Author: Nancy, PANews

While competitor LetsBONK.fun was rising strongly, the long-awaited Pump.fun airdrop was delayed, which became the last straw that broke the camel's back and accelerated the downward spiral of PUMP coin price. Short sellers took the opportunity to make huge profits, and whales cut their losses and fled.

The airdrop delay exacerbated the decline of PUMP coin price, and nearly 90% of investors have voted with their feet

On July 24, the PUMP airdrop that the community had been looking forward to did not land as rumored. Instead, it was clarified by Pump.fun co-founder Alon in the live broadcast, and the market's bearish sentiment was further intensified.

In this highly anticipated live broadcast, Alon made it clear that the airdrop would not be carried out immediately, but a detailed timetable and mechanism would be announced in the short term. He pointed out, "We are eager to reward the community that supports us, but we need to make this airdrop an event that promotes the ecosystem, rather than an opportunity for people to withdraw their funds. This is part of the long-term strategic preparation, and we hope to use this as an opportunity to strengthen the ecosystem, increase trading volume, and maintain community activity for a longer period of time."

He also said that the current team is focusing on core community building to ensure that everyone's voice can be heard and that every community has the opportunity to win in the trenches, and declared that "the most important thing now is to focus on the right direction, focus on serving the community, stimulate ecological activity, and ensure that we are ready to expand. We will win this battle at all costs." In addition, Alon also promised to inject a large amount of liquidity in the short term to support its ecosystem.

However, these statements did not effectively repair market trust, and the airdrop bounce became the last straw that broke the camel's back.

Since the launch of PUMP, driven by factors such as airdrop expectations and repurchase mechanisms, the price of the currency briefly surged at the beginning of the launch, but then fell all the way, and has fallen 26.5% compared to the private placement price of $0.004.

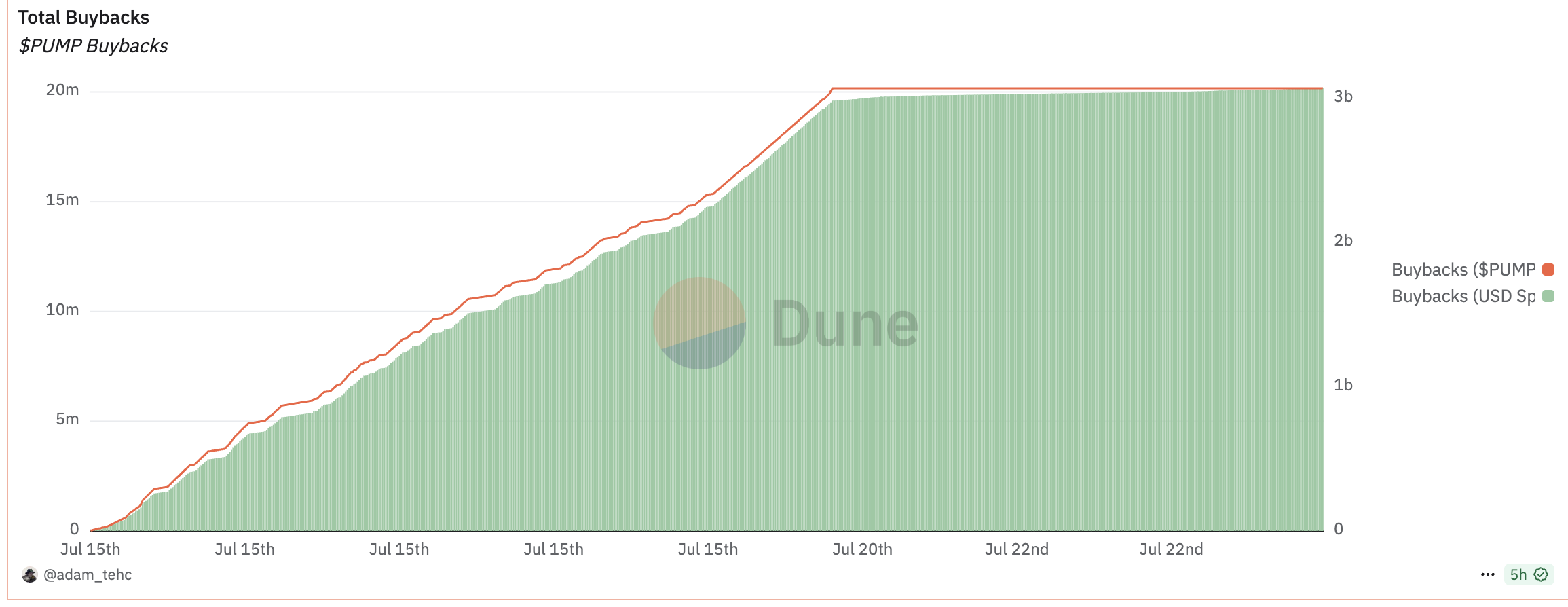

Ironically, Pump.fun once claimed to launch a repurchase mechanism to protect the market, but judging from the data, the repurchase strength is showing a clear downward trend. According to Dune data, as of July 23, the platform has repurchased PUMP worth about 20.17 million US dollars, of which the first-day repurchase accounted for as high as 75%, and the average daily repurchase amount in the past week was only between 100,000 and 200,000 US dollars. For the entire selling pressure, such a repurchase scale is a drop in the bucket.

At the same time, although Alon purchased ecological tokens through public wallets to show support, the amount used was small, and he was also questioned for his lack of sincerity. At the same time, he released "jew mode" during the PUMP rising stage, and was accused of deliberately creating panic and buying chips at a low price.

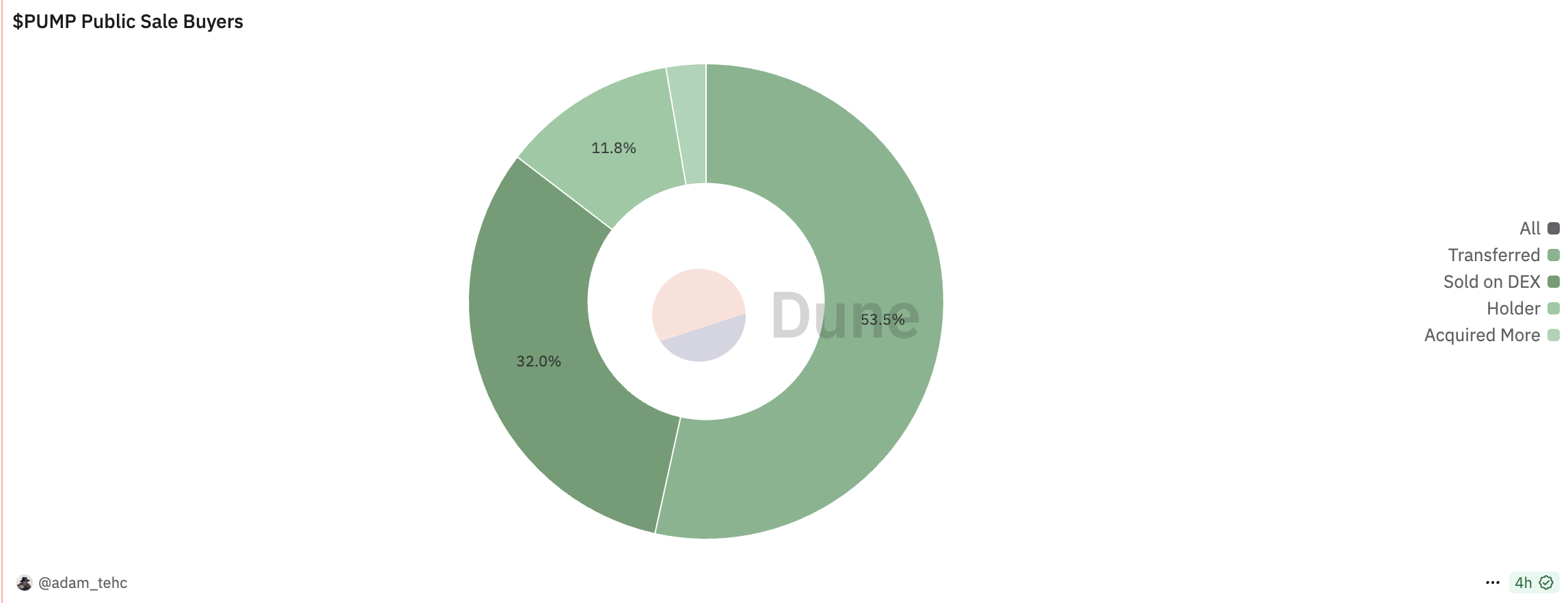

The community is experiencing a "double kill" of funds and confidence. Dune data shows that as of July 24, among the 10,145 successful pre-sale buyers, only 11.8% still hold tokens, 32% have sold them on DEX, and 53% have transferred tokens to new wallets or centralized exchanges. This means that nearly 90% of investors have voted with their feet and lost confidence in PUMP.

Some whales cut their losses and fled, further exacerbating market panic. For example, according to Lookonchain monitoring, after the PUMP price fell below its private/public offering price of $0.004. The largest coin holder, who spent 100 million USDC to purchase 25 billion PUMP in the private round, has recharged 17 billion PUMP to the exchange through FalconX, worth about $89.5 million, and currently still holds 8 billion PUMP, worth about $29.58 million. In addition, the second largest PUMP holder previously spent 50 million USDC to purchase 12.5 billion PUMPs, worth about $71.37 million, which have now all been transferred to the exchange; according to the monitoring of the on-chain analyst Ember, today, an institution transferred all 3.75 billion PUMPs (worth $14.3 million) to Coinbase Prime for meat-cutting. The institution previously used 15 million USDC to obtain these PUMPs at a price of $0.004 in a private placement. This operation caused the institution to lose $700,000 on PUMP (the current value of the 15 million USDC investment has shrunk to $14.3 million); Spot On Chain monitoring showed that private investor PUMP Top Fund 2 deposited 2 billion PUMPs (worth about $12.79 million at the time) into Binance 8 days ago, when the PUMP price was $0.0064. However, since Binance has not launched PUMP spot trading, these 2 billion PUMPs have been stranded on the platform and cannot be sold. The funds have been returned, but the falling price of PUMP has caused the investor to miss an exit opportunity of about $6 million.

At the same time, the longs suffered heavy losses. For example, Huang Licheng, the "big brother" of PUMP, used 5x leverage to buy PUMP on Hyperliquid. The current paper loss is more than $6.6 million, and the total value of the position is about $11.3 million. On the other hand, the shorts have made a lot of money. According to Onchain Lens data, a whale has closed a short position in PUMP and made a profit of $2.448 million.

Falling into crises such as user loss and class action lawsuits, the identities of the three post-00s founders have been exposed

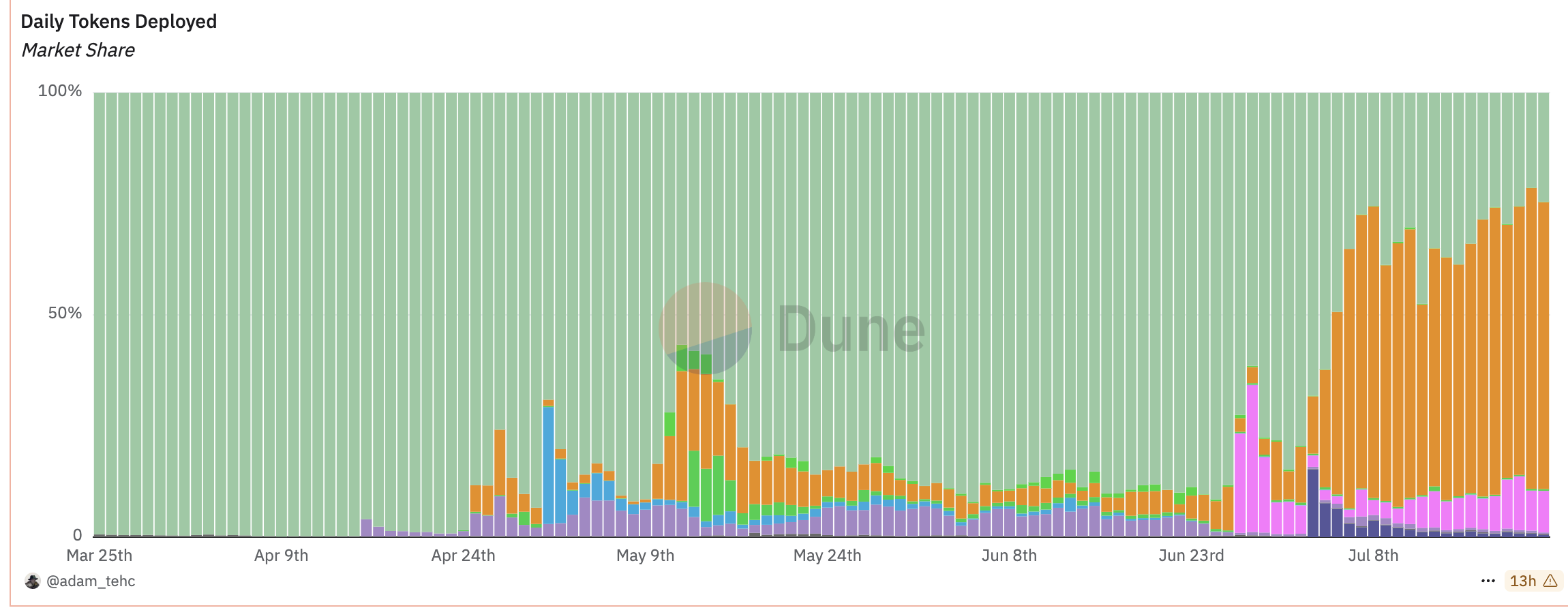

In addition to the poor market performance of the currency price, the current market share of Pump.fun has been greatly surpassed by LetsBONK.fun, and the gap is widening.

According to Dune data, as of July 24, Pump.fun's daily token deployment has dropped to 24%, the daily token graduation rate is only 19.5%, and the daily transaction volume is only 18.9%. At the same time, Pump.fun's revenue in the past 24 hours was about 29.95 million US dollars, while LetsBONK.fun's revenue in the same period was close to 140 million US dollars, almost 4.6 times that of Pump.fun.

To make matters worse, Pump.fun is currently facing huge pressure from class action lawsuits. In January this year, the US law firms Burwick Law and Wolf Popper jointly announced that they would file a class action lawsuit against Pump.fun on behalf of more than 500 investors, accusing it of violating US securities laws and allegedly providing unregistered securities products to the public. Subsequently, Burwick Law claimed that its legal team and some plaintiffs received threats of violence and were subjected to human flesh searches, which caused an uproar in public opinion.

Faced with the lawsuit, Baton Corporation, the parent company of Pump.fun, hastily hired a team of lawyers to respond to the lawsuit just before the deadline last month. The defense team is supported by the well-known law firm Brown Rudnick, and its members include former SEC investigator Daniel L. Sachs, crypto litigation expert Kyle P. Dorso, and senior blockchain legal adviser Stephen D. Palley.

Recently, Burwick Law and Wolf Popper filed an amended lawsuit, expanding the scope of the charges against Pump.fun to the Solana Foundation, Solana Labs, and Jito executives. The lawsuit named Solana network co-founders Anatoly Yakovenko and Raj Gokal, as well as Solana Foundation Executive Director Dan Albert and other executives as defendants, accusing them of violating the RICO Act (anti-fraud law), including illegal gambling, wire fraud, intellectual property theft, etc. The lawsuit also accuses Pump.fun of violating multiple U.S. financial crime prevention regulations, failing to implement anti-money laundering measures, assisting in the creation and promotion of illegal tokens, and infringing trademark rights. However, the case is still in its early stages and the trial date has not yet been set.

It was this lawsuit that revealed the people behind Pump.fun, including 21-year-old CEO Noah Bernhard Hugo Tweedale, 21-year-old CTO Dylan Kerler, and 23-year-old COO Alon Cohen. The parent company Baton Corporation was founded in March 2023 and is registered in a business park in Bury St. Edmunds, Suffolk, England. This young entrepreneurial team has accumulated more than $740 million in revenue.

Faced with the trust crisis caused by the airdrop bounce, the large-scale meat-cutting departure of giant whales, the escalating litigation pressure and the strong rise of competing products, Pump.fun, the former money printing machine, is facing unprecedented challenges.