this mean for ETH?

For those of us who are native to crypto assets, the competitive landscape of smart contract platforms seems very fragmented. There is Solana, Hyperliquid, and a dozen new high-performance chains and Rollups.

We know that Ethereum’s leadership is facing real challenges and existential threats. We know that it has not yet solved the problem of value accumulation.

But I highly doubt Wall Street knows about this. In fact, I’d say most Wall Street “outsiders” barely know Solana exists. XRP, Litecoin, Chainlink, Cardano, and Dogecoin probably have more external visibility than SOL. Don’t forget, these people haven’t been paying attention to our entire asset class in years.

What Wall Street knows is that ETH has stood the test of time, is battle-tested, and has been the primary “follower” of BTC for many years. What Wall Street sees is that it is the only crypto asset other than BTC that has a liquid ETF. What Wall Street likes is a classic relative value investment opportunity with a clear catalyst.

These suited investors may not know much, but they know Coinbase, Kraken, and now Robinhood has decided to “build on Ethereum.” With a little due diligence, they’ll find that Ethereum has the largest stablecoin pool on the chain. They’ll start doing “moon math” and quickly realize that while BTC is hitting new highs, ETH is still more than 30% below its 2021 high.

You might think relative underperformance is a bearish sign, but these people invest differently. They prefer to buy assets that are priced lower and have clear targets, rather than chasing charts that make them wonder, “Is it too late?”

I think they are already in. Investment mandate is not a problem, any fund with the right incentives can drive crypto asset investment. Although the crypto community has been vowing to never touch ETH again for more than a year, the token has performed well for a month.

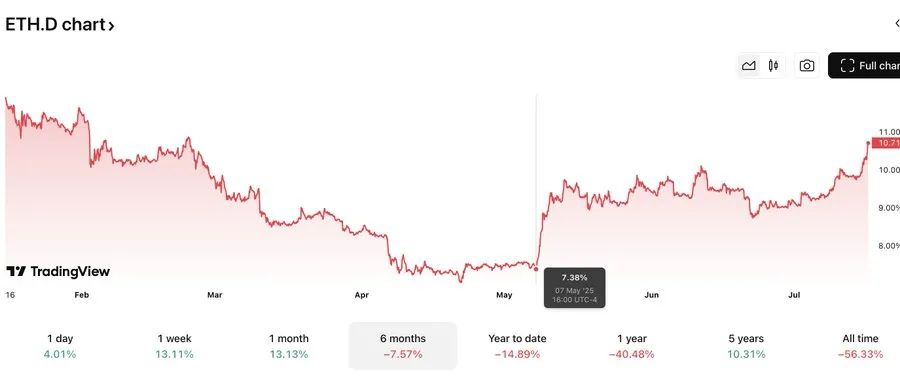

Year-to-date, SOL is down nearly 9% against ETH, which bottomed out in May and has since seen its longest uptrend since mid-2023.

If the entire crypto community believes that ETH is a "cursed coin", why does it still perform well?

03. It’s attracting new buyers

Cash ETF inflows have been rising steadily since March.

Source: Coinglass

ETH’s “micro-strategy” imitators are also making efforts to introduce structural leverage to the market in its early stages.

Even some crypto-native participants may have realized that they are under-exposed to ETH and started rotation, possibly withdrawing from BTC and SOL positions that have outperformed over the past two years.

I’m not saying Ethereum has solved anything. I think what’s happening is that ETH as an asset will start to decouple from the Ethereum network.

04. Summary

External buyers are bringing a paradigm shift to the ETH asset, challenging our view that it can only go down and not up. Shorts will eventually be liquidated. Then, our crypto-native capital will decide to chase the craze before the market's full speculative craze for ETH reaches its peak.

If this happens, new highs are not far away.