1. Market observation

In the current macroeconomic context, the market is paying close attention to the potential challenges facing the independence of US monetary policy. The core focus is that Trump may exert influence on Powell, the chairman of the Federal Reserve during his tenure, and even seek to replace him. This move is generally seen as a move that may shake the foundation of the Federal Reserve as an independent institution. Analysts worry that if the independence of the Federal Reserve is damaged, it may succumb to the political demands of the executive branch and prioritize debt costs rather than inflation targets, thereby raising the risk of long-term inflation expectations getting out of control. Although potential successors, including Warsh and Waller, have emphasized that they will maintain independence, the market generally believes that once the chairman can be easily replaced, the credibility of the successor will be greatly reduced.

Wall Street responded quickly, giving rise to so-called "Powell hedge" strategies, such as the yield curve steepening trade of buying short-term Treasuries and selling long-term Treasuries, as recommended by James Van Gielen of Citi Research, to hedge against expectations of rate cuts and inflation risks. Megan Swiber, a strategist at Bank of America, suggested building a purer hedge by betting on a rise in the break-even inflation rate. Michael Hartnett, chief investment strategist at Bank of America, warned that all of its sell signals have been triggered and market breadth has deteriorated to historical extremes, but he believes that the real tipping point will be when the 30-year Treasury yield breaks through 5%, which could repeat the policy mistakes of the 1970s. At the same time, changes at the regulatory level have also brought uncertainty to the market. JPMorgan Chase plans to charge fintech companies for accessing its customer data. Although this move has limited impact on mature companies, it may be a blow to startups in areas such as cryptocurrencies.

In such a market atmosphere, Jeffrey Ding, chief analyst at HashKey, pointed out that Ethereum has performed strongly recently, with prices exceeding $3,600. There are three driving forces behind it: first, the positive signals brought by the cryptocurrency legislation process in the U.S. Congress; second, the accelerated inflow of institutional funds through channels such as ETFs, such as BlackRock's Ethereum ETF, which recorded a net inflow of nearly $500 million in a single day; and finally, the decline in Bitcoin's market dominance, indicating that Ethereum may lead the market in the upcoming "altcoin season." Jeffrey Ding believes that Ethereum's powerful DeFi and smart contract ecosystem provide it with solid long-term value support, and recommends that investors pay close attention to regulatory dynamics, ETF fund flows and on-chain indicators.

Bitcoin hit a new high last week and ended with a negative line. Analyst KillaXBT observed that the price fluctuated between $115,000 and $123,000. There were a large number of buy orders in the $114,000-116,000 area. If it fell below, it might trigger stop-loss liquidation and drop to $112,000. At the same time, sell orders accumulated at $119,500 and above $120,000, but if it could stand at $119,500, it would be expected to hit a new high. Analyst Merlijn The Trader predicted through complex Fibonacci analysis that the cycle peak may appear in the $133,665-151,539 range in October, while the Cooper Research quantitative model showed that every 10,000 BTC increase in ETF holdings could push up the price by 1.8%, and it is expected that it may reach $140,000 in September. In addition, according to Greeks.Live data, the options market is significantly divided, with bears deploying put options at $100,000-110,000, while bulls construct a ladder structure with an exercise price of up to $190,000.

Regarding Ethereum, technical analyst Ted Pillows emphasized that after ETH breaks through the $3,250-3,500 resistance band, the short-term target is $4,000, and the $331 million short position may be liquidated at that time, but the current overbought state of RSI 84.38 warns of the risk of a pullback. If ETH can maintain the current support level, the price is expected to rise further; if it fails, it may retreat to the $2,950-$3,250 range to re-accumulate buying momentum. Crypto Caesar added that ETH is testing the upper track of the $3,700-3,800 channel, and breaking through $4,100 will confirm the acceleration of the bull market. The continued inflow of institutional funds through ETFs such as BlackRock provides fundamental support for this.

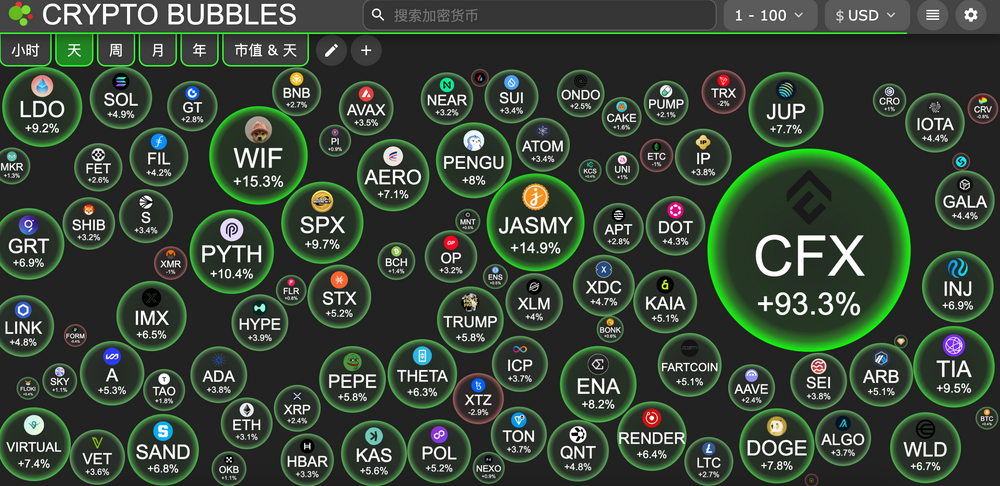

Over the weekend, the domestic public chain Conflux announced that it would launch version 3.0 in August, and jointly developed blockchain SIM cards with Eastcompeace, pushing CFX to surge 150% in a single day to $0.25. Its participation in the "Belt and Road" offshore RMB stablecoin pilot may reshape the cross-border payment landscape. In addition, last week, Coinbase Wallet was renamed Base App and integrated the Zora protocol to realize the content asset casting function, stimulating the ZORA token to rise by 77.7%. The 24-hour fast pass on the chain has seen a peak of $PSYOP's market value of $27 million, and is currently $19 million.

2. Key data (as of 12:00 HKT on July 21)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)

Bitcoin: $118,604 (+26.73% YTD), daily spot volume $41.418 billion

Ethereum: $3,773.44 (+13.13% YTD), with daily spot volume of $54.025 billion

Fear of Greed Index: 72 (greed)

Average GAS: BTC: 0.44 sat/vB, ETH: 0.59 Gwei

Market share: BTC 60.1%, ETH 11.6%

Upbit 24-hour trading volume ranking: XRP, DOGE, ETH, CKB, XTZ

24-hour BTC long-short ratio: 49.25%/50.75%

Sector ups and downs: NFT sector rose 6.73%; Meme sector rose 5.32%

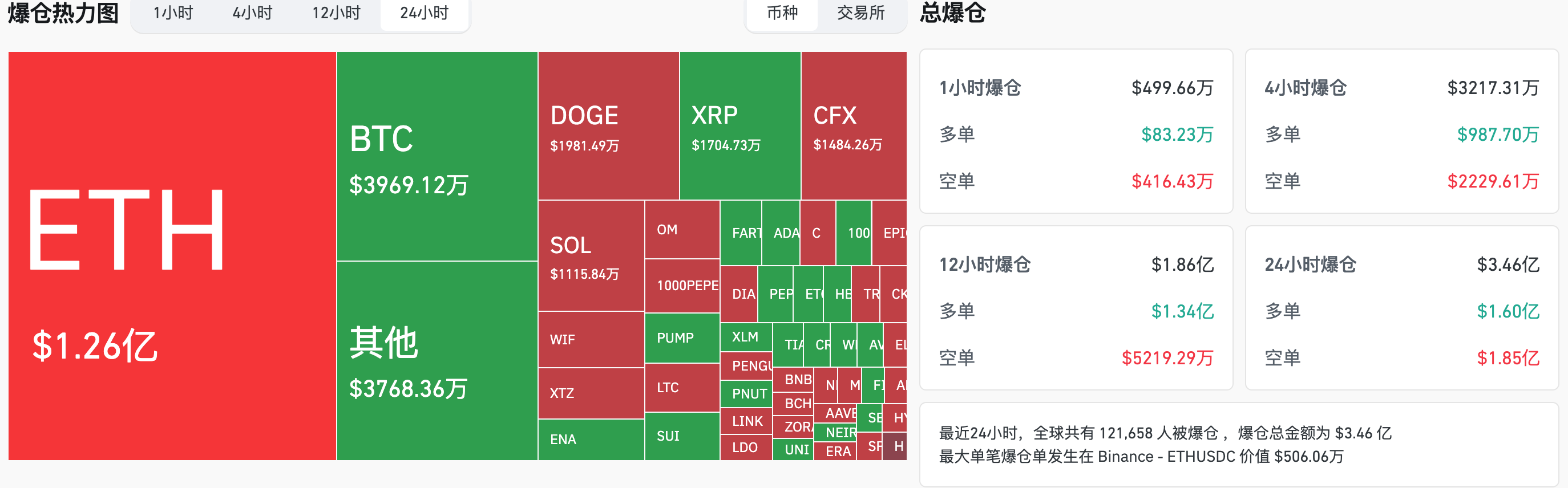

24-hour liquidation data: A total of 121,658 people were liquidated worldwide, with a total liquidation amount of US$356 million, including BTC liquidation of US$36.96 million, ETH liquidation of US$126 million, and DOGE liquidation of US$19.81 million.

BTC medium and long-term trend channel: upper channel line ($117,329.45), lower channel line ($115,006.10)

ETH medium and long-term trend channel: upper channel line ($3309.45), lower channel line ($3243.92)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend; otherwise, it is a bearish trend. When the price passes through the cost range repeatedly within the range or in the short term, it is a bottoming or topping state.

3. ETF flows (as of July 18)

Bitcoin ETF: +$363 million

Ethereum ETF: +$403 million

4. Today’s Outlook

Binance will remove the seed tags for BONK, EIGEN, ETHFI, PENGU, and PEPE on July 21

Trusta.AI (TA) will be available on Binance Alpha and Binance Futures on July 21

Binance Wallet Exclusive TGE 31 to List Delphinus Lab (ZKWASM) on July 22

Bittensor (TAO) will unlock approximately 210,000 tokens on July 21, worth approximately $73 million

The biggest gainers in the top 100 by market value today: Conflux (CFX) up 93.3%, dogwifhat (WIF) up 15.3%, JasmyCoin (JASMY) up 14.9%, Pyth Network (PYTH) up 10.4%, SPX6900 (SPX) up 9.7%.

5. Hot News

The White Whale made nearly $30 million in profits from long ETH and SOL in the past week

Analysis: Last week, some on-chain addresses hoarded 391,000 ETH, worth about $1.4 billion

This article is supported by HashKey, the largest licensed virtual asset exchange in Hong Kong and the most trusted crypto asset fiat currency portal in Asia. HashKey Exchange is committed to defining new benchmarks for virtual asset exchanges in terms of compliance, fund security, and platform security.