Title: Crossroads of the Structural Bull Market: AI Capital Expenditure, US Dollar Liquidity, and Market Rebalancing

Author: arndxt

Compiled by Tim, PANews

The prospects for macroeconomic re-acceleration are relatively limited, and its sustainability depends on the support of asset-rich households and capital expenditure driven by artificial intelligence. For investors, the key to this cycle is not broad beta returns:

- Focus on semiconductors and artificial intelligence infrastructure as long-term growth drivers.

- Remain cautious on broad-based indices, as the concentration of the tech giants, Big Seven, masks market vulnerabilities.

- Keep an eye on the US dollar: its direction may determine whether the current cycle continues or ends.

As in the 1998-2000 cycle, market fundamentals may remain solid, but volatility will be more intense, and asset selection will become the key factor separating active winners from those who simply follow the market's rise.

1. Dual-track economy

The market is the economy. As long as stocks are at or near record highs, recession talk is unlikely to materialize.

We are definitely in a dual-track economy:

The top 10% of income earners contribute over 60% of consumer spending. The wealth they have accumulated through stocks and real estate has kept consumption levels high.

At the same time, inflation has disproportionately eroded the wealth of middle- and low-income households. This widening gap explains why the economic "reacceleration" is being accompanied by a weak labor market and an affordability crisis.

2. Fed policy seen as narrative risk

Policy volatility will become the norm, and the Federal Reserve is facing the dual challenges of inflationary pressures and political cycles. This creates a window for opportunistic investment, but it could also trigger a sharp downward shock when expectations are reset.

The Fed faces a dilemma:

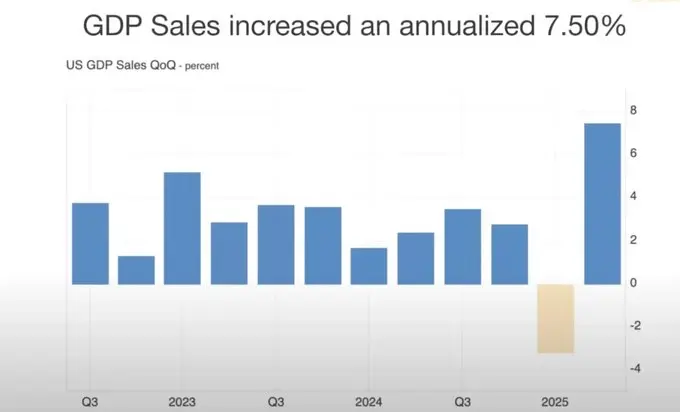

- Strong GDP data and resilient consumer spending justify a slower pace of interest rate cuts.

- The market is overextended and delaying rate cuts could trigger a "growth tantrum."

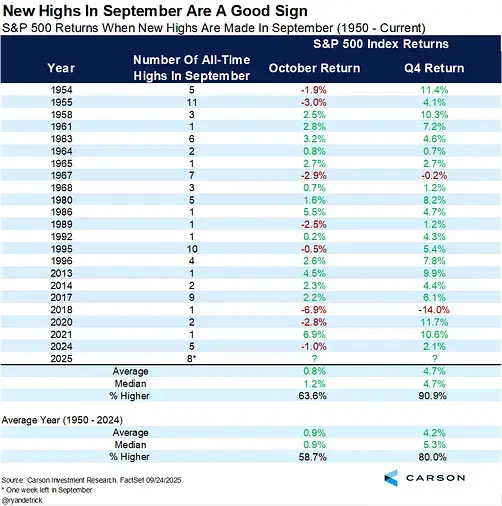

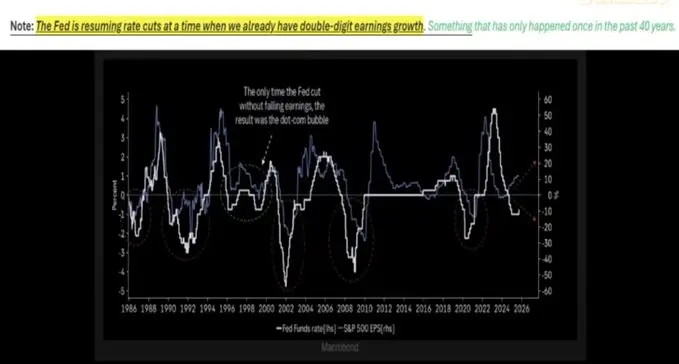

Historically, rate cuts during periods of strong earnings (the last such event was in 1998) have tended to prolong bull markets. But the current cycle is distorted: stubborn inflation persists, the "Big Seven" dominates earnings, and the remaining 493 S&P 500 stocks are underperforming.

3. Asset selection in a nominal growth environment

Allocate scarce physical assets (gold, key commodities, real estate in supply-constrained areas) and productivity platforms (AI infrastructure, semiconductors), while avoiding excessive concentration in the field of internet celebrity stocks driven by online popularity.

The future situation is more like a structural bull market rather than a general rise.

Semiconductors remain the foundation of AI infrastructure, and capital spending continues to drive growth.

Gold and real assets are steadily re-establishing their status as a hedge against currency debasement.

Cryptocurrencies are suffering from the dual pressures of leveraged liquidation and Treasury bond overhang, but their structure remains closely linked to the liquidity cycle that pushes up gold.

4. Housing Market and Consumption Trends

If both the housing and stock markets weaken, their psychological "wealth effect" on consumption will collapse.

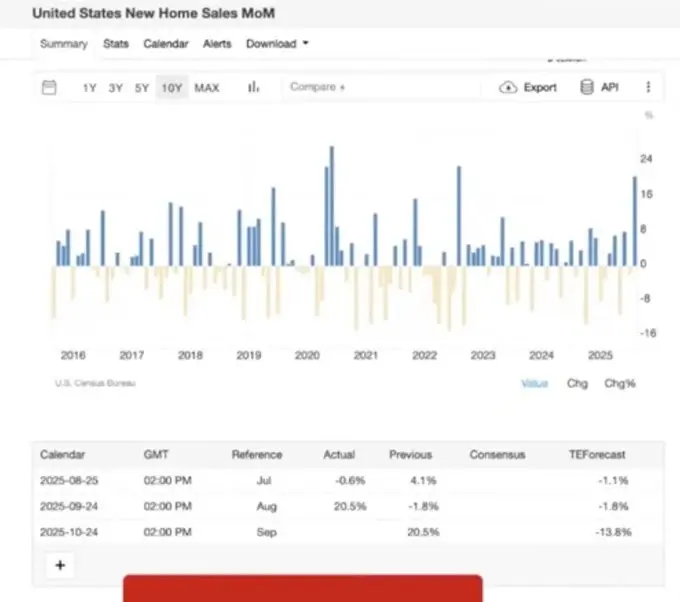

The housing market experienced a short-term rebound (dead cat bounce) when interest rates were lowered, but structural difficulties remain:

- Imbalance between supply and demand caused by population pressure.

- The end of student loan and Federal Housing Administration payment moratoriums has led to a surge in foreclosures.

- Regional economic divergence (baby boomer asset buffers coexist with pressures on young families).

5. US dollar liquidity

The US dollar is a hidden fulcrum. At a time of global economic weakness, a stronger US dollar may first crush more vulnerable markets rather than the United States.

An underestimated risk is a contraction in the supply of dollars.

Tariffs would reduce the trade deficit, thereby limiting the global flow of dollars back into U.S. assets.

Fiscal deficits remain high, but liquidity mismatches have emerged as external buyers of U.S. Treasuries have declined.

The U.S. Commodity Futures Trading Commission (CFTC) position data shows that short positions in the U.S. dollar have reached a historical level, which indicates that a short squeeze in the U.S. dollar may be triggered, which in turn will hit risky assets.

6. Political Economy and Market Psychology

We are at the end of a financialization cycle:

- Economic policies are designed to “keep things going” before key political junctures (general elections, midterm elections, etc.).

- Structural inequalities—rents rising faster than wages, wealth concentrated among older people—are fueling populist pressures for policy changes in areas ranging from education to housing.

- The market itself is two-sided: the concentration of the seven major weighted stocks both supports valuations and lays the groundwork for fragility.