1. Market Observation

Recently, Chinese and US trade leaders held candid and constructive talks in Stockholm, Sweden. The two sides reached a consensus to continue pushing for a 90-day extension of the suspended 24% reciprocal tariffs by the US and China's countermeasures. This has provided some relief to the market. However, global markets still face challenges and await the Federal Reserve's interest rate decision with bated breath. While the Federal Open Market Committee (FOMC) is widely expected to hold interest rates steady for the fifth consecutive time at this week's meeting, the real focus is on the timing of the first rate cut, with two camps forming on Wall Street. One camp, led by Goldman Sachs and Wells Fargo, predicts that the Fed will begin its rate cut cycle in September as signs of economic weakness become more apparent over the summer. The other camp, led by BNP Paribas and Nomura Securities, believes that policymakers will remain cautious due to inflation uncertainty caused by tariffs, delaying the first rate cut until December or even later.

Against this backdrop, Bank of America strategist Michael Hartnett warns that global central bank easing, deregulation of financial markets, and the Trump administration's policy shift are collectively fueling a "bigger bubble" driven by "larger retail investors, more abundant liquidity, and greater volatility." With a series of major events on the horizon, including the second-quarter US GDP data, the Federal Reserve's decision, earnings reports from tech giants, and the July non-farm payroll report, global markets are entering a critical "super 72-hour period" whose results will set the tone for the rest of the year. The Ethereum market is undergoing a structural shift driven by institutional capital. HashKey Chief Analyst Jeffrey Ding noted that Ethereum has risen by over 50% since July. He believes this surge is primarily driven by favorable macroeconomic policies, micro-capital inflows, and shifting investor sentiment. Ding noted that the US Congress's active progress in cryptocurrency legislation has instilled confidence in the market, while the massive inflow of funds into Ethereum spot ETFs is the most direct catalyst. This demonstrates that Ethereum's asset attributes are shifting from "world computer fuel" to "interest-bearing reserve assets." With Ethereum's transition to Proof-of-Stake (PoS), its ability to generate on-chain returns through staking has attracted institutional funds seeking real returns. Ding also noted that Bitcoin's relative decline in market dominance could also prompt a rotation into mainstream "altcoins" like Ethereum, ushering in a new upward cycle. Bitcoin prices have recently been consolidating between $117,000 and $120,000, with analysts' views diverging. Traders like Roman believe the market may first dip to the $108,000 area to clear liquidity before rebounding. Material Indicators also suggest that whales are selling at high levels, and if $116,750 fails to hold, BTC prices could quickly fall to the $110,000 range. Crypto trader Killa plans to enter positions at $113,850 and $112,000. Killa argues that if Bitcoin successfully reclaims $120,000, the expected decline will be negated, and the market could head straight for $125,000. He suggests that investors can choose to hold long positions above $123,000 or wait for a clearer entry opportunity. Analyst Axel Adler Jr. suggests that if the price breaks through, the short-term target is $122,000, which could trigger the liquidation of approximately $2 billion in short positions. Markus Thielen, founder of 10x Research, suggested that a break above $120,000 is a bullish signal, but a more ideal entry point might be to wait for a pullback to the previous resistance level of $111,673.

As for Ethereum, with the price returning to $3,800, analysts are generally expressing strong bullish sentiment, with its futures open interest (OI) reaching a record high of $5.8 billion. Analyst Merlijn The Trader believes that current data confirms this trend, with the continued inflow of leveraged funds fueling a "vertical rise." Data from Glassnode also indirectly supports the market's optimism, indicating a shift in funds from Bitcoin to Ethereum, with its open interest share climbing to 40%, a nearly two-year high. Analyst Elja, analyzing on-chain activity, believes that the Ethereum network's active addresses and transaction volume have seen significant growth, and that a new all-time high is only a matter of time. Bitcoinsensus also stated that Ethereum has demonstrated strong momentum and is poised for an upward breakout. Regarding key price levels, analyst Daan Crypto Trades emphasized that the $4,000 to $4,100 range is the key focus for further gains, and a successful breakout of this range is crucial for the next phase of growth. It's worth noting that today marks the tenth anniversary of Ethereum's creation, with its price surging from $0.3 to $3,800, catapulting it to 28th place in the global asset class. Linea, a Layer 2 network within the ecosystem, has finally unveiled its token economics, planning to airdrop 10% of its tokens to early community users, aiming to establish the network as a "home base for ETH capital." In Asia, the Hong Kong Monetary Authority announced that it will open applications for the first batch of stablecoin issuer licenses starting August 1st and will require real-name registration (KYC) for all compliant stablecoin holders. Anticipation of this policy also triggered short-term market volatility, with Hong Kong-related projects like CFX and CKB retreating after a brief surge.

2. Key Data (as of 12:00 HKT, July 30)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)

-

Bitcoin: $117,951 (+26.06% YTD), daily spot trading volume: $40.132 billion

-

Ethereum: $3,803.76 (+14.12% YTD), daily spot trading volume: $33.228 billion

-

Fear of Greed Index: 74 (Greed)

-

Average Gas: BTC: 1 sat/vB, ETH: 1.38 Gwei

-

Market Share: BTC 60.7%, ETH 11.9%

-

Upbit 24-hour Trading Volume Rankings: OMNI, XRP, ETH, BTC, CKB

-

Sector gains and losses: AI down 3.89%; RWA down 3.67%

-

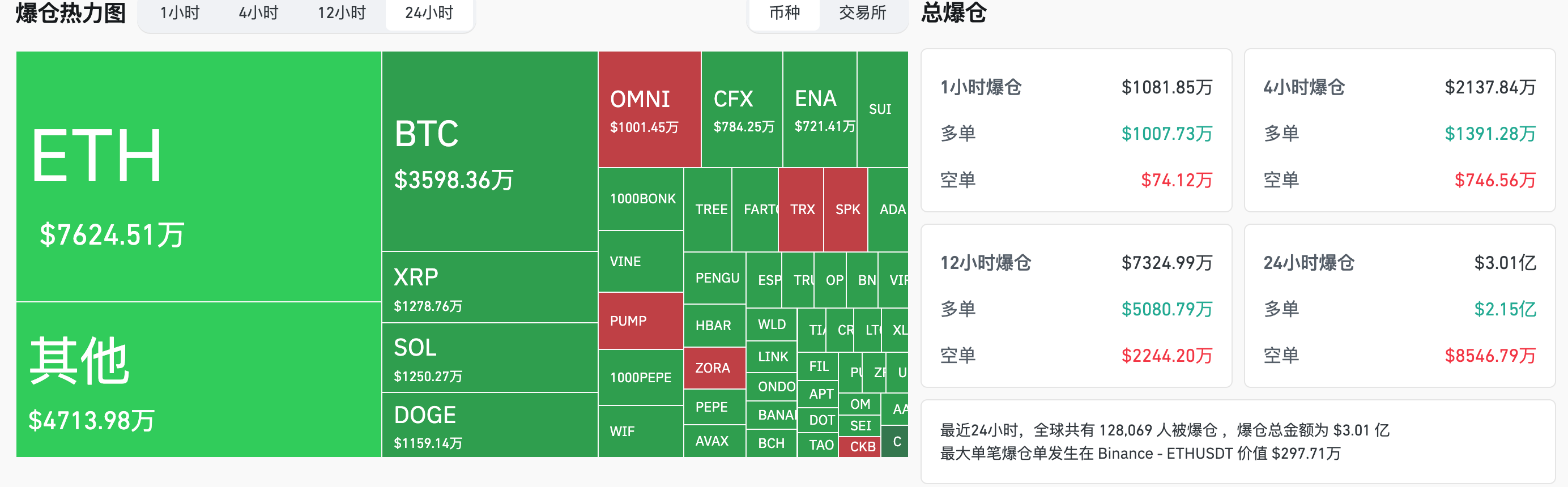

24-hour liquidation data: 128,069 individuals worldwide were liquidated, totaling $301 million, including $35.98 million in BTC, $76.24 million in ETH, and $12.78 million in XRP.

-

3. ETF Flows (as of July 29)

-

Bitcoin ETF: +$79.9781 million, 4 consecutive days of net inflow

-

Ethereum ETF: +$219 million, 18 consecutive days of net inflow Daily Net Inflow

4. Today's Outlook

-

Strategy plans to announce its second-quarter financial results on July 31st.

-

Big Time (BIGTIME) will unlock approximately 600 million tokens on July 30th, valued at approximately $32 million.

-

Kamino (KMNO) will unlock approximately 229 million tokens on July 30th, representing 9.53% of the current circulating supply and valued at approximately $13.8 million.

-

-

U.S. Federal Reserve Interest Rate Decision (Upper Limit) on July 30th (July 31st, 02:00 AM)

-

Federal Reserve Chairman Powell Holds Monetary Policy Press Conference. (July 31, 02:30)

-

U.S. Initial Jobless Claims for the Week Ending July 26 (10,000 people): Previous value: 21.7, Forecast: 22.4 (July 31, 20:30)

-

U.S. Core PCE Price Index Annual Rate in June: Previous value: 2.7%, Forecast: 2.7% (July 31, 20:30)

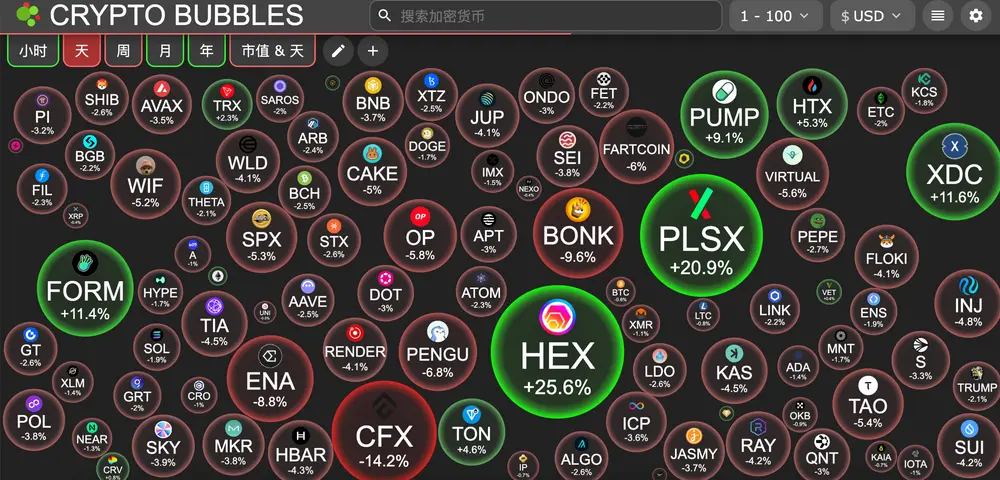

Today's Top 100 Market Cap Gains: HEX (up 25.4%), PulseX (up 20.7%), XDC (up 20.7%) Network rose 11.4%, Four rose 11%, and Pump.fun rose 10%.

5. Hot News

-

Anchorage Digital Purchases Over $1.19 Billion in Bitcoin in 9 Hours

-

Ark Invest purchased another $15.3 million worth of BitMine shares on Tuesday

-

BTCS plans to raise $2 billion to increase cryptocurrency investment

-

Linea announces token distribution details, 9% distributed to users via airdrop

-

Multiple addresses accumulated 648,000 ETH in just two weeks, worth $2.44 billion

-

Market News: Pump.Fun pledges 100% of daily revenue for buybacks

-

The DEGEN Foundation is exploring a phased burn of 32.5% of its DEGEN token supply

This article is supported by HashKey. HashKey Exchange is the largest licensed virtual asset exchange in Hong Kong and Asia's most trusted crypto-to-fiat gateway. It is committed to setting new standards for virtual asset exchanges in terms of compliance, fund security, and platform assurance.

-