1. Market observation

US President Trump recently announced that he would impose a comprehensive tariff of 15% to 20% on most trading partners, and impose a 35% tariff on Canadian imports from August 1, triggering sharp short-term fluctuations in the USD/CAD exchange rate. Although the EU is preparing to impose more than $100 billion in retaliatory tariffs and continues negotiations, the market reaction is relatively stable. The S&P 500 and Nasdaq indexes closed at new highs on Thursday, and Nvidia's market value exceeded $4 trillion for the first time. JPMorgan Chase CEO Jamie Dimon warned the market that it was too complacent about the threat of tariffs, and predicted that the probability of the Federal Reserve raising interest rates was 40%-50%, far higher than the market expectation of 20%, based on potential inflationary pressures such as tariff policies, budget deficits and global trade restructuring. There are significant differences within the Federal Reserve on the policy path. Although Chairman Powell hinted at the possibility of a rate cut in late summer, officials are still in dispute over whether tariffs will push up inflation. St. Louis Fed President Musallem believes that the impact of tariffs is still unclear, while San Francisco Fed President Daly maintains the expectation of two rate cuts this year. Wall Street Journal reporter Nick Timiraos pointed out that the Federal Reserve is facing a key data verification period, and inflation readings in the coming months will determine the direction of policy. At the same time, investors turned their attention to the second quarter earnings season. Bloomberg expects S&P 500 corporate earnings to grow by only 2%, but HSBC strategist Max Ketner believes that pessimistic expectations are exaggerated, and the weakening of the US dollar and improved earnings guidance may bring positive surprises.

In terms of Hong Kong's digital asset policy, Jeffrey Ding, chief analyst of HashKey Group, said that the "Hong Kong Digital Asset Development Policy Declaration 2.0" clearly incorporates digital assets into the global financial center strategy, and promotes measures such as stablecoin licensing, RWA on-chain practice, and tokenized asset tax exemption. HashKey Group is actively participating in the transformation process, including cooperating with Bosera Fund to issue tokenized money fund ETFs to realize the real transaction of RWA; supporting the compliance listing and custody architecture design of multiple stablecoins; and building an open, audit-friendly on-chain channel around HashKey Chain to promote the mapping and circulation of traditional financial assets.

Bitcoin hit a new high of $112,000 on Wednesday and maintained its strength, breaking through $117,000 this morning. Trader Eugene pointed out that the price needs to break through $115,000 in large volume to confirm the accelerated upward trend. On-chain data shows that the "increased holding address" of Bitcoin has reached 248,000, an increase of 71% in 30 days. Analyst Biraajmaan Tamuly combined the MVRV indicator to predict that it will be difficult to see large-scale profit-taking before the price reaches $130,900, while Glassnode monitored a $4.3 billion increase in actual market value, confirming the continued inflow of funds. Markus Thielen, founder of 10x Research, emphasized that driven by macro factors such as Trump's pressure to cut interest rates, the Bitcoin ETF has absorbed more than $15 billion in funds since April. Its trend model shows that there is a 60% probability of continuing to rise by 20% in the next two months, or reaching $133,000 in September. Milk Road co-founder Kyle Reidhead sees a high of $150,000 based on the cup-handle pattern. As for Ethereum, yesterday, whales and institutions bought 358 million USD of Ethereum, pushing the price above 2,800 USD, and this morning it broke through 3,000 USD. Yesterday, the Ethereum ETF had a net inflow of 383 million USD, the second highest in history. Trader Eugene pointed out based on historical patterns that the previous three breakthroughs above 2,800 USD all quickly rose to around 4,000 USD. Analyst Rekt Capital also believes that Ethereum has returned to the macro range of 2,200-3,900 USD and maintained an upward trend.

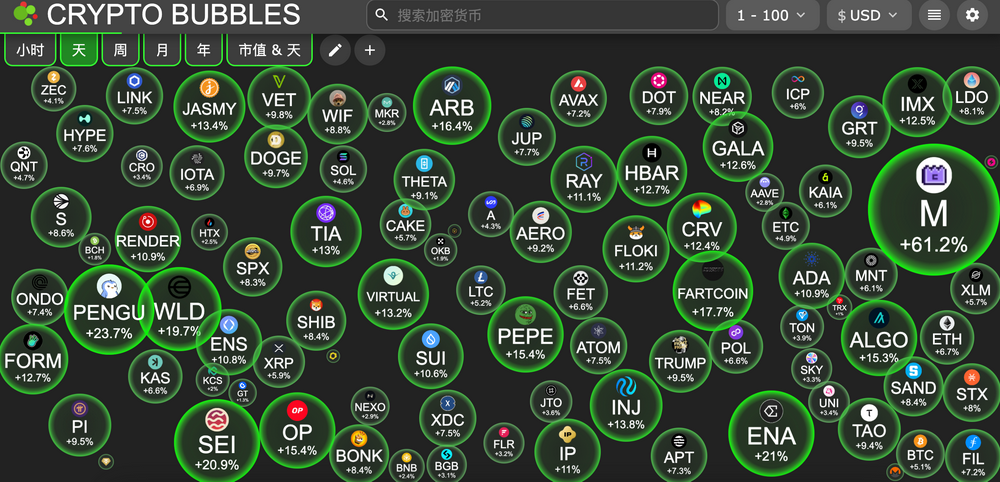

Driven by the record high of Bitcoin, the altcoin market has seen a long-awaited general rise, which also enabled exchanges to obtain continuous liquidity after announcing the listing of coins. Among them, Hyperlane token HYPER rose by more than 455% within 24 hours after listing on Upbit, and its trading volume ranked first on the platform, surpassing the second place XRP by nearly 5 times; Binance announced that it would launch Infinity Ground and Cross perpetual contracts, which also pushed the token AIN up by 105.9% and CROSS up by 71%. In addition, the price of the banana BANANAS31, which was hotly discussed on BNB Chain recently, nearly doubled within 24 hours, and the current increase has narrowed to 40%, and the MemeCore token M has risen by more than 80% in 24 hours; at the same time, the Viction token VIC has more than doubled in the past week; and the trading volume of the blue-chip NFT project Pudgy Penguins has also continued to rise, with the price rising by 130% in two weeks. Pump.fun announced yesterday that it had acquired the Solana on-chain tool Kolscan, causing the market value of the token of the same name to soar to $21 million in a short period of time before falling back to $5.9 million, a 24-hour increase of 1816%. It is worth noting that Pump.fun will conduct IC0 at 22:00 on July 12, and multiple traders on the chain are shorting PUMP with leverage.

2. Key data (as of 12:00 HKT on July 11)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)

Bitcoin: $116,539 (+24.97% YTD), daily spot volume $61.806 billion

Ethereum: $2,968.02 (-11.02% YTD), with a daily spot volume of $40.603 billion

Fear of Greed Index: 72 (greed)

Average GAS: BTC: 0.55 sat/vB, ETH: 2.36 Gwei

Market share: BTC 63.8%, ETH 9.8%

Upbit 24-hour trading volume ranking: HYPER, XRP, BTC, ETH, PENGU

24-hour BTC long-short ratio: 1.0777

Sector ups and downs: Meme sector rose 12.87%; NFT sector rose 11.8%

24-hour liquidation data: A total of 240,219 people were liquidated worldwide, with a total liquidation amount of US$1.136 billion, including BTC liquidation of US$592 million, ETH liquidation of US$242 million, and HYPER liquidation of US$41.25 million

BTC medium- and long-term trend channel: upper channel line ($111,234.12), lower channel line ($109,031.46)

ETH medium and long-term trend channel: upper line of the channel ($2678.38), lower line ($2625.34)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend; otherwise, it is a bearish trend. When the price passes through the cost range repeatedly within the range or in the short term, it is a bottoming or topping state.

3. ETF flows (as of July 10)

Bitcoin ETF: +$1.179 billion, the second highest in history

Ethereum ETF: +$383 million, the second highest in history

4. Today’s Outlook

Binance will launch CROSSUSDT and AINUSDT perpetual contracts on July 11

pump.fun: PUMP will launch its first token offering on July 12, with 15% used for ICO public sale

Immutable (IMX) will unlock approximately 24.52 million tokens at 8:00 am on July 11, accounting for 1.31% of the current circulation and worth approximately $10.1 million.

io.net (IO) will unlock approximately 13.29 million tokens at 8 pm on July 11, accounting for 7.87% of the current circulation and worth approximately US$9.1 million;

Movement (MOVE) will unlock approximately 50 million tokens at 8 pm on July 11, accounting for 1.92% of the current circulation and worth approximately US$7.7 million.

Delysium (AGI) will unlock approximately 106 million tokens at 8 am on July 11, accounting for 5.97% of the current circulation and worth approximately US$5.4 million;

Aptos (APT) will unlock approximately 11.31 million tokens at 10 pm on July 12, accounting for 1.75% of the current circulation, worth approximately US$49.9 million;

Cheelee (CHEEL) will unlock approximately 20.81 million tokens at 8 am on July 13, worth approximately $17.4 million

The biggest gainers in the top 500 by market value today: Omni Network (OMNI) up 195.50%, Hyperlane (HYPER) up 97.00%, CROSS (CROSS) up 70.72%, MemeCore (M) up 64.49%, Banana For Scale (BANANAS31) up 55.88%.

5. Hot News

SharpLink Gaming, a listed company, increased its holdings of 12,648 ETH today, worth $35.31 million

Grayscale updates its "List of Proposed Assets" and includes 31 tokens in the scope of investigation

The Cardano Foundation has a total asset of $659 million, of which 76.7% is ADA and 15% is Bitcoin.

BNB completes 32nd quarterly destruction, worth approximately $1.024 billion

CryptoQuant: US buying boosts Bitcoin to new highs, bullish market sentiment may not be over yet

Justin Sun pledges to buy $100 million worth of TRUMP tokens

Thumzup adds ETH, XRP, DOGE and 6 more tokens to Bitcoin-dominated corporate treasuries

Upbit will list HYPER in the Korean Won market and BABY in the BTC and USDT markets

This article is supported by HashKey, the largest licensed virtual asset exchange in Hong Kong and the most trusted crypto asset fiat currency portal in Asia. HashKey Exchange is committed to defining new benchmarks for virtual asset exchanges in terms of compliance, fund security, and platform security.