Original title: Was the Friday Crash a Coordinated Attack? The Evidence Points to Something Disturbing

Original author: @yq_acc

Original translation: Jia Huan, ChainCatcher

The black swan event of October 10th and 11th led to the largest liquidation in crypto history, totaling $19.3 billion. While initial reports attributed the cause to market panic caused by the tariff announcement, a deeper analysis of the data raises questions. Was this a coordinated attack on Binance and USDe holders? Let's examine the evidence.

Question 1: Why these three assets?

The most puzzling aspects of this crash center around three specific assets whose prices collapsed catastrophically, but only on Binance:

- USDe: Plummeted to $0.6567 on Binance, while remaining above $0.90 on other exchanges.

- wBETH: Crashed to $430 on Binance, 88.7% below ETH’s normal price.

- BNSOL: plummeted to $34.9 on Binance, while other exchanges saw little fluctuation.

This phenomenon of a “specific exchange” crash immediately set off alarm bells. Market panics don’t usually affect a single platform so precisely.

Suspicion 2: Suspicious timing

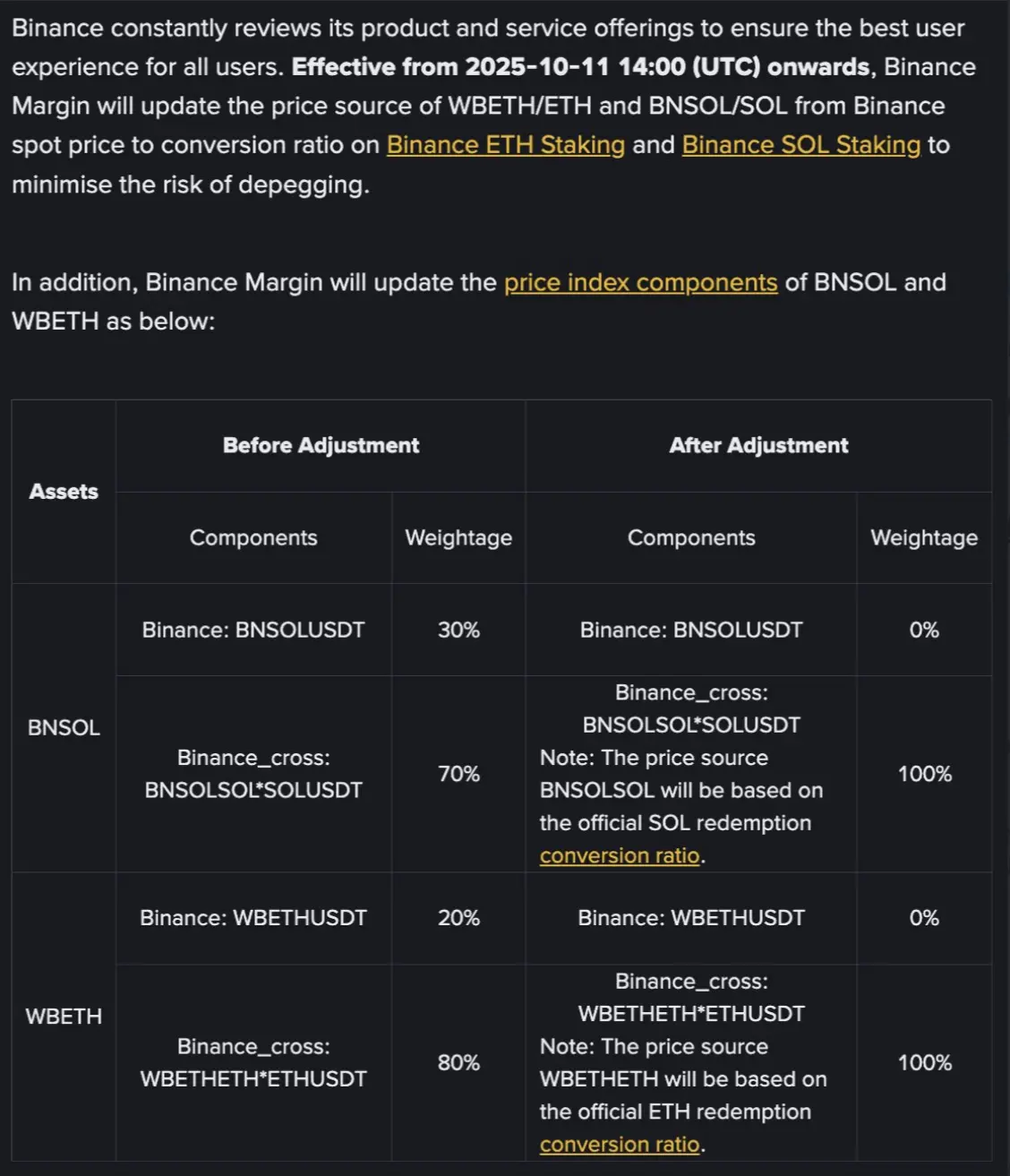

Things get even more interesting. As early as October 6th, Binance announced that it would update the pricing mechanism for WBETH and BNSOL, with an expected date of October 14th (now changed to October 11th). This crash happened between October 10th and 11th—precisely falling within the "vulnerability window" between the announcement and the implementation of the new mechanism.

Among the tens of thousands of trading pairs, why did only these three, whose updates were announced in advance, experience such extreme decoupling? The probability that this is purely coincidental is extremely small.

Attack Hypothesis Playout: A Carefully Planned Timeline

Assuming this was indeed a coordinated attack, the timeline suggests careful planning:

5:00 AM (UTC+8): Markets begin to fall on the tariff news, which is a normal reaction.

5:20 AM: Altcoin liquidations suddenly and dramatically accelerate. This move may be intended to target market makers.

5:43 AM: USDe, WBETH, and BNSOL all begin to crash simultaneously on Binance.

6:30 AM: Market structure completely collapsed.

Specific crash details:

5:00 AM (UTC+8) : Initial market movement begins

Bitcoin begins its decline from $119,000

Trading volume is within normal range

Market makers maintain standard spreads

5:20 AM : First wave of liquidation waterfalls

Altcoin liquidations accelerate dramatically

Trading volume surges: 10 times normal trading activity

Market maker withdrawal mode appears

5:43 AM : Key decoupling event

USDe: $1.00 → $0.6567 (-34.33%)

WBETH: 3,813 USDT → Start of catastrophic decline

BNSOL: ~200 USDT → Accelerated Collapse

5:50 AM : Maximum dislocation

WBETH reached 430.65 USDT (-88.7% below parity)

BNSOL bottomed out at 34.9 USDT (-82.5%)

Buy-side liquidity is completely absent

6:30 AM : Market structure completely collapsed

Total liquidation volume exceeds US$10 billion

Market makers completely withdraw

- Binance-specific price anomaly reaches peak

USDE/USDT fell at 5:43 AM (Singapore time)

WBETH/USDT fell at 5:43 AM (Singapore time)

There was a 23-minute gap between the first wave of liquidations and the collapse of USDe, WBETH, and BNSOL, suggesting a sequential execution rather than a random panic event.

BNSOL/USDT fell at 5:43 AM (Singapore time)

USDe Factor

USDe itself has several weaknesses that make it an ideal target for attack:

1. Hidden leverage: Binance’s 12% yield plan encourages users to engage in recursive lending, creating leveraged positions of up to 10x.

2. Collateral concentration: Many traders use USDe as margin collateral.

3. Weak liquidity: Despite being called a “stablecoin,” USDe’s order book depth is surprisingly shallow.

When USDe collapsed to $0.6567, it didn’t just cause immediate losses—it likely set off a chain reaction throughout the ecosystem.

Market maker perspective

One theory circulating among traders is that the initial wave of altcoin liquidations at 5:20 AM was designed to specifically target market makers. Once market makers are forced out due to losses, they will simultaneously cancel their orders for all trading pairs, instantly wiping out liquidity and leaving the market vulnerable.

The evidence is that the prices of many altcoins on Binance were much lower than on other exchanges at the time, which is consistent with the pattern of major market makers being liquidated.

Tracking the Funds

If this was an organized attack, the attackers made staggering profits:

Potential short profit: $300 million-$400 million

Accumulating at Low Prices: A $400-600 Million Opportunity

Cross-exchange arbitrage: $100 million to $200 million

Total profit potential: $800 million to $1.2 billion

This is not a normal trading profit, but a robbery-style return.

Other explanations

There are other possibilities:

1. Chain liquidation effect: A large liquidation naturally triggers a snowball effect.

2. Risk is too concentrated: too many traders use similar strategies.

3. System stress: Exchange systems fail under extreme trading volumes.

4. Panic psychology: Fear itself creates a self-fulfilling prophecy.

However, none of these explanations can explain why the crash was so precisely targeted to specific assets and specific exchanges.

Suspicious aspects of the incident

Several factors distinguish this event from a typical market crash:

- Venue Specificity: The price crash was almost entirely confined to Binance

- Asset selectivity: only assets with pre-announced vulnerabilities are severely impacted

- Time precision: occurs within the exact vulnerability window

- Sequentiality: Market makers are eliminated before the primary targets are hit

- Profit model: consistent with pre-deployed strategy

If true, what does this mean?

If this was indeed a coordinated attack, it represents a new evolution in crypto market manipulation. Instead of hacking systems or stealing cryptographic keys, attackers are weaponizing the market structure itself.

This would mean:

- Every exchange announcement becomes a potential vulnerability

- Transparency may paradoxically reduce security

- Market structure needs fundamental redesign

- Current risk models are insufficient

Some disturbing possibilities

While we cannot definitively prove an organized attack, the evidence raises reasonable suspicion. The precision, timing, location specificity, and profit patterns are consistent with a coordinated attack.

Whether through brilliant speculation or deliberate planning, someone turned Binance’s transparency into vulnerability and seized nearly a billion dollars in the process.

The crypto industry must now grapple with an uncomfortable question: In our interconnected, 24/7 markets, has transparency itself become a weapon that can be wielded by devious actors?

Until we get definitive answers, traders should assume that all exchanges have similar vulnerabilities. The events of October 10-11 could have many explanations, but one thing is certain: it was not random.

The analysis in this article is based on available market data, cross-exchange price comparisons, and established patterns of market behavior. The views expressed are my own and are for reference only, but do not necessarily reflect the views of any institution.