Author: Nancy, PANews

Another crypto institution is targeting the US capital market. Recently, Bullish, a crypto trading platform under Block.one, restarted its IPO plan after a failed attempt to go public many years ago. With the increasingly clear regulatory environment in the United States and the accelerated influx of institutional capital, Bullish has once again launched an impact on the capital market with its rich early Bitcoin reserves and strong traditional capital support, but it still faces difficulties such as revenue pressure and high customer concentration.

Compliance and capital support, the IPO plan was restarted after three years

On July 18, Bullish submitted an IPO document to the US SEC, planning to be listed on the New York Stock Exchange with the stock code "BLSH". The specific number of shares to be issued and the price range have not yet been determined. The IPO is led by several top investment banks, including JPMorgan Chase, Jefferies Financial Group, Citigroup, Cantor Fitzgerald LP, Deutsche Bank and Societe Generale. The SEC grants underwriters the option to purchase additional shares within 30 days.

"We are now planning an IPO because we believe the digital asset industry is at the beginning of its next stage of growth. We believe that transparency and compliance are core values of Bullish's operations, which are highly aligned with the public capital markets. We also believe that becoming a public company will bring key advantages to our business: enhanced credibility with partners, counterparties and regulators; access to more capital channels; and equity currency for strategic acquisitions." Farley pointed out that the digital asset industry is at a turning point with the accelerated entry of institutional investors, and Bullish already has sufficient resources and compliance models to meet this wave of institutionalization.

In fact, this is not the first time Bullish has impacted the capital market. As early as 2021, two months after its establishment, Bullish announced its intention to go public through a SPAC merger with Far Peak Acquisition Corp., with a valuation of up to US$9 billion and a proposed issue price of US$10 per share.

At that time, Bullish also raised approximately US$900 million through PIPE financing (private investment in public equity), of which Far Peak contributed US$600 million, and the remaining US$300 million came from heavyweight traditional and crypto capital including Thiel Capita and Founders Fund under former PayPal CEO Peter Thiel, Nomura Holdings, Louis Bacon and Galaxy Digital.

The reason why Bullish received a high valuation at the time was that it received a large amount of asset support from Block.one, including $100 million in cash, 164,000 bitcoins (worth about $9.7 billion at the time) and 20 million EOS tokens. However, due to the drastic changes in the global financial environment in the second half of 2022, the global market risk appetite plummeted, and crypto assets also entered a bear market cycle. Bullish eventually terminated the SPAC plan in the second half of 2022.

The restart of the IPO is Bullish's keen response and strategic adjustment to changes in the market environment. On the one hand, U.S. market regulation is gradually becoming clearer, and many crypto institutions are scrambling to advance their listing process. In particular, the successful case of Circle's sharp rise after its listing has further boosted market confidence. On the other hand, traditional financial institutions are entering the digital asset field on a large scale, and Bitcoin and Ethereum spot ETFs continue to attract money. The wave of listed companies hoarding coins has accelerated the compliance and institutionalization trends in the crypto industry. Bullish is gradually completing its global compliance layout, and has established subsidiaries in the Cayman Islands, the United States, Singapore, Gibraltar, Germany and Hong Kong, including obtaining a virtual asset trading platform license issued by the Hong Kong Securities and Futures Commission (SFC) earlier this year.

In addition, Bullish has also received heavyweight traditional capital support. For example, important shareholder Peter Thiel is not only one of the most influential investors in Silicon Valley, but the Founders Fund and Thiel Capital he founded are also Bullish's earliest and most determined investors; and CEO Tom Farley himself has rich experience in the capital market. He has served as president of the New York Stock Exchange Group and led multiple listing projects. He has also served as CEO of the SPAC platform Far Peak and is familiar with the complete process of connecting with the public market.

Huge losses cannot stop strong reserves, and management holds more than 60% of the shares

As the parent company of EOS, Block.one once raised an astonishing amount of $4.2 billion through ICO, and is still one of the private companies with the largest number of Bitcoins. However, EOS has already parted ways with Block.one, officially changed its name to Vaulta, and announced its transformation into a Web3 bank. Block.one focuses on building a compliant crypto exchange. Currently, Bullish's main business is divided into the exchange Bullish and the crypto media CoinDesk.

Among them, CoinDesk was acquired by Bullish from Digital Currency Group (DCG) in November 2023, enabling it to indirectly gain more than 6 million users. It then launched products such as CoinDesk Indices, CoinDesk Data and CoinDesk Insights. Its revenue mainly comes from advertising, sponsorship, event ticket sales and data subscription services.

According to the latest IPO documents submitted, as of March 31, 2025, Bullish Exchange's cumulative trading volume has exceeded 1.25 trillion US dollars, of which spot trading is an important business, with an average daily trading volume of 1.498 billion US dollars in 2024 alone. Among them, in the first quarter of this year, Bullish's BTC and ETH spot trading volumes reached 108.6 billion US dollars and 52.3 billion US dollars, respectively, an increase of 36% and 43% over the same period last year. It claims to be among the top ten mainstream digital currency trading platforms in the world.

However, the document also pointed out that there is a relatively obvious customer concentration risk in Bullish's core business segment, which is highly dependent on large customers (institutional market makers, institutional arbitrageurs and high-frequency traders). The top five customers account for 69% of spot trading volume and 83% of trading revenue.

Not only that, judging from the profit data, Bullish's financial performance in recent years has fluctuated significantly. The documents show that Bullish had a net loss of $4.246 billion in 2022, and only achieved a net profit of $79.56 million in 2024. In the first quarter of this year, it had a net loss of $348 million, which was in sharp contrast to the net income of $105 million in the same period last year.

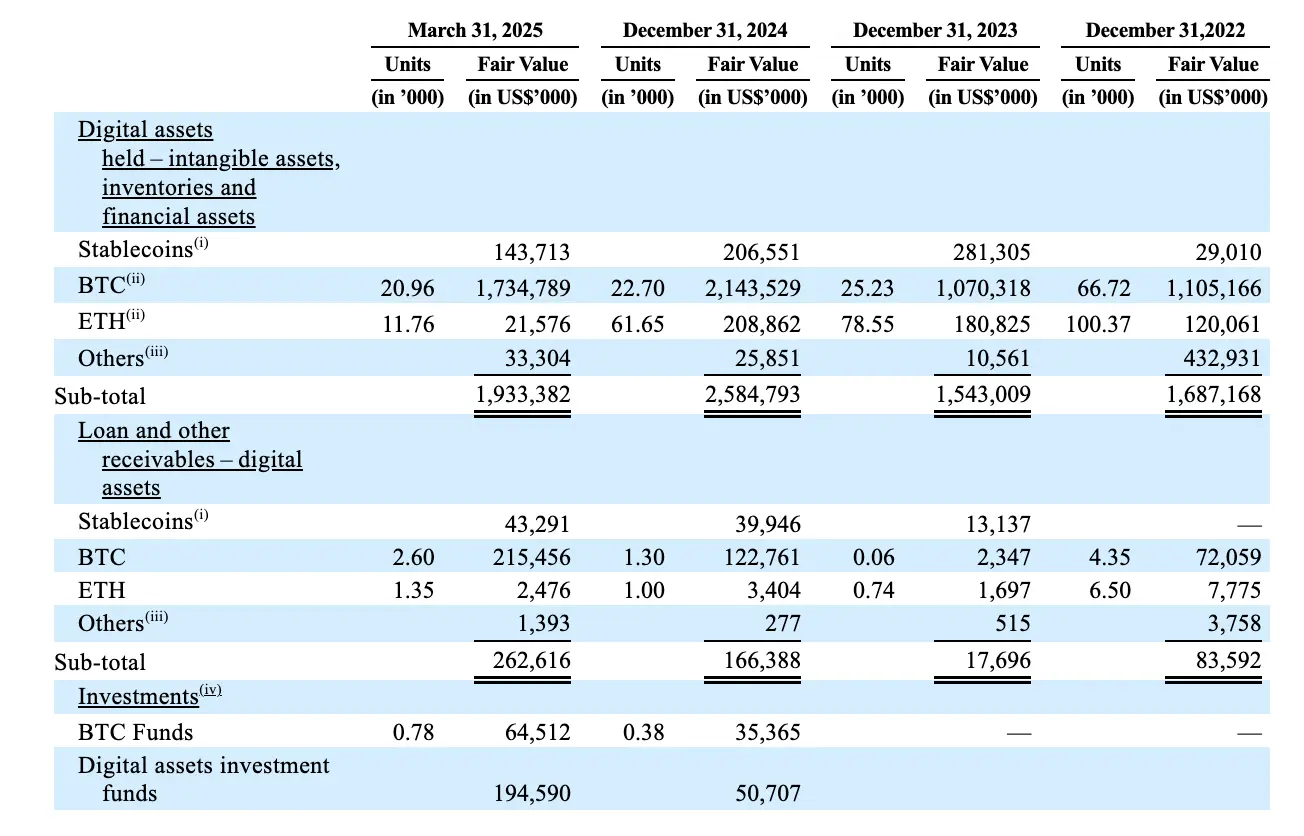

Despite the pressure on performance, Bullish still maintains ample liquidity. The prospectus shows that as of March 31, 2025, Bullish held liquid assets worth more than $1.962 billion, including $1.735 billion in Bitcoin, $144 million in U.S. dollar stablecoins, $28 million in cash, $22 million in Ethereum and $33 million in other digital assets. Among them, the number of Bitcoins held by Bullish has dropped sharply from about 66,720 at the end of 2022 to about 20,960 on March 31, 2025, a decrease of more than two-thirds. It is currently mainly used for intangible assets, lending and other receivables and investment funds. Total liabilities are approximately $700 million, including customer deposits, crypto assets and liabilities, financial leases and deferred taxes.

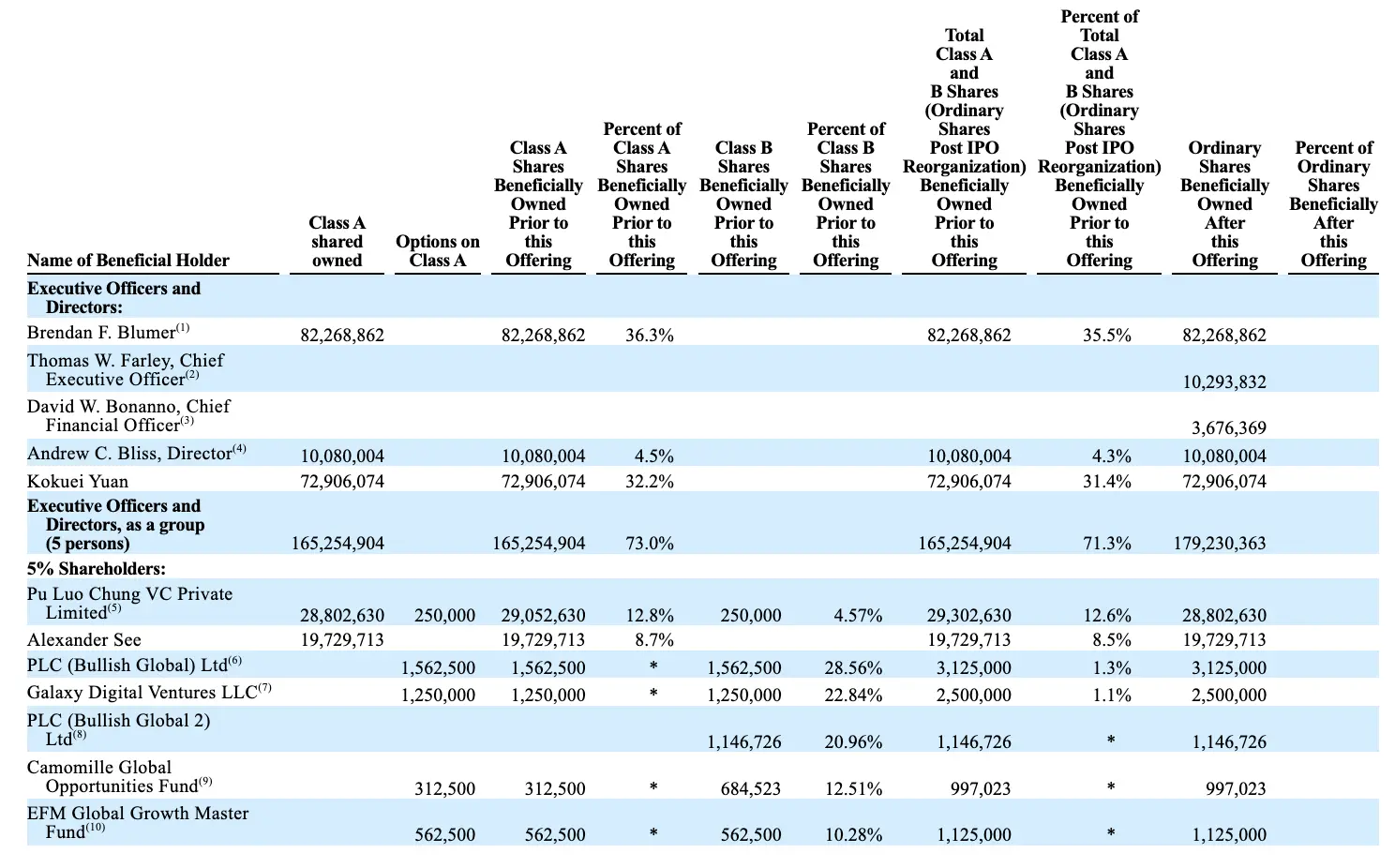

In terms of equity structure, Bullish's control is highly concentrated in the hands of management. Several executives hold more than 60% of Class A common stock and the majority of equity, including Block.one CEO Brendan Blumer, who holds 36.3% of Class A shares and 35.5% of equity; Thomas holds more than 10.29 million shares; CFO David W. Bonanno holds more than 3.67 million shares; and executive Kokuei Yuan holds 32.2% of Class A shares and 31.4% of equity. Among external institutional shareholders holding more than 5%, important shareholders include: Pu Luo Chung VC Private Ltd., with a 12.6% stake after IPO; Alexander See holds 8.5%; PLC (Bullish Global) Ltd has 1.3%; and Galaxy Digital Ventures has 1.1%.

In general, with the opening of the regulatory window and the recovery of the capital market, Bullish is trying to grab a pass to enter the mainstream market. However, whether Bullish can really gain a foothold in the capital market will still face considerable challenges in the future.